INDEX

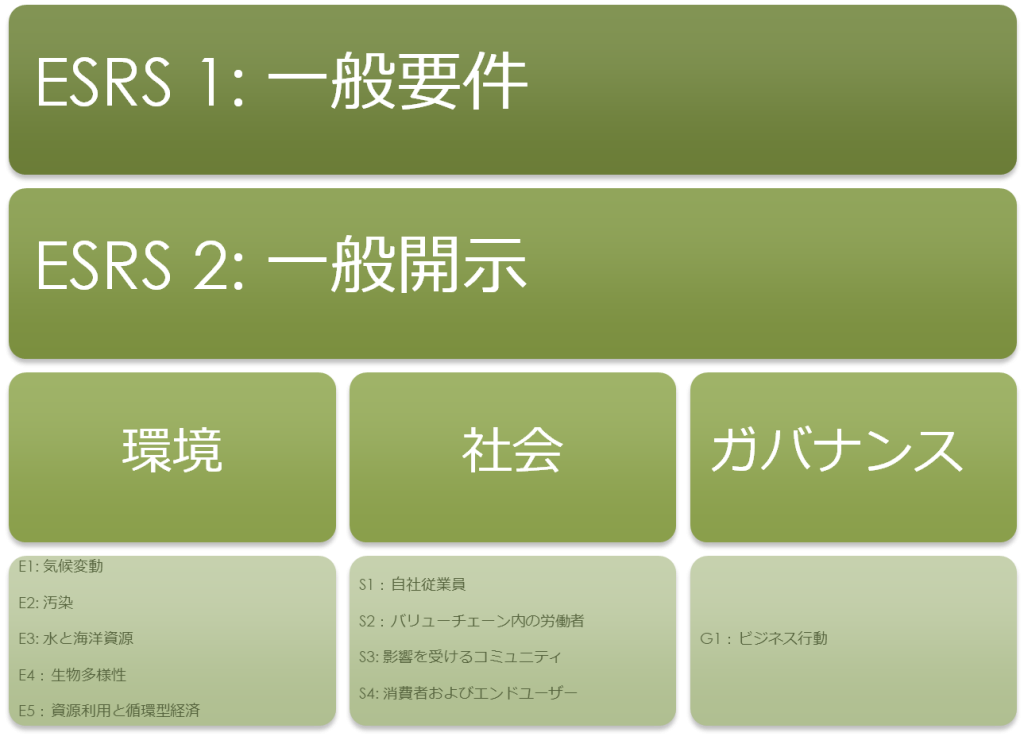

- The CSRD is a law (directive) that requires companies to report on sustainability, and the ESRS serves as a standard (guidebook) that explains what should be disclosed and how.

- Currently, the ESRS consists of 12 criteria and includes cross-sectoral criteria (ESRS1 and ESRS2) as well as topic-specific criteria on environment (E1-E5), society (S1-S4) and governance (G1).

- ESRS1 outlines the overall logic of sustainability reporting and explains the materiality assessment methodology while clarifying the terminology used.

- The disclosures required by ESRS2 are mandatory for all companies and cover areas related to governance, strategy, and management of sustainability issues.

What is ESRS?

In recent years, sustainability has moved from a niche topic to a central concern for companies, customers, investors, and regulators worldwide. Companies can adopt a number of reporting frameworks (GRI, SASB, TCFD, etc.) in their sustainability reports, but few are legally binding. The European Sustainability Reporting Standard (ESRS), first proposed by the European Financial Reporting Advisory Group (EFRAG) in 2021, will set a global precedent for comprehensive and enforceable sustainability reporting The ESRS is governed by European legislation called the Corporate Sustainability Reporting Directive (CSRD) The ESRS is governed by a European law called the Corporate Sustainability Reporting Directive (CSRD). For more information on the CSRD, please visitthis way (direction close to the speaker or towards the speaker)Please see from

The CSRD is the 'rule' that provides order,

The ESRS can be thought of as a 'guideline' for following that order.

The CSRD and ESRS integrate key elements from previous EU policies, international frameworks, and reporting standards, including the Global Reporting Initiative (GRI), the International Sustainability Standards Board (ISSB), and the Task Force on Nature-related Financial Disclosures (TNFD). For those interested,Correspondence table between TNFD and ESRS disclosure requirementsfor more information.

Who will follow.

As a European regulation, the CSRD applies primarily to EU-listed companies, but some non-EU companies will also comply. The chart below summarizes when various types of EU and non-EU companies should begin collecting and reporting data.

Figure 1: CSRD response schedule by business type

Source Prepared by the author based on EFRAG data.

In this regard, large Japanese companies with subsidiaries in the EU will be subject to CSRD as early as fiscal year 2025. how will CSRD affect Japanese companies?This articlePlease read the following.

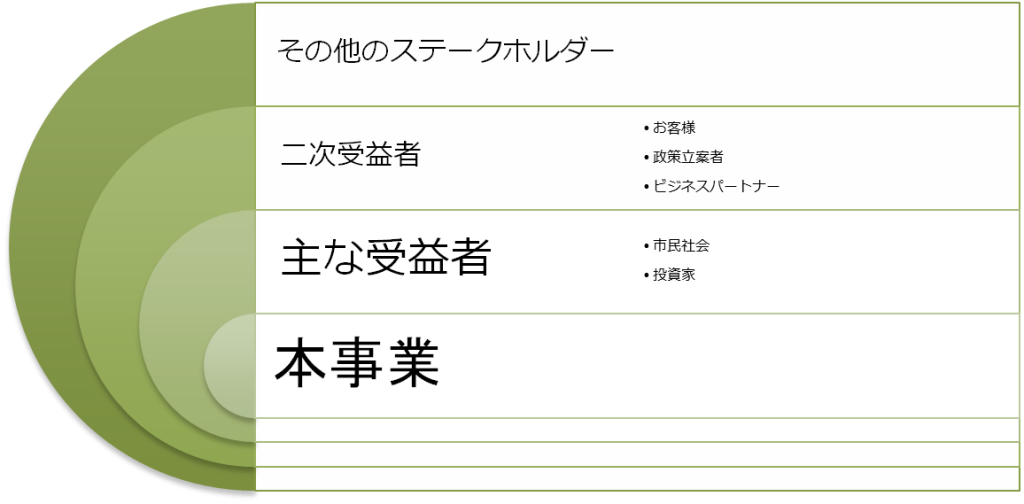

Who benefits?

The CSRD and ESRS were designed to enable investors, civil society organizations, consumers, and other stakeholders to assess corporate sustainability performance in a standardized manner. The expectation is that this will help to channel funds to companies that demonstrate strong environmental and social responsibility.

Figure 2. expected beneficiaries of CSRD/ESRS

In addition, companies themselves are expected to derive significant benefits from ESRS reporting in the form of financial, reputational, and strategic opportunities.For example.The 851 TP3T of companies that participated in the initial implementation of the ESRS (Q2 2024) intend to integrate the findings of the report into their business strategies and decision-making.

ESRS 1: General Requirements

The ESRS consists of cross-sectoral standards (as described in ESRS1: General Requirements and ESRS2: General Disclosures) and sector-specific standards (environmental, social, and governance) The ESRS structure is described in the figure below and in theThis articlePlease refer to the following information.

Figure 3: ESRS disclosure structure

The role of ESRS 1 is to set forth the general principles of the ESRS and to guide companies in preparing their sustainability statements; ESRS 1 consists of 10 chapters that explain terminology, assessment criteria, data collection and analysis methods, timeframes, and more. This section presents selected portions of ESRS 1 that are most relevant to understanding compliance with the ESRS.

General structure of information disclosure

All disclosure requirements consist of four reporting areas:

- Governance (Governance)GOV)Description of the governance process for monitoring impacts, risks, and opportunities.

- Strategy (SBM)A description of the firm's business model and its strategy for addressing these risks and opportunities, including

- Impact, Risk and Opportunity Management (IRO)A description of how the firm identifies and assesses the materiality of its sustainability impacts. Also, an overview of how the firm manages these matters through specific policies and actions.

- Metrics and Targets (MT):A description of the metrics used to track the company's performance and progress toward achieving its sustainability goals.

Double Materiality (Double Materiality Assessment)

Information regarding environmental, social, and governance disclosures is determined based on the results of internal assessments. In other words, companies are required to report only relevant material information, rather than all disclosure requirements covered by the ESRS. Such an assessment is called a double materiality assessment. As the name suggests, double materiality has two aspects: impact materiality and financial materiality.

Figure 4. double materiality range (highlighted in red)

Impact materiality refers to the positive or negative impacts of a company on people and the environment (including both actual and potential impacts) in its business activities, including its value chain. Financial materiality, on the other hand, refers to the financial risks and opportunities associated with a company's sustainability. Since impact materiality and financial materiality are often interrelated, both are considered important for ESRS reporting. EFRAG does not prescribe a specific methodology for assessing dual materiality, allowing each company to choose the approach that best suits its operations. It does, however, suggest four general steps:

- Provide an overview of the company's activities and business relationships in order to understand the key stakeholders affected.

- Identify actual and potential impacts related to sustainability and develop a list of risks and opportunities.

- Evaluate and determine significant Impacts, Risks, and Opportunities (IRO: Impact, Risks, Opportunities) based on the ESRS thematic disclosure requirements and determine what to include in the report.

- Document the evaluation method and its results in detail.

After the assessment is completed, the results are aligned with the specific sustainability topics outlined in ESRS 1 (e.g., Topic: Own Employees → Sub-Topic: Working Conditions → Sub-Sub-Topic: Health and Safety). Once the key issues and their exact topics have been identified, companies should look into the relevant disclosure requirements. For example, if employee health and safety is determined to be a material issue due to exposure to hazardous chemicals, the company should look at Social Disclosure, specifically S1 Your Employees, S1 -1 Policies, S1 -4 Taking Action, S1 -5 Targets, S1 -14 Health and Safety Metrics, and other sections should provide details.

value chain

The ESRS emphasizes the value chain as an integral part of the sustainability declaration. The double materiality assessment should include the impacts, risks, and opportunities for the company related to direct and indirect business relationships. However,Recent EFRAG reportsThe majority of companies recognize that the value chain is one of their most difficult challenges, according to the Approximately 90% of companies are still working on their value chain mapping methodologies, including access to historical Tier 1 supplier information. Recognizing these challenges, the ESRS uses reliable sources of information, such as sector average data and other proxies, to help companies estimate information.The services provided by aiESG areThe company will help companies identify key hotspots in the supply chain based on industry averages and provide in-depth analysis.A case study of supply chain analysis conducted by aiESG for a Tokyo-based apparel companyfor a better understanding.

ESRS 2: General Disclosures

ESRS 2 "General Disclosures" is mandatory for all companies included in the scope of the CSRD. The requirements are organized into five main areas

- Basics of Creation (BP)

- Governance (GOV)

- Strategy (SBM)

- Disclosure of Materiality Assessment Process (IRO)

- Indicators and Targets (MDR)

Basis of Preparation (Basis for Preparation): BP

The main purpose of this requirement is to provide stakeholders with transparency and a clear understanding of a company's approach to sustainability reporting. bp-1 requires disclosure of the general approach used to prepare the report. the key elements of bp-1 are as follows

- Scope of consolidation:Clarification as to whether the report represents the entire organization or only a portion of it, and the extent to which the sustainability declaration is consistent with the financial disclosures.

- value chain:Disclosure of the extent to which the company's upstream and downstream value chains are included.

- Abbreviated information: A description of any confidential or secret information that has been omitted, including the legal reason for the omission.

- Use of estimates:Explanation of the rationale, methodology, and accuracy of indirect sources of information used (e.g., sector averages).

BP-2, on the other hand, contains disclosure requirements regarding specific circumstances that may affect the reporting process, such as the use of non-standard timeframe definitions, descriptions of how value chain data is estimated, and changes or updates to the preparation process.

governance (Governance): GOV

The Governance chapter defines requirements for governance processes implemented to monitor and manage sustainability matters. These chapters (GOV-1 through GOV-5) cover the following topics

- Company Leadership Role

The firm should disclose the composition, diversity, roles, responsibilities, and expertise of its leadership in assessing sustainability impacts (GOV-1). It should also explain how often and by whom leadership is updated on key sustainability impacts, risks, and opportunities. - Incorporating Sustainability Performance into Incentive Programs

The firm should outline its incentive program for governance members, detailing specific performance measures and stating whether these measures affect pay and promotions (GOV-3). - Mapping Due Diligence

The company should explain the key steps in the due diligence*1 process by linking core elements such as governance, stakeholder engagement, impact assessment, and mitigation actions to relevant ESRS disclosures (GOV-4). - risk management

Disclose risk management systems for sustainability reporting, including risk assessment methodologies and key mitigation measures.

strategy (Strategy and Business Model)SBM

This chapter outlines disclosure requirements for the company's strategy in three key areas: sustainability, business model, and value chain. The chapter emphasizes the importance of stakeholder involvement in shaping the company's strategy and business model, and assesses the specific outcomes of the company's assessment of sustainability matters.

- Strategy, Business Model, Value Chain Identify key strategic elements related to sustainability, including the value chain

List key products, services, and markets; provide a breakdown of revenue by key sectors (>10% of sales); specify sustainability-related goals; and provide a detailed description of key suppliers, customers, and business partners (SBM-1). - Stakeholder Engagement

Describe your approach to incorporating stakeholder interests and views into the overall business model. You should specify how you engage with key stakeholders and provide specific examples of changes you have made to your business model to incorporate stakeholder views (SBM-2). - Sustainability Assessment (Significant Impacts, Risks, and Opportunities)

The company must outline where in the value chain the significant impacts, risks, and opportunities identified through the materiality assessment occur. The company must also identify how sustainability-related risks and opportunities impact business decisions and resource allocation, and estimate the associated financial implications.

Impact, risk and opportunity management (Impacts, Risks and Opportunities management) : IRO

As already mentioned, the disclosures described in ESRS 2 are mandatory for all companies included in the scope of the CSRD. In addition to the mandatory disclosures, companies are required to select topics related to environmental, social, and governance impacts, risks, and opportunities and disclose them in their sustainability reports. Relevant topics are identified using a double materiality assessment as described in ESRS 1.

The IRO section requires companies to explain the methodology used to assess materiality, identify relevant topic criteria, map sustainability impacts to potential financial impacts, and explain the topics included in the topic disclosure The IRO section requires companies to outline the following The IRO section requires companies to outline the following

- Methods used for materiality assessment

The firm should explain the methodology used in the evaluation and how the identified topics were prioritized (IRO-1). - Relationship between identified sustainability issues and financial impacts

The company should explain the relationship between the identified sustainability challenges and financial risks and opportunities, including an assessment of the likelihood of these events (IRO-1). - Conclusion of the Double Materiality Assessment

Companies should explain in detail what topics were (or were not) included in the report and why. It should also provide a list of all relevant ESRS disclosure requirements and page references where they are covered in the report (IRO-2).

The Impacts, Risks, and Opportunities section also establishes minimum disclosure requirements (MDRs) for sustainability policies. Companies are required to disclose information about their policies for managing material sustainability issues (including the value chain) (MDR-P) and the implementation of these policies (MDR-A).

Indicators and Targets (Metrics and Targets)MDR-M and MDR-T

One of the factors driving the CSRS/ESRS was the perceived lack of generally accepted metrics and methodologies in sustainability reporting. To address this barrier and to effectively assess corporate actions related to sustainability, the ESRS1 defines indicators for evaluation in MDR-M and Minimum Dislosure Requirements for setting targets (MDR-T) in MDR-M and MDR-T, respectively.

The MDR-M requires that the evaluation indicators used to track performance on sustainability issues be clearly defined and that the methodology used be explained. In addition, it requires stating whether the metrics have been verified by an external agency and (where relevant) aligning the metrics with the financial statements.

The MDR-T, on the other hand, outlines information for setting goals for each key sustainability issue to ensure the effectiveness of corporate actions toward achieving sustainability goals. This section includes requirements for the scope, baseline, and methodology of goal setting, ensuring that goals are measurable and time-bound.

Topical Standards

ESRS1 and ESRS2 are mandatory for all companies in the scope of the CSRD. In addition to these cross-sectoral standards, the ESRS includes sector-specific standards that address environmental, social, and governance-related issues in more detail. However, these sector-specific standards are not relevant to all companies. To determine which Sectoral Standards should be included in a company's sustainability statement, a double materiality assessment should be conducted, as described in ESRS 1. Only those topics identified as important to the company should be addressed in the report.

In the next issue, we will discuss the environmental, social, and governance criteria in more detail.

References

EFRAG.(2024). Implementation of ESRS: Initial Observed Practices from Seleced Companies.

Eurpoean Commission.(2023, 07 31). Questions and Answers on the Adoption of European Sustainability Reporting Standards. Retrieved from https://ec.europa.eu/commission/presscorner/detail/en/qanda_23_4043

European Commission.(2023). Commission Delegated Regulation (EU) 2023/2772 supplementing Directive 2013/34/EU of the European Parliament and of the Council as regards sustainability reporting standards.

EFRAG.(2024). Implementation Guidance: Materiality Assessment.

Related Articles

CSRD: The European Union's Corporate Sustainability Reporting Directive Latest Information

[Commentary] "Correspondence Map", a mapping table of correspondence between TNFD and ESRS

CSRD: The EU Sustainability Reporting Standard Just Before It Enters into Force: The Impact on Japanese Companies

Commentary] Overview of ESRS (European Sustainability Reporting Standards)

Case Study] Supply Chain ESG Assessment of the Apparel Company hap by aiESG - Visualization of Human Rights, Environmental, and Economic Valuation of Sustainable Fashion