INDEX

Introduction.

The Advisory Group on Corporate Disclosure released an interim report in June 2024. The report identifies issues in the disclosure of information by Japanese companies and proposes a grand design for the future disclosure system. This article provides an overview of the interim report and its discussion points in an easy-to-understand manner.

Corporate Accounting Office, Economic and Industrial Policy Bureau:Interim Report of the Advisory Panel on Corporate Information Disclosure

What is the "Roundtable Conference on Corporate Information Disclosure"?

Up until now, Japan has made efforts to enhance corporate information disclosure through such means as annual securities reports and corporate governance reports. In addition, in response to the growing importance of sustainability information in disclosure internationally in recent years, more and more companies are preparing and disclosing integrated reports and annual business reports. Please refer to this article for more information on recent trends in annual reports and integrated reports.

Commentary] The Importance of Social and Human Capital in Securities Reports

https://aiesg.co.jp/topics/report/240529_securities-report/

Commentary] Integrated Reporting - For Increasing Transparency in Corporate Activities

https://aiesg.co.jp/topics/report/240322_integrated-report/

While corporate information disclosure is becoming increasingly popular, the variety of media and formats has made the disclosure system more complex, resulting in problems such as duplication of information among reports and difficulty in comparison due to differences in disclosure formats among companies. In addition, as the need for sustainability information increases rapidly, the burden of report preparation is increasing, and it has been pointed out that current information disclosure is insufficient for evaluating corporate value.

The "Roundtable on Corporate Information Disclosure" operated by the Ministry of Economy, Trade and Industry (METI) discusses issues related to disclosure by Japanese companies from the two perspectives of (1) disclosure system and (2) information disclosure that contributes to enhancing corporate value, including sustainability information, and pursues what kind of disclosure system and information disclosure should be established. For a more detailed explanation of the "Roundtable on Corporate Information Disclosure," please click on the link below.

Corporate Accounting Office, Economic and Industrial Policy Bureau:Holding of "Round-Table Conference on Corporate Information Disclosure

Issues in Corporate Disclosure

At the roundtable, issues regarding disclosure by Japanese companies were identified from two perspectives.

The first issue is the content and quality of corporate disclosure.

Specifically.

- Insufficient disclosure of business model

- Disclosure is necessary to highlight the characteristics of the company

- Lack of disclosure of sector-specific data and KPIs

Three points are noted.

Here, business model refers to "a structure that achieves sustainable growth with a differentiated structure" (quoted from the interim report), and it is thought that the difficulty for investors and analysts to judge and compare corporate value throughout the entire process is an issue. The interim report also points out that there are not enough English versions of various disclosure documents, and that foreign investors are demanding more information disclosure in English.

Three points are noted.

Here, business model refers to "a structure that achieves sustainable growth with a differentiated structure" (quoted from the interim report), and it is thought that the difficulty for investors and analysts to judge and compare corporate value throughout the entire process is an issue. The interim report also points out that there are not enough English versions of various disclosure documents, and that foreign investors are demanding more information disclosure in English.

The second issue is the system of corporate information disclosure. Currently in Japan, one disclosure document corresponds to each law and regulation related to corporate information disclosure, resulting in the preparation of multiple reports (e.g., securities reports based on the Financial Instruments and Exchange Law, business reports and financial statements based on the Companies Act, and corporate governance reports based on the listing rules of stock exchanges, etc.). It was pointed out that the purposes of each law and regulation often overlap in part, and that similar information is described and duplication of content occurs between these different media.

In addition, sustainability-related information is also required to be disclosed in the Corporate Governance Report due to the revision of the Corporate Governance Code in June 2021[1], and the Securities Report has a new section for "Sustainability-related Policies and Initiatives" starting from the fiscal year ending March 31, 2023[2]. 2], the duplication of content between annual securities reports, corporate governance reports, and sustainability reports has begun to occur.

This fragmentation and duplication of related and similar information in multiple disclosure media allows

- Increased burden on investors and other users to read multiple reports

- Increased difficulty in systematically understanding corporate information and collecting necessary information

- Increases the burden on the preparer to prepare the report

The interim report states that there are problems such as

Grand Design of New Disclosure System

In the interim report, two image proposals were presented for the future of corporate information disclosure that could solve these issues. The features and advantages of each image are explained below, citing the images.

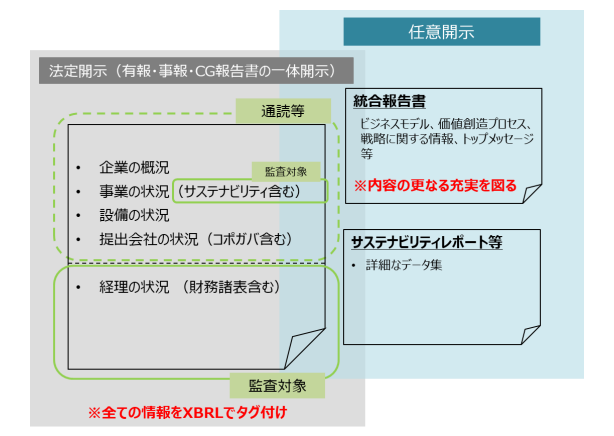

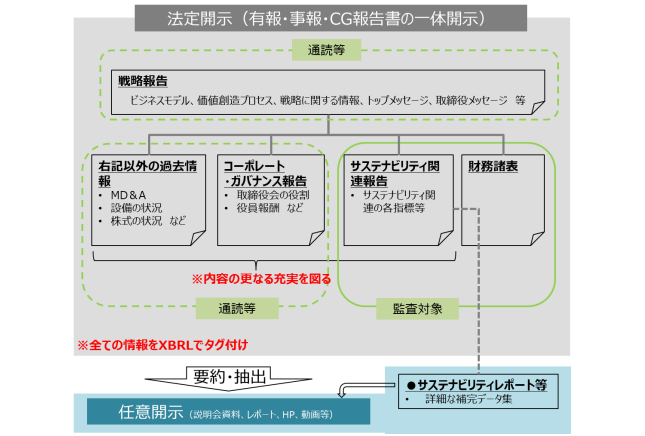

Image Proposal 1 is a proposal to clarify the division of roles between statutory and voluntary disclosure. (Figure 1)

Image proposal 1 proposes the following two points

- Consolidate and disclose three legal disclosure documents into one

- Allow each company to freely prepare reports other than statutory disclosure documents

Legal disclosure documents are set in detailed format and content, making it difficult to communicate a company's business model and value creation process to users. By consolidating statutory disclosure documents (annual securities reports, business reports, financial statements, and corporate governance reports) into a single document, we aim to improve the efficiency of corporate disclosure operations and information gathering for investors and others, while ensuring the free dissemination of information by leaving room for companies to disclose information on a voluntary basis, such as in integrated reports. The Company aims to improve the efficiency of corporate disclosure operations and the collection of information from investors and other parties by consolidating statutory disclosure documents (securities reports, business reports, financial statements, and corporate governance reports) into a single document.

Image Proposal 2, on the other hand, proposes a two-tiered disclosure system in which the contents of the integrated report are also integrated into one statutory disclosure document and then into one legal disclosure document. (Figure 2)

In the statutory disclosure documents based on Image Draft 2, we propose a two-tier structure consisting of a section for obtaining an overall picture of the company's value creation efforts (first layer) and a section for obtaining detailed supporting information (second layer). The first layer, "Strategic Report," is intended to include descriptive information such as business model, value creation process, strategy, top management message, etc. The second layer is intended to include corporate governance-related information, sustainability-related information, financial statements, and other historical information.

The interim report states that by consolidating and correlating information from the first and second tiers in a single legal disclosure document, the report will make it easier for investors to understand the past, present, and future information of a company in an integrated manner.

The following four points are important points common to both proposals.

- Integrated disclosure of the Business Report, Financial Statements, Annual Securities Report, and Corporate Governance Report

This is expected to make it easier for investors and other users to collect corporate information, and for companies to improve the efficiency of their disclosure practices. - Disclosure of Integral Documents Prior to the Annual General Meeting of Shareholders

The Companies Act requires that business reports and financial statements be provided electronically at least three weeks prior to the annual general meeting of shareholders. However, since securities reports and other documents are often released immediately before or after the annual general meeting of shareholders, investors have long demanded that they be released well in advance of the annual general meeting. Therefore, we will require companies to disclose information well in advance of the annual general meeting in both Proposal 1 and Proposal 2, while taking into consideration the option of moving back the date of the annual general meeting. - Promote disclosure of information in English

As mentioned earlier, there are many companies in Japan that do not disclose corporate information in English. In order to attract investment from overseas investors, it is necessary to promote disclosure of statutory disclosure documents in both Japanese and English. - Improvement of machine readability by XBRL

It is proposed to improve the ease of information collection and machine readability by tagging in XBRL format in light of the fact that reports are increasingly being read using AI, etc. It is pointed out that disclosure of information in XBRL format will be beneficial for analysis and fund formation by securities analysts since users can easily obtain and compare information from a large number of companies. This is also beneficial for securities analysts' analysis, fund formation, and other purposes. Tagging is also believed to have the effect of clarifying the definition of data and creating a common understanding.

A relatively large number of participants in the discussion group expressed the opinion that Image Proposal 2 should be the way to go. Some of the reasons given were that having financial and non-financial information disclosed in a single document would provide investors with more consistent access to information and make it easier for them to obtain the information they need to forecast future cash flows.

Those who prepare such reports expressed the hope that the elimination of the situation in which similar information has to be disclosed in multiple media will improve operational efficiency. Some also expressed the opinion that encouraging the preparation of integrated reports would promote integrated thinking in corporate management.

Grand Design Issues

The two main issues identified for the realization of Image Proposal 2 are as follows

- Feasibility of combining all disclosure information into one document prior to the implementation of the General Meeting of Shareholders

- Transition to a New Disclosure Structure

In particular, it has been pointed out that a barrier to the transition to the new disclosure system is the fact that the number of companies required to submit annual securities reports in Japan is far greater than the number of companies required to submit similar reports overseas. It has been argued that uniformly requiring companies of various sizes to submit statutory disclosure documents based on the proposed image2 may be burdensome for companies with little experience in preparing integrated reports and the like.

Some have also pointed out that the new disclosure system should be introduced at the same time as the introduction of the SSBJ standards for sustainability information disclosure. In Japan, the finalized version of the Sustainability Information Disclosure Standards is expected to be released at the end of March 2025. If the new disclosure system is introduced in parallel with the introduction of the SSBJ Standards, Japanese companies will be required to take prompt actions to enhance their sustainability information disclosure.

To learn more about trends in SSBJ standards, please click here.

SSBJ (Sustainability Standards Board) Deliberation Trends

~Scope 3 Disclosure Standards in Japan

https://aiesg.co.jp/topics/report/240520_ssbj/

Prospects for Information Disclosure

While taking these issues into consideration, it is expected that the efforts of companies to create sustainable value will be effectively disclosed to investors and that the effectiveness of dialogue and engagement between companies and investors will be improved in the future. It is also expected that related ministries and agencies will work together to design specific systems.

If a two-tiered disclosure system that aims to disclose all corporate information in one report is realized, investors will be able to collect information more efficiently and obtain consistent information, and companies will be able to streamline their disclosure operations and promote integrated thinking.

On the other hand, the report also points out several issues that need to be addressed in order to achieve this goal, such as the increased burden on preparers and the barriers to changing the disclosure system. The interim report also points out the need to improve disclosure with a sense of urgency in order to attract global investment to Japan, and it is expected that discussions on how to establish an effective disclosure system while overcoming these challenges will accelerate toward implementation.

aiESG provides ESG analysis services related to the supply chain of manufactured goods. If you have any questions or concerns about corporate disclosure and sustainability information disclosure, please feel free to contact us.

References

[1] https://www.fsa.go.jp/news/r2/singi/20210611-1/01.pdf

[2] https://www.fsa.go.jp/policy/kaiji/sustainability-kaiji.html

Related Articles

Commentary] The Importance of Social and Human Capital in Securities Reports

Commentary] Integrated Reporting - For Increasing Transparency in Corporate Activities