INDEX

In December 2024, a joint research paper was published by aiESG's Chief Researcher, Keeley Alexander Ryuta, and Representative Director Shunsuke Managi.

The paper is published in Corporate Social Responsibility and Environmental Management, an international journal that evaluates corporate social and environmental responsibility initiatives.

Paper Title:

"Does environmental materiality matter to corporate financial performance: evidence from 34 countries."

DOI (paper link): https://doi.org/10.1002/csr.3062

The following three points were identified through this study as being of particular importance to companies.

- Mere disclosure is not enoughand the substance of the environmental improvement activities (i.e., environmental performance) that a company actually undertakes is directly related to its evaluation by investors and the market.

- In companies with excellent environmental performance,Good trend in financial indicators such as ROA and Tobin's Qand indicates,Positive effect on financing costs, especially cost of equityis seen.

- Responses to industry-specific materiality issues remain uneven,Limited overall effect on financesThis highlights the difference in the quality of the response, as it is

1. Introduction

In recent years, with growing global concern about climate change and environmental issues, "environmental initiatives" have become an unavoidable and important management issue for companies. Against the backdrop of the realization of climate risks, resource constraints, and rising expectations from society, environmental and sustainability initiatives are no longer limited to CSR (Corporate Social Responsibility), but are becoming a strategy itself that influences a company's medium- to long-term growth.

In particular, as international rules such as the Paris Agreement, TCFD (Task Force on Climate-related Financial Disclosure), CSRD (European Corporate Sustainability Reporting Directive), ESRS (European Sustainability Reporting Standards), and IFRS (International Financial Reporting Standards) Sustainability Disclosure Standards (S1 and S2) are developed one after another As international rules such as CSRD (European Corporate Sustainability Reporting Directive), ESRS (European Sustainability Reporting Standards), and IFRS (International Financial Reporting Standards) Sustainability Disclosure Standards (S1 and S2) are being developed one after another, companies are now required to provide both "transparency of environmental information" and "effectiveness of initiatives.

In response to this trend, investors and consumers are becoming more and more demanding. The focus is now not simply on information disclosure, but on whether or not a company is actually delivering results.

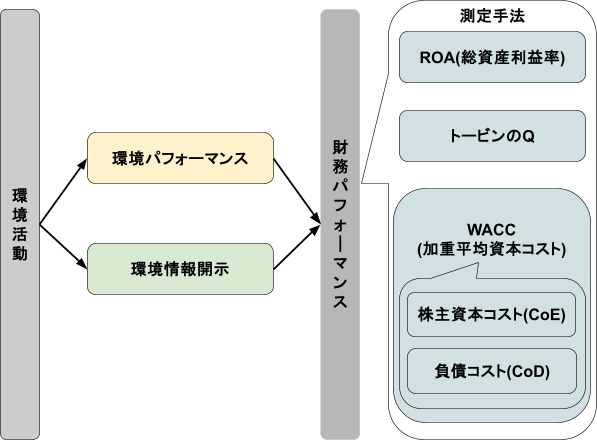

Therefore, in this article,"How do a company's environmental activities and its disclosure affect its financial performance?" The theme is "How do corporate environmental activities and disclosure affect financial performance?The latest research results dealing with

Is it important to get the information out?

Or is actual action more important?

By unraveling this question, we will deliver hints for companies to promote ESG management in an essential and strategic manner.

2. Detailed explanations of the research in an easy-to-understand manner

In order to properly understand this research, it is essential to first understand "how a company's environmental efforts are evaluated" and "how those efforts are measured financially. In this section, we will explain the main indicators and concepts used in the actual research analysis.

(1) What is the Environmental Score?

Environmental score is a numerical expression of how environmentally friendly a company is.It is.

In this study, the authors found that the "Content of Actual Efforts (Environmental Performance)" and "How much of its efforts are disclosed (environmental information disclosure)The evaluation is based on a clear distinction between the two. The two are not similar. Even if information is disclosed in detail, if the activity is not accompanied by substance, it will not be evaluated.

Another important perspective is that "MaterialityThis is the concept of "the This is,Assumption that different industries have different environmental themes that require special attention.We are standing on the For example, each industry has its own environmental challenges, such as CO₂ reduction in the manufacturing industry and waste and resource efficiency in the retail industry.

The study also includes in its evaluation how well companies are addressing key industry-specific themes, based on industry-specific criteria established by the Sustainability Accounting Standards Board (SASB).

(2) What are financial performance indicators?

The study assessed the impact of environmental activities on a company's financial performance using three key indicators.

- ROA (Return on Assets)The indicator shows how efficiently a company uses the assets it owns to generate profit.If this number ishighThe more efficient the use of assets and theExcellent corporate management.Indicates that

- Tobin's Q (Tobin's Q)Market Value: The market value of a company divided by the book value of its assets, which indicates the market's expectation of future growth potential.Tobin's Q is.highThe more a company is valued by the market, the more it is valued by the market,High expectations for future growthis considered to be a

- Cost of capital (WACC, cost of equity, cost of debt): It is the cost that a company incurs when it raises funds.

- Cost of Equity (CoE): The cost of guaranteeing the return that shareholders expect from a company (dividends and stock price appreciation).

- Cost of Debt (CoD): Interest cost on bank loans, corporate bonds, etc.

The weighted average of these two costs is calledWACC (Weighted Average Cost of Capital)It is a ". It is an indicator that measures how favorable the financing conditions are for the company as a whole. In general,The lower these numbers are, the more favorable the conditions under which a company can raise funds.This will be the case.

After capturing the key indicators in the study, the actual methodology will be explained.

3. Research Methods

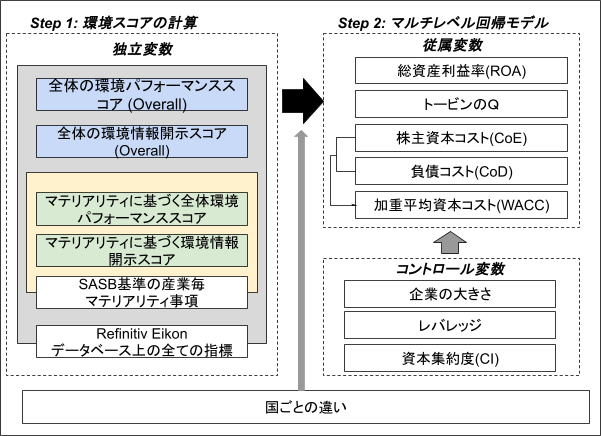

This study is designed to examine how a company's environmental response affects its financial performance,Spanning the eight-year period from 2015 to 2022Data were included in the analysis. Target companies are,8,547 companies in 34 countries (excluding the financial industry)The number of employees in this category is about 1,000.

Data is a global financial information platform that covers a wide range of corporate financial information and ESG (Environmental, Social and Governance) metricsRefinitiv Eikon".The data is obtained from

As mentioned earlier, environmental initiatives are evaluated from two perspectives

- Environmental Performance ScoreHow many environmentally friendly actions the company is actually taking (e.g., CO₂ reductions, etc.)

- Environmental Information Disclosure Score: How clearly the company discloses its efforts to the outside world.

Furthermore, based on the SASB (Sustainability Accounting Standards Board) industry-specific standards,Status of response to materiality (environmental issues of particular importance in each industry)is also taken into account.

In addition, this study was designed to provide an analysis of the environmental score by using the "Overall Scoreand "Materiality-based ScoreWe use two different types of

- Overall Scoreof ESG assessments provided by Refinitiv, Inc,Comprehensive combined score of all environmental indicatorsand reflects the company's assessment of all environmental areas in which it is involved.

- On the other hand,Scores based on materialityagainst the materiality map for each industry sector established by the SASB,Extract only relevant environmental indicators and recalculate their scoresThe following is an example.

- In other words, based on the assumption of what is important for each industry (e.g., CO₂ emissions in manufacturing, waste management in retail, etc.),How well is the company responding to the items that really need to be focused on?The score that evaluates theMateriality-based scoreThe first two are the following.

In analyzing,Company-specific characteristics(e.g., size, capital structure, etc.) and,Economic and institutional differences among countriescan reflect both the "multilevel regression modelWe used a statistical method called

The following three measures of financial performance are used

- ROA (Return on Assets)Profitability of the company

- Tobin's QMarket valuation (expectations for the future)

- Cost of capital (WACC)Cost of financing

Through these efforts, we examine "how much impact our environmental initiatives actually have on corporate value and management" from various perspectives.

4. Research results

In this study, we analyzed data from 8,547 companies in 34 countries around the world, taking into account a variety of industry and market environments. As a result, several important points were identified regarding the impact of environmental initiatives on corporate financial performance.

(1) Relationship between "Environmental Performance" and "Financial Performance

First,Companies that are actually active in environmental improvements tend to have better financial indicatorsThe results are found in the following table.

Specifically, a one point increase in the overall environmental performance score results in a 1.467 point increase in ROA (return on assets) and a 0.987 point increase in Tobin's Q (market valuation index). Furthermore, Tobin's Q showed a continuing positive effect of 1.295 points in the following year, indicating that the market views environmental responsiveness not only as a short-term performance measure, but also as a factor that enhances corporate value in the future.

Also,Specializing in key issues (materiality) for each industryalso showed a certain level of effectiveness, with an increase of 0.218 points in Tobin's Q, butIts impact is somewhat modest compared to the overall environmental scoreIt was.

(2) Relationship between "information disclosure" and "financial performance

On the other hand,Environmental "disclosure" alone has limited effect on financial performanceIt also became clear that

For example, a one point increase in disclosure score resulted in a 0.649 point increase in Tobin's Q, but only a 1.078 point increase with respect to ROA, which was somewhat less statistically reliable. The impact on financial indicators in the following year was also not clear and did not have a lasting effect (-0.263 points).

Furthermore, no significant relationship between ROA and Q has been identified for materiality-based disclosure scores. This indicates that the market places more importance on how much environmental value a company actually creates (ability to execute) than on mere "showmanship.

(iii) Impact of environmental activities on financing costs

Companies with higher environmental performance have a cost advantage when raising capital.It was shown that

In particular, there was a strong relationship between the cost of equity (CoE), which decreased by 1.341 points with a 1-point increase in the environmental score. In addition, the overall cost of capital (WACC) and cost of debt (CoD) also tended to decrease by 0.962 and 0.351 points, respectively.

From these results,Corporate environmental activities are positively evaluated by investors and the market as a risk mitigation factorand may be able to raise funds on more favorable terms.

(iv) Strength of materiality impact

In an analysis based on materiality (key issues for each industry) based on SASB's industry-specific criteria, compared to overall environmental performance,Relatively small financial impactWe found out that

This may be due to differences in the depth and maturity of efforts to address industry issues among companies. At present, it seems that a company's environmental responsiveness as a whole is more likely to be evaluated highly in the market than its individual materiality.

(5) Supplemental analysis with robustness check

Robustness checks (robustness tests) were also performed to verify the reliability of the results.

Specifically, we measured how high (i.e., relative positioning) each company's environmental score was compared to the "industry and year-by-year average" and analyzed it again. The results,The better a company's environmental performance compared to its peers, the higher its Tobin's Q for the following year.The trend was clear.

In other words, "environmental differentiation" within an industry may be the source of a company's mid- to long-term market reputation and competitiveness.

5. Discussion: Key points indicated by the study results

This study examined the relationship between a company's environmental initiatives and its financial performance from multiple perspectives, and the following four points were derived as implications for practice.

(i) Substantial environmental activities are important.

The study shows that financial performance (ROA and Tobin's Q) improves both in the short and long term when companies promote substantial and effective environmental activities. In particular, there is a significant impact on Tobin's Q, which represents the market value of a company, indicating that the market values environmental activities as a factor that creates long-term value. Therefore,Companies need to promote environmental activities from a long-term perspective as the core of their business strategy, rather than merely pursuing short-term profits.

(2) Limitations and risks of mere information disclosure

Disclosure is essential, but it is not the goal of a company. In the results of this study,Limited impact on financial performance compared to actual environmental improvement activities (performance) in the case of information disclosure onlyIt was.

In addition, relying solely on information disclosure risks being perceived by the market and investors as "greenwashing" without substantive initiatives, which in turn may lower the company's reputation.Companies need to communicate the results of their actual environmental activities concretely and transparently to the market in order to gain a true reputation.There are

(iii) Impact of materiality on different countries

Materiality's impact on financial performance is small compared to overall environmental activitiesThe results of the survey showed that One reason for this may be that many companies are still not adequately addressing industry-specific issues. Since the magnitude of the impact of materiality varies by country and market environment, companies are required to clearly understand the environmental issues specific to their industry and business region, and to implement specific and effective measures to address them.

4) Impact of environmental activities on financing costs

Improved environmental performance also lowers a company's financing costs andYes. In particular, the decrease in the cost of equity (CoE) is evident, indicating that the market perceives companies with more environmental activities as less risky. Actively integrating environmental activities into financial strategies will be an important factor in increasing competitive advantage in the capital markets and supporting sustainable growth.

The above discussion shows that a company's strategic promotion of environmental activities, accompanied by financial benefits, can contribute significantly to strengthening its long-term sustainability.

6. Limitations and future challenges

A major feature of this study is that it comprehensively captures the relationship between a company's environmental activities and financial performance from an international comparative perspective by conducting an analysis based on large-scale data from 8,547 companies in 34 countries around the world.

On the other hand, because of its sizeFailure to fully reflect the characteristics of individual companies and regionsThis also leaves us with the challenge of

For example, the level of systems, market maturity, and environmental regulations varies greatly from country to country, so careful judgment is required when applying overall trends directly to one's own company. In the future, as more detailed analysis focusing on specific industries and regions progresses, we expect to accumulate more concrete knowledge that can be applied in practice.

Also, in order for companies to achieve financial results,Establish KPIs (Key Performance Indicators) that are appropriate for the company's industry and growth phase, and work on continuous improvement and visualization of these KPIs.is important. An environmental strategy based not only on short-term measures but also on a long-term perspective will lead to a sustainable competitive advantage.

Conclusion (Summary and Outlook)

The most important points revealed by this study are,The question is, "Will the company's environmental activities actually act and produce results?"That is to say.

While companies that engage in substantial environmental improvements show a positive impact in financial indicators such as ROA and Tobin's Q,Disclosure of information alone has only a limited effect.It has also been shown. In other words, we live in an era in which investors and the market evaluate what we have done and what results we have achieved, rather than superficial PR.

The survey also highlighted the lack of understanding of and response to materiality (critical issues) in each industry. In the future, according to the characteristics of the company's business structure and the industry to which it belongs,Clarify which issues you are serious about facing, and take strategic actions accordingly.is required.

Japanese companies, in particular, need to shift their perspective from "environment = cost" to "environment = investment that drives up corporate value. Continuous efforts and transparent communication of results will be the pillars for earning trust in the global market and supporting long-term growth.

aiESG utilizes the findings of this research to provide concrete and practical support to help companies achieve sustainable enhancement of corporate value through environmental activities. We hope you will take advantage of our services.

About aIESG's services:https://aiesg.co.jp/service/

[Related Article.

- The Latest Trends in ESG as Deciphered by AI: An Introduction to the Latest Research https://aiesg.co.jp/topics/report/250321-esg-tendencies-from-news-investigated/

- Clarifying the Relationship between Corporate Climate Change Measures and Cost of Capital: Data Analysis of 2,100 Japanese Firms Reveals a Relationship.

https://aiesg.co.jp/topics/report/240627_report-climate-change-capital/ - The Relationship between Environmental Valuation and Stock Price Returns Investors consider companies that do not engage in environmental management to be a significant risk.

https://aiesg.co.jp/topics/report/230712_escore_investor/ - [Paper description] The Impact of Climate Change on Conflict: A Systematic Review of the Vulnerability Conditions of Societies.https://aiesg.co.jp/topics/report/report_climatechange_conflict/

- What is the SASB Standard for ESG Information Disclosure? (Part 1)Outline of SASBhttps://aiesg.co.jp/topics/report/2301025_sasb1/

- What is the SASB Standard for ESG Disclosure? (Part 2) Benefits for Companieshttps://aiesg.co.jp/topics/report/2301115_sasb2/

- Commentary] Current Status of SASB Standards and Adopted Japanese Companieshttps://aiesg.co.jp/topics/report/240405_sasbstandard/

- Explanation] What is "materiality" in sustainability reporting?https://aiesg.co.jp/topics/report/240201_materiality/