INDEX

The need to incorporate sustainability and ESG-related information in corporate annual reports is increasing. In this context, the SASB Standard stands out among the standards and frameworks for sustainability (ESG).

aiESG is the only Japanese company to do so,Obtained SASB standards "Corporate Reporting Software" LicenceI am doing this.

This article will provide an overview of the SASB Standard, including background on its establishment.

Outline】What is the SASB Standard for ESG Information Disclosure?

The SASB Standards proposed by the SASB (U.S. Sustainability Accounting Standards Board) stipulate ESG information disclosure for each of the 77 industries in 11 sectors. By ensuring fair disclosure of information among companies, this will not only provide investors and evaluation criteria with materials for deciding what to invest in, but is also expected to have a significant effect in hedging risks and improving branding in corporate management. From the aspect of recommended standards in environmental reports, more and more Japanese companies are adopting them every year. As an international ESG standard, the SASB Standard is attracting more and more attention.

Table of Contents - Part 1

1. about SASB standard

What is "materiality"?

2. what are the standards set forth by the SASB Standards?

How does it differ from other ESG-related frameworks?

3. who is subject to the criteria?

Japanese companies are also hiring.

4. the pros and cons of legal binding force

International Trends in the Integration of Sustainability Standards and Frameworks

5. summary

As corporate management is required to respond to ESG and sustainability issues in the future, sustainability information disclosure will play an important role in appealing to investors. The SASB Standard is expected to be part of the first common international sustainability standard for global business in the future. The SASB Standard is expected to be part of the first common international sustainability standard for global business in the future.

Basic information about the SASB will be explained in detail in two parts, Part I and Part II.

The first part focuses on the overview of the SASB standard, from its inception to the legally binding nature of the regulation.

1. about SASB standard

The Sustainability Accounting Standards Board (SASB) is a non-profit organization established in the United States in 2011 to assist companies in identifying and disclosing financially material sustainability information.

The purpose of its establishment was to improve the quality of corporate disclosure by developing more quantitative (and sometimes qualitative) indicators in the field of ESG, for which evaluation criteria had previously been considered undisclosed, and to contribute to investors' decision-making from a medium- to long-term perspective.

The SASB Standard (SASB Standard) is the standard for disclosing ESG factors that are expected to have a high future financial impact, as specified by the SASB.

A key feature of the SASB is its focus on materiality (non-financial disclosures) that have a significant financial impact. The SASB Implementation Framework states that the SASB will "develop and maintain strong reporting standards that enable companies around the world to identify, manage, and communicate financially material sustainability information to investors.

In other words, the SASB Standards aim to provide an opportunity to discuss and examine economic activities among companies that ensure a fair perspective to investors through the application and disclosure of information by many companies.

Currently, it has been adopted by more than 2,000 companies worldwide as the global standard for sustainability disclosure, and is also used by Japanese companies and supported by investors who make large investments.

What is "materiality"?

Materiality" is a term that refers to "key issues" in a company's activities. It is one of the non-financial indicators that companies use to communicate their activities to investors and shareholders.

The SASB defines materiality as "information that, had it been disclosed, would have significantly altered the position of information used by a reasonable investor.

2. what are the standards set forth by the SASB Standards?

The SASB Standard sets individual criteria for 77 industries in nine sectors aligned to the Sustainable* Industry Classification System (SICS).

*The SASB Standards define "sustainability" as "corporate activities that amplify or sustain a company's ability to create shareholder value over the long term.

Table 1: List of SICS Regulated Industries & Sectors (Prepared by Author)

| consumer goods | Mining and mineral processing | financing | Food & Beverage | health care | infrastructure | Renewable resources and alternative energy | resource conversion | Tertiary Industry (Services) | communication technology | traffic |

| Apparel, accessories and footwear industry | Coal Business | Asset Management & Custody Services | crops | Biotechnology & Pharmaceuticals | Electric utilities and power generators | biofuel | Aerospace & Defense | Advertising and Marketing | Electronic Manufacturing Service (EMS), Original Design Manufacturing (ODM) | Air Cargo & Logistics |

| Manufacture of household electrical appliances | Construction material entities | commercial bank | alcoholic beverage | Pharmaceutical retailing | Engineering and Construction Services | forestry management | chemistry | Casino Games | hardware (esp. computer) | airline company |

| Building materials and furniture industry | Steel Business | consumer credit (finance, loan) | Food retail and distribution | Healthcare Delivery | Gas Business and Distribution | Fuel Cells and Industrial Batteries | Container Packaging | education | Internet Media and Services | Automotive Parts |

| E-commerce | metal mining industry | insurance | Meat, Poultry & Dairy | Healthcare Distributors | house construction | Bulp & Paper Products | Electrical and electronics | Hotels & Accommodations | semiconductor | Automobile Manufacturing |

| Household and personal products industry | Oil & Gas - Exploration & Production (E&P) | Investment Banks and Securities Firms | non-alcoholic beverage | Managed Care | real estate | Solar Technology and Project Development | Industrial Machinery & Commodities | recreational facility | Software and IT Services | Car rental and leasing |

| Multi-line and specialty retail and distribution | Oil & Gas - Midstream Entities | Mortgage Finance | processed food | Medical Equipment and Supplies | real estate brokerage | Wind Technology and Project Development | Media & Entertainment | Communication Services | Cruise-related | |

| Toy and sporting goods industry | Oil & Gas - Refining & Marketing (R&M) | Stock and commodity exchanges | restaurant (esp. Western-style) | Waste Management | Professional and commercial services | maritime | ||||

| Oil & Gas - Services | tobacco | Water Utilities and Services | rail transport | |||||||

| road transport |

In addition, the SASB Standards aim to create a clear disclosure standard by dividing the topics of disclosure according to the following five aspects

Environment

Social capital

Human Capital

Business model and innovation

Leadership and governance

These five core topics further branch out to form a total of 26 disclosure topics.

Table 2: Disclosure Topics (prepared by authors)

| environment | SOC | human capital | Business Models and Innovation | Leadership and Governance |

| GHG emissions | Human Rights and Community Relations | labor practice | Product design and life cycle management | business ethics |

| Air Pollution Level | Customer Privacy | Employee Health and Safety | Business Model Resilience | competitive behavior |

| Energy Management | data security | Employee Engagement Diversity and Inclusion | Supply Chain Management | Managing the Legal and Regulatory Environment |

| Water and wastewater management | Marketability and pricing | Material procurement and efficiency | Critical Incident Risk Management | |

| Waste and Hazardous Substance Management | Product quality and safety | Physical Impacts of Climate Change | systems risk management | |

| Ecological Impact | customer welfare | |||

| Sales Practices/Product Labeling |

These industry-specific standards and detailed disclosure topics are established because the materiality of sustainability issues varies from industry to industry.

(e.g., while "energy management" is a highly relevant issue for companies in the real estate industry, the toy and sporting goods industry does not see significant relevance.)

The SASB places a strong emphasis on establishing standards that are transparent, improve confidence building, and enable companies to capture business risks and disclose clear mitigation measures using quantitative data.

How does it differ from other ESG-related frameworks?

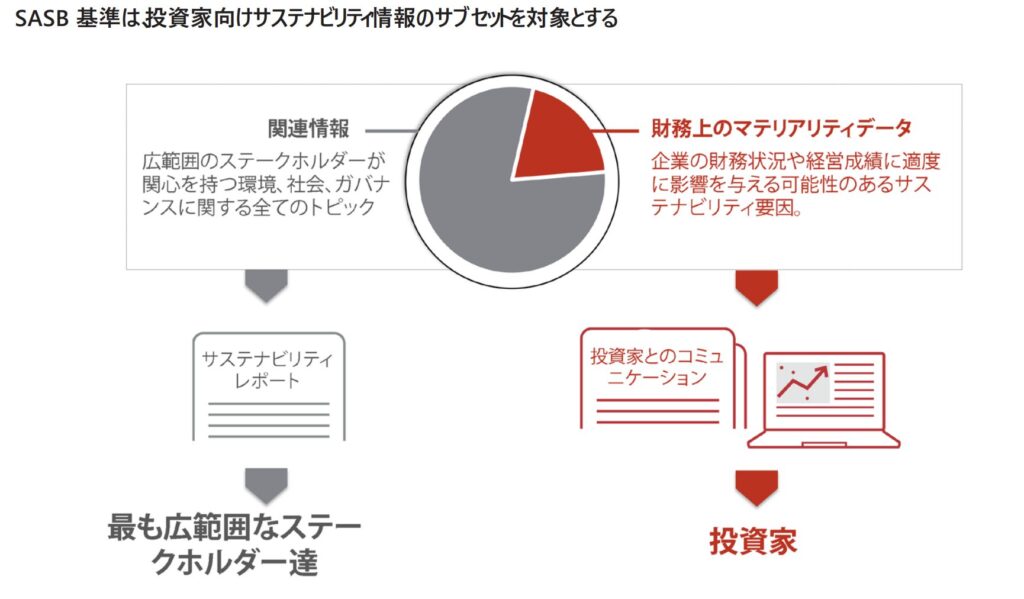

Figure 1: Relationship of the SASB criteria to other frameworks (cited from SASB Implementation Primer)

The SASB makes the following distinction between the Sustainability Framework and the Sustainability Standards

The Framework provides principles-based guidance on how to structure and create information and on what broad topics to cover.

The standards are specific as to what should be reported for each topic. They provide detailed and reproducible requirements for what should be reported for each topic."

The criteria are the building blocks that make the framework practical, and by their nature of ensuring comparable, consistent, and reliable disclosures, the framework and criteria are designed to be complementary and used concurrently.

From the above, the SASB Standards can be viewed as a complementary element to other sustainability frameworks (e.g., GRI and TCFD).

3. who is subject to the criteria?

The SASB Standards set disclosure standards primarily for investors, but can be used for both commercial and non-commercial purposes with a wide range of market participants in mind, including corporations and rating agencies.

Demonstrating compliance with the SASB standard is an economic benefit because it shows that the company is committed to sustainability.

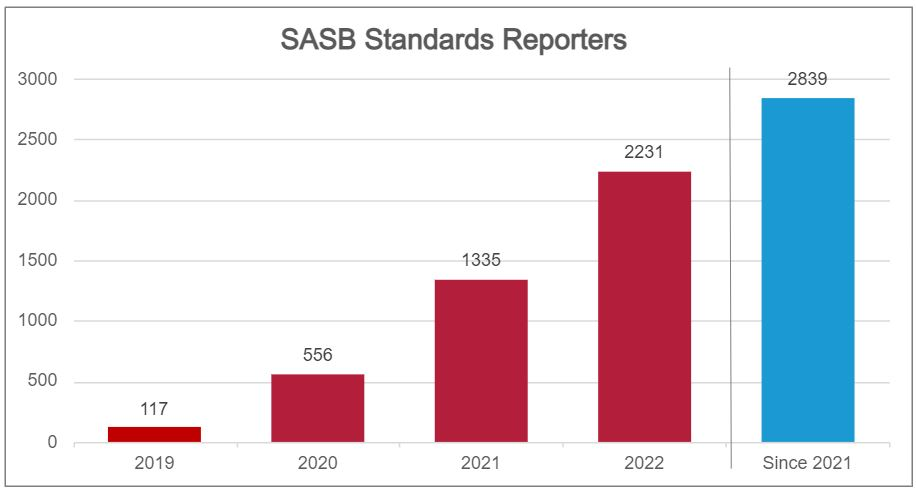

The number of companies compliant with the SASB standard as of 2022 is 2231 worldwide.

Figure 2: Global Number of Companies Adopting SASB Standards (Citation:https://sasb.org/about/global-use/ )

The number of companies adopting the SASB Standard was 117 in 2019, while in 2022 there will be more than 2,000 companies applying the SASB Standard.

Considering that the International Sustainability Standards Board (ISSB) has stated that it will integrate with the SASB Standards, it is expected that the importance of the SASB Standards as an international sustainability disclosure standard will increase and the number of companies adopting them will expand.

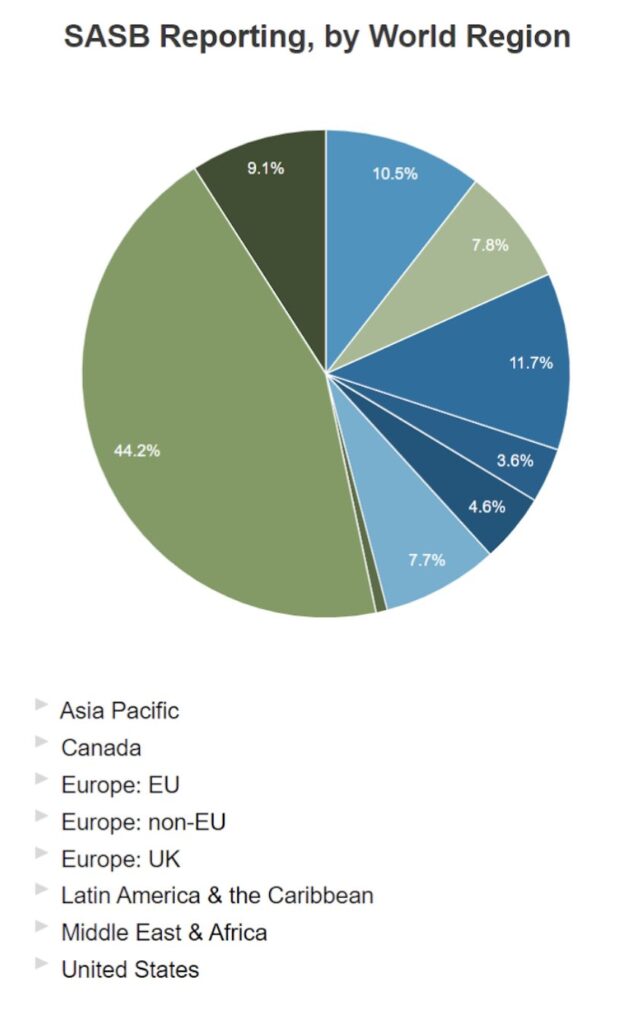

Figure 3: Employer Location Classification (Cited by https://sasb.org/about/global-use/ )

In addition, a review of the locations of companies that have adopted the SASB standard (as of 2022) confirms that while the majority are U.S. companies, the percentage of companies in Europe and the Pacific is also expanding (Image 3).

Japanese companies are increasingly adopting SASB.

The SASB Standards are officially accessible not only in English but also in Japanese. The presence of the SASB Standards as a sustainability standard is expected to increase among Japanese companies in the future.

According to the Profile of SASB Standards Reporters published by the SASB, the number of Japanese companies that have published reports compliant with the SASB Standards is 65 (total for 2018-2022).

Table 3: Selected Japanese Firms Compliant with the 2022 SASB Standard

(Prepared by the author with reference to Profile of SASB Standards Reporters:) https://sasb.org/company-use/sasb-reporters/ )

| Company Name | SICS Regulated Industries | SICS Regulated Sector | Degree of SASB compliance |

| Shiseido | Household and Personal Products | consumer goods | full compliance |

| INPEX Corporation | Oil & Gas - Exploration & Production (E&P) | Mining and mineral processing | full compliance |

| Mizuho Bank | commercial bank | financing | partial compliance |

| Asahi Group Holdings, Ltd. | alcoholic beverage | Food & Beverage | full compliance |

| Takeda Pharmaceuticals | Biotechnology & Pharmaceuticals | health care | full compliance |

| Kansai Electric Power Co. | Electric utilities and power generators | infrastructure | partial compliance |

| Sumitomo Forestry | forestry management | Renewable resources and alternative energy | full compliance |

| Asahi Kasei Corporation | chemistry | resource conversion | full compliance |

| Advantest Corporation | semiconductor | communication technology | full compliance |

| Nissan Motor | Automobile Manufacturing | traffic | full compliance |

Table 3 above confirms that major Japanese companies, regardless of industry, are reporting in accordance with SASB standards.

4. the pros and cons of legal binding force

Since the SASB Standards are published by a non-profit organization, they are not legally binding on companies. In other words, there is no penalty for non-compliance.

However, there are examples where the SASB Standard has been adopted as a sustainability standard used within corporate reports as well as other standards.

For example, the ESRS European Sustainability Reporting Standard will become operational in the EU in 2023, and the European Commission has included SASB among other recommended frameworks. Also,In the U.S., there is discussion about making it mandatory to disclose SASB information in the system disclosure documents.In some cases, such as in the case of

In Japan, the disclosure of sustainability information in securities reports and other documents will become mandatory as of January 2023. In other words, compliance with sustainability standards is an urgent issue for Japanese companies.

International Trends in the Integration of Standards and Frameworks for Sustainability

Investors and companies are demanding simpler sustainability disclosures to reduce the complexity of multiple frameworks. Given the large number of sustainability frameworks and standards in existence, in June 2021, SASB completed a merger with the International Integrated Reporting Council (IIRC) to form the Value Reporting Foundation (VRF). This was done with the aim of establishing a more comprehensive and consistent corporate reporting framework.

In 2022, the International Financial Reporting Standards (IFRS) Foundation took over the SASB standards through a merger with VRF, an international not-for-profit organization that aims to develop investment standards while ensuring transparency. The ISSB aims to strengthen and expand the SASB standards, including integration with the TCFD standards, to simplify application and improve sustainability reporting.

Thus, international standards and frameworks for sustainability are in the process of being integrated, and the SASB Standard will become increasingly important.

5. summary

The first part of this report provides an overview of the SASB Standards, which are an important sustainability standard for modern companies and an important means of increasing their appeal to investors. Their importance will increase in the future, and their integration and adoption internationally will continue.

The second part of the report will cover the benefits of actually adopting the SASB Standards for companies, as well as an explanation of the indicators in actual operation. It will also explain the services that aiESG can provide regarding the application of the SASB Standards.

aiESG is the only Japanese company to have obtained a SASB standards "Corporate Reporting Software" Licence.

aiESG becomes the first ESG evaluation organization in Japan to be licensed under the international sustainability standard "SASB Standards".

https://aiesg.co.jp/topics/news/20230808_sasb/

We can assist you with everything from the basics of SASB to the actual disclosure of non-financial information.

Please contact us if your company is having trouble with SASB compliance.

Contact us:

https://aiesg.co.jp/contact/

Related page

aiESG becomes the first ESG evaluation organization in Japan to be licensed under the international sustainability standard "SASB Standards".

https://aiesg.co.jp/topics/news/20230808_sasb/

What is the SASB Standard for ESG Disclosure? (Part 2) Benefits for Companies

https://aiesg.co.jp/topics/report/2301115_sasb2/

Explanation] What is TNFD? A new bridge between finance and the natural environment

https://aiesg.co.jp/topics/report/230913_tnfdreport/

Commentary] TNFD Disclosure Status and Issues

https://aiesg.co.jp/topics/report/230102_tnfdreport2/

Commentary] Key Points of the TNFD Final Recommendations and the Responses Required of Companies

https://aiesg.co.jp/topics/report/231106_tnfdreport3/