INDEX

Introduction.

On March 5, 2025, a finalized version of the Sustainability Standards for Business Reporting and Disclosure (SSBJ Standards) was published, setting forth the rules and content to be disclosed by companies when making corporate disclosures related to sustainability information [1]. The Sustainability Standards Board of Japan (SSBJ) is working to establish these standards in order to improve the transparency and reliability of corporate disclosure by Japanese companies and to ensure international consistency[2].

The application of the SSBJ Standards is expected to become partially mandatory in 2027, and the publication of the SSBJ Standards is expected to lead to significant changes in corporate disclosure and sustainable finance. This report provides an overview of the SSBJ standards and the major changes from the exposure draft in an easy-to-understand format.

For more information about SSBJ, please click here.

https://aiesg.co.jp/topics/report/0225-ssbj/

Please click here to read the text of the Sustainability Disclosure Standards.

https://www.ssb-j.jp/jp/ssbj_standards.html

Background of the Creation of the SSBJ Standards

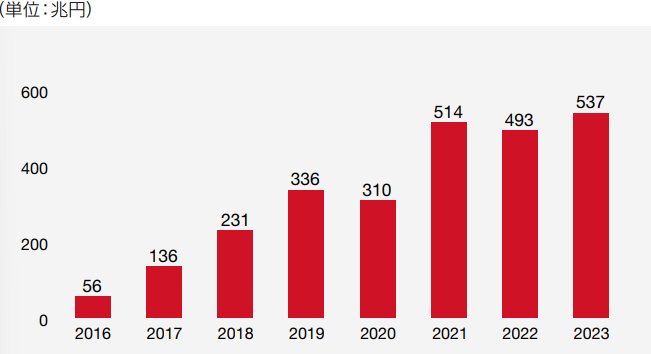

As interest in climate change and social issues grows worldwide, ESG investment and sustainable finance, in which corporate value is determined based on a company's commitment to social sustainability and investments and loans are made, are becoming increasingly popular.

As the amount of ESG investments increases year by year in Japan (Figure 1), there is a need for high-quality, comparable corporate disclosures by general investors and stakeholders in order to determine where to invest.

On the other hand, with regard to disclosure standards for sustainability information, different sustainability standards such as TCFD, TNFD, ESRS, and GRI have been in disarray, causing confusion among companies and investors.

Given this background, in June 2023, the International Sustainability Standards Board (ISSB) established the ISSB Standards, a set of sustainability disclosure standards that can be used worldwide, in order to create a unified international sustainability disclosure standard [4].

In Japan, the SSBJ Standards for Sustainability Disclosure were established based on the ISSB Standards and in line with Japan's own laws and regulations such as the Law Concerning the Promotion of the Measures to Cope with Global Warming, as well as the actual conditions of Japanese companies.

SSBJ Standards Overview

A broad overview of the SSBJ standards is given in Table 1, focusing on the contents of Table 1.

Table 1: Summary of SSBJ Standards ([2] [5] [6](Prepared by the author based on)

| Objective. | (1)Improve transparency and credibility of sustainability information disclosure by Japanese companies (2)Ensure international consistency in information disclosure by Japanese companies |

| policy of formulating and implementing | Consistent with ISSB standards and taking into account the requirements of Japanese companies |

| structure | Universal Standards: Defines rules and methods for applying SSBJ standards Thematic Standards (1) and (2): Defines specific information that should be included in corporate disclosures |

| Eligibility | Assumed to be applied by prime listed companies |

| Start of application | Voluntary application available from March 2025 Mandatory application scheduled for March 2027 |

The two primary objectives of the SSBJ standards are to

Ensure the quality of sustainability information disclosure

・Ensure that sustainability information disclosure by Japanese companies is acceptable to overseas users.

In relation to the second objective and formulation policy,Corporate disclosures applying SSBJ standards also comply with ISSB standards unless "SSBJ standard-specific treatment" is usedIf the company can demonstrate compliance with both the SSBJ and ISSB standards, it will be a more valuable corporate disclosure.

Structure of SSBJ Standards

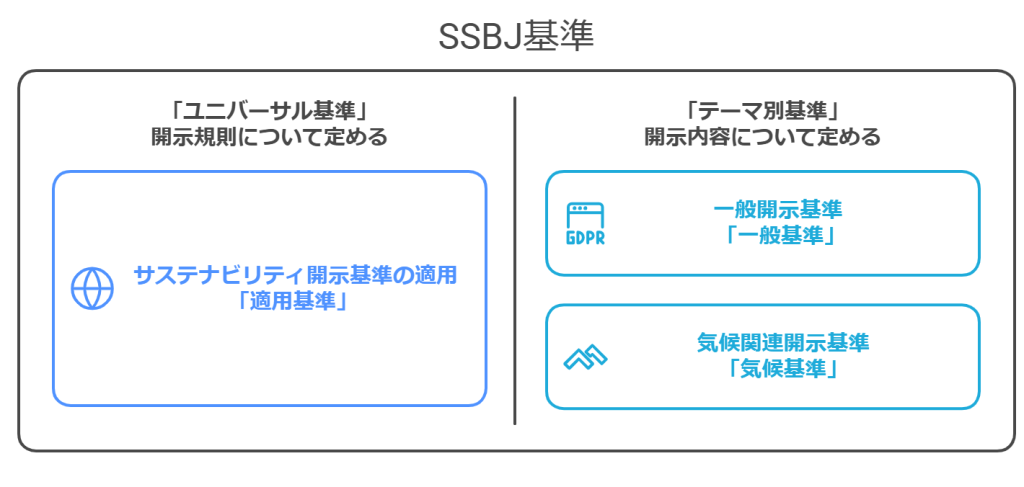

The SSBJ standards consist of three standards: applicable standards, general disclosure standards, and climate-related disclosure standards (Figure 2).

The SSBJ standards are structured in two parts: universal standards and thematic standards, and thematic standards are further divided into two parts: general disclosure standards (general standards) and climate-related disclosure standards (climate standards).

The Universal Standards (Applicable Standards) set forth the rules for applying the SSBJ Standards, the method of disclosure, definitions of terms, and other assumptions that are important in using and understanding the SSBJ Standards.

The thematic standards set forth the specific details that must be included in corporate disclosures that apply the SSBJ standards.

Climate Standard: Sets forth information that must be disclosed related to climate issues, such as greenhouse gases and climate scenarios.

General Criteria: Generally defines information to be disclosed related to issues other than climate issues, such as human capital, biodiversity, etc.

Applicability and start date

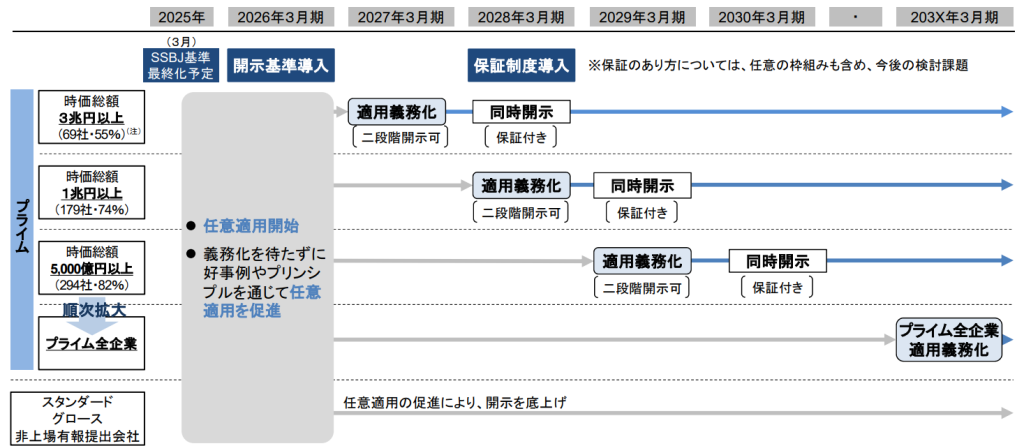

The Working Group on Disclosure of Sustainability Information and Guarantees of the Financial Services Agency is playing a central role in discussing and examining the scope and timing of application (Figure 3).

The obligation to apply SSBJ standards is currently under consideration, as shown in Figure 3.Mandatory for prime companies from March 2027.The company expects to achieve a net income of ¥2.5 billion in the fiscal year ending March 31, 2012.SSBJ standards are not legally binding.Therefore, it is expected to become mandatory in the form of promulgation of a law requiring the application of SSBJ standards.

Even in the phase where the application of the SSBJ standards is not mandatory, companiesApply at your discretionSince the SSBJ standards are effective for annual reporting periods ending on or after March 5, 2025, the date of publication, companies with a March 31 year-end may voluntarily apply the standards beginning in fiscal 2024. Voluntary application is to reduce the burden on companies,Climate-related disclosures only.Transitional measures such as the following may be applied.

Explanation of Universal Standards

The Universal Standards set forth the rules and methods for preparing sustainability-related financial disclosures by applying the SSBJ Standards. Table 2 summarizes a summary of what is stipulated in the Universal Standards.

Table 2: Summary of Universal Standards ([5](Prepared by the author based on)

| Company, time period, and timing for reporting | Must be the same as the related financial statements |

| Location of information | Required to be disclosed in conjunction with related financial statements |

| Commercial Confidentiality | No need to disclose if all certain requirements are met |

| Necessary to identify risks and opportunities | (⑴Applying SSBJ standards (⑵Considering the applicability of SASB standards) |

| Necessary to identify whether there is a duty to disclose | (1) Application of SSBJ standards (2) If (1) is not possible, consider the applicability of SASB standards |

| Disclosure of information of materiality | Information that is material regarding risks and opportunities that could affect the entity's prospects shall be disclosed. |

| subsequent event | (1) If new information that existed by the closing date*1 is obtained by the date of approval for publication for the prepared corporate disclosures, the related disclosures must be updated (2) Material information about transactions and events that occur after the closing date must be disclosed. |

| Comparative Information | All figures and useful descriptive and explanatory information disclosed in the current reporting period shall be disclosed together with comparative information for the previous reporting period (transitional provisions apply). |

Principles of information to be included

When preparing corporate disclosures in accordance with SSBJ standards, companies are required to disclose "information about sustainability-related matters that is reasonably expected to affect the company's prospects. On the other hand, in order to avoid confusing users by listing immaterial information, it clearly states that information that is not expected to have an impact is not required to be disclosed. (Sections 22, 28, 34)

When preparing sustainability-related financial disclosures in accordance with SSBJ standards, the following four points should be made to screen the information to be included (Paragraph 35)

(1) Identification of sustainability-related risks and opportunities (Sec. 36-45)

(⑵Determination of the scope of the value chain (paragraphs 46-47)

(3) Identification of information related to risks and opportunities (Sec. 48-55)

⑷Determination of materiality (paragraphs 56-59)

(1) Identification of sustainability-related risks and opportunities

This section requires companies to identify risks and opportunities (i.e., matters to be disclosed) that could affect their prospects from a wide range of sustainability topics, including climate change, human capital, and biodiversity. The applicable standards specify which sustainability disclosure standards should be followed, and specific identification methods are specified within the thematic standards (general standards and climate standards).

When identifying sustainability-related risks and opportunities, each sustainability standard must be referenced and applied according to Table 3.

Table 3 Sustainability criteria used to identify risks and opportunities ([8](Prepared by the author based on)

| must be applied | SSBJ Standards |

| Reference and applicability must be considered | SASB Standard |

| May be referenced and considered for applicability | The IFRS Sustainability Disclosure Standard "Guidance on Applying the CDSB Framework for Water-Related Disclosures" and "Guidance on Applying the CDSB Framework for Biodiversity-Related Disclosures", the most recently published documents by other standard setters, and sustainability-related risks and opportunities already identified by companies in the same industry or region. Risks and opportunities |

When applying the SSBJ standards to prepare corporate disclosures,Inevitably need to refer to the SASB StandardFor more information on SASB, please see this article.

What is the SASB Standard for ESG Information Disclosure? (Part 1)Outline of SASB

https://aiesg.co.jp/topics/report/2301025_sasb1/

(2) Determine the scope of the value chain

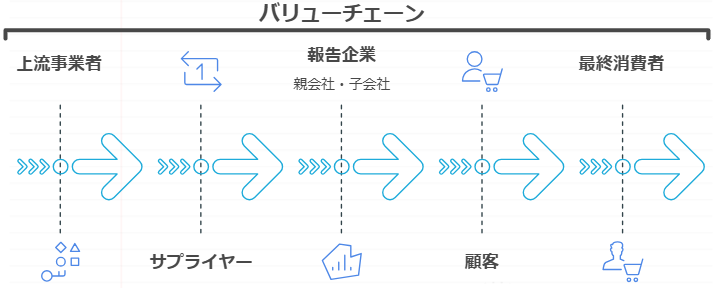

The value chain is defined as "all of the interactions, resources, and relationships that relate to the business model of the reporting entity and the external environment in which the entity operates" (Section 4 of the applicable standard).

When applying the SSBJ standards, the scope and composition of the value chain that could be affected by the risks and opportunities identified in (1) must be clarified with reasonable and supportable information. In addition, both upstream and downstream activities must be considered when determining the scope of the value chain [5] (Figure 4).

(3) Identification of information on risks and opportunities

Materiality information related to identified risks and opportunities, such as the relationship of greenhouse gas emissions to climate issues, must be disclosed. To identify what numbers and statements are material, the following process should be undertaken

(a) To the identified risks and opportunitiesThere are specific SSBJ standards that apply.case

⇒The provisions of the relevant SSBJ standards shall apply.

(b) To the identified risks and opportunities.No specific applicable SSBJ standards are defined.case

⇒ Need to determine materiality using sustainability criteria in Table 4.

Table 4 Sustainability criteria used to identify relevant information ([8](Prepared by the author based on)

| Reference and applicability must be considered | SASB Standard |

| May refer to and consider applicability | IFRS Sustainability Disclosure Standard CDSB Framework Application Guidance GRI Standard *2ESRS (European Sustainability Reporting Standard) *2・Recently published documents by other standard setters・Sustainability-related information already identified by companies in the same industry or region |

In the identification of relevant information, unlike the identification of risks and opportunities,SASB Standard can be applied only when the SSBJ Standard does not specifically provide for it.It is important to note that the

Specific stipulations are mainly those described in the thematic standards. Risks and opportunities related to climate issues, such as greenhouse gas emissions, since the Climate Standard on Climate Issues has now been published,When specific SSBJ standards are specifiedThis applies to the following.

On the other hand, no separate thematic standards have been developed for risks and opportunities related to human capital, biodiversity, etc. In this caseIn the absence of specific SSBJ criteria stipulationsThe identification would be made in accordance with the

⑷Determination of Materiality

Information that is "material" means "information that, if omitted, misstated, or obscured, could reasonably be expected to influence decisions made by users of the financial report" (paragraph 4).

(1) Identification of sustainability-related risks and opportunities; (3) Risks and opportunities/information already identified in the identification of information on risks and opportunities, taking into account changes in circumstances and assumptionsReassess its materiality at the end of each reporting period (closing date)must be done (Section 59).

General Criteria and Climate Criteria (Thematic Criteria)

Thematic criteria are used to apply the SSBJ standards to the preparation of sustainability-related financial disclosures.Specifically defined content to be disclosed (i.e., core content).They are. The Climate Criteria deal with content related to climate issues, while the General Criteria deal with social issues for which no specific thematic criteria exist, such as human capital, biodiversity, and so on.

The thematic standards refer to the content to be disclosed as "core content" and further classify core content into four categories: governance, strategy, risk management, and indicators and targets (Figure 5).

Core Content of General and Climate Criteria

The core content set forth in each of the General Standards and Climate Standards is generally consistent, but the Climate Standards are more specific because they are disclosure standards specific to climate issues.

This chapter provides an overview of the core content in the general and climate standards. Notable features of specific core content in the Climate Criteria are described in the next chapter.

Table 5: Key Core Content ([5](Prepared by the author from)

| governance | Management's role in organizational controls and procedures used to monitor, manage, and supervise information, risks, and opportunities for the organization or individual responsible for oversight of risks and opportunities*3. |

| strategy | (1) Risks and opportunities that can have an impact (2) Impact of risks and opportunities on the company's business model and value chain (3) Financial impact of risks and opportunities (4) Impact of risks and opportunities on company strategy and decision making (5) Resilience of company strategy and business model in relation to risks |

| risk management | Processes, policies, and opportunities for identifying, evaluating, ranking, and monitoring risks; the extent to which processes for identifying, evaluating, ranking, and monitoring risks and opportunities are integrated into the overall risk management process; and the methodologies used. |

| Indicators and Targets | Indicators required by applicable SSBJ standards; indicators for monitoring risk and opportunity and associated company performance; key industry-specific indicators relevant to the company; targets set by the company to monitor progress toward achieving its strategic objectives; and targets required to be met by law. Targets |

Resilience in ⑸ of the strategy is defined as "a company's ability to cope with uncertainty arising from sustainability-related risks." For example, resilience in climate issues would be the ability to predict the degree of global warming and extreme weather events and to identify and prevent the adverse effects of each risk on corporate operations. Companies should develop sustainability-related strategies and business models thatQualitative Assessment of Resiliencemust be disclosed.

Characteristics of Climate Standards

Since the Climate Standards are standards established specifically for climate issues, they are more detailed than the General Standards, which provide for universal content. We will pick up two noteworthy points in the Climate Standards and explain them here.

(1) Resilience and climate scenario analysis

As noted above, "resilience" refers to "a company's ability to respond to uncertainty caused by sustainability-related risks." The Climate Standard has more provisions for resilience than the General Standard. Also,Mandatory use of climate-related scenario analysisThe characteristics of the product are that it is attached (Table 6).

Table 6: Differences between general and climate criteria for resilience ([5](Created from)

| Resilience (general criteria) | Climate Resilience (Climate Criteria) | |

| Disclosure Details | Qualitative assessment of the resilience of the strategy and business model, the methodology used and the time horizon considered | Climate-relatedMethodology and timing of scenario analysisAssessment of climate resilience at the end of the reporting period |

| Evaluation Frequency | unsettled | Per reporting period |

| Evaluation Methodology | No specific methodology defined | Climate-related scenario analysis |

However, there is also language within the Climate Standard that suggests that companies obtain and use climate scenario analysis information from external organizations to avoid excessive cost and effort (Section A13 A14).

(2) Disclosure of greenhouse gas emissions

Under the Climate Standard, in addition to the risk, opportunity, and financial impact targets established in the General Disclosure StandardsGreenhouse Gas EmissionsThe company is required to disclose about [5].

For greenhouse gas emissions, the absolute total amount of greenhouse gas emissions generated during the reporting period

Scope 1 GHG emissions...GHGs directly emitted by companies

Scope 2 GHG emissions...GHGs indirectly emitted by companies

Scope 3 GHG emissions...GHG emitted when purchasing raw materials and after sales

The three categories of greenhouse gas emissions must be disclosed in the following three categories. These greenhouse gas emissions are also measured in accordance with the international standard for calculating and reporting corporate greenhouse gas emissions, theGHG Protocol (2004)This must be done in accordance with [13]. Scope 3 greenhouse gases in particular are difficult sustainability information to handle because they must be calculated back through the supply chain.

Scope 3 greenhouse gases is explained in this article.

Commentary】Trends in SSBJ (Sustainability Standards Board of Japan) Deliberations - Scope 3 Disclosure Standards in Japan

https://aiesg.co.jp/topics/report/240520_ssbj/

Significant changes from the exposure draft

How have the SSBJ standards changed over the year of discussion since the exposure draft of the SSBJ was released in March 2024? We will pick up and explain the major changes and explore the changes in SSBJ discussion trends and policies.

Adjustments to the climate standard due to the revision of IFRS S2

At the January 29, 2025 ISSB Board meeting conducted by the International Sustainability Standards Board (ISSB), which develops the International Sustainability Disclosure Standards (IFRS), it was tentatively decided to amend IFRS S2, which sets forth climate-related disclosures.

Since the SSBJ standards are designed to maintain consistency and international comparability with IFRS, the SSBJ climate standards were adjusted for the following two main points prior to the revision of IFRS.

(⑴Deferred mandatory use of GICS (Global Industry Classification Criteria)

GICS is an industry classification system jointly developed by two private U.S. companies, MSCI and S&P Dow Jones Indexes, and is widely used as a defining factor in measuring and comparing the economic size and GHG emissions of different industries [11].

Under IFRS S2, companies engaged in asset management, commercial banking activities and insurance industries were required to disclose additional finance emissions that were specifically classified and organized by the relevant industry sector (from [12] B62-B63). Among them, finance emissions for the commercial banking activities and insurance industry were required to be classified by industry sector using the GICS codes.

At this ISSB Board meeting, it was pointed out that since the GICS code is not free of charge, requiring its application would force certain private companies to pay a license fee, which would not be fair. In response to this point of view, it is expected that a permissive provision such as "an industry classification system other than GICS may be used if required by a jurisdiction or exchange" will be established.

The SSBJ Exposure Draft of the Climate Standards also stipulated that companies in the asset management, commercial banking, and insurance industries must disclose additional finance emissions broken down by industry using the GICS Code, but following the ISSB Board meeting's revised policy, "for the time beingInformation broken down by industry using GICS codes need not be disclosedand amended [10] (Section C7).

(⑵A permissive provision that reduces the scope of disclosure of financial emissions

As mentioned earlier in the exposure draft, companies in the asset management, commercial banking, and insurance industries were required to disclose additional finance emissions, and in the process of disclosure, they were required to calculate GHG emissions throughout their supply chain in accordance with the GHG Protocol.

Under the new SSBJ standards, even in the case of the above-mentioned industrial activities, "if the business is not regulated by law as a business, it is not required toNo need to disclose additional financing emissionsThe permissibility provision was established as "the

Since it is difficult to accurately and effectively calculate greenhouse gas emissions in these industries, the reduced scope of disclosure is expected to reduce the cost of corporate disclosure.

Changes Surrounding Sustainability Disclosure

From the ISSB Board meeting's policy to revise IFRS and the SSBJ standard to reduce the burden of financial emission disclosures, there has been a movement to reduce the burden that sustainability-related disclosures place on companies. In addition, CSRD and CSDDD have been simplified [14], and there is a trend to trace back the supply chain around the world.Difficulty/burden of collecting primary datais being reaffirmed.

It will be important for companies to disclose non-financial information more effectively and to promote sustainability disclosure as a business investment to increase corporate value.

aiESG provides ESG services that enable comprehensive analysis of product supply chains, including SSBJ standards and other ESG-related standards, and is happy to answer any questions or concerns you may have about corporate disclosure.

About aIESG's services:https://aiesg.co.jp/service/

Related Articles

SSBJ: From the Background to the Creation of SSBJ to Sustainability Disclosure Standards

https://aiesg.co.jp/topics/report/0225-ssbj/

Commentary] ISSB - Global Baseline for Sustainability Disclosure

https://aiesg.co.jp/topics/report/2301130_issb/

References

[1]Sustainability Standards Board, "Sustainability Standards Board Publishes Sustainability Disclosure Standards," SSBJ,. https://www.ssb-j.jp/jp/ssbj_standards/2025-0305.html, 2025-03-18

[2]Sustainability Standards Board, "Sustainability Standards Committee," SSBJ,. https://www.ssb-j.jp/jp/list-ssbj_2.html, 2025-3-18

[3]JSIF "Sustainable Investment Balance Survey 2023," https://japansif.com/2023survey-jp.pdf

[4]IFRS, "General Requirements for Disclosure of Sustainability-related Financial Information," https://www.ifrs.org/content/dam/ifrs/publications/pdf-standards-issb/english/2023/issued/part-a/issb-2023-a-ifrs-s1-general-requirements-for-disclosure-of-sustainability-related-financial-information.pdf?bypass=on

[5]SSBJ "Sustainability Disclosure Standards Update,"https://www.fasf-j.jp/jp/wp-content/uploads/sites/2/20250306_01.pdf

[6]Corporate Disclosure Division, Planning and Markets Bureau, Financial Services Agency, "Trends in Sustainability Disclosure and Assurance,".https://www.fasf-j.jp/jp/wp-content/uploads/sites/2/20250306_02.pdf

[7]Working Group on Disclosure and Assurance of Sustainability Information "Fifth Reference Material",.https://www.fsa.go.jp/singi/singi_kinyu/sustainability_disclose_wg/shiryou/20241202/02.pdf

[8]SSBJ, "March 2025 Universal Standard for Sustainability Disclosure,"https://www.ssb-j.jp/jp/wp-content/uploads/sites/6/jponly_20250305_01.pdf

[9]SSBJ, "March 2025 Sustainability Disclosure Thematic Standard No. 1,"https://www.ssb-j.jp/jp/wp-content/uploads/sites/6/jponly_20250305_02.pdf

[10]SSBJ, "March 2025 Sustainability Disclosure Thematic Standard No. 2,"https://www.ssb-j.jp/jp/wp-content/uploads/sites/6/jponly_20250305_03.pdf

[11]MSCI, "The Global Industry Classification Standard (GICS®)," https://www.msci.com/our-solutions/indexes/gics, 2025-03-20

[12]SSBJ, "March 2024 Sustainability Disclosure Thematic Standard Exposure Draft No. 2," https://www.ssb-j.jp/jp/wp-content/uploads/sites/6/2024ed01_04.pdf

[13] "Greenhouse Gas (GHG) Protocol - Standard for the Calculation and Reporting of Emissions by Businesses",.https://www.env.go.jp/council/06earth/y061-11/ref04.pdf

[14]EU "Questions and answers on simplification omnibus I and II," https://ec.europa.eu/commission/presscorner/detail/en/qanda_25_615