INDEX

The International Sustainability Standards Board (ISSB) published the final version of its Sustainability Disclosure Standards on June 26, 2023.

In Europe, the ISSB standards and interoperable standards have already begun to be disclosed in many countries, and in Japan, the disclosure of sustainability information in annual securities reports has started in the fiscal year ending March 31, 2023.

In response to the demand for the development of specific sustainability disclosure standards, the Sustainability Standards Board of Japan (SSBJ) released the following three exposure drafts (the "Exposure Drafts") on March 29, 2024, prior to the release of the finalized standards at the end of March 2025. The following three exposure drafts ("Exposure Drafts") were released on March 29, 2024, prior to the release of the finalized standards at the end of March 2025. The following three exposure drafts (the "Exposure Drafts") were released on March 29, 2024.

(1) Exposure Draft of the Universal Standard for Sustainability Disclosure, "Application of the Draft Sustainability Disclosure Standard" (the "Applicable Standard").

(ii) Sustainability Disclosure Thematic Standard Exposure Draft No. 1 "General Disclosure Standards (Draft)

(iii) Sustainability Disclosure Thematic Standard Exposure Draft No. 2, "Draft Climate-related Disclosure Standard

(2) and (3) together are hereinafter referred to as the "SSBJ Standards.")

This exposure draft has been developed in accordance with the IFRS Sustainability Disclosure Standard, which is considered a global baseline, and also refers to Scope 3 greenhouse gas emissions, which is an important factor in terms of visibility of greenhouse gas emissions for decarbonization.

This paper describes the developments in Japan after the publication of the final version of the ISSB and the status of deliberations at the SSBJ, focusing on Scope 3.

1. background of the release of the SSBJ draft

The Sustainability Standards Board Japan (SSBJ) was established in July 2022 as an internal organization of the Financial Accounting Standards Foundation (FASF) to develop Japanese domestic standards for sustainability disclosure and to provide input to the ISSB (Figure 1).

Figure 1: Correspondence between the IFRS Foundation and the FASF(in Japanese history)Sustainability Standards Board Japan (SSBJ))

The SSBJ is the domestic counterpart of the ISSB, and the SSBJ standard is an interpretation of the ISSB's international standards for the Japanese market.

This SSBJ standard has been developed through an individual issue-by-issue study of whether the content of the IFRS Sustainability Disclosure Standards (IFRS S1 and IFRS S2) issued in June 2023 should be incorporated into the SSBJ standard.

IFRS S1 consists of two parts: one part that sets out the fundamentals for preparing sustainability-related financial disclosures and the other part that sets out the matters to be disclosed regarding sustainability-related risks and opportunities (the "core content"). IFRS S1 is comprised of two parts: one part that sets out the basic matters for preparing sustainability-related financial disclosures and the other part that sets out the matters to be disclosed with respect to sustainability-related risks and opportunities ("core content").

This Exposure Draft establishes a standard that is equivalent to IFRS S1 in Japan, which sets out the basic(1) "Applicable Criteria."And,

Define core content consisting of Governance, Strategy, Risk Management, and Metrics and Objectives.(2) "General Standards."The proposal is simpler in structure than the IFRS standard, as it proposes to present the information separately from the

Figure 2: Structural differences between ISSB and SSBJ standards

(Source: Sustainability Standards Committee, "Sustainability Disclosure Thematic Standard Exposure Draft No. 2 "Climate-related Disclosure Standards (Draft)"

IFRS S1: Provides a set of disclosure requirements designed to enable companies to communicate with investors about the sustainability-related risks and opportunities they face over the short, medium and long term.

IFRS S2: Sets out specific climate-related disclosures and is to be used in conjunction with IFRS S1.

Based on the desire of the Financial Services Agency's Financial System Council General Meeting on February 19, 2024 to apply the SSBJ standards to "companies that focus on constructive dialogue with global investors," the SSBJ standards are intended to apply in principle to prime listed companies.

With the release of the exposure draft of the previously unclear framework for measuring and disclosing Scope 3 greenhouse gas emissions, it is expected that efforts to disclose such emissions will become increasingly important in corporate governance.

The next section summarizes the deliberations to date, focusing on Scope 3.

2. overview of Scope 3

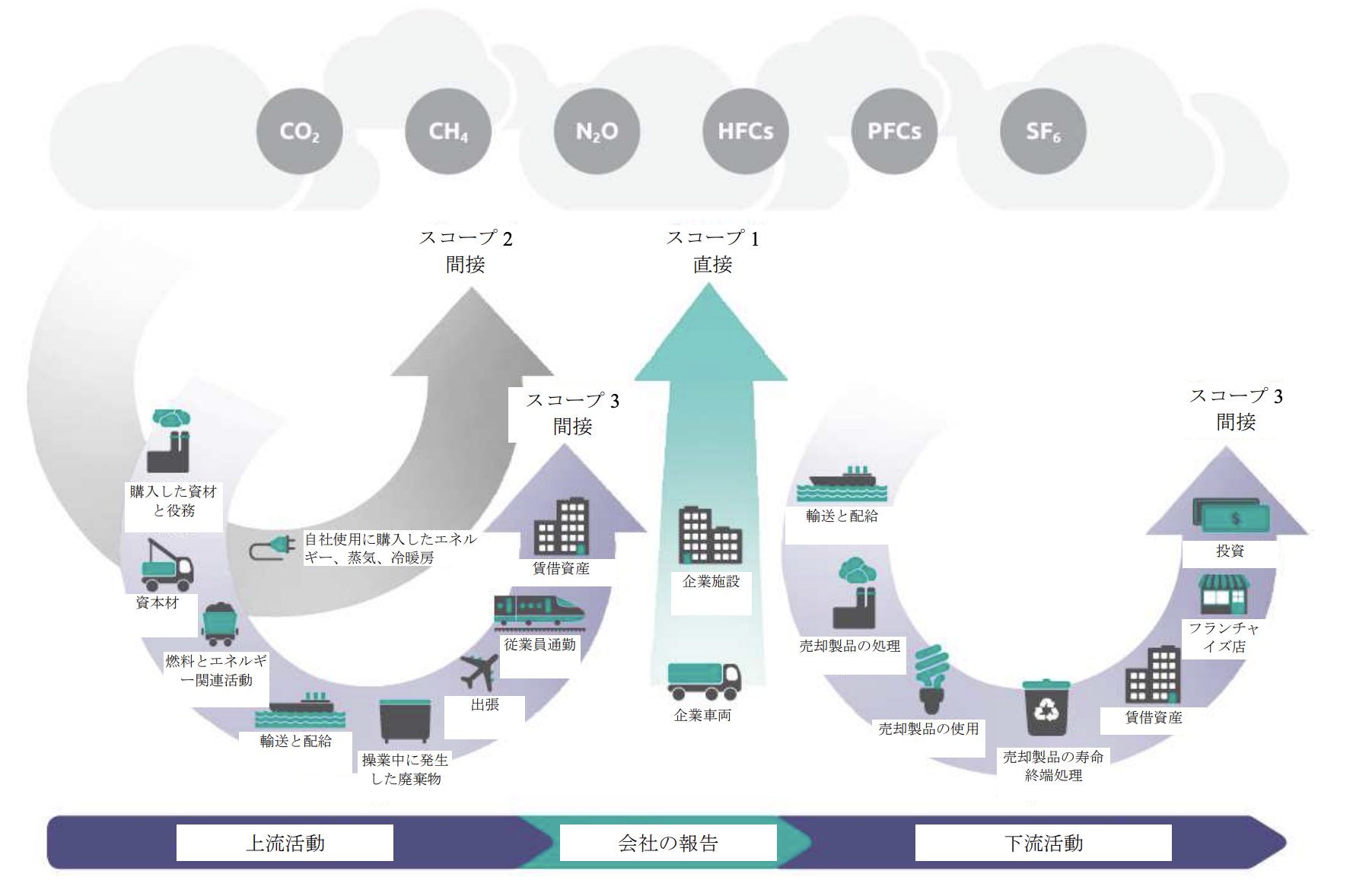

In order to achieve carbon neutrality, there is a growing demand for visualization of greenhouse gas emissions, and an important indicator for this is "Scope 3 greenhouse gas emissions".

Scope 1 represents direct greenhouse gas emissions by the reporting company itself, and Scope 2 represents indirect emissions resulting from the use of electricity, heat, and steam supplied by other companies.

Scope 3, on the other hand, refers to indirect greenhouse gas emissions occurring in the value chain of the reporting company that are not specifically included in Scope 2, and includes both upstream and downstream greenhouse gas emissions.

However, the proposed application of the SSBJ standard for prime listed companies will start from the March 2027 or 2028 reporting period, which means that the Scope 3 disclosure requirement for the Japanese market is an immediate issue. The demand for Scope 3 disclosure in the Japanese market is becoming an immediate issue.

Scope 3 greenhouse gas emissions are divided into the following 15 categories as defined in the Corporate Value Chain (Scope 3) Standard for Greenhouse Gas Protocols (2011), 8 of which are relevant upstream and 7 downstream of the company.

For example, the Scope 3 category "Category 15" is "Investment," which in this case would classify greenhouse gas emissions by third parties financed by the reporting company.

Table 1: 15 categories defined by the Corporate Value Chain (Scope 3) Criteria for the Greenhouse Gas Protocol (2011)(Source:GHG Protocol Scope 3 Criteria(Prepared by the author from)

| (i) | Purchased goods and services | nine | Downstream transportation and distribution |

| (2) | capital goods | 10 | Processing of sold products |

| (iii) | Fuel and energy related activities not included in Scope 1 or Scope 2 greenhouse gas emissions | eleventh sign of the Chinese calendar | Use of products sold |

| 4) | Upstream transportation and distribution | ⑫ | Disposal of sold products |

| 5) | Waste generated in the business | ⑬ | Downstream leased assets |

| 6) | business trip | ⑭ | franchise |

| seven (used in legal documents) | Employee Commuting | 15 (used in legal documents) | investment |

| viii) | Upstream leased assets |

The term "greenhouse gases" in the SSBJ standards refers to the seven greenhouse gases listed in the Kyoto Protocol: carbon dioxide (CO₂), methane (CH₄), dinitrogen monoxide (N₂O), hydrofluorocarbons (HFCs) nitrogen trifluoride (NF₃), perfluorocarbons (PFCs ) and sulfur hexafluoride (SF₆).

In the SSBJ standard, as in the IFRS Sustainability Disclosure Standard, Scope 3 greenhouse gas emissions are measured in accordance with the "Corporate Accounting and Reporting Standard for Greenhouse Gas Protocols (2004)" and in accordance with the 15 categories above,Must be broken down and disclosed by category relevant to the activities of the reporting entityThe policy stipulates that.

On the other hand, the practice of measuring Scope 3 GHG emissions is still developing with little accumulation, and the categories included in Scope 3 GHG emissions vary depending on the facts and circumstances of a company, so not all categories are applicable to a company.

Thus, while companies are required to consider the relevance of all 15 categories,It may be determined that all categories do not need to be included in the measurement of Scope 3 greenhouse gas emissionsThe following is a list of the most common problems with the "C" in the "C" column.

The exposure draft also requires that the absolute total amount of greenhouse gas emissions generated during the reporting period be disclosed separately for Scope 1, Scope 2, and Scope 3, and that theseSum of absolute totalThe company is required to disclose the following information.

Disclosure of totals is not required by IFRS S2,This is SSBJ's own standard.

Figure 3: Overview of the scope of the GHG Protocol and emissions across the value chain

(Source:Ministry of the Environment)

Status of deliberations on Scope 3

October 2, 2023.SSBJ Public DocumentsAccording to the "Measuring Scope 3 Greenhouse Gas Emissions" report, there are two types of discussions on the measurement of Scope 3 greenhouse gas emissions: one common to all three scopes and one specific to Scope 3 greenhouse gas emissions.

The former includes "reassessing the scope of climate-related risks and opportunities through the value chain," "using information from different reporting periods," and "aggregating greenhouse gases converted into CO₂ equivalents," while the latter includes "applying the scope of materiality in the disclosure of absolute gross quantities," "Scope 3 measurement framework," and " emissions related to financing (financed emissions)".

Below is a summary of the main points in each discussion. The following discussion is based on Exposure Draft No. 2 and the applicable standards.

◆3 Scope Common Discussion

Reassess the scope of climate-related risks and opportunities throughout the value chain.

The value chain is defined as "all interactions, resources, and relationships that relate to the business model of the reporting entity and the external environment in which the entity operates.

The Exposure Draft requires that the scope of the value chain must be determined using reasonable and supportable information and that all affected climate-related risks and opportunities be reviewed throughout the value chain in the event of a significant event or material change in circumstances.

In measuring Scope 3 greenhouse gas emissions, it is also necessary to review which of the 15 Scope 3 categories and which companies in the value chain should be included.

Use of information from different reporting periods

In measuring GHG emissions, the period for which information is obtained from each company in the value chain may differ from the reporting period of the reporting company, which may make it difficult to use the information to disclose the greenhouse gas emissions of the reporting company.

In such cases,

(⑴Use the most recent data for each company in the value chain that is available without excessive cost or effort

(⑵The length of the calculation period for the information obtained from each entity in the value chain is the same as the length of the reporting period for the reporting entity.

(iii) Disclose the effect, if any, of significant events or material changes in circumstances related to the greenhouse gas emissions of the reporting entity that occurred between the end of the period for which the information obtained from each entity in the value chain was calculated and the end of the reporting period in the general purpose financial report of the reporting entity.

If all of the above requirements (1)~(3) are met, this exposure draft provides that a reporting entity's greenhouse gas emissions may be measured using information from a different calculation period than the reporting entity's reporting period.

[Aggregation of greenhouse gases converted to CO₂ equivalents].

In the course of a company's disclosure of greenhouse gas emissions,above-mentionedThe seven types of greenhouse gas emissions are required to be aggregated into CO₂ equivalents. There are two methods for measuring GHG emissions: "direct measurement" and "estimation.

If direct measurement is used, the seven greenhouse gas emissions must be converted to CO₂ equivalents using global warming coefficients for a 100-year time horizon based on the latest "Intergovernmental Panel on Climate Change Assessment" available as of the end of the reporting period.

If by way of estimate, the most expressive of a company's activities, "activity level" corresponding to the amount of activity in question.emission factorThe use of a "+" or "-" emission factor is required. The emission factor is the same as the "emission intensityIt is sometimes referred to as "the

◆Discussion on Scope 3 greenhouse gas emissions

[Application of materiality judgment in disclosing the absolute total amount of Scope 3 greenhouse gas emissions

According to the "Applicable Standards," information that is required by the SSBJ Standards need not be disclosed if it is not material.

Materiality" in this context is defined as "the ability of omitting, misstating, or obscuring certain information, in the context of sustainability-related financial disclosures, to reasonably be expected to influence the decisions made by the primary users of a general Defined as "could reasonably be expected to influence the decisions made by the primary users of the statement of purpose financial report.

It is expected that the judgment of materiality will be applied to the disclosure of absolute gross amounts in Scope 3, but a quantitative threshold for determining the categories for which absolute gross amounts are measured will not be established, taking into account the lack of accumulated practice, the potential for increased burden on some entities, and the balance with other standards, The exposure draft proposes to incorporate the provisions of IFRS S2 without modification.

*Definition of "absolute gross": non-intensity, pre-offset greenhouse gas emissions before taking into account any current or future direct and indirect mitigation and adaptation efforts by companies (e.g., carbon credits that they plan to use).

About the Scope 3 Measurement Framework

Under the SSBJ standards, greenhouse gas emissions must be measured in accordance with the "Corporate Accounting and Reporting Standards for Greenhouse Gas Protocols (2004)," which also applies to Scope 3.

In Exposure Draft No. 2, SSBJ provides guidance for preparing Scope 3 greenhouse gas emissions disclosures based on the Scope 3 Measurement Framework in IFRS S2.

There are two methods for quantifying emissions: "direct measurement" through monitoring and "estimation," but the former involves many challenges, so the latter is basically included in the calculation.

In the latter, as noted above, "activity leveland "emission factorThe measurement is based on a combination of two types of data: primary data obtained inside the value chain of the reporting company, and secondary data obtained externally.

In addition, the calculation of Scope 3 greenhouse gas emissions is,Public documents from the Ministry of the EnvironmentYou can also check it from

Disclosure of Financed Emissions

Financed emissions are part of Category 15, Investments, as defined in the Scope 3 Standards (2011), and if a reporting entity engages in one or more of the following activities: (1) activities related to asset management, (2) activities related to commercial banking, and (3) activities related to insurance, it is required to disclose additional information about financed emissions (1) activities related to asset management, (2) activities related to commercial banking, and (3) activities related to insurance, the reporting entity is required to disclose additional information regarding

If the reporting entity engages in such activities and is not regulated by the laws of the jurisdiction in which it operates, it may choose not to disclose additional information on financed emissions because it is difficult to determine whether such additional information is required. In such a case, the company is required to disclose such information.

4. feasibility and challenges of Scope 3 greenhouse gas emissions

We have outlined the conditions and methods for disclosing and measuring Scope 3 greenhouse gas emissions, but the status of Scope 3 disclosure varies greatly from company to company.

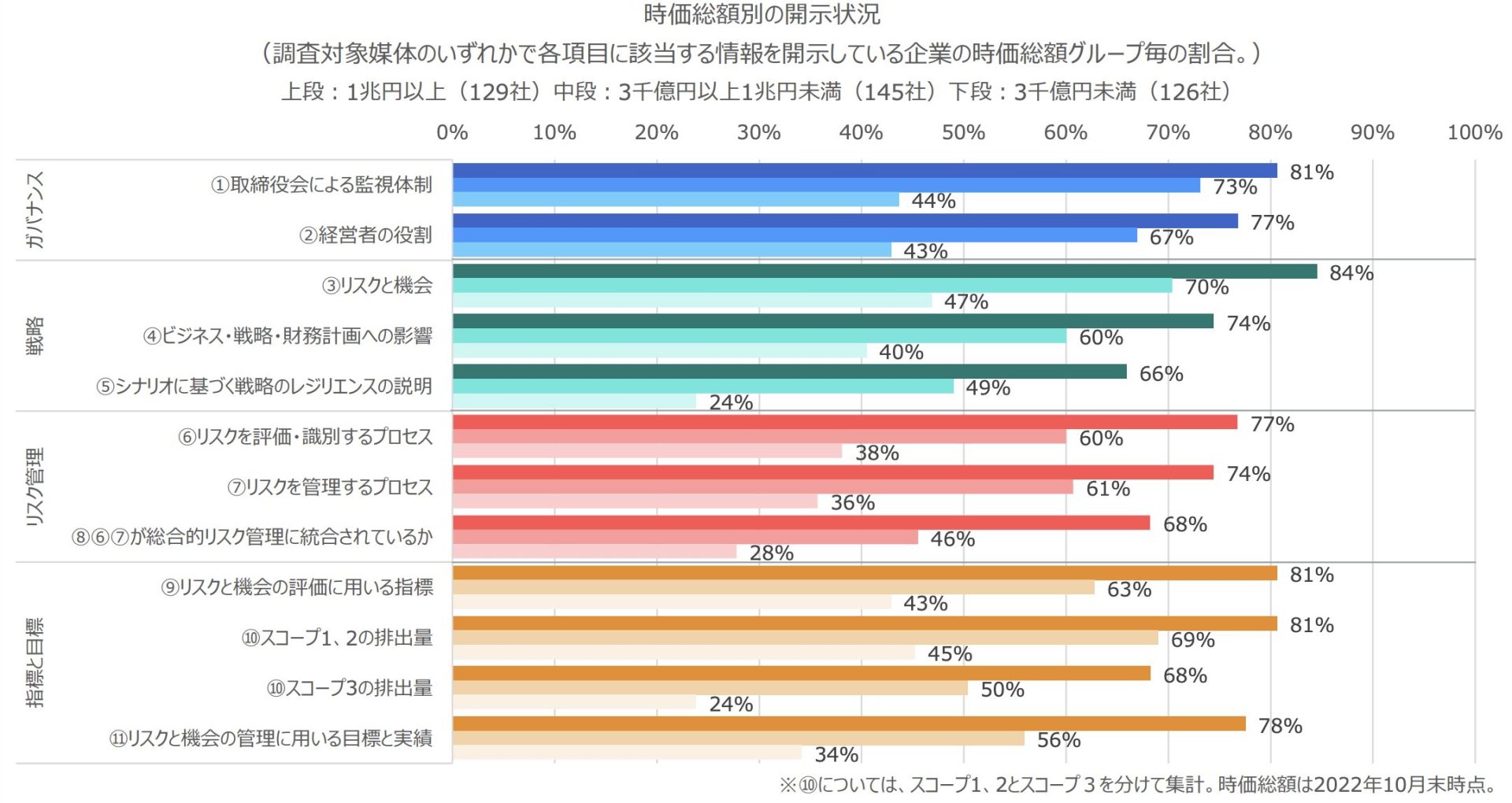

The chart below shows that companies with a market capitalization of 1 trillion yen or more have made progress in disclosing all of the TCFD recommendations (blue box in the table below), while companies with a market capitalization of less than 300 billion yen have disclosed less than 50% of the recommendations (red box in the table below), with scenario analysis, risk management, and Scope 3 disclosure being particularly The disclosure of scenario analysis, risk management, and Scope 3 is particularly low.

Figure 4: Disclosure of TCFD Recommendations by Market Capitalization

(Source:Japan Exchange Group, "Survey of Information Disclosure in Accordance with TCFD Recommendations (FY2022)")

Since Scope 3 requires visualization and reduction of greenhouse gas emissions throughout the supply chain, it is necessary to involve many companies in the supply chain. As a result, measurement and calculation have become more complex, and many companies are struggling to comply.

Currently in Japan, there are few requests for disclosure from the listed market or investors, and it is difficult to see the significance of efforts to reduce greenhouse gas emissions.

Lack of know-how and funds to visualize and reduce greenhouse gas emissions are also major barriers to disclosure.

In addition, difficulties in measuring and disclosing greenhouse gas emissions in Scope 3 include,Drawing the line of coverage on the value chainAnd,Capture accurate datawill be mentioned.

Reassess the scope of climate-related risks and opportunities throughout the value chain.As noted in Section 3.1, the Exposure Draft requires reasonable and supportable information in determining the scope of the value chain.

It is also necessary to specify the activities to be covered in each of the 15 categories in Scope 3, as well as whether the suppliers are limited to domestic or include overseas suppliers.

In some cases, a review of all affected climate-related risks and opportunities is required,

In measuring Scope 3 GHG emissions, a more detailed review may be required, which is expected to be very labor intensive.

The SSBJ standard is based on the assumption that Scope 3 GHG emissions can be reliably estimated by using secondary data, industry averaged data, etc. However, there may be cases where primary data is not collected and stored, and where secondary data from industry averages or third-party data providers is not collected and stored. However, in cases where primary data is not collected and stored, and where industry-averaged data or secondary data from third-party data providers is not collected and stored, the SSBJ Standards do not provide a reliable estimate of Scope 3 GHG emissions,Scope 3Circumstances in which greenhouse gas emissions cannot be measuredis possible.

Therefore, while acknowledging such a situation and requiring companies to disclose how they manage their Scope 3 GHG emissions and, if they do not, that they do so, other companies in the value chain must also be required to make accurate calculations.

There is no quantitative threshold for determining which categories of Scope 3 GHG emissions are to be measured in absolute terms, and the types of categories that apply vary from company to company, making it very difficult to measure and disclose for all categories.

For this situation, aiESG provides appropriate corporate evaluation indicators through AI-based analysis.

As a SASB license holder, aiESG's services can provide reliable support for compliance with the increasingly complex SSBJ standards, which include many elements.

5. conclusion

As decarbonization on a global scale progresses with the development of the ISSB international standard, attention is focused on future deliberations to finalize the SSBJ standard.

On the other hand, the importance of visualization of greenhouse gas emissions, including Scope 3, is increasing, and the trend toward disclosure among companies is expected to accelerate.

aiESG provides support from basic ESG-related standards and frameworks to actual disclosure of non-financial information, so please contact us if you have any ESG-related issues.

Contact us:

https://aiesg.co.jp/contact/

References

[1]https://www.ssb-j.jp/jp/wp-content/uploads/sites/6/2024ed01_01.pdf

[2]https://www.jpx.co.jp/corporate/sustainability/esgknowledgehub/disclosure-framework/06.html

[3]https://www.ssb-j.jp/jp/wp-content/uploads/sites/6/2024ed01_04.pdf

[4]https://www.fsa.go.jp/singi/singi_kinyu/sustainability_disclose_wg/shiryou/20240326/03.pdf

[5]https://www.ssb-j.jp/jp/wp-content/uploads/sites/6/2024ed01_02.pdf

Related page

Report List : Regulations/Standards

https://aiesg.co.jp/topics/report/tag/基準-規制/

Explanation] What is TNFD? A new bridge between finance and the natural environment

https://aiesg.co.jp/topics/report/230913_tnfdreport/

Commentary] ISSB - Global Baseline for Sustainability Disclosure

https://aiesg.co.jp/topics/report/2301130_issb/

[Commentary] Alphabet soup

〜˜Sustainability Standards in Disarray and Convergence

https://aiesg.co.jp/topics/report/2301226_alphabet-soup/