INDEX

In recent years, sustainability of corporate activities has become more and more important, and more companies are disclosing non-financial information with reference to ESG-related international standards. However, how is this vast amount of information being captured and reflected in actual investment? In this issue, we focus on the current status of international "sustainable investment" and the challenges it faces.

Table of Contents:

Seven Methods of Sustainable Investment

Current Status of Sustainable Investment

Issues Surrounding Sustainable Investment and ESG Management

Effort required for information disclosure

Discrepancy from the actual situation

Difficulty of evaluation

Conclusion

Seven Methods of Sustainable Investment

What type of investment does sustainable investing refer to in the first place? The terms sustainable investment, impact investment, and ESG investment are used rather vaguely, and it is often difficult to clearly explain the difference between them.

In this article, we will base our discussion on the seven methods defined by the Global Sustainable Investment Alliance (GSIA), an international organization that promotes sustainable investment.

| technique | summary |

| impact investment | Investment for positive social and environmental impact Measurement and reporting of impact and proof of investor intent are required. |

| Positive/Best-in-Class Screening | Investments in sectors, companies, and projects that demonstrate good ESG performance within their industry and above a specified threshold |

| Sustainability Thematic Investments | Investments in themes and assets that contribute to sustainable environmental and social solutions (e.g., sustainable agriculture, gender equality) |

| Screening based on norms | Screening according to compliance with international norms, such as standards issued by the UN, ILO, and OECD |

| Negative Screening | Exclusion of specific sectors, companies, countries, etc. from the fund or portfolio depending on the product or business activity that is determined to be ineligible for investment (e.g., weapons manufacturing, animal testing) |

| ESG Integration | An investment approach that systematically and explicitly incorporates environmental, social, and governance factors into financial analysis with the goal of improving risk-adjusted returns |

| Corporate Engagement and Voting | Using investor rights to influence corporate behavior through communication with management and voting rights |

Table 1 : Sustainable Investment Methodology

(Source:Definitions for Responsible Investment ApproachesPrepared by author from [1])

Non-financial information disclosed by companies can be used in a variety of ways, including when it is used to compare a company with its peers (positive/best-in-class screening), when it is used to confirm compliance with codes (code-based screening), and when it is used to evaluate various initiatives (e.g., sustainability theme investments). There are a variety of ways in which initiatives are evaluated (e.g., sustainability theme investments). A combination of these methods is used in actual investment products and strategies, and the proportion of these methods tends to vary from region to region and year to year.

Current Status of Sustainable Investment

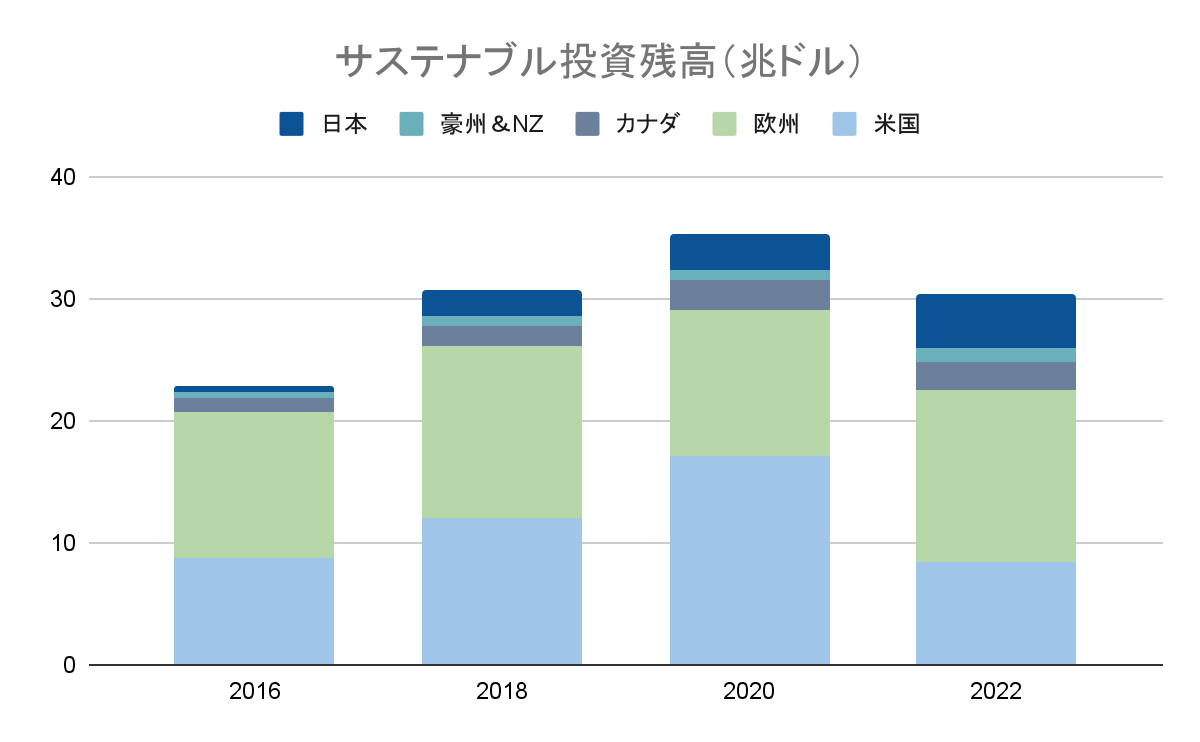

While it may seem that the growing focus on sustainable investment has led to an increase in investment balances globally, this is not necessarily the case. The graph shows the sustainable investment balance in each country and region according to the Global Sustainable Investment Review published by GSIA.

Figure 1: Sustainable Investment Balance

(Source:Global Sustainable Investment Review 2022Prepared by the author from)

The figure shows a marked decline in the U.S. data from 2020 to 2022. This reflects a change in survey methodology, as many ESG integrations, which had accounted for the majority of U.S. sustainable investments until the 2020 survey, are no longer counted. While it is possible to attribute this result simply to the change in standards, it is also possible that products with ambiguous realities have been treated as sustainable investments in the past. The fact that there are different evaluation organizations in different countries and regions also complicates the overall picture.

Meanwhile, the balance of investment in Japan is consistently growing. According to a survey by the Japan Sustainable Investment Forum (JSIF), the total amount of sustainable investments exceeded 537 trillion yen as of the end of March 2023[2].

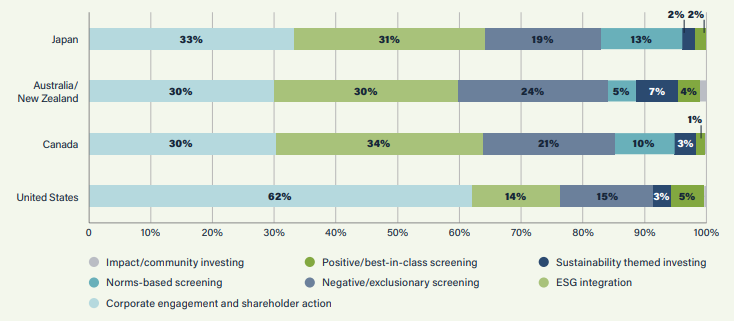

Country differences can also be seen in the breakdown of sustainable investment. Figure 2 shows the percentage of sustainable investments by method in Japan, Australia/New Zealand, Canada, and the United States.

Figure 2: Breakdown of sustainable investment in each country

(Source:Global Sustainable Investment Review 2022)

The investment breakdown for Europe is not disclosed in this GSIA report. In the other countries and regions, corporate engagement/voting, ESG integration, and negative screening accounted for more than 80% of the total. In Japan, negative screening accounts for a relatively small percentage, and norm-based screening is also the method of choice.

The U.S. shows a distinctive graph of 62% for Corporate Engagement and Voting, but this is due to the exclusion of funds that did not include specific information on ESG integration due to the aforementioned change in survey methodology.

The concept of sustainability has become impossible to ignore in the marketplace, but even now there are various ways to evaluate and use ESG scores. While the trend of companies being required to disclose non-financial information is expected to continue, it is likely that companies will take a harsher view of information with ambiguous evaluation criteria and the possibility of greenwashing.

Issues Surrounding Sustainable Investment and ESG Management

We will now look at the challenges for corporate ESG management and its evaluation system. The following hurdles exist for companies that engage in disclosure and for investment entities that make sustainable investments.

Effort required for information disclosure

First, corporate ESG information disclosure involves many costs. Just organizing the necessary information is no easy task, given the barrage of disclosure standards established by international organizations, the variety of disclosure items required, and the enormous amount of data to be processed. The path to getting the information together is not limited to information that can be completed within the company, such as the percentage of female managers, or items that can be easily measured quantitatively, such as carbon dioxide emissions, but also includes items for which there are no clearly established standards for disclosure, such as items that trace back through the supply chain or social aspects. The path to having all this information in place varies. In addition, ESG itself covers a wide range of fields and requires a wide range of skills, including the use of systems for data analysis and scrutiny of international standards, making it difficult for companies to find the right people to take charge.

Discrepancy from the actual situation

ESG information disclosure is associated with various difficulties, but it has also been pointed out that there is a discrepancy between the actual information that is actually disclosed and the actual business. According to a survey of Japanese companies conducted in 2023, more than 55% of companies reported that they are unable to utilize the ESG data they have collected for management decision-making and business operations[3]. [3]. Some say that it is necessary to raise the awareness of not only senior management but also the entire workforce regarding corporate initiatives, and companies around the world are implementing methods such as linking compensation to ESG scores[4].

Difficulty of evaluation

Due to the challenges of ESG management described above, it remains not easy for investment entities to evaluate companies using non-financial information. In addition, because different investors have different evaluation criteria and priorities for ESG items, we have not yet reached the point where companies reluctant to contribute to ESG are forced to exit the market. Investors and the market are calling for greater transparency from ESG evaluation agencies and measures to address greenwashing, and establishing an investment perspective in sustainable investment, which requires a long-term perspective before returns can be earned.

Conclusion

In this article, we have focused on the current status of sustainable investment and the challenges of ESG management in the context of the corporate and market sustainability movement. beyond research and initiatives for ESG reporting, there is a need for a mechanism to understand the current situation, to improve the actual situation, and to invest from a long-term perspective.

aiESG provides support for everything from basic information on sustainable investment and ESG management to actual disclosure of non-financial information, so please contact us if you have any ESG-related questions.

Contact us:

https://aiesg.co.jp/contact/

Bibliography

[1] Definitions for Responsible Investment Approaches (gsi-alliance.org)

[2] JSIF Survey 2023 Results Release Bulletin.pdf (japansif.com)

[3] Survey 2023 on ESG Data Collection and Disclosure|Strategic Risk|Deloitte Tohmatsu Group

[4] Global Management and Investor Attitudes on "ESG" and Compensation (pwc.com)

Related page

Report List : Regulations/Standards

https://aiesg.co.jp/topics/report/tag/基準-規制/

Explanation] Sustainable Finance

〜˜Sustainable Response in the Financial Industry

https://aiesg.co.jp/topics/report/240209_sustainable-finance/

SFDR: What are the EU Sustainable Finance Disclosure Rules?

~ESG-related information disclosure requirements for financial products

https://aiesg.co.jp/topics/report/2301222_sfdr/

Paper presentation] The Relationship between Environmental Valuation and Stock Price Returns

~Investors consider companies that do not engage in environmental management to be a significant risk.

https://aiesg.co.jp/topics/report/230712_escore_investor/

[Commentary] Alphabet soup

〜˜Sustainability Standards in Disarray and Convergence

https://aiesg.co.jp/topics/report/2301226_alphabet-soup/