INDEX

The EU has strengthened its regulations on sustainability reporting and introduced a new directive, the Corporate Sustainability Reporting Directives (CSRD), which requires companies to disclose detailed environmental, social, and governance (ESG) information. CSRD), a new directive that requires companies to disclose detailed information on ESG issues. This article summarizes the latest developments as a continuation of the commentary on the directive posted in the previous issue.

CSRD: The EU Sustainability Reporting Standard Just Before It Enters into Force: The Impact on Japanese Companies

https://aiesg.co.jp/topics/report/2301120_csrd/

Table of Contents

CSRD Overview and Update

Current situation on the company side regarding the adoption of CSRD

Momentum that CSRD application brings business benefits

Organizational structure of the company to which it applies

Challenges in Application

What action should Japanese companies take?

CSRD Overview and Update

The CSRD (Corporate Sustainability Reporting Directive) is a significant extension of the previous Non-Financial Reporting Directive (NFRD), expanding the scope of companies eligible to report and the content of their reports. The Sustainability Reporting Directive was adopted by the European Parliament and the European Commission in 2022 and was issued in January 2023, and some large groups of companies from Europe that have been subject to the NFRD are now obliged to report on sustainability under the CSRD for fiscal years beginning in January 2024. and will submit those reports for the first time in fiscal year 2025.

The Directive is supported by the ESRS (European Sustainability Reporting Standards), which is comprised of two cross-cutting standards and ten topical standards covering specific reporting requirements on various environmental, social and governance matters.

- Further information on ESRS is summarized in the following report.

Commentary] Overview of ESRS (European Sustainability Reporting Standards)

https://aiesg.co.jp/topics/report/2301208_esrs/

An important deadline for EU member states at this time is July 6, 2024, when they must approve by national law the content of the Directive as set forth in the CSRD (Anthesis). France was the earliest country to begin domestic legislation, enacting legislation as of December 2023.

In light of the fact that NFRD-adapted companies will be obligated to report their sustainability reporting in compliance with the CSRD by the end of 2025, we expect that many companies are currently being forced to respond to this requirement. A comprehensive consulting firmPwCis surveying 547 executives and senior professionals in more than 30 countries and territories between April and May 2024. The survey is designed to help PwC understand the challenges and expectations, with 57% of all respondents aiming to apply CSRD for the first time in fiscal year 2025.

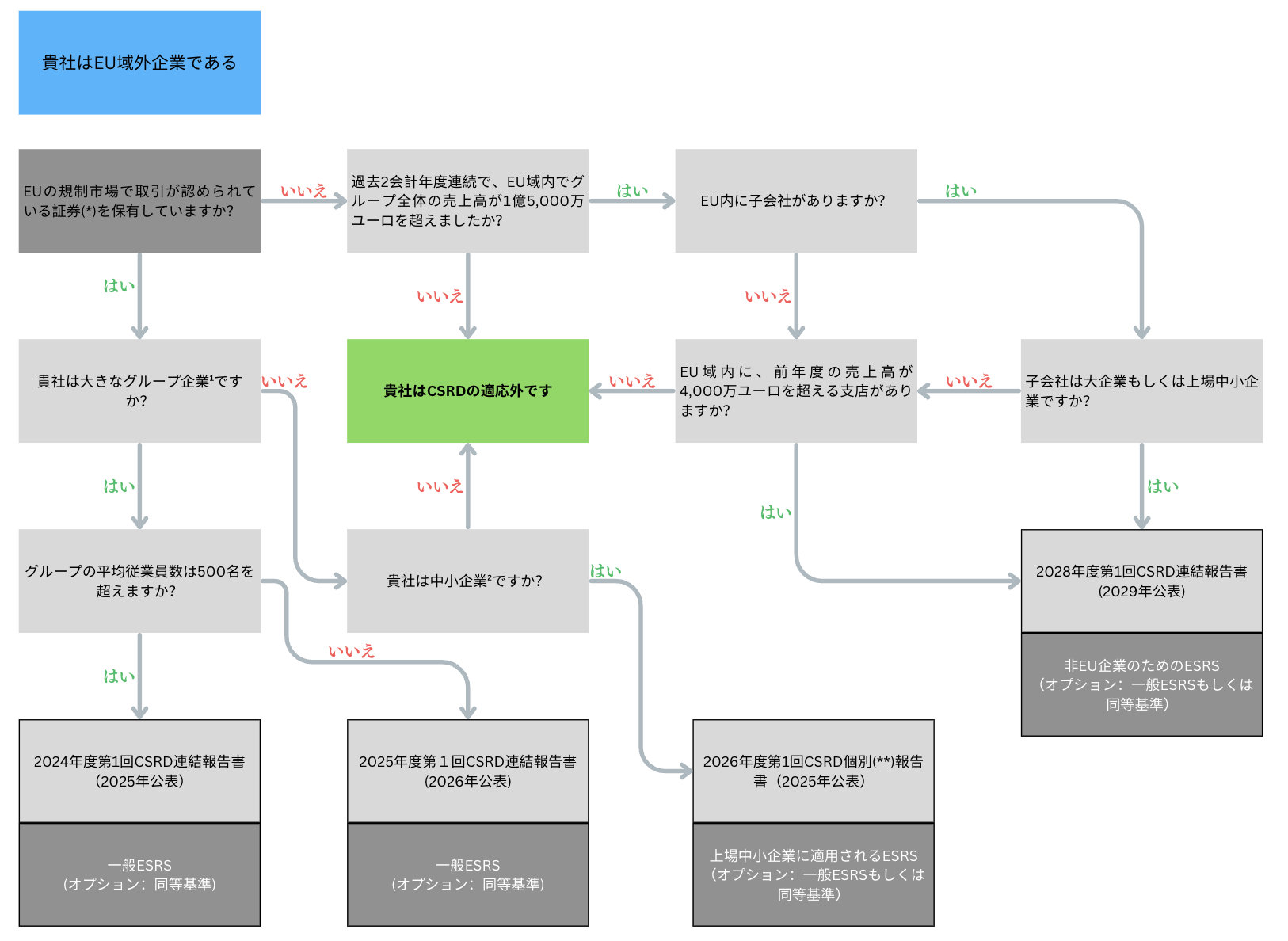

Non-EU companies that meet the requirements within the EU, including Japanese companies, must report from fiscal years beginning on or after January 1, 2028. With this in mind, the next section analyzes issues related to the adoption of CSRD that may affect Japanese companies through the results of PwC's survey.

Current situation on the company side regarding the adoption of CSRD

Momentum that CSRD application brings business benefits

Many companies already produce annual sustainability reports and report against other sustainability standards, but they need to be generally expanded and enhanced to meet the requirements of the CSRD.

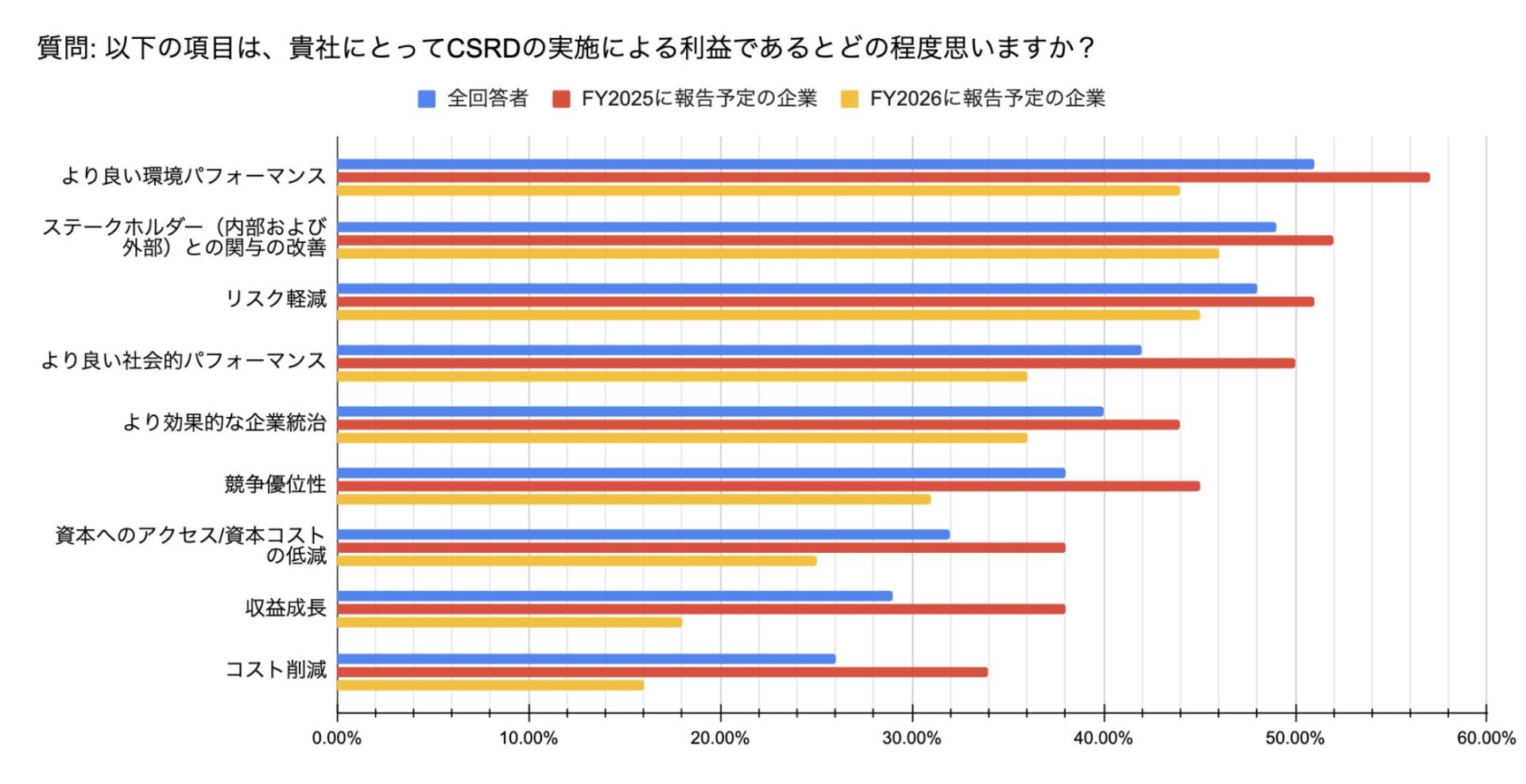

The survey, conducted by PwC, captures the conditions under which the application of CSRD is perceived to have benefits for a company's business. The survey found that companies are expecting not only indirect benefits such as improved environmental performance, better cooperation with stakeholders, and risk mitigation, but also direct benefits such as increased profits and cost reductions by incorporating sustainability-related knowledge into their decision-making processes. This is especially true for the group of companies that are actively engaged in the application of CSRD (as reported for the fiscal year 2025) (Figure 1).

Figure 1: Perceived benefits of CSRD implementation on the part of companies (Author's translation based on PwC survey)

The fact that companies that have made progress in their CSRD efforts have shown a positive attitude toward the Directive can be considered to reflect the fact that they have been improving the efficiency of their internal governance. Japanese firms are also required to obtain a wide range of internal information when applying the Directive. Those factors can be said to have a positive effect in this survey, leading to the recall of the possibility of economic benefits for companies.

Organizational structure of the company to which it applies

Tackling the broad and complex challenges of CSRD requires a large scale cross-functional effort within a company. On average, the survey found that on average, eight business functions and departments are involved, including sustainability, finance, operations, procurement, technology, and legal.

The CSRD has over 1,000 data points for disclosure requirements, and senior management must determine which disclosure requirements are material and need to be included in the report. In addition to confirming the requirements, the CSRD must also provide qualitative reports related to the assessment and the corresponding plans. In addition, all of this information must be assured by an independent third party for reasonable assurance (the first step begins with limited assurance.) Strong top-driven governance is expected to be a key factor in preventing stalled CSRD implementation.

Management committees or directors are involved in CSRD practices at more than 70% of companies, increasing to nearly 80% for companies planning to report in FY2025. Chief Financial Officers (CFOs) and Chief Information Officers (CIOs) should support the Chief Sustainability Officer (CSO) with their financial reporting and technology expertise to ensure effective sustainability reporting and the realization of sustainability-driven opportunities, the PwC side summarizes.

Challenges in Application

Throughout the PwC survey, most survey respondents expressed a high level of confidence. On the other hand, potential challenges are also evident, including low completion rates for some early-stage activities, lack of senior stakeholder involvement in some companies, and low adoption of technology to support effective ongoing reporting.

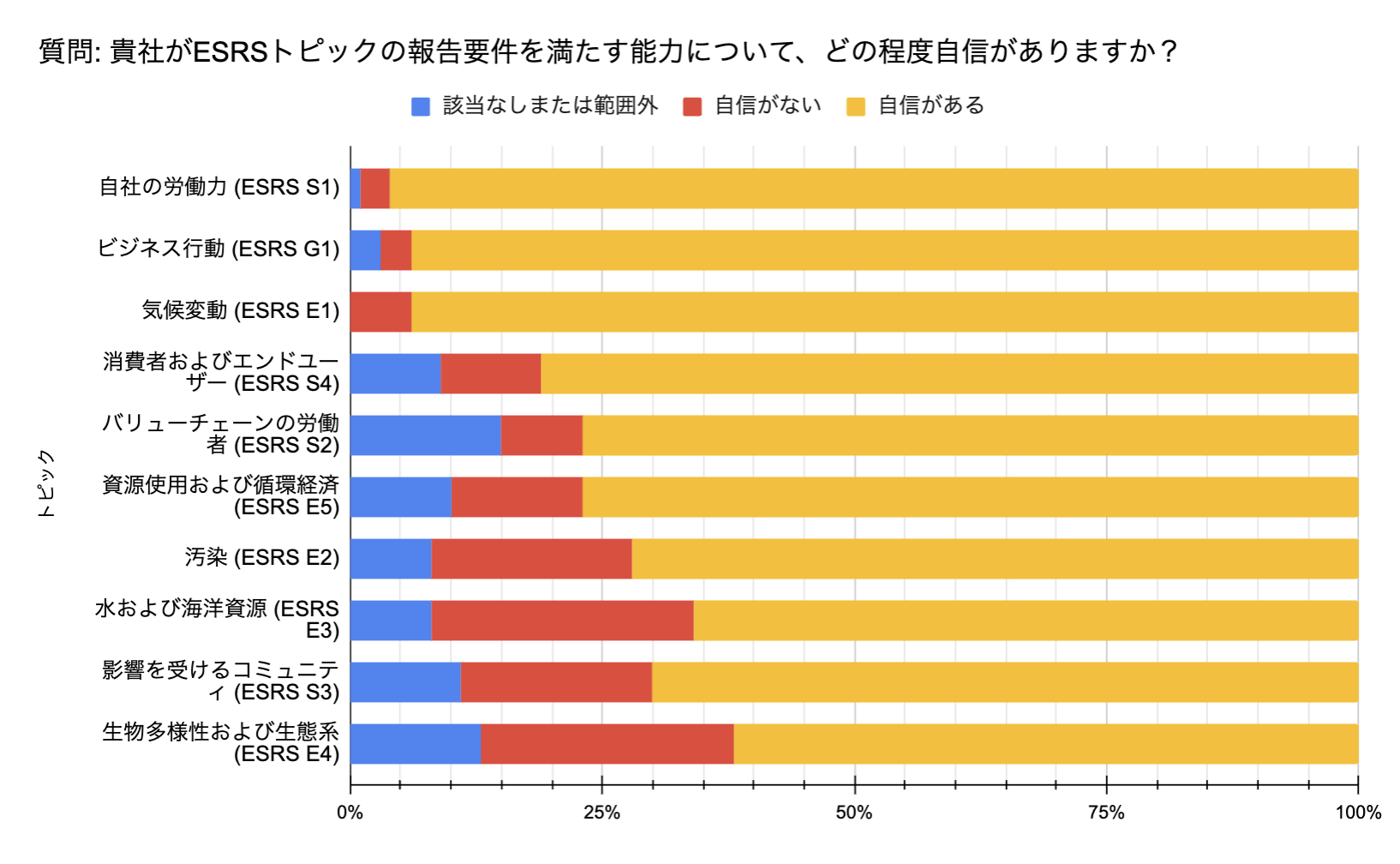

The majority of respondents (97% for companies reporting for fiscal year 2025) stated that they are confident about the likelihood of completing the preparation of their reports based on the CSRD. However, the degree of readiness varies according to the disclosure requirements of the ESRS.

Figure 2: Level of confidence in reporting realization of topic-specific requirements specified by the ESRS (Author's translation based on PwC survey)

While they report a high degree of confidence in topics commonly included in existing disclosures, such as labor, corporate actions, and climate change, many are less confident in their ability to meet reporting requirements for less familiar topics such as biodiversity, circularity, pollution, and workers in the value chain. For less familiar topics such as biodiversity, circularity, pollution, and workers in the value chain, many are not confident in their ability to meet reporting requirements.

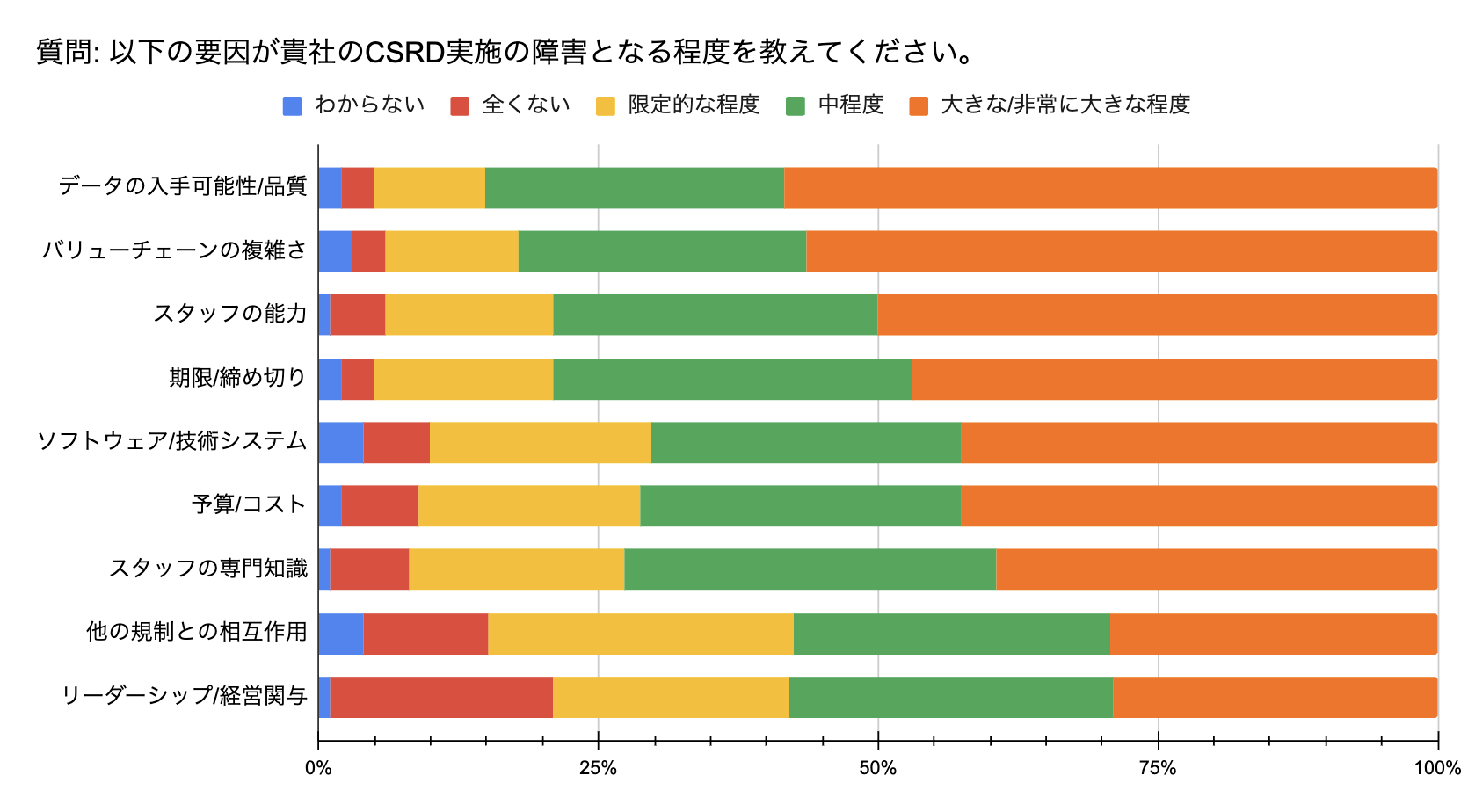

This difference can be attributed to the fact that "data availability and quality" is the biggest obstacle to implementation; the breadth and depth of CSRD reporting presents a major challenge for corporate departments to collect, verify, and integrate new types of data. There is no central information system to manage a large amount of information, especially information on the supply chain/value chain. This decentralized collection of information demands inefficient work on the part of the enterprise. Unless companies pay close attention to the fundamentals of their data strategy, they will be prone to errors.

The CSRD's requirement to look across the entire value chain presents new challenges pertaining to data. Companies will likely use data from suppliers, customers, and third-party data providers, but they will need to assess the reliability of the information. The basic premise is that the initial step of understanding and defining the value chain will take a lot of time. From this point of view, the complexity of the value chain is identified as the second major obstacle to implementation.

Figure 3: Difficult factors in CSRD adoption(Author's translation based on PwC survey)

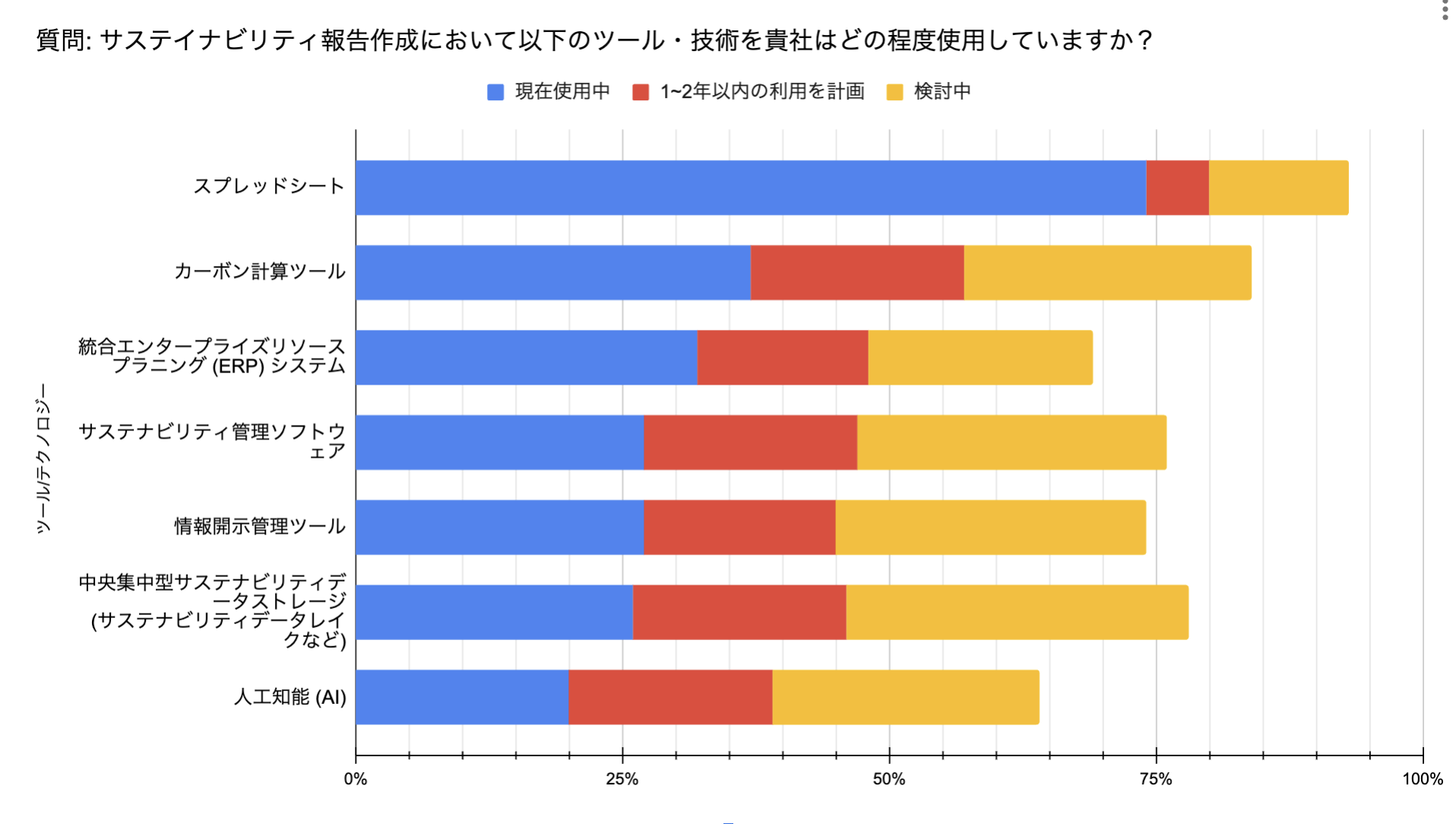

The difficulties associated with data processing are also exposed by the survey on organizational structure. While most respondents plan to involve the technology department, only about 60% have already integrated it into their reporting teams. Investing in and building an in-house technology department to perform complex sustainability analysis is an important option for achieving efficient ongoing reporting. Note that PwC expects the integration of technology departments to accelerate in many companies over time, and has found through its research that the use of AI tools will also become more prevalent. Currently, spreadsheets are proving to be the most used means.

Figure 4: Technologies and tools used by companies(Author's translation based on PwC survey)

What action should Japanese companies take?

What we have learned through our survey of a group of companies that are currently accelerating their preparations for CSRD adaptation is that leader-led decision-making with a long-term perspective will become increasingly important. Instead of conventional compliance-oriented management, value-creating management based on active collection, analysis, and consideration of sustainability information is expected through the adoption of CSRD reporting.

The following flowchart is a possible flowchart of the main responses that Japanese companies should take.

(*): All classes of securities (shares, bonds, etc.) transferable on the capital market. If only debt securities are to be issued, the par value per unit must be less than EUR 100,000. Otherwise, answer "NO" to this question.

(**): In this case, the sustainability report is prepared at the level of the non-EU parent company excluding its subsidiaries (i.e., on a stand-alone basis, not on a consolidated basis).

¹: 2 out of 3: average of at least 250 employees, net sales of at least EUR 40 million, balance sheet total of at least EUR 20 million

²: 2 out of 3 items: 10 < average number of employees ≤ 250, 700,000 EUR < sales ≤ 40 million EUR, 350,000 EUR < balance sheet total ≤ 20 million EUR

Figure 5: Flowchart of main actions companies should take (Author's translation of material from mazars)

(https://www.mazars.com/content/download/1151519/58967343/version//file/Mazars%20CSRD[%E2%80%A6]%20for%20non-EU%20groups%20and%20EU%20subsidiaries%202023.pdf )

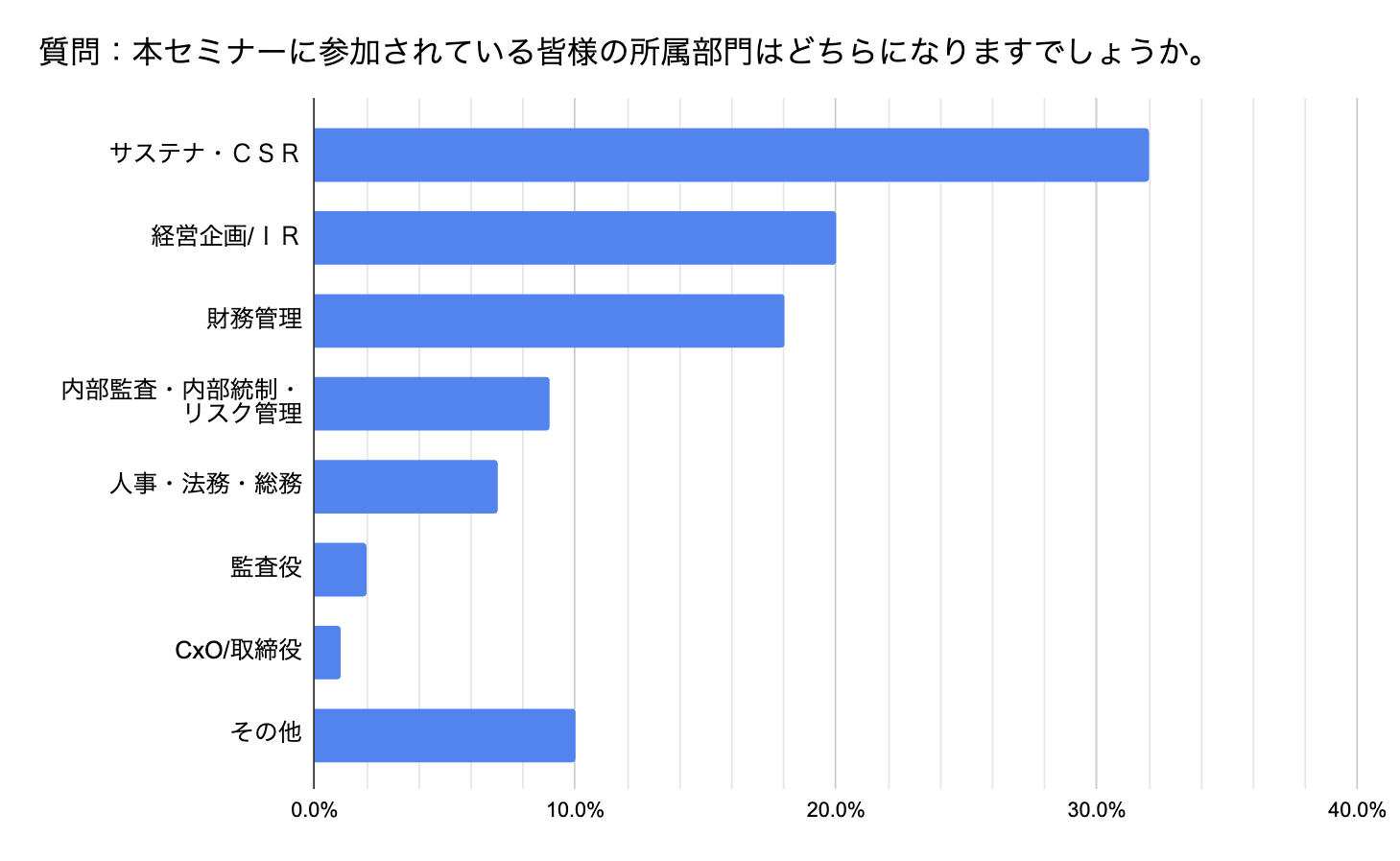

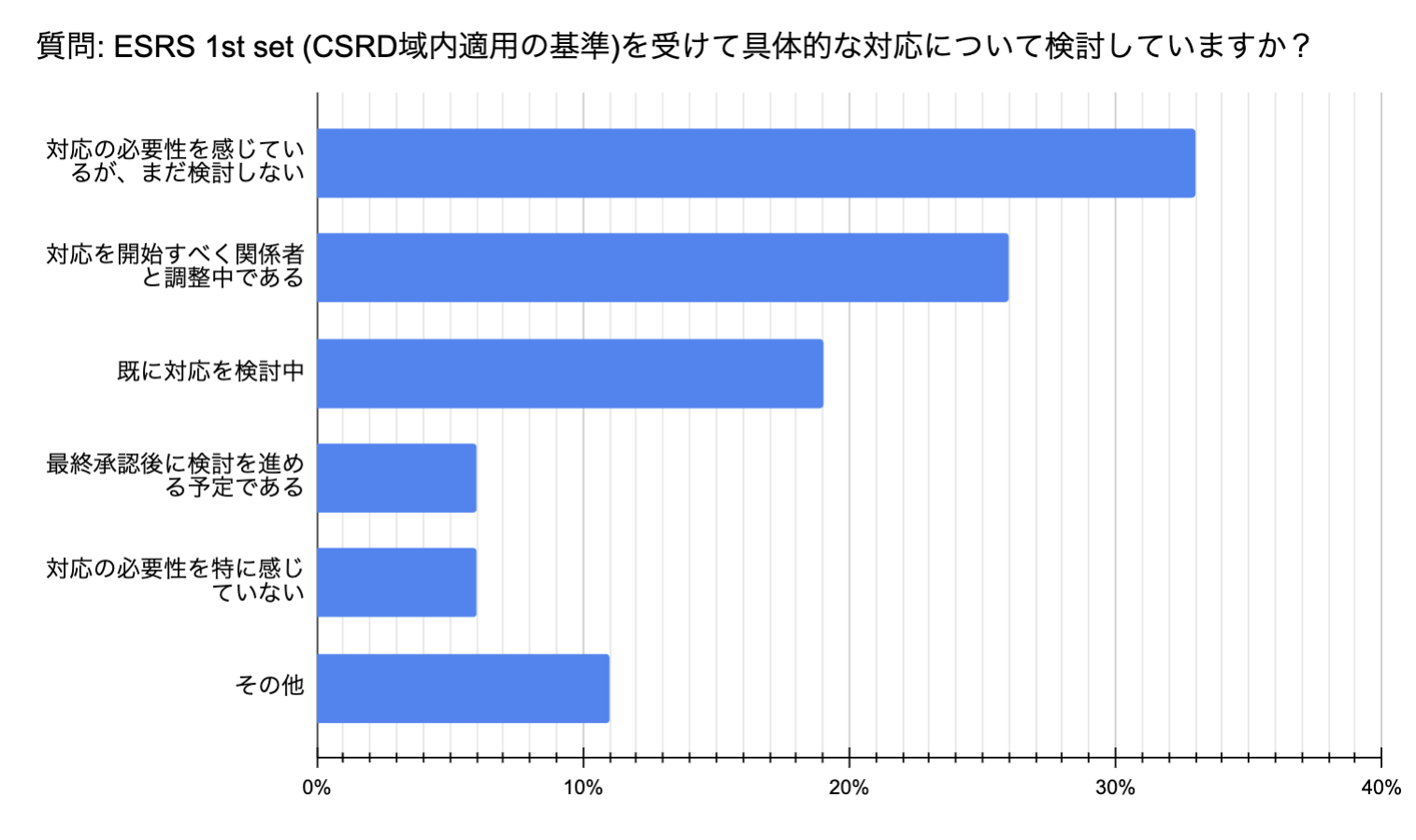

Deloitte Tohmatsu Co.Referring to the participant questionnaires for the CSRD/ESRS seminar (September 13, 2023) and the IFRS Sustainability Disclosure Standards seminar (November 9, 2023) conducted by the "Japan Sustainability Disclosure Standards Association," it is possible to see how Japanese companies are responding to current sustainability regulations (number of responses: 1116).

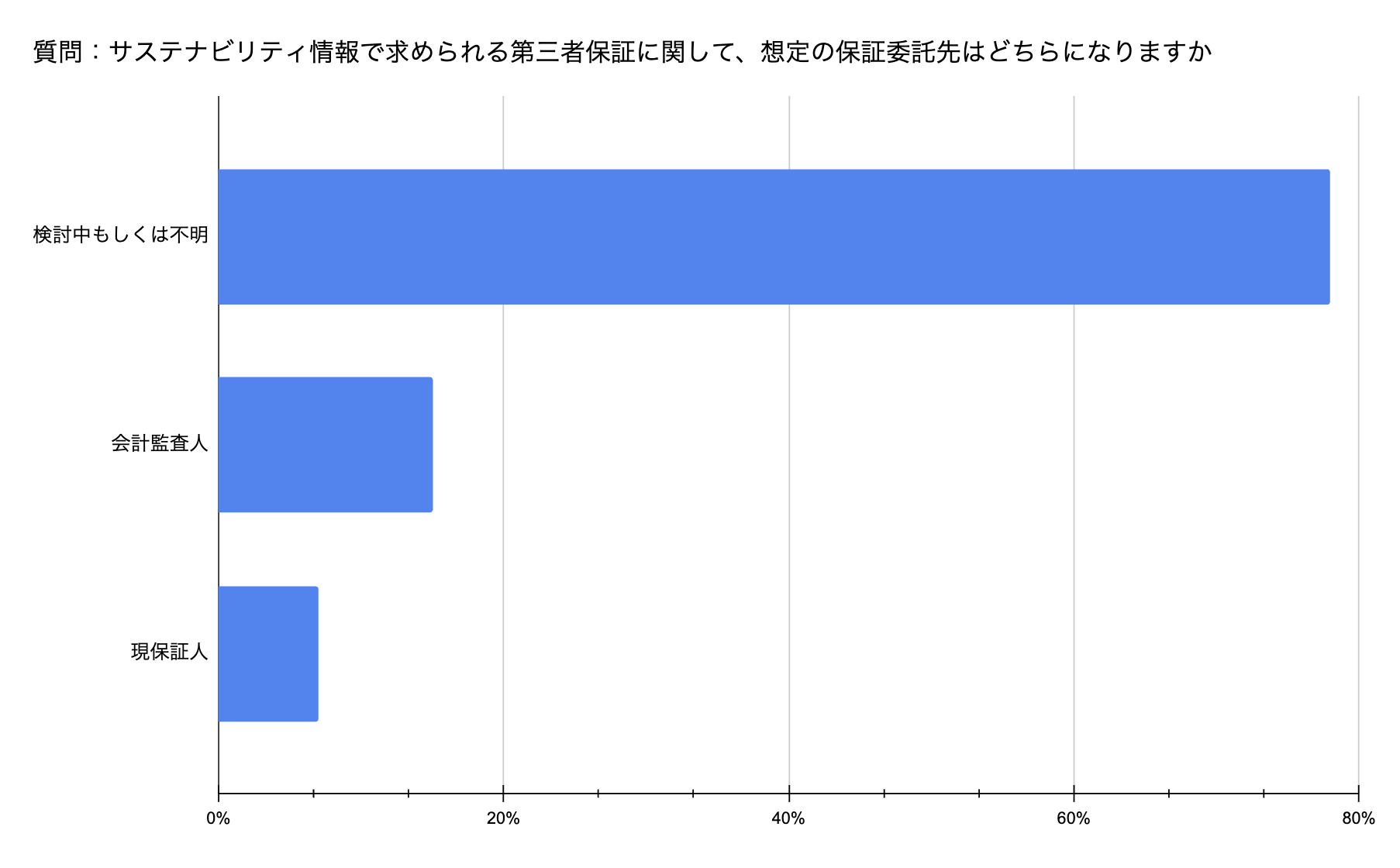

To begin with, we can confirm that most Japanese companies are led by the "Sustaina CSR Department," followed by the "Corporate Planning/IR" and "Financial Management" departments, which are responsible for coordinating sustainability reporting (Figure 6). In addition, the majority of respondents feel the need to conduct awareness surveys for CSRD compliance (Figure 7). It should be noted that nearly 80% of the participants were "considering or unsure" about the establishment of a third-party guarantor (Figure 8).

Figure 6: Sectors to which seminar participants belong (Prepared by the author with reference to Deloitte Tohmatsu survey)

Figure 7: Awareness of ESRS compliance (Prepared by the author with reference to Deloitte Tohmatsu survey)

Figure 8: Current Status of Third-Party Assurance for Sustainability Reporting (Prepared by the author with reference to Deloitte Tohmatsu survey)

PwC has identified the following actions for CSRD that companies should take

| Main Action | Details | Implementation Example |

| Recognition of progress and understanding of scope | Understand the scope of your company and move now to comply with CSRD and ESRS. Many companies have already been disclosing sustainability information for years based on regulatory mandates and voluntary standards. | Develop stakeholder engagement, materiality analysis, and data collection processes |

| Accelerate determination of CSRD requirements | Companies that have not completed requirements determination should accelerate this effort. This will allow them to fully understand the challenges and develop a concrete plan. | Interact with industry peers and partners to understand the importance of duplicity, etc. |

| Long-term data processes and systems | Investment is needed to manage sustainability information in a central system. Investment in data and systems equivalent to financial reporting is required. | System investments to ensure data accuracy, availability, and auditing systems |

| Top participation | A trio of CFO, CIO, and CSO will be given responsibility for CSRD implementation to promote cross-functional collaboration. | CFO provides information management, CIO provides data systems, CSO provides sustainability expertise |

Table 1: Actions to be taken by companies and examples (Author's translation based on PwC survey)

The key will be how to secure expert personnel to analyze corporate activities from a bird's eye view and to secure guarantees by third-party organizations.

Japanese companies are expected to start reporting as of 2028, but it will take a great deal of time and money to create the soil for data analysis within their own companies.

At that time, it is considered to be an option to outsource the analysis to a third party. In this case, as mentioned above, it is important to establish a cooperative system with a reliable analysis organization.

We are the first company in Japan to develop a sustainability analysis tool, and as such, we are able to offer a close examination of a company's activities from the supply chain/value chain up to the product manufacturing stage. If you have any questions about CSRD, please contact us.

Contact us:

https://aiesg.co.jp/contact/

*Related Article*.

CSRD: The EU Sustainability Reporting Standard Just Before It Enters into Force: The Impact on Japanese Companies

Commentary] Overview of ESRS (European Sustainability Reporting Standards)

Commentary] Alphabet Soup: The Disruptions and Convergence of Sustainability Standards