INDEX

SFDRとは?

2021年3月、サステナブルファイナンス開示規則(Sustainable Finance Disclosure Regulation:以下、SFDR)が欧州で施行されました。

SFDRの主な目的は、欧州経済圏で活動する投資家が、持続可能な方法で資金を調達できるようにすることです。投資家に対して、金融商品の環境・社会・ガバナンス(以下、ESG)に関する情報をわかりやすく開⽰することで、透明性と説明責任が向上し、グリーンウォッシュ(一見環境に配慮した取り組みをしているが、実際の行動や活動が伴っていないこと)の防止を目指します。

以下、目次に沿ってSFDRの詳細を説明していきます。

Table of Contents

interpoint (interword separation)SFDRの成立背景

interpoint (interword separation)SFDRとEUタクソノミーの主な違いとは?

interpoint (interword separation)SFDRの対象

interpoint (interword separation)日本を含むEU域外の企業への影響は?

interpoint (interword separation)コア開示要件

interpoint (interword separation)SFDRの意義

interpoint (interword separation)今後の課題

SFDRの成立背景

SFDRの成立前、EUの金融機関はESGの開示に関する基準を独自に設定し、声明を出すことが可能でした。しかし、こうした独自の開示基準に沿った声明の事実確認するための手段がなく、それが問題点となっていました。独自で設定した多様な開示基準が存在していると、金融市場参加者(以下、FMP)などの投資家が投資先の企業から信頼性の高いESG関連の情報を得ることができずに、グリーンウォッシュに繋がることもあります。

例えば、環境に配慮していることを謳った製品のなかには、正当なデータなどの裏付けがないものや、製品の製造過程で人権侵害が行われている可能性があります。しかし、さまざまな開示基準が乱立していると、投資家が実態の伴わない活動をしている企業を支援してしまう可能性があります。

SFDRは、こうした独自で設定した多様な開示基準に歯止めをかけるために、金融商品のESGに関する統一的で明確な基準を設けました。そして、SFDRは、EU内の資産運用会社やFMPなどの投資家に対して、ESG情報の開示を義務付ける形で成立しました。

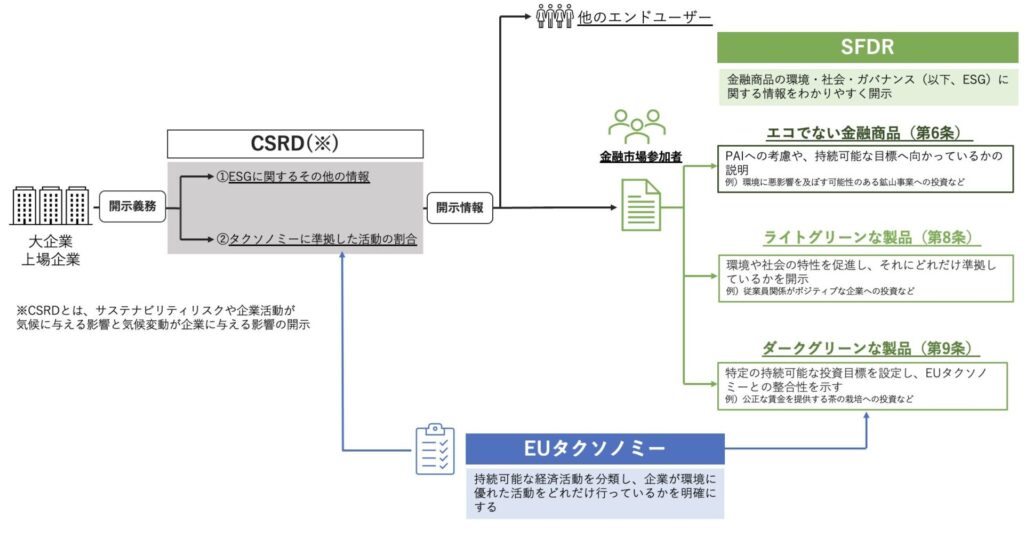

SFDRとEUタクソノミーの主な違いとは?

SFDRを理解するためには、EU Taxonomy Regulation(以下、EUタクソノミー)との違いを理解することが重要です。両者は、持続可能な社会を実現するための金融という同じ目標を共有しつつも、異なる機能を持ち、相互の要求事項を補完し合うように設計されています。

EUタクソノミーは、以下の6つの環境目標と4つの適合要件に基づいて、企業の経済活動が持続可能かどうかを判断します。EUタクソノミーはあくまで分類と開示義務を提供するのみであり、基準を満たさない経済活動への投資を禁じるものではありません。ただし、持続可能でないとされた経済活動に対する資金調達は、条件面で不利になると考えられます。

一方で、SFDRは、投資製品のESG情報の開示に焦点を当て、投資家が製品の持続可能性に関する情報を簡単に比較できるようにします。つまり、EUタクソノミーは企業の実際の活動に基づいて持続可能性を評価するのに対して、SFDRは投資製品の透明性向上を通じて投資家に情報を提供することに焦点を当てています。

| SFDR | EU Taxonomy | |

| 対象 | 主に投資製品(例:投資ファンド) | 主に企業や事業活動 |

| Objective. | 環境、社会、ガバナンス(ESG)の観点から投資製品の持続可能性を明確にする | 持続可能な経済活動を分類し、企業の環境に優れた活動を明確にする |

| 手段 | ESG情報の開示を要求し、投資製品を分類 | 持続可能な経済活動の分類体系を提供し、企業の基準適合性を評価 |

| 利点 | 投資家に異なる製品を比較しやすくする | 企業が自身の持続可能性を明示し、市場に対して信頼性を高める |

表1 SFDRとEUタクソノミーの主な違い

※EUタクソノミーの6つの環境目標と4つの適合要件

①気候変動の緩和、②気候変動への適応、③水と海洋資源の持続的な利用及び保全、④サーキュラーエコノミーへの移行、⑤環境汚染・公害防止及び抑制、⑥生物多様性と生態系の保護及び回復の計 6 つの環境目標を掲げています。

4つの適合要件とは、a)6つの環境目標の一つ以上に実質的に貢献する活動であること、b) 6つの環境目標のいずれにも著しい害を及ぼさないこと(DNSH原則:Do No Significant Harm)、c)ミニマムセーフガード(人権・労働など社会面も含む)に準拠すること、d)技術的スクリーニング基準(原則、指標、閾値)に準拠すること

SFDRの対象

上述のように、SFDRはFMPに適用されます。主に「ビッグプレーヤー」と定義されるEU拠点の従業員数500人以上の金融機関や、銀行、保険会社、投資会社、資産運用会社に適用されます。EU内の金融アドバイザーだけでなく、EU市場向けに商品を提供する非EU拠点の企業にも影響があります。従業員500人未満のFMPは、SFDRを遵守する義務はありません。ただし、コンプライ・オア・エクスプレイン(Comply or Explain)が適用されます。当事者は、コーポレートガバナンス・コードを遵守する、もしくは遵守しないのであれば、その理由を説明することが義務になっています。

SFDRの影響を受ける資金は膨大で、2021年にはEU拠点の金融企業の総資産は81.6兆ユーロでした。そして、SFDRはEUの子会社を通じて非EU拠点の金融企業にも影響を及ぼすため、その影響はさらに拡大します。例えば、EU金融市場で活動する企業の中で、世界中で子会社を持つ62の親会社が3.2兆ドルの市場価値を持っており、そのうち米国企業だけで2.5兆ドルを占め、22社が存在します。

日本を含むEU域外の企業への影響は?

SFDRの適用範囲は比較的広く、EUを拠点とするFMPが遵守を求められています。加えて、米国、アジアなどEU域外のFMPがEU域内で金融商品を販売したり、EUのファンドにポートフォリオ管理サービスや投資助言を提供する場合、EU域内の顧客や運用・助言するEUのファンドに販売する商品ごとにSFDRを遵守する必要があります。

つまり、直接的に開示規則の対象にならなくとも、欧州を拠点にしている金融機関や投資家から資金を調達している企業は、一定の影響を受けます。EU域外のFMPは、SFDRの開示義務がその企業や製品に適用されるかどうかを判断する際に、以下の①~③の基準を考慮すべきです。原則として、①~③のいずれかがEU内にある場合、SFDRが適用されます。その結果、日本などのFMPも開示義務の対象となります。

(i)事業単位の所在地

これは金融商品やアドバイスを提供またはマーケティングしている事業単位がどこにあるかについての情報です。企業や規模が大きい場合、親会社、子会社、または支店など、さまざまな部門が異なる場所に存在する可能性があります。本店所在地及び当該支店の所在地などがEU内にある場合、SFDRが適用されます。

②顧客の所在地

これは金融商品やアドバイスを購入している顧客(個人または法人)がどこに住んでいるか、またはどこに法的に登録されているかに関する情報です。顧客の所在地がEU内にある場合、SFDRが適用されます。

③金融商品などの所在地

これは金融商品やアドバイスがどこで登録され、どこで提供またはマーケティングされているかに関する情報です。金融商品が発行または登録された場所と、それが提供またはマーケティングされている場所は異なる場合があります。金融商品の発行や提供地がEU内にある場合、SFDRが適用されます。

また、日本を含むEU域外企業が上記の基準を満たす場合、対応策としてまず取り組むべきなのは、開示に向けた情報の収集です。経済活動がEUタクソノミーに整合していたとしても、データ不足によって投資家などに対して開示ができなければ意味がありません。必要に応じて、開示ができるように、データ収集などの準備をすることが考えられます。

コア開示要件

SFDRには、レベル1とレベル2の大きく分けて二つの開示要件が求められています。レベル1は2021年3月に施行されました。レベル1は、事業体レベルの開示になっています。サステナビリティ・リスク統合の方針、サステナビリティに有害な影響を与える事象(以下、PAI)、報酬方針について、金融機関のウェブサイトで開示することが求められています。EU以外の金融機関は、一般的には事業体レベルの開示は免除される傾向にあります。しかし、オルタナティブ投資ファンド運用会社(AIFM)などの登録を行っている場合、日本の金融機関であっても会社レベルの開示が必要となります。

レベル2(規制技術基準)は、レベル1を補完する形で、2022年4月に公表され、2023年1月1日から施行されました。レベル2は、金融商品レベルの開示となります。各金融商品をESG投資の度合いに応じて分類し、プリコントラクチュアル・ディスクロージャー(契約前の開示:金融商品やサービスに関する情報が契約締結前に顧客に提供されること)や定期報告書及び/またはウェブサイトで公表される必要があります。

ESGに関する金融商品は、2パターンに大別できます。一つ目が、ライトグリーンな製品(第8条)です。環境や社会の特性を促進し、それにどれだけ準拠しているかを開示する必要があります。例えば、従業員関係がポジティブな企業への投資など幅広い⾦融商品が該当します。二つ目が、ダークグリーンな製品(第9条)です。特定の持続可能な投資目標を設定し、EUタクソノミーとの整合性を示す必要があります。

例えば、公正な賃金を提供する茶の栽培への投資などのサステナブル投資が⽬的である⾦融商品が該当します。⾦融商品の第8条と第9条の分類は、規制当局などによる承認は不要であり、⾃社で判断することになります。両者の分類に関する細かい要件が定められていないため、特定の要件を満たせば機械的に第8条または第9条に分類できるものではありません。また、第8条または第9条の基準をクリアしない第6条(エコでない金融商品)もあります。こうした商品の場合、FMPの運用活動がもたらすサステナビリティへの主要な悪影響(Principle Adverse Impacts:以下、PAI)を考慮しているか、そして持続可能な目標に向かっているかどうかを説明する必要があります。例えば、環境に悪影響を及ぼす可能性のある化石燃料会社への投資や、鉱山事業への投資などが含まれます。このように、SFDRでは、金融機関は持続可能性の影響を事業体と商品レベルの両方から公開する必要があります。

また、2024年6⽉には、温室効果ガス排出量のスコープ3の開⽰が求められました。スコープ3とは、スコープ1、およびスコープ2以外の間接排出量(事業者の活動に関連する他社の温室効果ガスの排出量)です。つまり、企業活動の上流(購⼊に関する排出)および下流(販売に関する排出)の排出量を意味しています。スコープ3は、従来は規則が標準化されていなかったことからデータが整備されておらず、企業間の⽐較が困難でしたが、少しずつ標準化の⽅向性が⾒えてきています。

図 1 金融庁(2022)をもとに筆者作成

(in Japanese history)https://commission.europa.eu/system/files/2021-04/sustainable-finance-taxonomy-factsheet_en.pdf)

*CSRDとは、サステナビリティリスクや企業活動が気候に与える影響と気候変動が企業に与える影響の開示規制

SFDRの意義

SFDRの導入によって、FMPは自分たちの投資が地球温暖化や環境・社会に対してどのように貢献しているのか、ますます気を配る必要があります。SFDRは、企業は投資にどれだけ環境や社会の側面を取り入れているかをしっかりと説明する必要があるため、金融機関やアドバイザーは、環境や社会に深刻なダメージを与える分野への投資やうわべだけは環境や社会に配慮をすることはできなくなります。これらの開示により、大手機関投資家から一般の投資家までが、グリーンな投資商品を選び、ファンドを支え、ネットゼロへの歩みを促進させることが期待されます。

今後の課題

SFDRには、気候、生物多様性、人権に影響を及ぼす産業からの輸入品には規制がありません。EUは2022年に、鋼鉄業などのCO2排出削減が困難な産業(Hard-to-Abate産業)からの輸入に対する新しい炭素関税(novel carbon border tariff)を導入しましたが、この政策は森林伐採によって生産された革や、環境的・社会的悪影響をもたらす他の例が対象外になっています。欧州市場や関係者だけに焦点を当てることで、サプライチェーンの重要な資金の流れが欠落しています。最近の他のEU政策(CSRDなど)は付加価値とサプライチェーンに焦点を当てていますが、SFDRは気候変動の影響が大きい製品や人権に影響を及ぼす商品への制限に関してはまだまだ限定的です。SFDRはEUの持続可能な社会を実現するための政策の一環であり、将来的にはさらなる政策措置が期待されます。

aiESGでは、SFDRについての基本的な内容から実際の非財務情報の開示に至るまで、サポートいたします。SFDR対応にお困りの企業様はぜひお問合せください。

Contact us:

https://aiesg.co.jp/contact/

References

https://finance.ec.europa.eu/sustainable-finance/disclosures/sustainability-related-disclosure-financial-services-sector_en

https://www.sustain.life/blog/sfdr-reporting

Related page

Report List : Regulations/Standards

https://aiesg.co.jp/topics/report/tag/基準-規制/

CSRD: The EU Sustainability Reporting Standard Just Before It Enters into Force: The Impact on Japanese Companies

https://aiesg.co.jp/topics/report/2301120_csrd/

Commentary] Overview of ESRS (European Sustainability Reporting Standards)

https://aiesg.co.jp/topics/report/2301120_csrd/

【【Explanation] What is TNFD? A new bridge between finance and the natural environment

https://aiesg.co.jp/topics/report/230913_tnfdreport/

What is the SASB Standard for ESG Information Disclosure? (Part 1)Outline of SASB

https://aiesg.co.jp/topics/report/2301025_sasb1/