INDEX

This page is a joint seminar by SPEEDA ASEAN and Ocean Network Express Pte. Ltd. (ONE) on November 2, 2023, at which Keeley, Director of aiESG, was a speaker.The Carbon Neutral Frontline Series: Dejima Organization and ESG Management - Creating a New Global Trend" (Japanese only)The report of the event is published with the permission of the sponsoring organization.

The seminar will include ESG initiatives in the shipping business by Mr. Shiomi of ONE, and aiESG Keighley's "ENew Trends in SG Management, Global Trends and Solutionsand a panel discussion between the two. Keeley explained ESG research, international trends, and aiESG initiatives.

The PDF version of the report isthis way (direction close to the speaker or towards the speaker)You can view it from

Contents

ONE Shiomi: The origins of the Dejima Organization "ONE" and the challenge of ESG management

History of Containership Business

History surrounding ONE

ONE's Present and Future

aiESG Keighley : New Trends in ESG Management, Global Trends and Solutions

ESG Research and Major Initiatives

State of the World

Current Trends in ESG

Current Status of Corporate Valuation Methods

aiESG Initiatives

Panel Discussion / ONE Shiomi, aiESG Kiely, Moderator: Naito

How do I understand ESG and SDGs?

What ESG activities should Japanese manufacturers engage in?

What should be prioritized among the various ESG-related indicators?

What should ESG do in the future in the Western-dominated political game?

What is the winning formula in creating a standard with a scientific approach?

Where are we now with the ONE initiative?

How does ONE make ESG an enjoyable endeavor?

ONE Shiomi: The origins of the Dejima Organization "ONE" and the challenge of ESG management

Mr. Shiomi of Ocean Network Express gave a presentation on three points: an overview of the history of the containership business, the history of ONE's (Ocean Network Express) business, and the status of ONE's ESG initiatives.

Mr. Juichi Shiomi Senior Vice President, Ocean Network Express Pte.

He has been in charge of the industry (steel, shipping, land transportation, and air transportation) at the head office of Sakura Bank (now Sumitomo Mitsui Banking Corporation) for more than 10 years in total, with a stint in New York in between. From 2016 to 2009, he was in charge of Ship/Aircraft Finance in Asia in the Transportation Sales Department of the bank.

He joined ONE in July 2021. From April 2022, he joined the Corporate Strategy and Sustainability Department (CSS), which was reorganized from the Green Strategy Department (GSD), in charge of corporate strategy, M&A, and environmental strategy. Since July of the same year, he has also served as Director of Public Relations, and since April 2023 as Director of Finance.

History of Containership Business

- The Invention of Containers

The container box is considered the greatest invention of the 20th century. The reason is that it has driven the role of infrastructure in the world economy by greatly increasing the volume of global logistics. This is sometimes described as the containerization of the world economy.

Specifically, the creation of the container, a box, enabled a one-ton cargo that used to take 60 hours to load and unload to be reduced to two minutes. Also, since the inventor of the container was a person who worked for a land-based logistics company, the container was designed with the connection of sea and land in mind, making it possible to realize multimodal transportation from the very beginning of its invention, which was revolutionary.

In terms of numbers, a 19-fold increase in logistics volume has been realized in the 40 years from 1980 to 2020. The GDP growth of the global economy has also grown almost in parallel, which I believe supports the reason that the containership business is the infrastructure of the global economy.

- Containership Business Overview

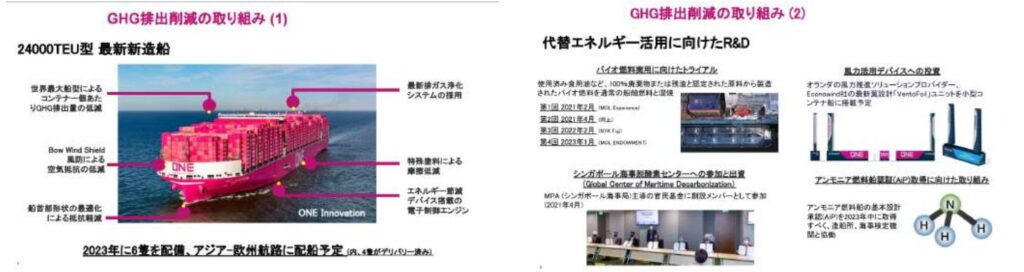

The first full container ship, built in the 1960s, weighed 750 kg, but today the largest ships weigh up to 24,000 tons. The largest ships are now scaled up to 24,000 tons. In other words, the trend toward expansion is continuing.

To give you an idea of the loading capacity, a 40-foot container (about 12 meters) can hold 100,000 bananas. This means that just 60 containers are large enough to distribute one banana to every resident of Singapore, including foreigners. Container ships also carry almost all of the goods necessary for our daily lives around the world, with the exception of buildings, water, and electricity. The routes of container ships are changed every time to take into account the effects of typhoons, etc., forming an incredibly complex sea lane. one container ship turns around the world, so AI is being used to manage it.

History surrounding ONE

- History of Japanese Shipping Companies

We have been in the global containership business since around 1985. At that time, our competitors were not large in size, and Japan was in a relatively high position. When MSC entered the global containership business in 1994, the company expanded its fleet size one after another, and now occupies the number one position in the world.

In other words, Japanese container shipping companies lost global market share in the 1990s. We believe that the reason behind this is that shareholders were looking at business from a Japan-centric perspective and missed opportunities, and that they lost growth opportunities due to ground subsidence triggered by Japan's declining population. Today, Japan is far from the center of international trade, with trilateral trade being the norm.

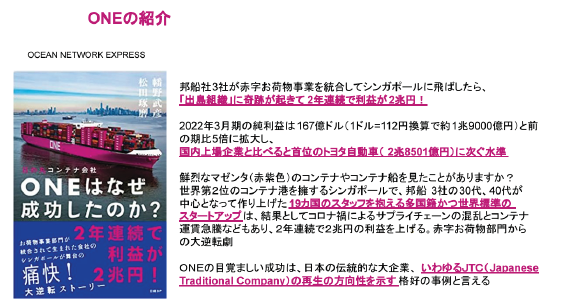

- Company Profile

ONE is the company that took over the containership business from NYK, MOL, and Kawasaki Kisen Kaisha. Today, it is the seventh largest shipping company in the world, and while not the global leader by any means, it is a global company with 215 ships, 1.7 million containers, 11,000 employees, and operations in 80 countries. Only in Singapore, there are about 550 employees working in about 20 countries.In 2016, the three companies announced a merger, and after a six-month preparation period starting in October 2017, in April 2018, we became the only Japanese ocean liner container shipping company to start new operations simultaneously in all countries of the world. During this period, the container shipping fleet was becoming larger and larger, and while the amount of investment was increasing, profitability was deteriorating. In response, we have overcome this situation by forming alliances and handling cargo without investment.

- Trends of other companies surrounding ONE

Because the containership business handles daily commodities, it is highly sensitive to economic conditions, and a downturn in the economy, such as the collapse of Lehman Brothers, would directly lead to a deterioration in business performance. This is when the Maersk Shock occurred. Maersk, which was the leader in the industry at the time, thought that it would be able to drive out its competitors by providing services at fares that were just barely in the black on a cost basis, taking advantage of the company's economies of scale, and this triggered cost competition. As a result, Maersk lost the most money, and the industry-wide decline in freight rates made it impossible for many shipping companies to survive.

Since the Maersk Shock, the container industry has been moving in two major directions. One is the company that adopts a family-type business structure. The other is a national company. The background of this trend is the history of the increasing size of vessels, which makes it difficult for a single company to manage its business.

ONE's present and future

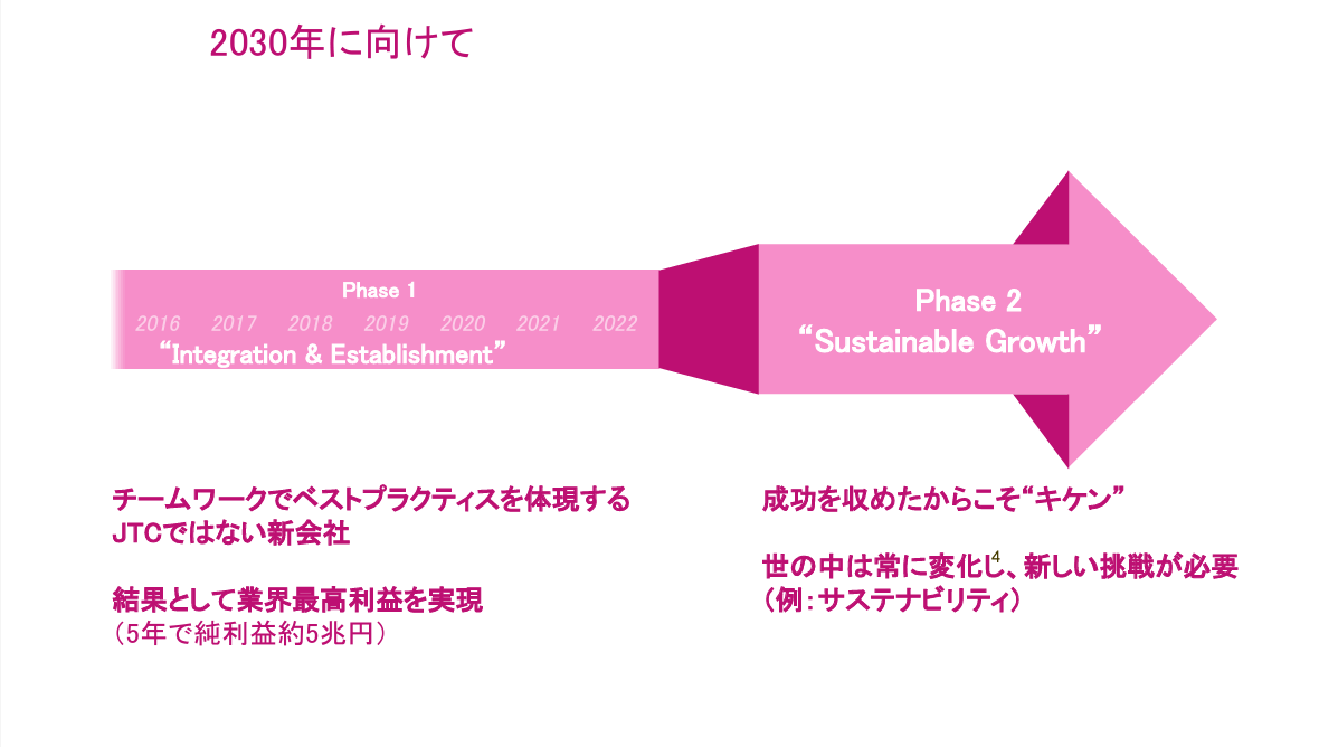

- Getting through the difficult times of Phase 1

ONE has a different message that is clearly conveyed when it is read as "ONE" and when it is read as "O.N.E.". When read as "ONE," the catchphrase "As ONE, We can." is made clearer, indicating our willingness to stand firm in the face of various difficulties. It also conveys the message that the company has been considering what value it can deliver as an outlier under the identity of Dejima. There were many difficulties during the turmoil of the 5-year start-up period, but we believe that Phase1 was successfully completed by welcoming a Korean company called HNM and overcoming the Corona disaster with high employee engagement. And we believe that sustainability is important for Phase 2.

- Phase 2 will focus on sustainability.

Shipping companies have always had a proclivity for gambling. I believe this is due to the fact that it has been industry practice to take risks on large investments as the market grows. The idea behind ONE's investment policy is that the volatility of the container business cannot be absorbed on its own.

In this context, we are also engaged in portfolio management, promoting collaboration with academia, systematizing operations to a high degree through digitalization, etc.

We are also moving forward in the direction of reducing environmental impact. To cite one example, we are attaching sails to containers to improve fuel efficiency by allowing the sails to catch the wind. As a result, carbon intensity has improved by nearly 20%. Furthermore, we have achieved a 60% reduction compared to the benchmark year before the IMO disclosure in 2008.

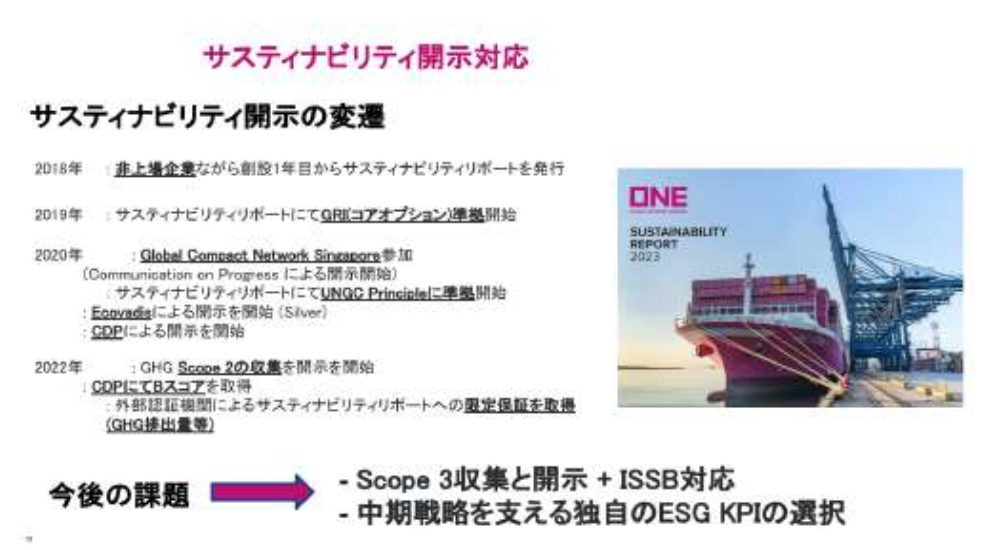

In terms of ESG S (Social), we are committed to our local communities, including the Sisters Island Marine Nature Preserve and Penguin Cove in the newly established Birdbark. In terms of G (governance), we were one of the first to publish a sustainability report and to disclose all the various measures we have taken to raise our CDP rate to a B.

As a global company, neither a Western-style top-down company nor a Japanese-style consensus-oriented company, but a company positioned somewhere in between, we intend to compete with owner companies around the world from a unique position. Although we are based in Singapore, we intend to continue to develop our business by inheriting the spirit of challenge and other aspects of Japanese shipping.

aiESG Keighley : New Trends in ESG Management, Global Trends and Solutions

Keeley, Associate Professor at Kyushu University's Faculty of Engineering and Chief Researcher at aiESG, Inc. explained the ESG approach, its impact on the supply chain, the progress of the international framework, the challenges of the assessment methodology, and aiESG's approach.

Keely, Alexander, Ryuta

Chief Researcher, aiESG Corporation | Associate Professor, Department of Environment and Society, Graduate School of Engineering, Kyushu University

Head of the "ESG and Corporate Value" study of the Ministry of the Environment of Japan. Member of T20 Task Force, Head of Social Engineering Co-Unit, Moonshot Project "DAC-U". Research Specialist, World Bank

We will conduct empirical research on a wide range of complex problems facing cities, such as energy depletion, environmental pollution, population decline, and disasters, using multifaceted and interdisciplinary approaches such as urban engineering and economics.

Main Research Themes

ESG analysis, social, environmental and economic impact assessment of energy technologies (e.g. renewable energy, hydrogen, DAC-U)

An analysis of sustainable development in a society with a declining population, based on external shocks to the economy

Analysis of Sustainable Investment and Green Bonds

Analysis of Corporate Activities and New Urban Proposals

ESG Research and Major Initiatives

After graduating from Kyoto University, I worked for the World Bank. I gradually came to believe that society would not change due to the complex intertwining of interests of various countries at an international organization. At that time, I was approached by Professor Umanaki, a leading expert in ESG research, who asked me if I would be interested in working from the standpoint of academia to the point of implementing the results of my research in society.

Current major initiatives include the Ministry of the Environment's "ESG and Corporate Value," the Moonshot Project "DAC-U" (a research project to capture carbon dioxide and other substances in the air with a thin membrane and convert them into fuel), and the submission of recommendations to the G20. The UN/New National Wealth Report refers to efforts to measure sustainability at the national and municipal level, following the work of Nobel economist Kenneth Arrow. In general, please understand that the main focus of the research is on ESG and finance and sustainability assessment, with a view to social implementation.

I would like you to consider that half of the ESG content I will be presenting was born out of my academia knowledge and the other half was born out of the creation of my business.

The State of the World

The photo on the slide shows child labor in a sewing factory in Delhi, India. Currently, child labor, migrant labor, and forced labor actually exist all over the world. The photos from Bogor, Indonesia, show people working barefoot in a garbage heap and exposed to toxic gases. The harsh reality is that the computers and cell phones we use every day are only possible with the support of this kind of labor.

This slide with a picture of a T-shirt shows the extent of the social impact on all workers going back through the supply chain until a single T-shirt in the apparel industry is made. I won't go into the details, but the supply chain from the production of one T-shirt to the production of another shows various issues, including gender issues and hospital access issues, in a situation where human rights are not protected. Because these realities are the basis of our lives, I believe it is a natural progression that we need to change ESG.

Current Trends in ESG

ESG is an acronym for Environmental, Social, and Governance, and there is a fairly well-developed international framework as the importance of ESG grows.

The TCFD (Task Force on Climate-related Financial Disclosure) is the most advanced disclosure by Japanese companies. However, if we look at other countries, the TNFD (Task Force on Nature-Related Financial Disclosure) is attracting attention. The TNFD was released in September of this year and is characterized by the inclusion of social aspects such as impacts on indigenous peoples and communities, as well as natural capital, ecosystems, and biodiversity, as Nature-Related. I hope you understand that the international community is now paying attention not only to the environment but also to society.

The last one, TIFD, is a global movement to promote inequity-related disclosure, although I am not sure how successful it will be. I am not sure to what extent this movement will become mainstream, but I think it is safe to say that a major trend will definitely come, changing formats and names, and spreading throughout the world.

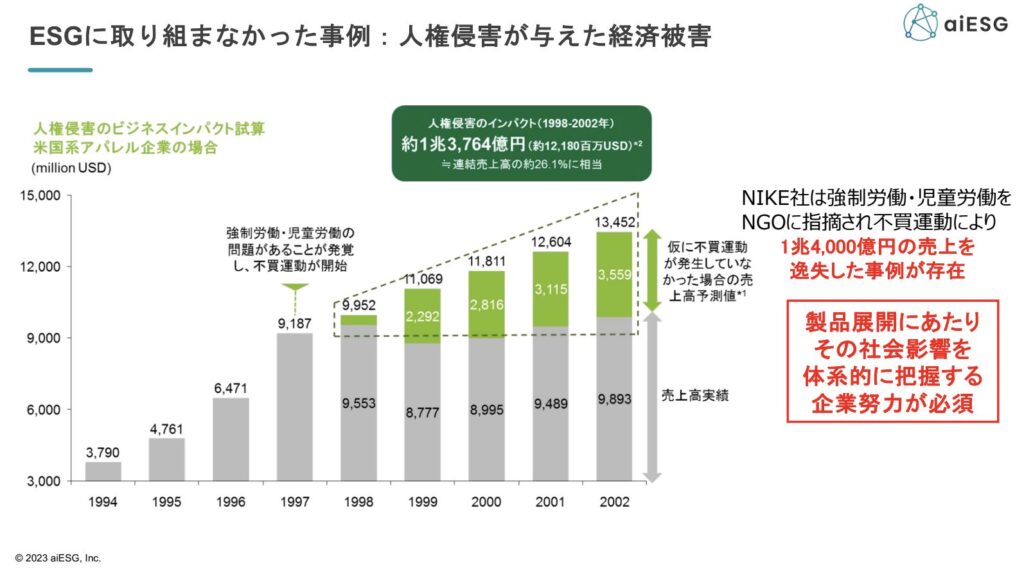

Even without guidelines, several cases have shown that not addressing ESG issues can have a negative impact on corporate value. For example, Nike, Inc. was forced to use forced labor at the end of its supply chain, which led to a boycott of the company by consumers.

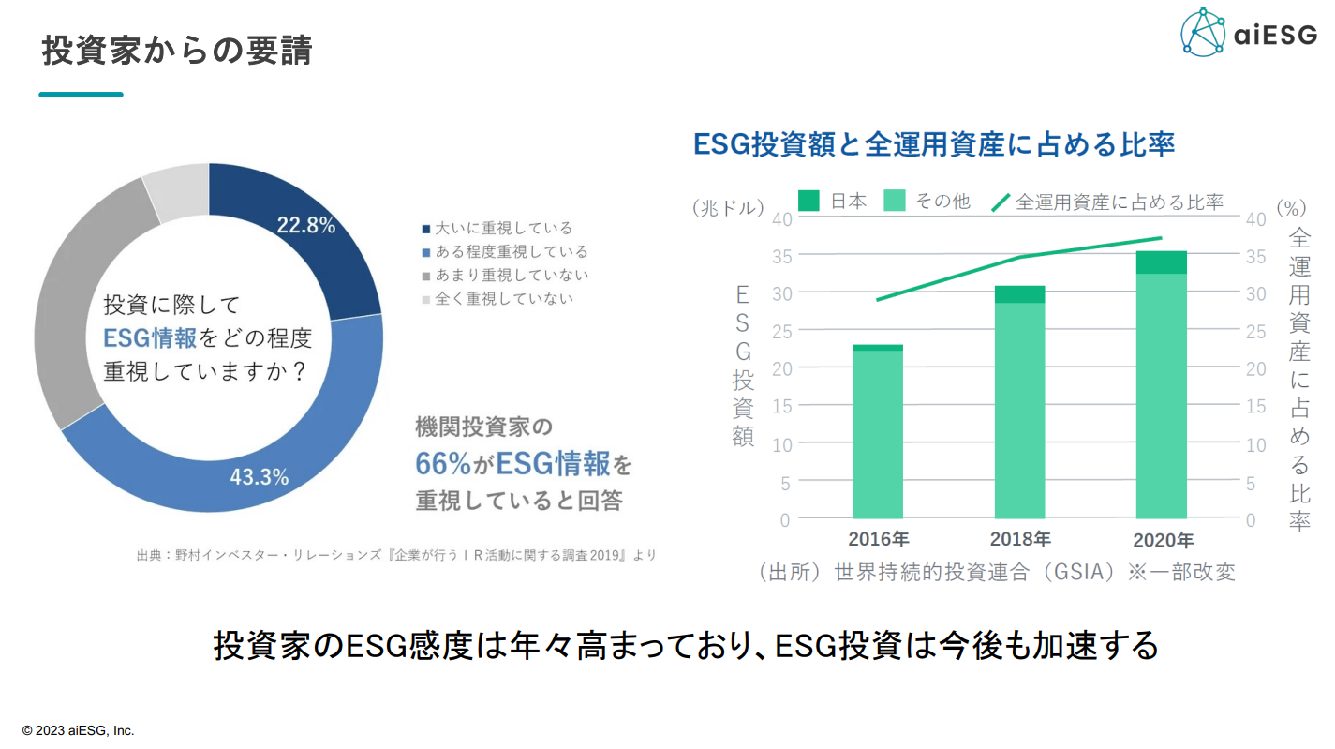

The overall trend is that the percentage of investments is increasing year by year, although the numbers are changing due to the revised definition of ESG investments.

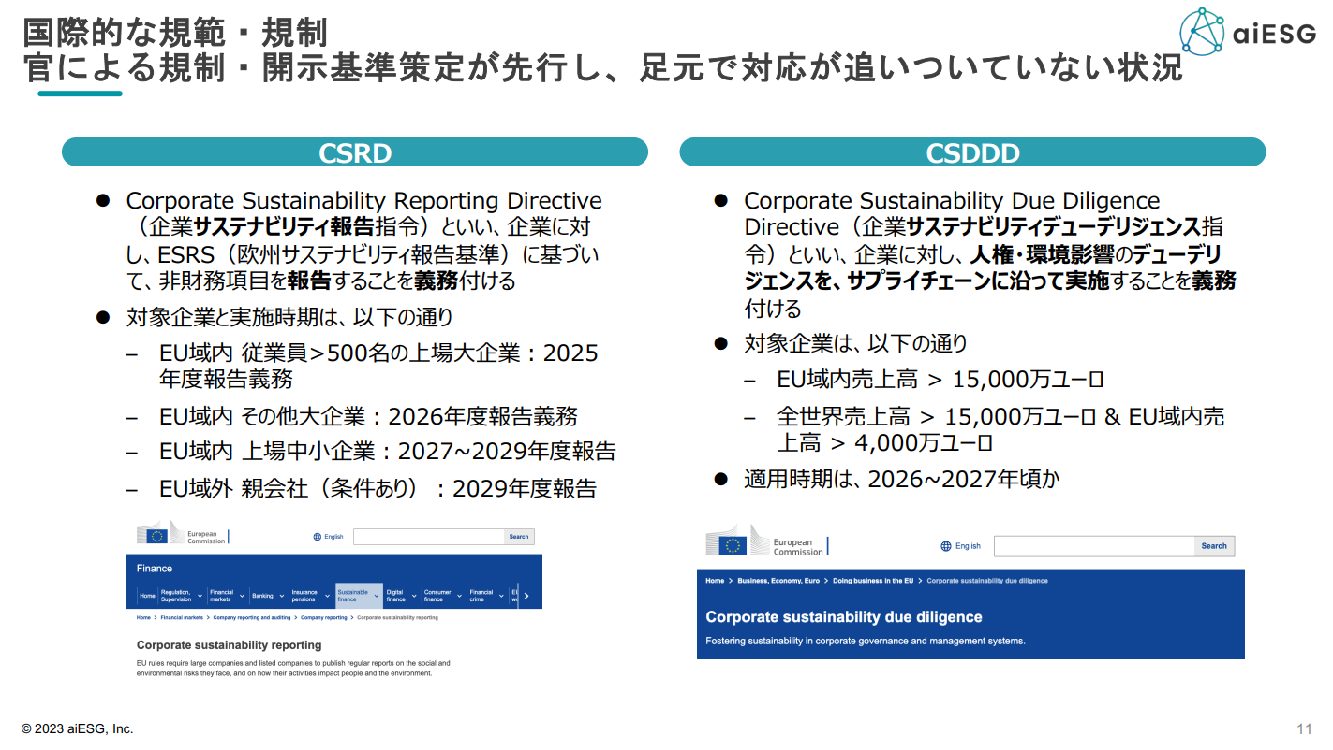

In addition to TCFD, TNFD, and TIFD, other major frameworks such as SDGs, Paris Agreement, and Business and Human Rights are being developed as international frameworks as higher-level concepts. The current trend is that what used to be non-legally binding soft law is now becoming legally binding hard law.

In Europe, the U.K. and Germany have issued guidelines and have enacted legislation within a few years, and there is an emerging trend that the entire supply chain should be monitored from a social aspect as well, but among the G7 countries, Japan is lagging far behind.

The number of issues that companies need to address, such as compliance with CSRD (Corporate Sustainability Reporting Directive) as the next step after TNFD, is increasing, and although the standards are changing by the minute, we expect that they will eventually converge. Although this is only an estimate, the number of Japanese companies subject to CSRD is said to be approximately 800, a situation that cannot be overlooked.

Companies have actually begun to experience cases where they have been suspended from doing business with suppliers, etc. if they do not disclose environmental and social information (e.g., the amount of emissions reduction contributions, etc.). Under these circumstances, we work with companies on a daily basis to determine what should be done and to what extent.

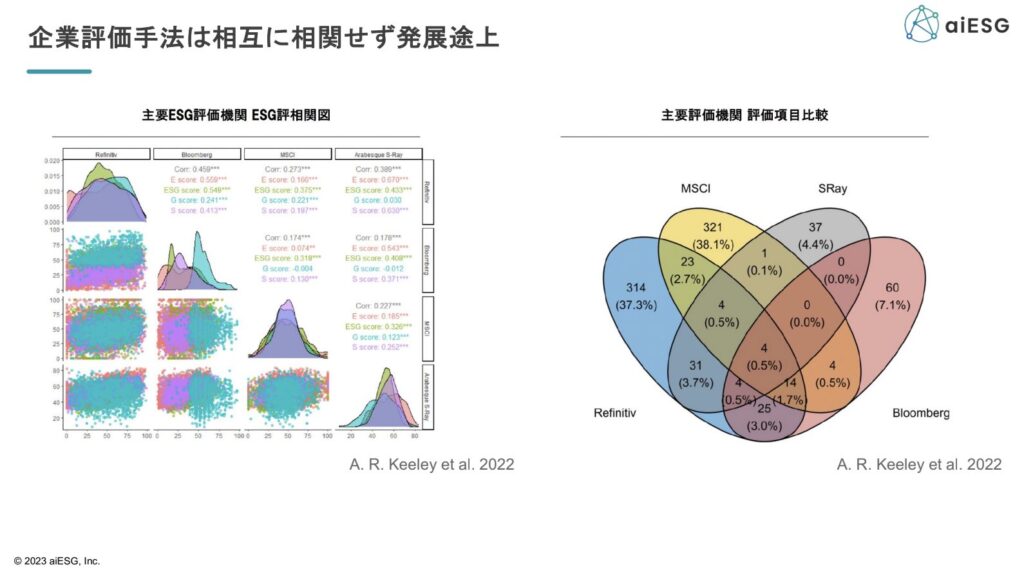

Current status of corporate valuation methods

The most commonly heard names of external evaluation organizations used by GPIF (Pension Fund Investment Management Inc.) for ESG evaluation are MSCI (Morgan Stanley-derived), Refinitiv (Reuters-derived), and others. They are said to have a considerable bias in terms of fairness and transparency. When we actually analyzed the contents of the ESG assessment data, it became clear that there was no consistency in the assessment items. Specifically, the correlation between the ESG scores of each evaluation organization, none of the correlation coefficients exceeded 0.5. This indicates that the GPIF has no idea what kind of investment returns it would receive if it were to invest based on the Bloomberg and MSCI evaluation criteria. Therefore, it can be said that the companies disclosing information also do not know what to believe.

Disclosure standards are also in a state of flux, commonly referred to as an alphabet soup. However, in recent years, they have begun to converge in the form of integration into IFRS, and are expected to encompass the disclosure requirements of various valuation indices such as GRI, SASB, CDP, TCFD, and others.

aiESG Initiatives

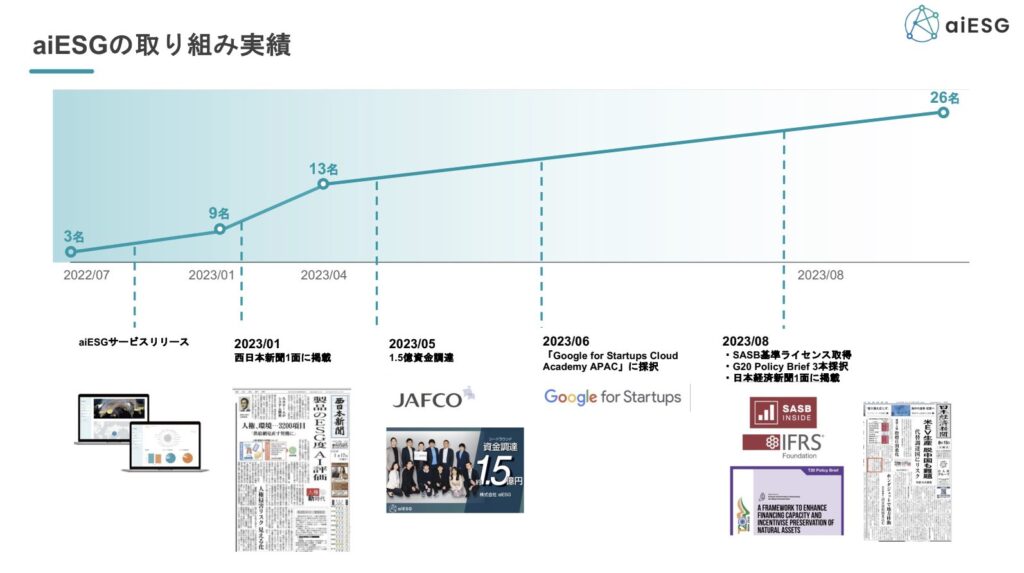

Since its release, aiESG has been able to steadily expand its scale and increase its presence, including receiving investment from JAFCO, being selected by Google for Startups, and being selected for the G20 Policy Brief and featured in the Nikkei newspaper.

aiESG provides not only ESG evaluations on a company-by-company basis, like MSCI, but also ESG evaluations on a product or service-by-product basis as a service. Specifically, we can calculate quantitative data similar to the cost of labor hours spent on T-shirt manufacturing at the beginning of this section, based on data such as work-in-process and financial information held by a company. Naturally, if it can be done on a product-by-product basis, ESG evaluation can be done on a factory, division, or company-by-company basis, making it highly versatile.

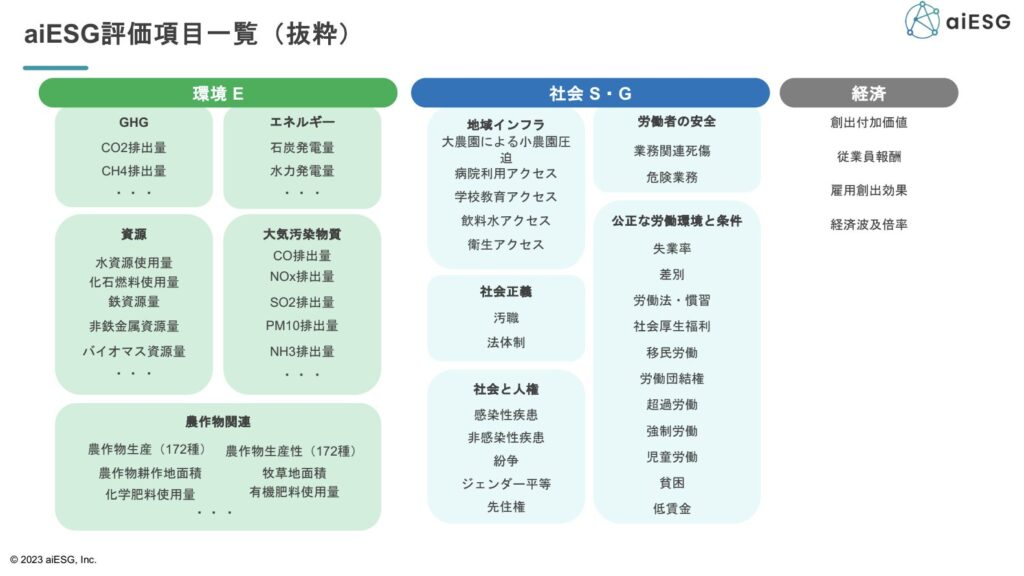

The data used in previous ESG assessments was quantitative data for a few items such as CO2 and water consumption, while other items were either zero or qualitative data. Therefore, they were not very accurate evaluation indicators. We are attempting to look at all of the nearly 3,200 indicators quantitatively, for example, we are collecting data on greenhouse gases other than CO2, biomass, etc.

In addition, in order to accurately assess the social aspects of the project, we are taking the time to create satellite data, which will, for example, reveal all of the social impacts from resource extraction to user utilization.

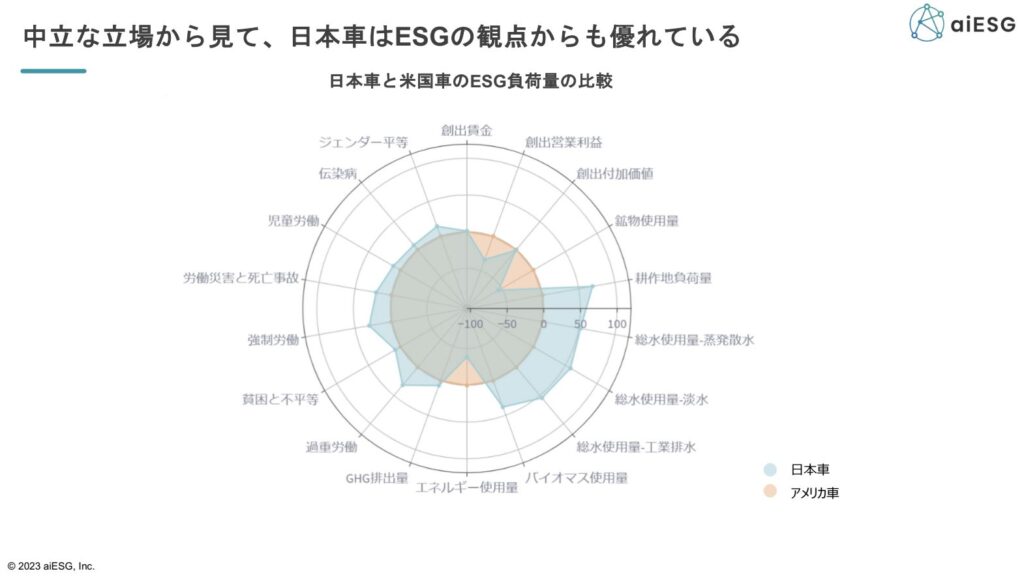

Looking at the data, I have the impression that Japanese companies are generally already making progress in their supply chain initiatives, which should be rewarded. Looking at the international community, Europe is leading the way in rule making, and I feel that it is significant to disseminate information originating from Japan. For example, the international carbon tax adjustment measure seems to be completely aimed at Europe's own industries, and I believe it is no exaggeration to say that it is a political measure aimed at Toyota. We feel it is worthwhile to look at this in a neutral way, not reflecting national interests. To give an example, a product comparison of Japanese and American automobiles shows that Japanese cars are generally more positive from an ESG perspective, although they are inferior in some indicators. With this kind of issue in mind, we are now working to have ESG evaluations originating in Japan utilized on a global scale.

Panel Discussion / Moderator: Mr. Naito

During the panel discussion, the participants discussed ESG and SDG understanding, Japanese manufacturing activities, indicator priorities, the need for a scientific approach, the relationship with the political game, examples of ESG initiatives, the importance of a practical approach, and Ocean Network Express (ONE) KPI setting and initiatives. The participants discussed the following topics.

Moderator: Mr. Yasutomo Naito

Executive Officer, CEO of SPEEDA Southeast Asia Business, User Base, Inc.

He joined Userbase in 2016 and came to Sri Lanka to work with members from ASEAN countries and Sri Lanka to support Japanese companies in their corporate planning and business development through the SPEEDA business.

Prior to joining User Base, he promoted business reforms in Asia, including leading business integration and post-acquisition integration in the Greater China market. He also joined a consulting firm as a new graduate, where he was engaged in organizational strategy, logistics reform, and business reform, and has consistently promoted business reform in his career.

He is co-author of "Global Organization and Human Resource Management for Expansion into Emerging Countries.

What is the relationship between ESG and SDGs?

- aiESG Keeley

To give an example to promote understanding, the SDGs include "responsibility on the part of those who make and use". This indicates that the goals include even the people who use them. It is true that the ESG and SDGs can be shown to correspond to each other, but the SDGs are something that society as a whole and all stakeholders should work on, while the ESGs are something that companies should work on. We do not want ESG to be seen as a cost, but rather as a contribution to corporate value, as our research has shown.

What ESG activities should Japanese manufacturers engage in?

- aiESG Keeley

The risk of negative aspects of S (Society) and E (Environment) negatively affecting corporate value should be lowered. In addition, I think the key is to launch positive aspects and conduct PR to increase corporate value.

It is important to identify hot spots. For example, it is important to consider what would happen if the rapeseed oil used in a certain product is changed from its current Dutch origin to France, Germany, Italy, etc., and to examine the most appropriate combination of the two. In addition to taking into account the balance with economic efficiency, such measures will contribute to the improvement of ESG scores.

It is also important to start from the R&D stage. Even in the case of retailers such as Aeon and 7-Eleven, they are working on a major mission to make their products ESG-friendly across the board. In the manufacturing industry, a large risk can be reduced in advance by conducting a simple needs check and simulation from the manufacturing stage.

What should be prioritized among the various ESG-related indicators?

- aiESG Keeley

Although MSCI is currently the most used ESG evaluation, the physical quantity (quantitative data) is minimal, and most decisions are made based on qualitative data without disclosure operations. Although the market now accepts this assessment, I believe it is unreliable data, and aiESG hopes to change this trend.

● Is ESG in the Western-dominated political game?

- aiESG Keeley

To win in Europe, it is important to present quantitative indicators that are overwhelmingly scientific, neutral, and free of bias. It is also important that the way quantitative indicators are presented be transparent. By doing this thoroughly, the indicators will be indisputable. This is what we are working on now, starting in Japan.

- ONE Mr. Shiomi

To add to Alex, the IMO is deliberating on fuel regulations and two years ago received proposals from Japan, the EU, and China, respectively. In fact, although the Japanese proposal was scientific and neutral, few people were aware of this fact because IMO meetings are closed to the public. I believe that the Japanese people have been blindly following the top-down standards set by the Europeans. Based on these facts, I believe that there are two things that we, as business operators, should do. One is to show it quantitatively by numbers. The other is to "visualize" the situation and expose it to the world.

● What is the winning formula in creating a standard with a scientific approach?

- aiESG Keeley

One approach is from international organizations. Double materiality disclosure was also used by the World Economic Forum (WEF) in the context of stakeholder capitalism, and was first reflected in the guidelines as soft law, which gradually became mandatory and hard law. It is important to prove correctness by approaching international organizations and national research institutes. For example, one of the reasons why biochar was approved for J-Credit was that the research paper was published in one IPCC report. Academic papers have strong persuasiveness and credibility because they are evidence-based. Science is not concerned with national interests, so I think it is important to put it forth at international conferences.

The other approach is from the practical side. In other words, the approach is to establish de facto standards by disclosing highly reliable information. For example, the TNFD is currently in the voluntary disclosure stage, which means that any items may be disclosed. Therefore, I think it is important for each company to disclose positive aspects quantitatively and transparently in an easy-to-understand and reliable manner, thereby building up a body of case studies.

Where are we now with the ONE initiative?

- ONE Mr. Shiomi

In the past, this was a regulatory response, but we are beginning to set KPIs as part of our expanding collaboration with academia. We are now taking the stance of measuring various KPIs over a long time span and verifying through trial and error whether or not corporate value can really increase. However, this is like searching for a vein of ore that no one has found in the absence of a correct answer, as in the days of the western frontier, and we hope to find a de facto standard for container shipping companies as a result.

● How does ONE make ESG an enjoyable endeavor?

- ONE Mr. Shiomi

Basically, we try to keep our organization even-tempered, regardless of titles or departments. We also create an open atmosphere where people with ideas can take on challenges with a sense of responsibility.

That's all for the seminar report.

aiESG provides support for ESG assessments and sustainability-related activities based on global trends. Please contact us if you are considering disclosure and sustainability-related initiatives.

Contact us:

https://aiesg.co.jp/contact/

Related page

Report List : Regulations/Standards

https://aiesg.co.jp/topics/report/tag/基準-規制/

[Commentary] Nikkei article: aiESG Supply Chain Analysis of "Electric Vehicle (EV) Production, ESG Indicators Deteriorate Due to 'De-China'".

https://aiesg.co.jp/topics/report/2301016_nikkeiev1/

Commentary] Alphabet Soup - Disruptions and Convergence of Sustainability Standards

https://aiesg.co.jp/topics/report/2301226_alphabet-soup/

【【Explanation] What is TNFD? A new bridge between finance and the natural environment

https://aiesg.co.jp/topics/report/230913_tnfdreport/

What is the SASB Standard for ESG Information Disclosure? (Part 1)Outline of SASB

https://aiesg.co.jp/topics/report/2301025_sasb1/

CSRD: The EU Sustainability Reporting Standard Just Before It Enters into Force: The Impact on Japanese Companies

https://aiesg.co.jp/topics/report/2301120_csrd/