INDEX

The disclosure of information on the risks and opportunities posed to companies by climate change is being questioned at an alarming rate. Of particular interest is "quantitative disclosure" - the disclosure of specific figures showing the risks and countermeasures with financial impact.

This year, risk management, investment, and academia gathered to discuss the relationship between quantitative disclosure and corporate value. Participating were Ohata of Nomura Asset Management, Nagamura, a Tokio Marine & Nichido fellow and international organization correspondent, and Managi, a Kyushu University professor and founder of aiESG, Inc.

This column draws on the discussions that took place during the dialogue and the analysis results shared to paint a picture of quantitative disclosure now and in the future.

Introduction of interlocutors

Akio Ohata

Senior Analyst, Global Research Department and Head of Net Zero Strategy Office, Nomura Asset Management Co. He has served as an expert member of the Disclosure Study Group of the Securities Analysts Association of Japan and the Technical Committee on Fee Regulation Accounting of the Accounting Standards Board of Japan.

Masaaki Nagamura

Fellow of Tokio Marine Holdings, Inc. and Tokio Marine & Nichido Fire Insurance Co. Mr. Kuroda is a member of the Financial Stability Board (FSB) Task Force on Climate-related Financial Disclosure (TCFD), a member of the Geneva Association's Working Group on Climate Change and Environmental Challenges (CC+EET), and a member of the Asia-Pacific Finance Forum (APFF) Sustainable Finance Development Network (SFDN) Sustainability Disclosure Sherpa. SFDN) Sustainability Disclosure Sherpa.

Shunsuke Managi

Lead Professor at Kyushu University. Founder and Representative Director of aiESG, Inc. Director of the UN Inclusive Wealth Report, lead author of the Intergovernmental Panel on Climate Change (IPCC), Vice-Chair of the OECD Joint Working Group on Trade and the Environment, and other international organizations and corporations. He is the Chair of the Subcommittee on Sustainable Investment of the Science Council of Japan. He is the author of 25 books and 400 journal articles. He has received the Japan Society for the Promotion of Science (JSPS) Prize and many other awards.

Evolution of ESG Disclosure: Trend from "Qualitative" to "Quantitative

Toshi Managi reported on the results of his analysis of quantitative disclosure and corporate value. Following up on this report, we are pleased to have this opportunity to discuss "Quantification of Climate Change Risk and Corporate Value" from both practical and academic perspectives.

In this dialogue, we hope to go beyond a mere explanation of the results and share in a frank manner the challenges of current ESG disclosure and the differences in views from the standpoints of companies, investors, and researchers, respectively.

Before discussing the results of the analysis, I would like to ask the three of you to explain the trends in corporate disclosure, which were the background to this analysis.

large field

In terms of ESG-related disclosure, Japan is one of the top countries in the world in terms of the number of companies endorsing the TCFD. However, there is still room for improvement in the "substance" of disclosure, especially in terms of quantification.

long village

As someone who was involved in the development process of the TCFD, I can tell you that in 2021, the TCFD recommended disclosure indicators were reorganized. that what they want is information that communicates financial impact.

In addition to greenhouse gas emissions as indicated in Scope 1, 2, and 3 as representative climate-related indicators, the recommended disclosures have been reorganized to include how to confront the physical risks posed by climate change. Information on physical risks is necessary as one useful basis for deriving financial impact. In particular, we have seen an increase in expectations about physical risks over the past year. One of the reasons for this is that the debate on physical risks finally started in earnest in the fall of 2008 at the UNFCCC, which can be said to be the headquarters of the climate change debate. Then, in a document issued in January 2025 by the FSB, the parent of the TCFD, the importance of physical risks was also reiterated in the assessment of climate-related risks from a macro perspective in the financial sector. The background to this is the recent increase in the frequency and severity of extreme weather events and events at the global level.

In Europe in particular, the flooding around the Mediterranean Sea has been particularly noticeable, and the EU is beginning to have a strong sense of the problem there, and as the EU continues to drive, the international community is being forced to respond, whether it wants to or not.

large field

There are challenges regarding the disclosure and use of physical risk.

In the case of Japanese companies, energy-related facilities, such as thermal power plants, are almost always located by the sea because they import fossil fuels from overseas. Given this situation, there are similar physical risks. I think that when investing mainly in Japanese stocks, it is difficult to put a relative weight on that.

Managi

Quantifying the physical risk of the environment became fashionable in the 1990s. This was shortly before the Kyoto Protocol.

The terms that came up at that time were material flow, life cycle assessment, and the carbon and water footprint derived from that, and also disaster risk. There is a history of being quite specific to physical risk. On the other hand, in the 2000s, the next discussion on physical risk was to connect it to policy. But you couldn't answer economic value either, such as how much it would be in terms of social value. I think that while physical risk will continue to be in vogue, at the same time we will start to look at economic value.

Difficulty of quantification felt in the field

─ So far, you have shared with us the importance of quantitative disclosure and its trends. Now, could you tell us what hurdles and specific challenges actually exist for quantitative disclosure in the corporate world?

The first barrier is "no data."

long village

TCFD focuses on financial institutions, but we hear from banks and investment management companies that there is a lack of data. What we hear from banks and investment management companies is that there is no data.

─ ─ What kind of data is the problem that you do not have?

long village

First of all, data on the location of assets. For example, there are bulk figures such as "total assets of ¥0.0 billion," but in many cases, such information is not understood within the company, such as where the assets are geographically located - even by prefecture. In addition, there is also a lack of understanding of the actual risk in each region. I think this is probably a common issue not only in Japan, but worldwide.

I had thought that transition risk might be more difficult to grasp, but I have found that as long as you identify the scenario and the industry, you can derive numbers that seem reasonable. That is not the case with physical risk, which is why we are all suffering.

The authorities have been aware of the problem, but have not yet been able to draw a picture of how to take the first steps from there. Companies with money have been able to hire consultants and data vendors to come up with physical risks for their portfolios.

And a physical risk calculation tool by the government.

long village

There is actually government support that enables companies without sufficient funds to calculate their own physical risk, and in our country, the Ministry of Land, Infrastructure, Transport and Tourism had a hand in this.

The Ministry of Land, Infrastructure, Transport, and Tourism (MLIT) had developed the concept of basin flood control to strengthen the flood risk response of rivers. The Ministry of Land, Infrastructure, Transport, and Tourism (MLIT) has been working on the concept of river basin flood control to enhance flood risk response in rivers. We used the TCFD framework to think about how we could get all the stakeholders, including companies, involved in this process. I was brought in with the idea that if Japanese companies were working so hard on TCFD disclosure, why not use that as leverage?

In fact, using local data and tools available on the Internet, it is possible to measure the physical risk, which can withstand reasonable disclosure. It is also possible to estimate the value not only now, but also in the future when global warming has progressed, and you have published a single guide that brings all of this together. I think this is a great breakthrough. Once that information is available, we can use the Flooding Navigator published by the GSI to identify areas at risk of flooding, and then we can calculate how much of the area will be inundated in the event of a flood, and if so, how much economic damage will result from the flooding. The Ministry of Land, Infrastructure, Transport and Tourism has developed a Flood Control Economics Manual, which can be used to convert this information into economic value. In addition, there is software that can be used to determine future hazard maps, which can then be applied to determine how much the situation will worsen from the current situation.

Now if we can utilize it to produce future values, we will have a series of figures, and since we have created a guide to eventually incorporate them into the TCFD disclosure, I am wondering if we can disseminate it as one tool.

Managi

Are MLIT's efforts internationally advanced?

long village

We do not hear much about such initiatives from other countries.

In the first place, most countries view the TCFD as a matter for the financial authorities. In Japan, there is fortunately inter-ministerial cooperation. While the Financial Services Agency is the lead agency for the TCFD, the Ministry of Economy, Trade and Industry is responsible for supporting industry, the Ministry of the Environment was the first to start scenario analysis and its dissemination, and the Ministry of Land, Infrastructure and Transport has been working on the physical risks of real estate and rivers. The Ministry of Land, Infrastructure, Transport and Tourism has been working on physical risks in real estate and rivers. In terms of administrative support, I think there is no other country in the world that is so generous.

Managi

Elsewhere, the Ministry of Agriculture, Forestry and Fisheries (MAFF) has issued Nature Positive as a (other ministries) joint free policy. Also, MLIT has started discussions on green infrastructure. We really need to collaborate on all of this, including the environmental value of rivers.

long village

You are right. The truth is that climate change, especially in the area of adaptation, is interlinked with many other things. As you mentioned, there are linkages with biodiversity and agriculture, so I think it is desirable to create policies in collaboration with various other areas, rather than promoting climate change alone.

The gap between investors' and companies' awareness and dialogue

large field

On the other hand, it is somewhat of a challenge that this point has not yet penetrated the user side.

I believe that the physical risk of TCFD is difficult for users to interpret. We also try to understand the physical risk by using tools, etc., but since the data is from a global perspective, I think there are issues that need to be improved regarding the evaluation of the data from a more detailed perspective only in Japan.

─ ─ What kind of challenges are there?

large field

The highest priority data is still the disclosure of GHG emissions through the GHG Protocol.

Furthermore, I have the impression that the climate change risk of how to reduce GHG emissions to net zero is more of a transition risk to be aware of. In addition, the interpretation of physical risks needs to be improved. In the world of non-financial information, I have the impression that there is relatively little interaction between users and preparers. In the area of accounting and finance, there are often discussions between accounting standard creators and users, and study groups are held. However, in the area of sustainability, the creation of standards has taken the lead, and I think the issue for the future is how to disseminate this information. I have been in a study group for accounting, and we have a program where the users, preparers, and auditors have a one-year study session. Sustainability still gives the impression that the relationship between the three parties is not very deep, and there is not much awareness of the standards and how to use them, which I sometimes think is a bit of a waste of time.

─ ─ If you were to do this, what kind of organization would be ideal?

large field

One is SSBJ.

There is a worldwide view that the private sector should be the standard-setting body in accounting, and an organization called ASBJ was created; the ISSB is also under the IFRS Foundation. In this sense, I think it would be natural for the SSBJ to indicate its role in promoting exchanges among preparers and users in Japan as well.

long village

Originally, in the world of sustainability, experts in the fields of climate change, human rights, and biodiversity formed groups to work on these issues, and each group has produced valuable results. I hope that the ISSB will play a central role internationally and the SSBJ will play a central role domestically, and that horizontal collaboration will become more active.

Transform physical risk into "language" that can be communicated through economic value

Managi

The complexity of the domain seems to be at the root of the problem. For example, air pollution used to be an environmental issue only, but as health hazards have increased, it has become a medical issue as well.

long village

Often, on the policy and administration side, it has been deliberately put in the forefront of health hazards because it is easier to garner support if it is tied to health than if it is focused on the environment or something else.

Managi

We felt the same way when we made recommendations for India's air pollution policy. Even though environmentalists told us that air pollution in India was a problem, the political and administrative authorities were reluctant to take action. We were able to get people to understand that it was an economic issue by linking human capital to economic capital, such as the negative impact of less than 11 TP3T in terms of GDP, or the tens of thousands of people who would die if a subway system was built to reduce the damage from pollution. The Times of India, an Indian economic newspaper, picked up on the project. I thought it was important to have both economic value and economic value.

large field

In this sense, there is also the topic of disclosure burden. I would like to request that corporate disclosure staff, as much as possible, use quantitative expressions for physical risks, rather than qualitative expressions such as "high risk". Qualitative expressions have a hard time resonating with our investor users. There are obstacles such as lack of data, measurement methods, and disclosure burdens. However, I would like to see it quantified in terms of financial impact.

Also, one advantage of companies that go into quantification is that the number of questions from the stock market will always increase. If you write qualitatively that this physical risk has a large impact, the conversation will end with the statement, "That is true. However, if you say that the impact is 15.2 billion yen, people will ask, "What kind of impact is this? What is the basis for this calculation? What is the basis for this calculation? If the impact is shown only in terms of large, medium, or small, or only in the direction of the arrow, the conversation will end there. We always know the numbers inside the company. I think it would be easier for us to ask questions if those numbers were presented to the outside world to the extent that they are not problematic, and I believe this would increase the likelihood of lowering the risk.

Enhancing Corporate Value through Disclosure Stance and Dialogue

long village

It is not clear from the operating companies that investors see it that way, so it is no wonder that many companies feel it is difficult to present the numbers as they are and try to keep them to arrows.

Managi

It's the same argument as with toxic chemicals.

The rule was established that when a company, such as a particular manufacturer, moves a chemical substance, it has to disclose it. In the early stages of research, it was often said that the more a company disclosed, the lower its stock price would be. However, later studies conducted around the world, including ours, showed that the more emissions a company has, the more it works hard to address the problem, which lowers its cost of capital and raises its total valuation.

The conclusion was that disclosure would have been better. But that fact was probably not communicated to the corporate side and ended up in academia.

In this sense, I suppose the same difficulty in creating an organization that I mentioned earlier is also a problem in that academic discoveries do not lead to the next step, such as policies and corporate measures.

long village

It would be good if more and more feedback from investors on how they are using the system is also provided to companies. In Japan, there is an organization called the TCFD Consortium, which provides a forum for business companies and financial institutions to meet and exchange opinions focusing on climate-related disclosure. By having investors directly communicate to business corporations what kind of information they are looking for and in what manner, business corporations are able to make more convincing and effective disclosures. For investors, it seems that they also gain insight into what the companies are having trouble with, or they learn that they are actually doing great things but are not properly disclosing them, or that disclosure is being done digitally. I think such opportunities are very valuable.

Managi

Companies tend to seek perfection in their disclosures, but there are cases where, while they are taking time to prepare for perfection, other companies gain social impact by disclosing first, even if it is simplified. Even if they disclose elaborate details afterwards, it may not be enough to have the same initial impact, right?

long village

I see.

Managi

It is not perfect, but we need to get it out first, and it is important to communicate with society, including changing needs.

long village

TCFD has also been saying that it is important to take things with a grain of salt and not expect perfection from the outset. However, when it comes to disclosure, everyone tends to become defensive. Investors are well aware of the fact that it is not possible to disclose information adequately from the beginning, but those that dare to do so stand out and are evaluated favorably.

large field

It would be very helpful for us, as users, if the preparers could also look at the way the financial market uses the instruments and point out any differences in interpretation if the usage is different from what was intended. Regarding sustainability, I feel that it is necessary to mature the practice through exchanges among users, preparers, and guarantors.

Managi

It's important to allow for errors.

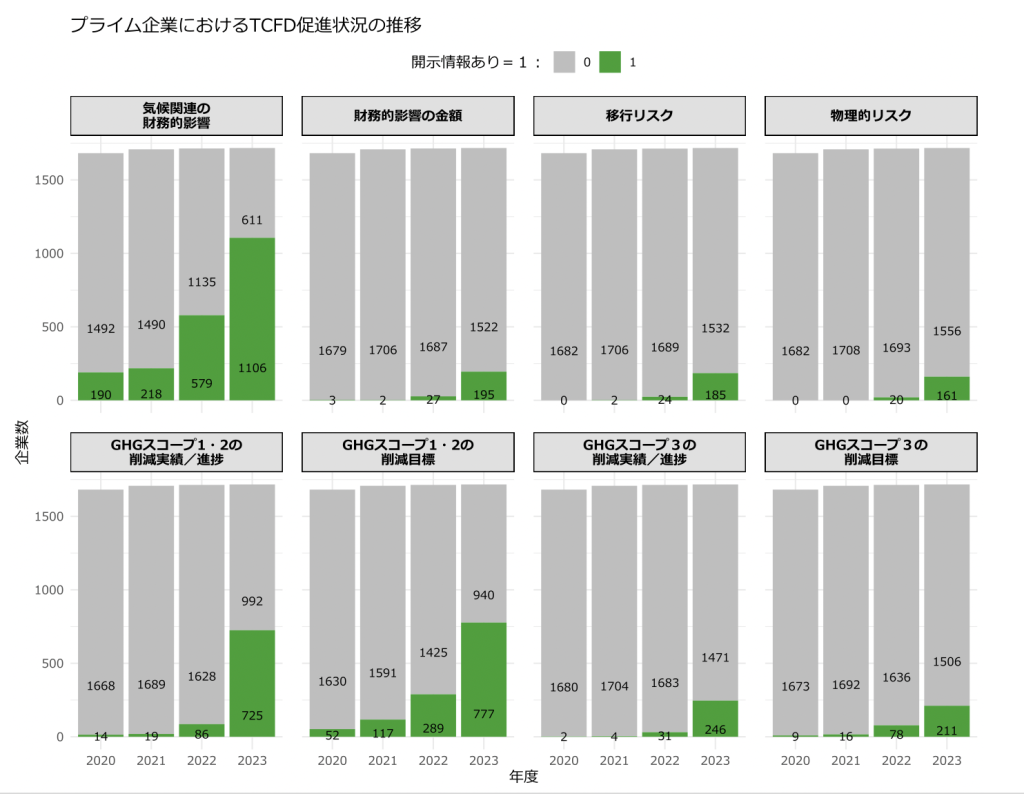

Aggregate results of quantitative disclosures in securities reports for the past three years

─ ─ We have conducted one analysis at Kyushu University. In preparation for this analysis, we have tabulated the quantitative disclosures in securities reports for the past three years. What do you think the results of this tabulation show about the current trend?

large field

I have the impression that the energy sector has a slightly higher ratio, while the other sectors are reasonable. Unfortunately, there are companies that do not disclose their financial impact of climate change, especially in numbers. This is a point that does not lead to the discussion I mentioned earlier. I think it is important to improve the ratio of disclosure of monetary values of financial impacts.

Managi

Is there any discussion about which method to use, etc.?

large field

There is also an impact of methodology. There are scattered companies that face various internal hurdles to disclose figures, making it difficult to do so.

Managi

Which do you think is more likely, that the companies that actually disclosed solved the difficulties and were okay afterwards, or that the hurdles were not so high as you say?

large field

I have the impression that the latter percentage is higher. In this analysis, you checked the annual securities report, but the integrated report is also important. When disclosing in this integrated report, some companies include notes and other information in an inconspicuous manner. There are many integrated reports that are difficult to interpret without reading them in detail, which I believe reduces the effectiveness of disclosure. There are also scattered companies that describe the information in a limited manner due to much discussion within the company.

long village

I have to admit that I was shocked to see how many companies have yet to make quantitative disclosures.

I had a little more hope, but I was reminded that the reality is so much harsher.

large field

If we talk about the energy sector, which I am in charge of, the ratio of quantitative disclosures is quite high. In that sense, only industries in which climate change is highly regarded as a materiality, such as energy, have already reached the upper limit. Now it will be important for industries that recognize climate change as a low materiality to make quantitative disclosures.

Managi

Writing is also important, and I recently published a paper related to this. In the past, before AI became popular, there was a study that used text analysis based on keywords to evaluate disclosure text. The study found that there was actually no correlation between the results of that study and the various ESG scores that were eventually externally evaluated. Rather, the result was that when the advanced AI evaluated and interpreted the text from context, it was connected to the ESG score.

Context is still extremely important. The fact that it is written in a footnote does not mean that it is good enough if it is described, but it could be evaluated low in the context that it is only a footnote.

long village

In such cases, we may gradually see how much thought the companies really put into their disclosures. However, if a company simply copies and pastes the contents of last year's report, the reader may be able to see right through the document.

Managi

Ultimately, we would like to disclose even the economic value of our company's social impact. By doing so, we will gain the trust of the government. Since all taxpayer funds are ultimately used for social issues, you do what the private sector cannot do. To quantify social issues, you can use a billion yen of taxpayer money to create a billion yen of value for society. At that time, if a company is the first to create a mechanism that reduces the value to economic value, it can be applied. If the government tries to create the first example on its own, the hurdles are high. The hurdle of having to convince each of the parties involved is incredible, isn't it? And if we reach an age where quantification of social issues is the norm, the resulting figures to social value will become better and better, and this will lead to solutions to social issues.

long village

It is also necessary to change the mind-set of corporate management, and to recognize that the Yuho and the Integrated Report are tools for making an appeal in one's own words about how one wants to change society, and not something that one is forced to do.

The second part analyzes the impact of quantitative disclosure on corporate value and discusses future prospects. Please continue reading.