INDEX

Introduction

Reflecting the growing importance of the social dimension in ESG assessments, the Taskforce on Inequality and Social-related Financial Disclosures ("TISFD") has emerged. It is.

TISFD is a global initiative to develop recommendations for companies and investors to identify, assess and report inequality and social-related risks, opportunities and impacts.

The aiESG report article also introduces TISFD.

[Commentary] TISFD: Task Force on Inequality and Social-related Financial Disclosures

[Commentary] Future Activities of the Task Force on Inequality and Socially Related Financial Disclosures (TISFD)

Hundreds of millions of people around the world are unable to meet their basic needs (nutrition, comfortable working conditions, indigenous rights, etc.). In many countries, disparities in income and health are growing, and gender equality is far from equitable.

TISFD aims to strengthen financial disclosure on such inequalities and social issues and to assist companies and investors in identifying, assessing, and managing financial risks and impacts.

Although the TISFD was officially launched on September 23, 2024, it is still in the discussion phase among relevant stakeholders and is still in its developmental stages as a task force. Therefore, as a preparatory step for its establishment, TISFD will consult with companies, financial institutions, and other stakeholders to develop a future work plan, etc.Publicly Available Materials ("People in Scope")The company has published this information as a

This article provides an explanation of the public documents. It will mainly introduce an overview of TISFD's future efforts and explain terminology.

2. the need for TISFD

Why is TISFD necessary in the first place?

The challenges of social inequality in the world, such as disparities in income, property, and gender, child labor, and violations of indigenous rights, present significant system-level risks to market actors. On the other hand, there are also significant opportunities for economic and market actors to collaborate with the private sector, including businesses and financial institutions, to address inequality and improve outcomes for people, as well as to address climate change and natural loss.

However, it is not clear how the actions of the private sector affect people, contribute to inequality, how they pose risks to business and finance, and how they can be addressed to open new opportunities.

To advance effective management and reporting of these issues, companies and financial institutions need

- Inequality and social-related impacts, dependencies, risks, and opportunities (Impact, Dependency, Risk, Opportunity:IDROon the practice and performance of the initiatives toData and information useful for decision-making

- Prevent overburdening companies with diverse approaches to social and inequality-related issues,Expectations for a coherent and reasonable set of reports

- Meaningful regarding IDROSet of metrics and indicatorsGoals and ObjectivesAdequate guidance, thresholds and allocations.applicabilityand how best to use and interpret specific data.distinctiveness

These are necessary to effectively address inequality and social problems. However, companies and financial institutions have not yet acquired them, or even recognized the need for them in the first place. The TISFD framework supports companies and financial institutions in recognizing and acquiring this need, and in determining their guidelines regarding social aspects.

3. what are inequality and social-related impacts, dependencies, risks, and opportunities?

As mentioned in the previous section, what exactly is meant by inequality and social-related IDRO (impacts, dependencies, risks, and opportunities), which are often used in discussions of ESG social-related issues?

The following diagram represents a conceptual picture of how inequality and social-related IDROs interact with the actions of public, corporate, and financial institutions and how society is affected by them.

の概念的表現-.jpg)

A: Corporations and financial institutions have positive/negative, intentional/unintentional, direct/indirect impacts onpeopleto the company (e.g., employees, workers in the value chain, communities, and consumers). For example, a company's employees are affected in many ways through salaries and wage allocations, compensation and subsidies, working environment, etc.

B: In addition, businesses and financial institutions, through their tax payments and competitive activitiespublic institutionand ... andeconomyThis has an impact on the

C: On the other hand, companies and financial institutions need the skills, capabilities, health, and trust of workers, communities, and others, as well as the health and stability of the economy and society, to sustain business operations and growth.dependenceThese dependencies are the result of the company's dependence on the company and its financial institutions. These dependencies are on corporations and financial institutions,riskandopportunityThe company is giving the

D: In other words, while companies and financial institutions have various impacts on each sector, companies and financial institutions have dependencies on each sector, and there is an interrelationship that involves risks and opportunities.

What is the impact on businesses and financial institutions?Fostering the accumulation of inequality in societyHigh levels of inequality can also lead to a decline in the number of companies and financial institutions.System-level riskThis will give rise to a

*Entity-level risk: Risks that arise for individual entities.

System-level risk: Impact on the entire system that connects companies and financial institutions with society and the economy, as shown in Figure 2.

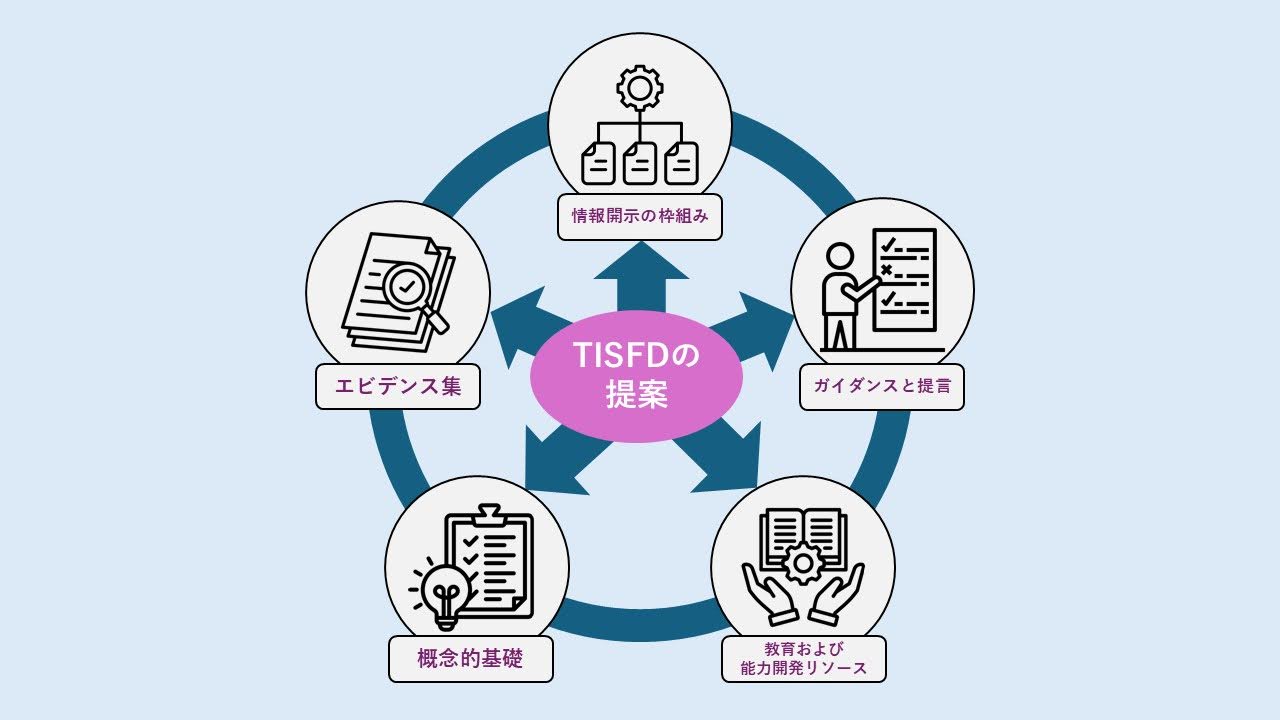

4. proposal of deliverables

In addition, TISFD has identified the following documents to be released and the projects to be undertaken as Proposed Deliverable.

- Global Disclosure Framework

The TISFD framework aligns with the four pillar structure of the TCFD and TNFD disclosure frameworks used in the International Financial Reporting Standards (IFRS) Sustainability Disclosure Standards (Governance, Strategy Risk Management, Indicators and Targets) used in the International Financial Reporting Standards (IFRS). On the other hand, the content of the framework will be adapted to the particularities related to IDRO (Impacts, Dependencies, Risks, and Opportunities) people. - Guidance and Recommendations

Relates to the implementation of a disclosure framework for corporations and financial institutions. Helps to effectively identify, assess, and report inequality and social-related IDROs. - Education and Capacity Building Resources

Contribute to, understand, and help use TISFD's disclosure framework and recommendations. It can be used by a wide range of audiences (policy makers, trade unions, civil society organizations, etc.) as well as corporations and financial institutions. - Conceptual foundations

It includes overviews, definitions, and terminology of the types of "human rights," "human and social capital," "well-being," and other terms commonly used in inequality and social-related issues. It is intended to promote understanding of inequality and social-related issues. - Evidence Collection

Documents research on social financial risk and system-level inequality risk for firms and financial institutions. Includes evidence on the relationship between organizational impacts and their cumulative effects, exacerbation of inequality, and system-level financial impacts on firms, investors, markets, and financial stability.

5. the approach and scope of social issues

The following diagram visualizes the many facets of people's well-being and their inequalities and illustrates how TISFD approaches inequality and social challenges related to corporations and financial institutions.

A:People's happiness is multifacetedand span many aspects, including health and safety, income, social connections, and knowledge and skills.

B: However, disparities in people's well-being within or between groups, or "inequalityexists.

C: In that happiness, the lowest level that should not be further below is "human rightsIt is "the right to life in accordance with one's fundamental dignity. Human rights, as established in international law, are the right of all human beings to live their lives in accordance with their fundamental dignity on an equal basis.

D:Human Capital and Social Capitalreflects the accumulation of people's abilities and relationships that can create value and benefits to society over the long term.

E: All achievements related to social inequality and human rights are reflected in human and social capital, which is directly related to the value that society can generate.

Therefore, society as a whole needs to address the above issues.

However, due to the broad scope of social problems and social inequalities, TISFD prioritizes issues based on the following criteria

- Relevance to a wide range of reporting agencies

- Significance of related impacts, dependencies, risks, and opportunities

- Relevance of effective management by firms and financial institutions of IDROs at the entity level

- Relevance of managing system-level risks and opportunities

The TISFD has also stated that it will develop disclosure recommendations that address financial materiality and impact materiality. This approach is also referred to as "double materiality" and is used in other ESG reporting frameworks such as TNFD.

*financial materiality: an approach that relates to information requested by investors and financial institutions, including risks and opportunities that are expected to affect the prospects of the entity in the short, medium and long term.

IMPACT MATERIALITY: An approach related to information relevant to investors and other stakeholders that assesses the actual or potential significant impact of an institution in the short, medium, and long term.

In light of the above, and in order to avoid perpetuating inequalities, the TISFD states that the participation of various actors is essential in its construction, deliberations and decisions. This includes large investors and corporations, civil society, labor organizations, local communities and individuals belonging to them, as well as small businesses.

TISFD also explores the importance of inequality as a system-level risk. To do so, we examine evidence of organizations' contributions to inequality and the resulting system-level financial impact of inequality on economic, market, and financial stability, and ultimately on firms' and investors' portfolios.

6. design principles

The following diagram shows the six design principles that are followed in the output of the TISFD.

The output of TISFD is based on the following design principles

- Marketable:

Producers and users of information, especially businesses, financial institutions, policy makers, civil society, labor organizations, and otherCreate recommendations that are directly useful and valuable to the actors. - Align with the Corporate Standards of Conduct:

UN Guiding Principles on Business and Human Rights, International Labour Organization (ILO) Tripartite Declaration of Principles on Multinational Enterprises and Social Policy, OECD Guidelines for Multinational Enterprises on Responsible Corporate Behavior, etc.Make recommendations in line with international standards. - Integration with reporting standards:

Utilize and build on existing reporting standards and frameworksand address gaps and weaknesses as needed to contribute to harmonization of the reporting situation. - Support and Information:

Existing standard setters such as IFRS, GRI, and EFRAG, as well as countries and regions interested in mandating sustainability-related disclosuresActing as a knowledge partnerand facilitate the integration of the Task Force's recommendations into future standards and regulations. - Connecting People to the Earth:

Reflect the deep interconnections between inequality and social-related issues, as well as between climate change and addressing natural losses. Promote the efforts of business and financial institutions, building on recommendations from the TNFD and TCFD,Full integration of the human-earth framework and its interoperabilityThe goal is to - Relevance to the World:

Whether developed, emerging or developing countries,Recommendations are globally relevant, fair, valuable, accessible, and actionableConfirm that

7. future work plan for TISFD

The TISFD describes its goals for the next several years in three phases: short, medium, and long term.

The following roadmap has been published, starting with the establishment of a public framework in September 2024.

◆short-term target(from setting up a public framework)1-2 years)

It enables businesses and financial organizations to

- Recognize inequality and social issues as sources of risk at the entity and system levels, as well as opportunities related to improving people's outcomes.

- on social and inequality-related IDRO (impacts, dependencies, risks, and opportunities).Enhanced identification, evaluation, and reportingDo.

- To respect human rights, improve people's outcomes, reduce inequalities, thereby reducing financial risks and realizing financial opportunities,Dealing with situations as they ariseto do.

◆Medium-term target(in Japanese history)2-3 years)

TISFD will work with policy makers and standard setters.

- Voluntary and mandatory TISFD recommendations.Incorporate into standards and lawsThe following is a list of the most common problems with the "C" in the "C" column.

- on social and inequality-related IDROs.Promoting Global Harmonization of ReportingDo.

- Across jurisdictions worldwideCorporations and financial institutionsdue toPromote adoption of TISFD recommendationsDo.

◆Long-term goal(in Japanese history)5-10 years)

The goal is that TISFD's activities will enable corporations and financial institutions to adopt its disclosure recommendations.

- Access to information that enables civil society organizations to engage with the private sector on inequality and social issuesProvides accessand thereby provide additional accountability mechanisms for corporations and financial institutions to improve outcomes for people and mitigate associated financial risks.

- Benchmarkers, rating agencies, and data providers for social and inequality-related benchmarks, ratings, and data repositories.Improved accuracy and validityThe new system enables the use of the same technology as the old one.

- Governments, financial supervisors, and macroprudential authorities to use disclosure and the resulting information and data to achieve a more inclusive and equitable society, markets, and financial system.Develop effective policies and strategiesThe company will realize that it will be

- Ultimately, to reduce systemic-level risks related to inequality and other social issues, and to seize the great opportunities presented by building a fairer and stronger economy and society,Companies and financial institutions act in unison.The following is a list of the most common problems with the "C" in the "C" column.

It also describes a specific work plan.

The proposed work plan consists of six phases: (1) launch, (2) stakeholder capacity building, (3) definition and refinement, (4) framework development and testing, (5) publication, and (6) implementation and advocacy.

TISFD collects feedback prior to the official launch of the task force (results arethis way (direction close to the speaker or towards the speaker)(From).

Once the TISFD task force is officially established in September 2024, the first three months of its existence will see the formation of a steering committee, the participation of a secretariat, the creation of an alliance to support TISFD's mission and inform TISFD's activities, and the launch of several more working groups.

At the same time, we will build stakeholder capacity building and a conceptual foundation to support the disclosure framework and gather evidence on risks at the financial and systemic levels.

In parallel, TISFD will develop a set of criteria to be used to assess the relative usefulness and relevance of various indicators and metrics.

TISFD then expects to begin developing a beta version of the framework in late 2025. While the beta version of the guidance and other recommendations will be developed, it will also provide an opportunity for corporations and financial institutions to pilot use of the disclosure framework.

The first public version of the disclosure framework will then be released at the end of 2026. It will be accompanied by guidance and recommendations on implementation and will support entities that use it, including corporations and financial institutions.

8. Conclusion

This article focuses on the official launch of TISFD and is a commentary article on publicly available materials.

It explains key terms in the social dimension, such as inequality and IDRO (human rights, dependencies, risks, and opportunities), and emphasizes their importance as components of human and social capital. The article clearly demonstrates how TISFD views the importance of the social dimension of ESG.

One of aiESG's strengths is its ability to measure social impact upstream in the supply chain, an area where it is very difficult for companies to collect data. This is an area where it is very difficult for companies to collect data. aiESG leverages reliable data sources, special AI algorithms, and big data to provide comprehensive analysis at low cost. aiESG's analysis can be used to measure risks upstream in the value chain (forced labor, child labor, and other risk time) associated with potential risks in quantitative terms, and tracks the social impacts of a company's products and services during their production. This insight will help companies identify the potential social and human rights impacts of their business and prepare for early implementation of the TISFD disclosure framework.

aiESG provides support from basic ESG-related standards and frameworks to actual disclosure of non-financial information, so please contact us if you have any ESG-related issues.

Contact us:

https://aiesg.co.jp/contact/

(Report prepared by Hayato Harada, ESG Research Division)

[Related Article.

The Importance of Social Aspects in Nonfinancial Information Disclosure

[Commentary] TISFD: Task Force on Inequality and Social-related Financial Disclosures

[Commentary] Future Activities of the Task Force on Inequality and Socially Related Financial Disclosures (TISFD)

の立ち上げとロードマップ-~People-in-Scopeより~-min-1-1024x683.png)