INDEX

Europe: The Corporate Sustainability Due Diligence Directive (CSDDD) is a regulation that requires large companies, primarily those doing business in Europe, to conduct due diligence on the negative impacts of their activities on both human rights and the environment. The CSDDD (Corporate Sustainability Due Diligence Directive) is a regulation that requires large companies, mainly those doing business in Europe, to properly assess and address the actual and potential negative impacts of their activities on both human rights and the environment.

In the previous article, we summarized the twists and turns in the adoption of the CSDDD and gave a general summary of the target companies and other details.

Commentary] Overview of the European Corporate Sustainability Due Diligence Directive (CSDDD) and its Amendments

https://aiesg.co.jp/topics/report/240426_csddd/

The CSDDD was formally adopted by the Council of the European Union on March 15, 2024, and approved by the EU Parliament on April 24, 2024. It is expected to be in full use in EU member states for the next two years, after which the institutions are set to enact national legislation.

The purpose of this issue is to summarize the details of the CSDDD and to provide an understanding of the sustainability response in the European region.

1. conditions and timing for CSDDD-eligible companies

The CSDDD aims to establish a framework for companies to identify, prevent, mitigate, and account for adverse human rights and environmental impacts* The CSDDD encompasses due diligence requirements** that extend to a company's direct actions, subsidiaries, and supply chain, and outlines a company's obligation to align its business model and strategy with sustainability principles and outlines the obligations of companies to align their business models and strategies with the principles of sustainability. The scope of the Directive is expressed in terms of a "chain of activities" and specifies that spillover economic relationships such as "indirect business partners" are also within the scope of due diligence. (Hereinafter referred to as "Chain of Activities")

The Directive mandates the integration of human rights and environmental considerations into corporate operations and governance. In addition, they must adopt a transition plan to align their business model with the Paris Agreement's global warming mitigation target of within 1.5°C.

*EU Parliament Press Release: *EU Parliament Press Release: *EU Parliament Press Release: *EU Parliament Press Release

https://www.europarl.europa.eu/news/en/press-room/20240419IPR20585/due-diligence-meps-adopt-rules-for-firms-on-human-rights-and-environment

**Due diligence refers to "the investigation of the value and risks of a company or investee for the purpose of making an investment" (SMBC Nikko Securities WebsiteSee also).

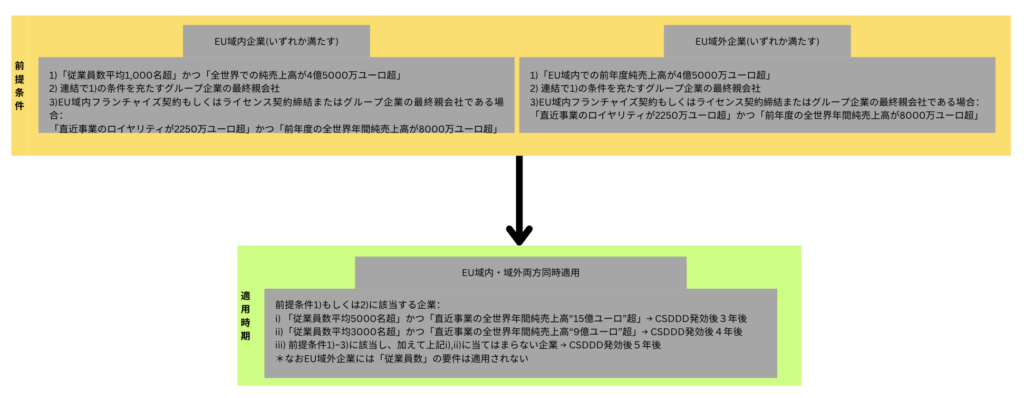

The specific categories of companies subject to the regulation and the timing of its application are as follows

Figure 1: Overview chart of CSDDD's corporate application conditions and timing of application

(European Commission (executive of the EU)andEuropean Parliamentprepared by the author)

Upon formal adoption as of April 2024, EU member states will enact national legislation during a two-year adjustment period.

The EU Parliament has provided the following information on the expected application timing of the CSDDD:

a. Companies with more than 5,000 employees and global sales of more than 1.5 billion euros: from 2027 onwards

b. Companies with more than 3,000 employees and global sales of more than 900 million euros: from 2028

c. Companies fulfilling all remaining conditions (more than 1,000 employees and global sales of more than 450 million euros): from 2029

Since the CSDDD obliges parent companies to conduct due diligence throughout the chain of activities, it is highly likely that Japanese companies will be required to do so even if they are outside the scope of the applicable conditions. From this point of view, it can be said that the CSDDD has an influence that goes beyond the scope of European regulations.

2. negative impact range specified by CSDDD

The scope of the due diligence response is set out in this Directive with the intention of covering "upstream to downstream". The "chain of activities" is defined as the production or provision of goods by a company, including the development of products or services, to its business partners (upstream) and the distribution, transport, and storage of products to its business partners (downstream). Waste treatment and recycling in the terminal area are not included in the scope of application.

For service companies, services provided by downstream companies are excluded from the scope of due diligence. Incidentally, the scope of the CSDDD explicitly excludes SMEs from its scope. However, when they are part of a chain of activities, the parent company, the large company, actively promotes the support of these SMEs, and the SMEs may need to respond in a similar manner.

As of March 2024, the CSDDD has been adopted as an amendment and is currently in the process of being adapted to national legislation within EU member states. In other words, the CSDDD has not yet entered into force, and there is still some uncertainty as to how it should be implemented in practice. In particular, for companies adapting the CSDDD, it is unclear where the chain of activities (the so-called supply chain) should be included in the scope.

It is important to recognize that the scope of due diligence impact assumed by the CSDDD is broad. At the same time, however, certain considerations have been made, such as the exclusion of small and medium-sized enterprises from the scope of the CSDDD. Since the CSDDD is expected to enter into force in three years, it is expected that the definition of the scope to be imposed on the applicable companies will be further specified in the future.

3. what happens if the CSDDD is not followed

Member States will be required to provide companies with detailed information about their due diligence obligations online through a practical portal that includes guidance from the European Commission. And for applicable companies that do not comply with the CSDDD, they will be incentivized to do so by adopting multi-faceted penalties, such as

(Authority Sanctions)EU countries will impose penalties for violations of the CSDDD, including fines of "at least 5% of the offending company's worldwide net sales". Failure to comply with the fines will be sanctioned with social recognition by publicizing the company name of the affected company.

For companies that still do not respond to the fines, injunctive and other measures will be taken. Although the specific details have not yet been determined, the possibility of suspension of product distribution and import/export has been mentioned.

(Civil Liability) At the European level, we aim to ensure coordinated CSDDD enforcement through a network of supervisory authorities. If a company is injured by these non-compliance measures, it is entitled to compensation for damages. This is imposed on the company as a so-called civil liability.

The envisioned negative consequences are far-reaching, including trade unions and civil society organizations. A five-year period has been established for filing lawsuits.

The applicable company shall not be liable for damages caused solely by its business partners in the supply chain.

To motivate companies to comply with the CSDDD, public authorities will be able to use the CSDDD as part of their criteria for awarding contracts. This will require many companies to comply with this directive, as government and other contracts can also be made conditional on CSDDD compliance.

4. due diligence response

As identified above, the CSDDD will ask companies to improve their corporate governance and integrate human rights and environmental risks and their impact risk management and mitigation processes into their corporate strategies. Specific negative impacts include child labor, forced labor, pollution, and deforestation, as well as overuse of water resources and destruction of ecosystems.

Figure 2: Due Diligence Process

Adapted from OECD (2018), "OECD Due Diligence Guidance for Responsible Business Conduct"

The CSDDD explains the process in accordance with the regulations set forth by the OECD for due diligence.

Figure 2 references the general flow of due diligence.

(1) Incorporate responsible corporate behavior into corporate policies and management systems

2) Identify and assess negative impacts on the company's operations, supply chain and business relationships

3) Stop, prevent and mitigate negative impacts

(4) Track implementation and results.

5) Communicate how you dealt with the impact

interpoint (interword separation)

interpoint (interword separation)

[ 2) to 5) repeated if necessary ]

interpoint (interword separation)

interpoint (interword separation)

(6) Take corrective action when appropriate or cooperate in corrective action

In order to fulfill these obligations, CSDDD-eligible companies will need to make the necessary investments, and to obtain due diligence assurances in their contracts with business partners. They will also need to improve their business plans and provide the necessary support to their small and medium-sized business partners. Effective engagement in these processes, including dialogue and consultation with affected stakeholders, is also an obligation.

It should be noted that under the proposed EU Council Directive, if a CSDDD-eligible company is unable to identify, prevent, or remedy adverse environmental and human rights impacts caused by a business partner, the company may consider, as a "last resort," entering into a new transaction with such a partner or terminating the continuation of an existing transaction.

Prior to the interruption or termination of the business relationship, the entity would not reasonably anticipate or assess that the adverse effects of those end measures would be significantly more severe than the adverse effects that could not be prevented. If the termination of the business relationship would have a more adverse effect, the applicable entity would be required to continue these relationships and report to the competent authorities.

5. summary

The CSDDD is a directive that was decided upon through a lengthy discussion period as of March 2024.The CSDDD requires companies to fulfill their environmental and social responsibilities. Even though its applicable company requirements themselves are detailed, the SME side of the supply chain is also incorporated into the due diligence response. This is a regulation that should be recognized not only by Japanese companies operating in Europe, but also by a wide range of Japanese companies.

At this time, there is no practical data on the response of the subject companies. This means that it is not clear to what extent the negative impact of due diligence should be reflected. We will continue to follow the latest information on CSDDD and update this page as appropriate.

aiESG offers a service that provides quantitative analysis tools for corporate sustainability indicators. aiESG can be contacted by companies wishing to assess the impact of their activities on the environment and human rights, for example, in response to the CSDDD.

Contact us:

https://aiesg.co.jp/contact/

*Related Article*.

Report List : Regulations/Standards

https://aiesg.co.jp/topics/report/tag/基準-規制/

Commentary] Overview of the European Corporate Sustainability Due Diligence Directive (CSDDD) and its Amendments

https://aiesg.co.jp/topics/report/240426_csddd/

Commentary] Alphabet Soup - Disruptions and Convergence of Sustainability Standards

https://aiesg.co.jp/topics/report/2301226_alphabet-soup/

CSRD: The EU Sustainability Reporting Standard Just Before It Enters into Force: The Impact on Japanese Companies

https://aiesg.co.jp/topics/report/2301120_csrd/

SFDR: What are the EU Sustainable Finance Disclosure Rules?

~ESG-related information disclosure requirements for financial products

https://aiesg.co.jp/topics/report/2301222_sfdr/

Commentary] Overview of ESRS (European Sustainability Reporting Standards)

https://aiesg.co.jp/topics/report/2301120_csrd/