INDEX

May 21, 2024, Shunsuke Managi, Representative Director, Keely Alexander Ryuta, Director and Chief Researcher, and Hidemichi Fujii, Professor, Graduate School of Economics, Kyushu University, and others examined "The Impact of Corporate Climate Change Measures on the Cost of Capital and Its Reflection on Corporate Value" in a paper written by

The research results have been published in the preliminary online edition of Corporate Social Responsibility and Environmental Management (2022 Impact Factor: 9.8), a top journal in the field of environmental economics and environmental management.

How corporate climate change mitigation actions affect the cost of capital

https://onlinelibrary.wiley.com/doi/epdf/10.1002/csr.2853

This report will explain the contents of the above paper.

summary

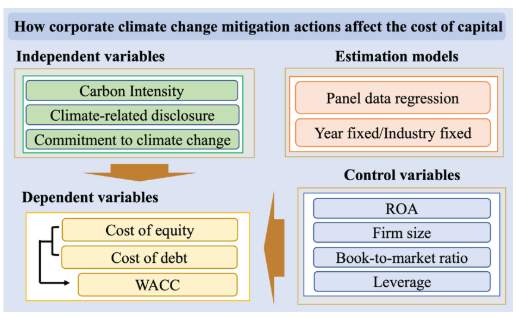

This study examines how the cost of capital is affected by a company's implementation of climate change measures.

As the climate change problem becomes more serious, investors and financial institutions are demanding that companies reduce their greenhouse gas (GHG) emissions more and more each year, but they are not fully considering the economic benefits that companies can gain by taking climate change action.

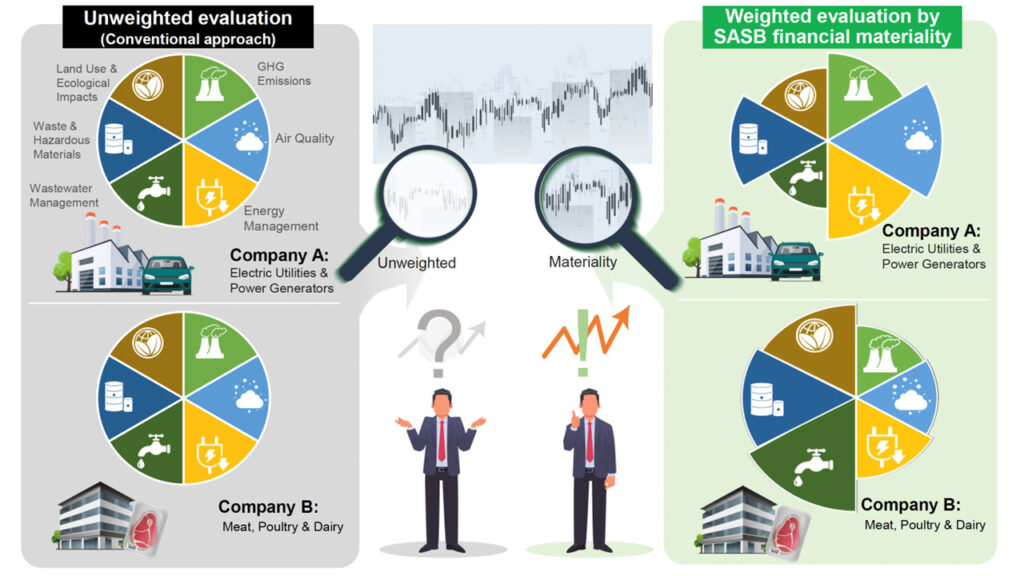

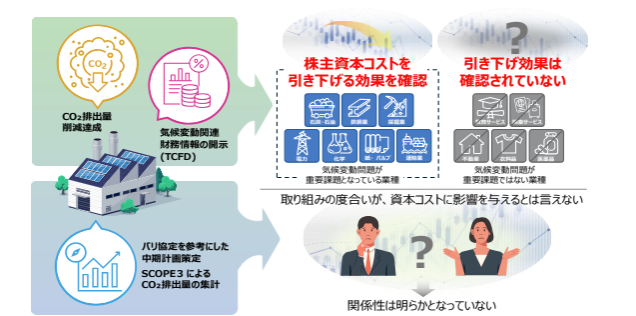

By analyzing data using carbon performance, climate-related information disclosure, and corporate commitment to climate change as indicators, this study shows that corporate climate change measures are effective in reducing the cost of shareholders' equity, and that this effect is significantly observed in industries where climate change issues are important. The results of this study are as follows.

Background and Objectives

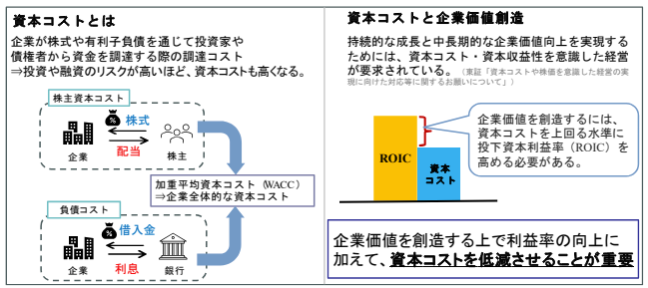

In order for a company to use the capital it raises to create value, it must generate profits that exceed its cost of capital.

The return that investors expect from a company's business activities is called the cost of equity, and the cost of equity is affected by the uncertainty of business activities, including climate change risk. Investors perceive high risk and expect high returns on investment issues with high uncertainty. Similarly, financial institutions provide loans in line with the uncertainty of the companies in which they invest.

Against this backdrop, investors and financial institutions are increasingly interested in corporate climate change policies in light of the fact that uncertain climate change risks are rising year by year.

Climate change risk refers to physical risk (e.g., more severe extreme weather events due to climate change) and transition risk (e.g., policy changes or behavioral changes to cope with climate change), and an increase in these risks could adversely affect the business activities of the investee, resulting in the possibility that the expected return cannot be recovered. In this regard, if climate change risks can be identified in advance and investment and loan decisions can be made in a manner that takes into account the degree of such risks, unexpected losses can be avoided.

The authors considered that if climate change measures have the effect of reducing the cost of capital, then climate change measures may lead to the creation of corporate value through the reduction of the cost of capital.

Therefore, the purpose of this study was to clarify the following

Does corporate carbon performance have a positive impact on the cost of capital?

Is corporate climate-related disclosure under the TCFD negatively correlated with cost of capital?

Is corporate commitment to climate change negatively correlated with the cost of capital?

method

To address the above issues, the authors examined each of the three indices, Cost of Equity (CoE), Cost of Debt (CoD), and Weighted average cost of capital (WACC)*1 , to identify in detail the factors that affect the cost of capital. (CoE), Cost of Debt (CoD), and Weighted average cost of capital (WACC).

We use a three-pronged assessment of a company's climate change performance: carbon performance (CO2 emissions/sales), disclosure of climate-related information based on the Task Force on Climate-Related Financial Disclosure (TCFD), and corporate commitment to climate change.

The analysis used data from about 2,100 listed Japanese companies for the period 2017-2021 to analyze the relationship between corporate climate change measures and the cost of capital.

result

The analysis yielded the following results

1. poor carbon performance is shown to increase CoE, CoD, and WACC, and higher cost of capital tends to be required when a company emits more CO2 relative to its sales.

2. the disclosure of climate-related financial information based on the TCFD recommendations will have the effect of lowering the CoE and WACC.

About 1.

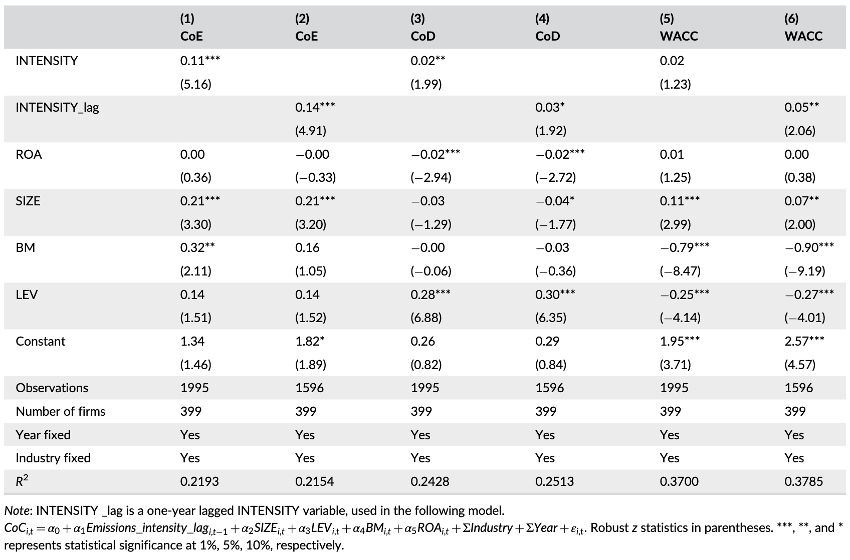

Table 1 shows the magnitude of the impact of carbon performance on CoE, CoD, and WACC.

In (1) and (3), the coefficient of carbon performance (INTENSITY) is significantly positive. This indicates that higher carbon performance increases both CoE and CoD. checking columns (2), (4), and (6), which analyze carbon performance (INTENSITY_lag) lagged by one year, all indicators are significantly positive. These results suggest that if a company shows higher carbon emissions relative to sales, it is likely to require a higher cost of capital.

In both the stock and bond markets, investors actively consider a company's carbon emissions and greenhouse gas emissions as an important factor in their investment decisions, which is a result of the link between high carbon emissions and financial risk, as well as policy regulations.

Table 1: Carbon Performance and Cost of Capital

About 2.

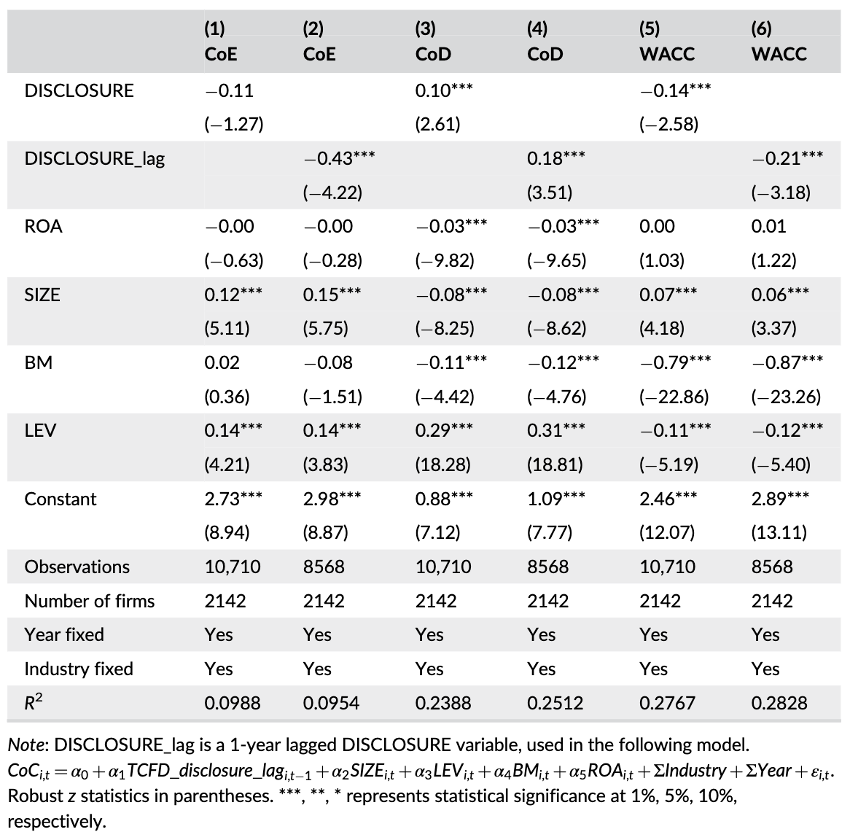

Table 2 shows the impact of TCFD disclosure on the cost of capital.

In column (1), we do not find a statistically significant association between disclosure (DISCLOSURE) and CoE, but when we incorporate a variable with a one-year lag, as in column (2), the coefficient for disclosure with a one-year lag (DISCLOSURE_lag) is 0.43, statistically significant at the 1% level. This lagged effect can be interpreted as suggesting that corporate compliance with TCFD recommendations in disclosing climate-related information has some negative impact on the CoE, albeit with a time lag of one year.

On the other hand, the WACC showed the same effect as the CoE, but for the CoD, the results were inconsistent with the expected hypothesis that the cost of capital increases with information disclosure. Notably, despite the increase in CoD, disclosure (DISCLOSURE) is consistently associated with a decrease in WACC. This paradoxical result suggests that the benefits of disclosure in the equity market may outweigh the costs in the debt market, leading to a lower overall cost of capital.

In the stock market, disclosure of climate change-related information reduces information asymmetry and allows investors to make more informed decisions about a company's performance and long-term sustainability. This increased transparency may be the driving force behind lower corporate CoE.

Table 2: Task Force on Climate-related Financial Disclosures (TCFD) and Cost of Capital

discussion

The study showed that corporate climate change measures are effective in reducing the cost of shareholders' equity, and the effect was observed to be more pronounced in industries in which climate change issues are important issues.

These results are expected to be used as one of the scientific evidences of the impact of corporate climate change mitigation actions on the cost of capital. In addition, the results of this study are expected to provide useful information for Japanese firms in developing effective policies to reduce the cost of capital and at the same time promote proactive responses to climate change issues.

1 Weighted average cost (WACC):

The weighted average cost of capital is the cost of capital that takes into account how much of the cost of equity capital incurred to raise funds from investors and the cost of debt incurred when borrowing from banks and bonds, respectively, is used. In general, it is a measure of how much a company that employs multiple sources of financing spends on financing.

Contact us:

https://aiesg.co.jp/contact/

Related page

Report List : Regulations/Standards

NEWS] A paper elucidating that corporate climate change measures reduce the cost of capital was published in the Nikkan Kogyo Shimbun.

Clarifying that corporate climate action lowers the cost of capital

Data analysis of 2100 Japanese companies reveals relationships/Kyushu University