INDEX

What is SFDR?

In March 2021, the Sustainable Finance Disclosure Regulation (SFDR) came into effect in Europe.

The main objective of the SFDR is to enable investors operating in the European Economic Area to raise funds in a sustainable manner. By disclosing information on environmental, social, and governance (hereinafter referred to as "ESG") of financial instruments to investors in an easy-to-understand manner, we aim to improve transparency and accountability and prevent greenwashing (i.e., apparent environmental initiatives that are not accompanied by actual actions or activities).

Below is a detailed description of SFDR according to the table of contents.

Table of Contents

interpoint (interword separation)Background of SFDR formation

interpoint (interword separation)What are the main differences between SFDR and EU Taxonomy?

interpoint (interword separation)Subject of SFDR

interpoint (interword separation)What is the impact on companies outside the EU, including Japan?

interpoint (interword separation)Core Disclosure Requirements

interpoint (interword separation)Significance of SFDR

interpoint (interword separation)Future Issues

Background of SFDR formation

Prior to the passage of the SFDR, financial institutions in the EU could set their own standards for ESG disclosure and issue their own statements. However, there was no way to fact-check statements made in accordance with these proprietary disclosure standards, and this was a problem. The existence of a variety of independently set disclosure standards can lead to greenwashing, as financial market participants ("FMPs") and other investors are unable to obtain reliable ESG-related information from the companies in which they invest.

For example, some products that claim to be environmentally friendly may not be supported by legitimate data or other evidence, or the manufacturing process of the product may violate human rights. However, if the various disclosure standards are in disarray, investors may support companies that are engaged in activities that are not accompanied by actual conditions.

In order to put a stop to these independently set diverse disclosure standards, the SFDR established uniform and clear standards on ESG for financial products. The SFDR was then enacted in the form of a mandatory ESG disclosure requirement for asset managers, FMPs, and other investors in the EU.

What are the main differences between SFDR and EU Taxonomy?

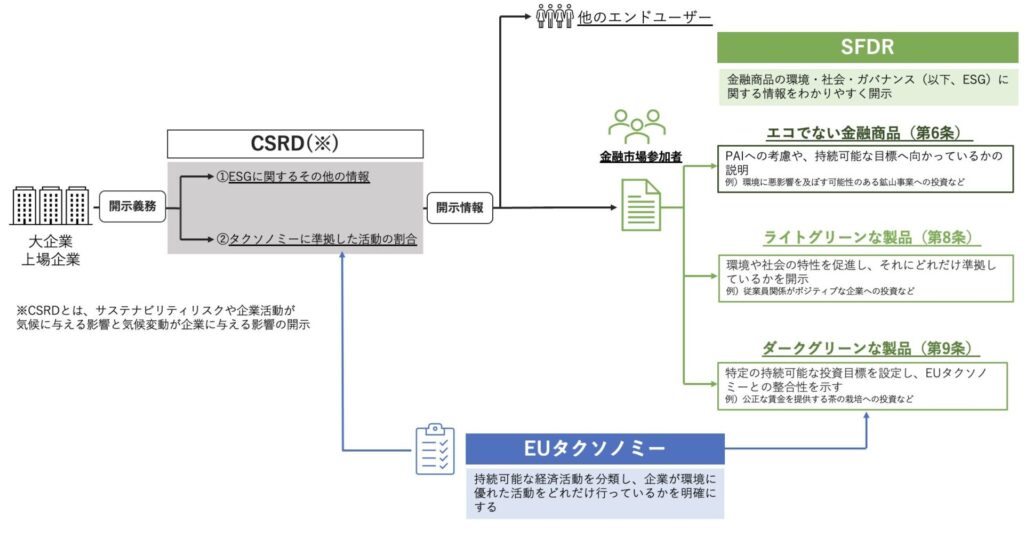

To understand the SFDR, it is important to understand how it differs from the EU Taxonomy Regulation ("EU Taxonomy"). While they share the same goal of financing a sustainable society, they have different functions and are designed to complement each other's requirements.

The EU Taxonomy determines whether a company's economic activities are sustainable based on the following six environmental objectives and four conformity requirements The EU Taxonomy only provides classification and disclosure requirements and does not prohibit investment in economic activities that do not meet the criteria. However, financing for economic activities that are deemed to be unsustainable is considered to be disadvantageous in terms of terms and conditions.

The SFDR, on the other hand, focuses on ESG disclosure of investment products, allowing investors to easily compare information on product sustainability. In other words, the EU Taxonomy assesses sustainability based on a company's actual activities, whereas the SFDR focuses on providing information to investors through increased transparency of investment products.

| SFDR | EU Taxonomy | |

| subject (of taxation, etc.) | Primarily investment products (e.g., investment funds) | Mainly corporate and business activities |

| Objective. | Articulate the sustainability of investment products from an environmental, social, and governance (ESG) perspective | Categorize sustainable economic activities and identify environmentally superior activities of companies |

| means | Require ESG disclosure and categorize investment products | Provides a classification system for sustainable economic activities and assesses companies' compliance with the criteria |

| advantage | Make it easier for investors to compare different products | The company makes its own sustainability explicit and credible to the market. |

Table 1: Main differences between SFDR and EU Taxonomy

The six environmental goals and four conformity requirements of the EU Taxonomy

It has a total of six environmental goals: 1) climate change mitigation, 2) climate change adaptation, 3) sustainable use and conservation of water and marine resources, 4) transition to a circular economy, 5) prevention and control of environmental pollution and pollution, and 6) protection and restoration of biodiversity and ecosystems.

The four conformance requirements are: a) the activity must substantially contribute to one or more of the six environmental goals; b) the activity must not cause significant harm to any of the six environmental goals (DNSH principle: Do No Significant Harm); c) the activity must comply with minimum safeguards (including social aspects such as human rights and labor); d) the activity must comply with technical screening criteria (principles, indicators, thresholds) d) comply with technical screening criteria (principles, indicators, thresholds).

Subject of SFDR

As noted above, the SFDR applies to FMPs. It applies primarily to EU-based financial institutions with more than 500 employees, defined as "big players," as well as banks, insurance companies, investment firms, and asset managers; it affects not only financial advisors in the EU, but also non-EU-based firms offering products for the EU market. FMPs with less than 500 employees are not obligated to comply with the SFDR. However, Comply or Explain does apply. Parties are obliged to comply with the Corporate Governance Code or, if not, to explain why not.

The funds affected by SFDR are enormous: in 2021, the total assets of EU-based financial firms were 81.6 trillion euros. And the impact of the SFDR will be even greater because it will also affect non-EU based financial firms through their EU subsidiaries. For example, among companies active in the EU financial markets, 62 parent companies with subsidiaries around the world have a market value of $3.2 trillion, with U.S. companies alone accounting for $2.5 trillion and 22 of them.

What is the impact on companies outside the EU, including Japan?

The scope of the SFDR is relatively broad and EU-based FMPs are required to comply with it. In addition, non-EU FMPs in the US, Asia, and other non-EU countries that sell financial products in the EU or provide portfolio management services or investment advice to EU funds must comply with the SFDR for each product they sell to EU clients or EU funds they manage or advise.

In other words, even if not directly subject to the disclosure rules, companies that raise funds from European-based financial institutions or investors are affected to a certain extent. non-EU FMPs should consider the following criteria (1) through (3) when determining whether the SFDR disclosure requirements apply to their companies or products. As a general rule, if any of the criteria (1) through (3) are in the EU, the SFDR applies. As a result, FMPs in Japan and other countries are also subject to the disclosure obligation.

(i)Location of business unit

This is information about where the business unit offering or marketing the financial product or advice is located. For firms and larger entities, different divisions may exist in different locations, such as a parent company, a subsidiary, or a branch. If the location of the head office and the location of such branch offices, etc. are in the EU, the SFDR applies.

(2) Customer Location

This is information about where the customer (individual or legal entity) purchasing the financial product or advice lives or is legally registered. If the customer is located in the EU, the SFDR applies.

(iii) Location of financial instruments, etc.

This is information about where a financial product or advice is registered and where it is offered or marketed. Where a financial product is issued or registered and where it is offered or marketed may be different. If the financial instrument is issued or offered in the EU, the SFDR applies.

If non-EU companies, including Japanese companies, meet the above criteria, the first thing they should do as a countermeasure is to collect information for disclosure. Even if economic activities are consistent with the EU taxonomy, it is meaningless if they cannot be disclosed to investors and others due to lack of data. If necessary, data collection and other preparations may be made to enable disclosure.

Core Disclosure Requirements

The SFDR requires two major disclosure requirements, Level 1 and Level 2. Level 1 went into effect in March 2021. Level 1 disclosures are at the entity level. Non-EU financial institutions generally tend to be exempt from entity-level disclosure. However, if a financial institution is registered as an Alternative Investment Fund Manager ("AIFM") or similar, company-level disclosure is required even for Japanese financial institutions.

Level 2 (Regulatory Technical Standards) was published in April 2022 and became effective January 1, 2023, as a complement to Level 1. Level 2 is a financial instrument-level disclosure. Each financial instrument must be classified according to the degree of ESG investment and published in a pre-contractual disclosure (pre-contractual disclosure: information about financial products and services is provided to clients before the contract is signed), periodic reports and/or a website.

Financial products related to ESG can be broadly classified into two patterns. The first is light green products (Article 8). They must promote environmental and social characteristics and disclose how well they comply with them. This applies to a wide range of financial products, for example, investments in companies with positive employee relations. The second is dark green products (Article 9). Specific sustainable investment targets must be set and alignment with the EU taxonomy must be demonstrated.

For example, a financial instrument whose objective is sustainable investment, such as an investment in the cultivation of tea that provides fair wages, would fall under this category. The Article 8 and Article 9 classification of a financial instrument does not require approval by regulators or other authorities and is left to the discretion of the self-determining entity. Since there are no detailed requirements for both classifications, it is not possible to mechanically classify an instrument as either Article 8 or Article 9 if certain requirements are met. There are also Article 6 (non-eco financial instruments) that do not meet the criteria of Article 8 or 9. In the case of such products, the FMP must explain whether it takes into account the Principle Adverse Impacts ("PAI") on sustainability that the FMP's operational activities may cause and whether it is working towards sustainable goals. Examples include investments in fossil fuel companies or mining operations that may have adverse environmental impacts. Thus, the SFDR requires financial institutions to disclose their sustainability impacts at both the entity and product level.

In addition, in June 2024, the disclosure of Scope 3 of greenhouse gas emissions was required. Scope 3 refers to indirect emissions other than Scope 1 and Scope 2 (i.e., greenhouse gas emissions of other companies related to the activities of the business). In other words, it means emissions upstream (emissions related to purchases) and downstream (emissions related to sales) of corporate activities. Scope 3 has been difficult to compare with other companies due to the lack of standardized rules and data, but we are beginning to see a trend toward standardization.

Figure 1 Prepared by the author based on FSA (2022)

(in Japanese history)https://commission.europa.eu/system/files/2021-04/sustainable-finance-taxonomy-factsheet_en.pdf)

*CSRDis the regulation of disclosure of sustainability risks and the impact of corporate activities on the climate and the impact of climate change on companies.

Significance of SFDR

With the introduction of SFDR, FMPs will need to be increasingly attentive to how their investments contribute to global warming, the environment, and society. because SFDR requires companies to make a strong case for how well they incorporate environmental and social aspects in their investments, financial institutions and advisors will no longer be able to invest in areas that cause serious environmental or social damage or ostensibly take environmental and social considerations into account. It is hoped that these disclosures will encourage everyone from large institutional investors to the general investing public to choose green investment products, support funds, and promote progress toward net zero.

Future Issues

The SFDR has no restrictions on imports from industries with climate, biodiversity, and human rights impacts; the EU introduced a new carbon border tariff in 2022 for imports from hard-to-abate industries, such as the steel industry, that have difficulty reducing CO2 emissions (novel carbon border tariff ), but this policy does not cover leather produced by deforestation and other examples of negative environmental and social impacts. By focusing only on the European market and the parties involved, important financial flows in the supply chain are missing. While other recent EU policies (e.g. CSRD) have focused on value added and supply chains, SFDR is still limited with respect to restrictions on products with significant climate change impacts or human rights impacts SFDR is part of the EU's sustainability policy and future Further policy measures are expected in the future.

aiESG provides support for everything from the basics of SFDR to the actual disclosure of non-financial information, so please contact us if you have any questions about SFDR compliance.

Contact us:

https://aiesg.co.jp/contact/

References

https://finance.ec.europa.eu/sustainable-finance/disclosures/sustainability-related-disclosure-financial-services-sector_en

https://www.sustain.life/blog/sfdr-reporting

Related page

Report List : Regulations/Standards

https://aiesg.co.jp/topics/report/tag/基準-規制/

CSRD: The EU Sustainability Reporting Standard Just Before It Enters into Force: The Impact on Japanese Companies

https://aiesg.co.jp/topics/report/2301120_csrd/

Commentary] Overview of ESRS (European Sustainability Reporting Standards)

https://aiesg.co.jp/topics/report/2301120_csrd/

【【Explanation] What is TNFD? A new bridge between finance and the natural environment

https://aiesg.co.jp/topics/report/230913_tnfdreport/

What is the SASB Standard for ESG Information Disclosure? (Part 1)Outline of SASB

https://aiesg.co.jp/topics/report/2301025_sasb1/