INDEX

Profiles of each dialogue participant are provided in the first part of this report.(Go to the first part)

How Quantitative Disclosure Benefits Corporate Value - Analysis Shows Impact

We have discussed the reasons why quantitative disclosure is required and the difficulties faced by companies in the field. Now, we would like to discuss what impact quantitative disclosure has actually had on the companies that have implemented quantitative disclosure. Could you briefly discuss the results of your analysis, Mr. Managi?

Managi

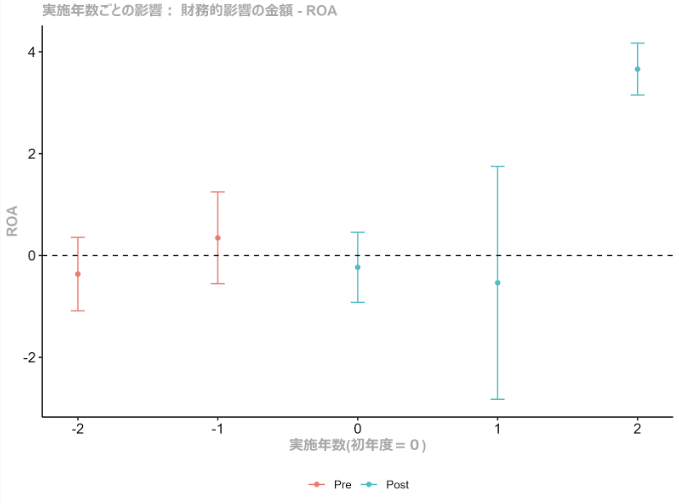

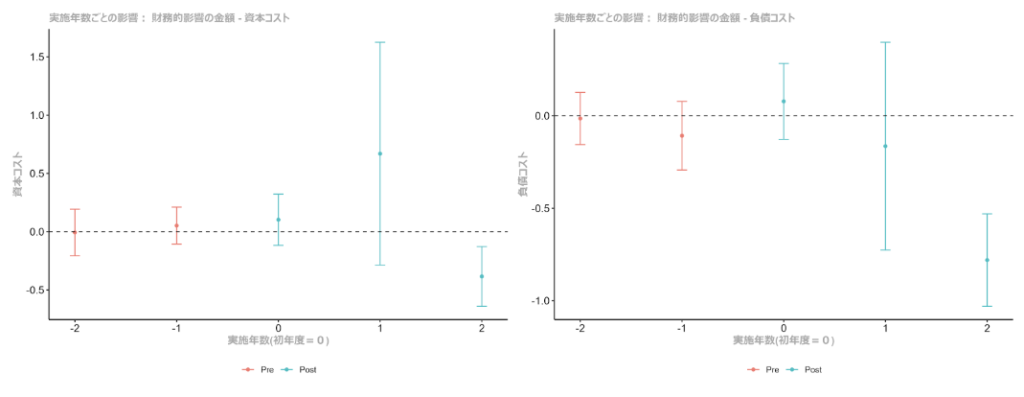

In this analysis, we statistically examined how quantitative disclosure affects corporate value for companies that are following the TCFD guidelines for disclosure. Specifically, we used data from 2020 to 2023 to look at the relationship with financial indicators such as return on assets (ROA) and cost of capital. We used a multi-period Difference-in-Differences (DiD) for our analysis. Rather than looking at a single year, we look at how the impact of the disclosure appears several years after the start of the disclosure.

Analysis Shows Effect of Quantitative Disclosure "Works in Year 3"

─ ─ What were the results of the analysis?

Managi

We observed a significant increase in ROA in the third year after disclosure for firms that had implemented quantitative disclosure.

In addition, statistically meaningful reductions were seen in the cost of capital and cost of debt.

Lower cost of debt is expected to result from banks and institutional investors estimating lower financing risks for companies that take appropriate measures to address climate-related risks. Lower cost of capital will be viewed favorably in the stock market as long-term investors, such as ESG investors, will be more willing to invest.

In general, we saw that it is better to have a good quantitative disclosure because it has a good impact in the third year. The best result was that we were able to say by the numbers that making it a quantitative value was a situation where the company was getting a decent return on its investment.

We also have results for each of the quantitative evaluation statuses of Scope III disclosure, physical risk, and transition risk. I think it is significant that we were able to show in the figures that for companies that are taking steps to address physical risk, the return on their investment in financial conversion is significant. If a company is not working on physical risk, I would like them to go all the way to financial conversion, including transition risk, at the same time. Otherwise, even if they manage to do their best to produce physical risk, they will not feel the value and the spread will be narrow.

large field

I think the period of analysis was a very good period, because from 2020 to 2023, we had the Corona disaster and the Russian invasion of Ukraine, and the companies with the highest GHG emissions are those that are relatively active in disclosing their GHG Scope 3 emissions. Fossil fuel prices were very volatile during this period due to these circumstances, and these companies experienced a great deal of profit volatility due to these fuel price fluctuations. In our short-term analysis, we believe that the low ROA is due to the fact that the companies were affected by the fuel price volatility. Some might argue that the lower ROA due to the impact of fossil fuel prices has nothing to do with whether or not GHG emissions are disclosed, but I do not believe this to be the case. This is because climate change measures are now inevitably restraining investment in fossil fuels. So the supply and demand for fossil fuels is fragile. The fact that companies that disclose GHG emissions are somewhat lower in the short term is due to the fact that they are more susceptible to the effects of such a highly vulnerable external environment. This is why I think ROA can be lower in the short term.

long village

I believe that this kind of finding is very innovative and very useful information. If possible, when this summary is completed, I would like to share it with TCFD officials if I can translate it, even partially, into English. I am sure everyone will be pleased.

large field

We have recently heard some say that the burden is increasing with respect to non-financial disclosures, and I think this type of analysis would be more encouraging. From that perspective, I think this is a welcome analysis.

long village

It is good to see this kind of powerful information coming out, especially since the world is now at the beginning of Trump 2.0, and climate change measures are facing an uphill battle. I hope that this will have the effect of appealing to those who are in the mood to give up on climate change. I believe that the Trump 2.0 shakeup will provide an opportunity for corporate executives to seriously consider what is right and how their companies should respond to it. It would be very good if disclosure could play an important role in this process.

Disclosure lowers risk.

─ ─ The results also show that the cost of capital and cost of debt are also reduced for companies that are engaged in quantitative disclosure. What do you see in these results?

large field

Basically, I think what is written in this interpretation is reasonable in general terms. I can see a certain relationship between my sense and valuations and GHG emissions; there is a concern that the risk will be perceived as higher for places with higher GHG emissions. Nevertheless, I believe that proactive disclosure, especially of Scope 3 value chain risks, will lead to lower risk for that company. It is not an odd result that the cost of capital will go down as a result, or the cost of debt as well.

large field

Also, the boundary (organizational boundary) varies considerably from company to company in the case of Scope 3, so the scope of the value chain can vary by a factor of 10 for the same type of business. Some companies disclose their CO2 emissions in the hundreds of millions of CO2e, while others disclose their CO2 emissions in the millions of CO2e. Here, we respect each company's ideas.

From this perspective, I think it is also important to disclose what is the value chain and how GHG emissions are measured within it, depending on the style of each company. Once a disclosure policy is set, I think it is important to show the results of reductions.

Managi

Certainly, if you underestimate the amount of disclosure because you are not sure, you are potentially at risk even if the amount appears small at first, and it will look bad if you change your policy in the future to take a broader view because other companies in the same industry are doing well. In addition, in the future, with various information technologies, the degree to which disclosures reflect the actual situation will also be evaluated.

large field

The hard part is that we are going to be required to guarantee non-financial information. At that time, it will be quite difficult to assure everything about the value chain. Currently, since assurance is not yet required, it does not matter how large the disclosure is. However, when it comes to guarantees, a variety of responses are required. Therefore, I believe that a balance will likely be necessary in the future.

Managi

Will the demand for guarantees increase in the future?

large field

Yes, I understand that the TCFD is not required to be in Scope 3. I understand that assurance is not required to go into the details of the TCFD or to Scope 3. However, I think it is going to be difficult to disclose Scope 3 by expanding the value chain, etc.

long village

For example, we have a presence in Europe and CSRD*1If a company is required to respond, the guarantee requirements are more stringent over there, so if one company starts taking out guarantees, it may end up being pulled in that direction because it will look inferior to its peers, regardless of whether it has a European presence or not.

Managi

I think the tools will be simplified. The earlier they are, the more likely they are to be noticeable, but later they will be less noticeable and therefore less expensive, so it is a matter of how much risk we are willing to take.

*1Corporate Sustainability Reporting Directive: Sustainability disclosure rules for companies in the EU introduced by the European Union

Risk-averse disclosure strategy "get it out first."

long village

I also think that depending on the industry, which category in Scope 3 is important.

From an investor's point of view, do you give any advice or anything if this category should obviously be important in this industry, but it is not disclosed?

large field

That's true. For example, a company that sells coal or has a mine would obviously be a big Scope 3 category 10 or 11, right? Some companies are still very limited in their disclosure there, because their investments are still equity method or general investments. That is one way to think about it, but there is a very simple emission coefficient for the relationship between coal production and CO2, which can be estimated externally. I believe that it is better for companies to disclose the information themselves to limit the risk than to let this external estimate walk all by itself.

Managi

Yes, that's right.

It's better to be the first to say what you are emitting than to be forced to say more than you are actually emitting because the values disclosed by other companies are used as a standard. I don't want to be called a greenwasher.

long village

Without sufficient disclosure, there is a risk of being evaluated by an evaluation organization or data provider, who may apply a figure based on what they consider to be a reasonable estimate. In order to eliminate such risks, I think it is becoming more and more important for companies to take responsibility for calculating and disclosing their own figures.

large field

You are right.

long village

I thought it would be good to be known as one of the significance of proper disclosure.

The Importance of "Communicative Disclosure

large field

Especially in the secondary stock market, it is important how to deliver information to investors on the other side of the world. It is difficult to convey information if the stance is, "Ask us and we will tell you. It is necessary to communicate information in the form of securities reports and integrated reports, and if possible, in English. I think we need to promote our data in a way that catches the attention of such data providers.

Managi

We have created a system to evaluate integrated reports, and we are sending them out with the Asian Development Bank while also sending out reports at the ASEAN Summit and other meetings, but if we create a system that allows evaluation in 130 different languages, there will be a slight difference between Japanese companies sending out reports in Japanese, English, and other languages such as Philippine, Indonesia, Korea, China, etc. If we create a system that allows evaluation in 130 languages, there will be a slight difference between Japanese companies submitting reports in Japanese, English, and other languages such as Philippine, Indonesia, Korea, and China. Sustainability discussions based on global standards and domestic sustainability are different, aren't they? There is a difference in the axis between a society that says it is good to recycle biomass power generation and waste, and a society that says it is not good to use waste in the first place. The local axis may be correct, but it would be seen as a bad thing by global standards. This argument is easily echoed in the ASEAN countries, and there is a connection to how to bring about appropriate disclosures.

large field

I would like to emphasize the fact that the cost of capital will actually be affected by continuous disclosure for two or three years. Even if the response to disclosure in the first year is not strong, I think it is important to continue to work on it.

Managi

You never know if society will react at the right time as a result of your hard work in the first year.

The fact that this continuity is attracting attention is not quantifiable and not always visible, is it? It would be nice if this kind of compilation could attract people's interest.

Prospects and Expansion beyond Quantitative Disclosure

─ ─ As the last session, I would like to ask you about the future direction of ESG disclosure and the attitude required of companies. In particular, what changes will be required as the scope of information disclosure expands to include themes other than climate change, such as biodiversity and human rights?

Managi

First of all, in this series of quantitative analysis, there is a discussion of uncertainty. If it is a measurement difficulty, or if the data is for a different period ahead of time, the results may change a bit again. In that sense, when we say that ROE will be worth plus X% in 3 years, we do not want to let the X number walk alone. What is important is that the quantification is positive over the long term.

When the world's major trends change, such as strong inflation or uncertainty about the future of oil and energy prices, not only the energy industry but also all industries will be affected. So all industries are affected. It is difficult to measure individual items, but I think we have cleared up this time that we were able to capture the overall trend. Whether or not this can be said to include all other countries in the first place is something that still needs to be done in the future. Even assuming that we do not know what will happen in the next society, I hope that we can send out something big like this.

long village

The fact that we were able to disseminate this kind of information is due to the large number of data disclosed, and I think it was possible because we are in Japan, where all the data is available.

Managi

Yes, we couldn't have done it three years ago.

large field

It is very gratifying to see that such quantitative analysis is well done, that certain conclusions have been reached, and that these conclusions are supportive of non-financial information disclosure. I believe that non-financial information was disclosed only after quantitative disclosure progressed. In the early days of disclosure, as I mentioned earlier, the information sometimes stopped at sentences or arrow directions, and it was difficult for the information to stick. However, as quantitative disclosure began to emerge, I believe the information began to stick. It may seem burdensome for some companies, but I would like to ask you to continue to do as much as possible here.

long village

Back in 2017, when the TCFD proposal had just been released, it was difficult to ask for quantitative disclosure out of the blue, as the general public was not familiar with the TCFD framework itself, so I said, "It's okay to start with qualitative information, and even qualitative information is meaningful, so please provide it. I remember that we were very modest about it. I am very happy that we are now able to say the value of putting it out quantitatively quite openly here.

large field

However, it is also said that there is disclosure fatigue. I try to disclose as much non-financial information as possible when I analyze it internally and discuss with companies based on that information. In that sense, I believe that the effect of lowering the cost of capital is a very significant result of this analysis.

long village

I think disclosure fatigue may also come up when people have the impression that the information they have worked so hard to produce is just cutting through the air, as if it is not actually being used.

On the other hand, if they realize that they have been heard and evaluated by the people who evaluate them, and that by persistently submitting their work, it may someday lead to results, it will be a boost to their motivation.

Managi

It is similar to technology development in that it is a cost but a plus if successful. Not all disclosure efforts will be positive, but if it were technological development, the probability would probably be quite low and you would not hit 1 out of 10. I think the trend of disclosure is correct, and I was able to show that on average it is positive, so in that sense it is like development that is relatively easy to do.

From "Appealing" to "Reachable" Disclosure

large field

This may be a bit detailed, but I feel that companies are making an effort to change their integrated reports every year, especially if they change their disclosures. To some extent, SSBJ*2I would like to request that the quantitative information be presented in a table as a standardized information. I think it is time to graduate from the practice of using charts and graphs to visually appeal and explain every time. I feel that this is what it means for non-financial information to become the norm.

Managi

So it is different from commercial advertising.

large field

Isn't accounting information just a table? I'm thinking that gradually moving closer to the financial section of financial statements and annual reports would be the maturation of non-financial information, wouldn't it? That is really the difficult part, though.

Managi

I would hate to take the initiative to do that and then be told that the report is tasteless.

large field

This report may be a bit tasteless, but I think we are now at the stage where we need to think about how to promote what we are doing and how to deliver information through the various information exchanges that we have with you at these meetings. While there is a legal framework for timely disclosure of accounting information, there is no such framework for non-financial information, so I think we need to think about how to deliver the information and how to make it stick once we have created it.

Managi

In this sense, the more data that is accumulated, the more AI can be used to make evaluations. If this kind of data can be accumulated, and it becomes possible to say, "Actually, this information is all we need," it will be easier to do and evaluate in the future, which will be good in many ways.

large field

On the other hand, as an investor, it is important to interpret and analyze the data responsibly now that you have that much data in place. Until now, I think there have been situations where we could not analyze the data because we did not have the information, but we have progressed to the point where we need to interpret the data more responsibly. Besides, in the process, for example, it may come out that this information may possibly be unnecessary, so we don't have to disclose it the next time. If that leads to a reduction in the burden on companies, I think it would be an even better cycle.

Managi

Do you think that the difficulty in using the numbers from the investor's point of view could be improved by proper communication with the rule makers as mentioned earlier?

long village

Where there has been little interaction in the past, I think it is fair to say that it is on the way to improving, as the process of developing climate-related disclosures is creating interaction between the creator and the reader.

Managi

We still don't know if we don't need this information, etc., do we?

large field

I don't think we know yet, and to take it to the extreme, the information needed is different in the accounting world, or even in stock investment analysis, because different people have different styles. For example, an integrated report or annual report is around 100 pages, whereas an ESG data book can be over 200 pages. I think that disclosure of information may be burdensome for some companies, so if we could say, "This is the maximum amount of information you need to disclose," I think that would be a step in the right direction.

long village

Yes, I agree. It would be nice if that is shared among investors.

ISSB internationally as an operating company*3can be made, and SSBJ in Japan*2Although the Sustainability Reporting Standards Board (SRSB) has been established, there are still many existing sustainability disclosure frameworks, and it takes a lot of effort to submit responses to CDP and other ESG evaluation organizations. As a result, the information is incorporated into the sustainability report, and as a result, the report may become thicker and thicker. In the long run, the establishment of the ISSB should lead to the consolidation of such practices as well.

I guess we are in a transitional period in that sense.

large field

In the case of IR in the so-called financial world, it is fair disclosure. In IR, when investors, users, or environmental activists ask for information, it is possible to refuse from the standpoint of fair disclosure. In non-financials, however, if you do not respond to various requests, you may be said to be not fulfilling your responsibilities. As one of the users, I would like to improve this situation. If possible, I think it would be good if the SSBJ and ISSB could create a climate in which companies can conversely say that they cannot provide information because it is outside the scope of fair disclosure, thereby lightening their burden a little.

Managi

There was a study conducted on each individual stakeholder to see to what extent increasing the amount of information on climate change would increase the environmental value that they would be willing to pay. We found that if the textual information is done properly, the value goes up well, and in the case of images, the value also goes up, but video does not increase the value in some cases. However, we found that in some cases, video does not increase the value of a product. There is probably a peak point about the amount of information, so if we can get a little better understanding of this for each industry, perhaps we can come up with a guideline that is easy to understand.

large field

Since this is a transitional period, it is difficult for us to say how far we are willing to go. However, we believe that once such practices are gradually accumulated and exchanges between users, producers, and guarantors are promoted, things will settle down to where they should be.

*2Sustainability Standards Committee. Established to enhance sustainability disclosure by Japanese companies in response to the development of international sustainability disclosure standards.

*3 International Sustainability Standards Council. An organization established to disclose corporate ESG information on an internationally uniform basis.

carbon intensity*4Even if the "risk awareness" is low, "risk awareness" is required.

Managi

I think you mentioned that energy-related industries are doing well, and in that sense, industries with low carbon intensity are probably the last group to be engaged. Based on these results, should we talk to these groups, even though they are a little far away from us, or should we approach them in order of intensity?

long village

Companies with high carbon intensity are in an environment that is watched by so many different parties. Since they are under constant pressure from government agencies, investors, and other parties, they seem to be that much more sensitive to the environment. In contrast, companies with low intensity tend to be more lax in their responses because there is no external pressure. On the other hand, I wonder how much sense it would make to force companies that are far away from their materiality to disclose something about climate change itself.

However, rather than avoiding it outright, it is necessary to at least consider what climate change means for your company and disclose the results.

large field

For IT companies that have been known to have low carbon intensity, if they are going to build a data center, they will be using a lot of power, so they may need to figure out what they are going to do with that power and where it falls in the Scope 3 value chain. If the company decides that such disclosure is not necessary, it should just explain that. On the other hand, it will be perceived as increasing the company's Scope 3 GHG emissions, so it would be better to be very clear about this. Therefore, I think it is necessary to check the value chain once even if the company perceives that the intensity is low.

Managi

Whether you are a BtoC company or an IT company, if you follow the supply chain, you are dealing with something big. I believe that how you perceive your company's risks in light of this can at least tell a big story, no matter what the responsibility for the risks may be. It's a big thing to understand and express your own risk perception at the top management level.

*4Carbon Intensity, also known as carbon intensity or carbon intensity. An indicator of the amount of CO2 emitted per unit of activity or production.

Biodiversity is also "Measured" in the Age of Biodiversity

Managi

What are your thoughts on biodiversity?

Since TCFD is related to energy, it is a matter of course for many Japanese companies. However, many of the guideline nature positives are ambiguous, and it is easy for companies to decide that they are not relevant to their mainstream business. This is probably true, but the argument that nature is indirectly related to the supply chain, not as close as CO2, is probably true for most companies.

large field

Yes, it is.

Managi

In that context, I think it will be toned down for a while, but I think it will come back soon in the supply chain discussion sooner or later, whether different social projects, which can be human rights as well as ecosystem services, will also be grasped in contrast to carbon. I think it will always be mentioned in parallel in these discussions of financial accounting and so on. But the reality is that the focus is more on those who say that CO2 Scope 3 should not be included, and even if Nature's or the Human Rights Bill's guidelines can be established, the reality is that the guidelines will be to such an extent that it will not be necessary to do so. Do you think that will eventually become this kind of trend?

Or do you think it is better to do it while specializing in climate change since it is still far away?

long village

In our case, we are also working on TNFD and feel the need to consider how to disclose with TCFD in an integrated manner in the future. I think the future of the ISSB is important, and I think it will be greatly affected by how the ISSB incorporates natural and human capital other than climate change. Since this is a major trend, we are currently in the process of establishing a corporate posture required for disclosure by making proactive efforts to disclose information on climate change. Once this posture is established, I think we will evolve in a way that covers themes such as nature, human capital, human rights, etc. on top of it.

In terms of the relationship between climate change and nature, climate change adaptation measures and biodiversity are closely intertwined, and in addition, I see issues related to human rights as highly relevant. I have a feeling that society's interest will shift from a focus on climate change alone to a trend that calls for a netted perspective on nature and human rights as well. I would like to keep a close eye on how society perceives and incorporates these expectations in the process of the ISSB's future sequel to the standard.

I understand that TNFD is still in the development stage of such representative KPIs. Since the theme of nature is so broad, I think it is a difficult issue to determine how to define KPIs.

Managi

Ultimately, I think we are talking about the same economic value.

For example, it would make a big difference if there were a system to check, using satellite imagery, whether the company's direct suppliers or companies at the end of the supply chain are maintaining the ecosystem by ensuring that they are managing the land properly. Without such a system, the problems of the past year will not be solved. Without such a system, we will be back to the discussion we have had in the past year, where the reliability of carbon credits is measured by satellite imagery, and the result is that the forests are not being managed properly, or that CO2 emissions have been reduced but human rights issues are still being raised. I wonder if the connection between satellite imagery and finance will work well together.

In such a society, it would lead to talk of guarantees.

long village

I believe that carbon pricing has been one of the most important factors in the progress of climate-related disclosure. The idea of putting a price on CO2 emissions was born around the time of the Kyoto Protocol, and it became possible to link a monetary value to a physical indicator. With this, I see the groundwork has been laid for a financial discussion of climate change. As you pointed out earlier, if a system is established to attach monetary values to biodiversity as well, companies will be able to better understand the economic potential of biodiversity. In this sense, there may be an idea to apply something equivalent to carbon credits to biodiversity as well.

Do you have any outlook on how widespread such things will be in the future?

Managi

Natural capital is also available through international private organizations such as the Natural Capital Consortium. When converting to capital, simply saying "area x 1 hectare, and how much per hectare, and how much for that" in a region will vary from country to country. The reason why the steps take longer than with CO2 is that climate change experts are less opposed to discussing in "tons", and that is the reason why they are more interested in the economics of the project. impact, so there was some disagreement on the value for money thing, but in the end we were able to reach a consensus.

On the other hand, for ecosystems, first of all, there are naturally many experts who are opposed to discussing or even doing so in Hale. There is an argument that says, "There are more diverse values, aren't we overlooking them?" First of all, it takes a little time here. It is the same as climate change, so in that sense, I think such a trend will come within five years, and various guidelines will be advanced in the same way as climate change.

long village

I see. So the COP on biodiversity will play a central role in that debate.

Managi

Yes, I am aware of the importance of the UN Environment Programme (UNEP) in the area of CO2 and biodiversity. In terms of the United Nations, UNEP, the United Nations Environment Programme, plays an important role in both CO2 and biodiversity.

Maturity of disclosure starts with dialogue

───Do you have any suggestions for those who are interested in quantification or upgrading their TCFD and TNFD after reading this column?

long village

The first step is to showcase the results of this kind of research. One of the more familiar examples are the TCFD Consortium and the GX Summit, both of which I am involved in, so I could introduce the results of my research at these events. There is also the GX League in Japan, so it may be possible to introduce the GX League at such events as well.

large field

I think it is very important for users, preparers, and guarantors to exchange information about such non-financial information and thereby mature the use of such information. In fact, I have participated in such workshops in Japan, and I have noticed and discovered many things. I feel that the level of recognition is low because opinions on usage and standards are also expressed, and I believe that non-financial information is still a standard that has a long way to go. We are at the starting point, but I would like to stimulate discussion as a participant so that we can make it mature more and more. I think it is important for non-financial information to appeal to a wide range of uses and interpretations.

Managi

Are most of the groups you work with in the same financial sector?

large field

Yes, we do. Most of them are from the financial industry, but occasionally we invite people from companies to come and learn about the actual disclosures. For users, we hope to have study sessions that lead to the discovery that this kind of interpretation is possible.

Managi

Will you be moving in the direction of growing such an organization?

large field

I have always looked at accounting as an analyst by background. Through the study group, I feel that the users, preparers, and assurers have become closer together, and analysis has become more standardized. I also believe that the method of disclosure has also changed. I think this kind of information exchange is still necessary among these three parties.

Managi

In the short term, I think it is important to have this kind of quantification, not only physical but also financial, system, and I think this will lead to consulting services. I think it will be a win-win situation if many companies adopt this system. It would be even more perfect if a system of three parties, including the compensation mentioned earlier, could be established. It would be the best if we can keep sending out such information to the outside world, and if we can take the next step and create a mechanism that extends to nature and human rights as well.

How to come to terms with global standards

─ ─ I would like to ask one last question at a time.

Let me ask you this from Mr. Managi.

Sustainability standards differ globally, and there are differences in evaluations between Japanese and English translations of disclosures. Which do you think is the best way for Japanese companies to respond?

Managi

I think there are both the current situation and the ideal. To speak of the difficulty of the current situation, for example, a major characteristic of Japan is its dependence on foreign countries for resources, which is mentioned in a well-known book. In this case, the old, advanced coal-fired thermal power generation is something that should be protected. But they created a global standard, and to put it simply, Japan lost. The rules were vague, but we overlooked them. Basically, I believe that the pursuit of Japan's uniqueness and its spread to the outside world will no longer work in the future. On top of that, Japan's uniqueness that is received internationally makes it easier to build a cooperative system, so we should take the initiative and do more and more things, including this kind of content. So you are saying that we are making allies by doing things that may be good for Japan as well as for other countries.

In fact, Japan still has strong potential in areas such as recycling and the circular economy, and Japan was the first country to begin using the term "recycling-oriented society. We have solid data on resource recycling in various industries, so it would be good if a good system could be created to promote the concept. In that sense, I think this is a project that can be brought up to global standards while at the same time demonstrating Japan's uniqueness. I believe that Japan will be strong if we focus on such projects. Basically, I think it is better to specialize in such projects and focus on them in a realistic manner, since "anything" is not possible. As a result, I believe that those things that are evaluated well due to their uniqueness in Japan and that can easily win allies internationally can go on to the next stage. I think the same is true for green infrastructure.

Both risks and opportunities are mirrored by ESG scores and the market.

I have a question for Mr. Ohata.

From the standpoint of the reader of the article, I was wondering if there is a possibility that the disclosure has been slightly advanced from 2020 to 2011, and at the same time, the evaluation mechanism on Nomura Asset Management's side may have also changed considerably. Also, I wonder if the physical risks that could not be reflected this time will be reflected in the same way as the disclosure increases in the future. I would appreciate a few comments on these two points.

large field

Our approach to sustainability in the companies in which we invest is centered on ESG scores, which we established several years ago and have fine-tuned slightly each year. The adjustments have been modified to meet the demands of society. We have not made any major changes, but we are constantly improving it.

If disclosures, including physical risks, are refined in the future, our response should first be to seriously consider how to incorporate them into the ESG score. One way forward may be to determine for each company what risks are factored into its stock price.

Managi

It would be even better if you could point out the omitted projects on the correct, also called Market is Always Right.

large field

I would like to see companies use non-financial disclosures to refine their disclosures by disclosing that they are factoring in too much risk or that there are other opportunities, and conversely, we would like to be prepared to incorporate them into our scores and so on.

Managi

I recently published a paper that the oil and gas industry tends to acquire wind and other clean energy companies because of their high carbon intensity. So in that sense, it is working properly from a market perspective.

large field

That kind of behavior can be seen in Japan as well.

Managi

It's interesting.

To make disclosure "the language of the company" - Top management's understanding is the starting point for effectiveness

─ ─ My last question is for Mr. Nagamura.

Many companies, even the most advanced ones, have told us that although they are externally recognized for their disclosure, they do not feel that they have done enough, or that they are not confident that they have properly incorporated the information into their strategies.

Can you comment on what the focus should be in terms of more effectiveness, in terms of inward?

long village

When I was a member of the TCFD and participated in discussions on the formulation of the framework, I recall that few people in the company understood the framework, and in fact, many people were concerned about it.

The companies most likely to be affected by the establishment of the TCFD framework will be those that are highly dependent on fossil fuels, and since these companies include some of our most important customers, we had to be very careful in our approach. Even so, we recognized the importance of participating in the creation of such an international framework in order to lead Japan's corporate society in the desired direction, and we worked to gain the understanding of top management. This type of initiative will not move unless the top management truly understands the importance of the initiative and believes that this is the way to move the company forward. The creation of a department specializing in GX support for clients was also made possible by the understanding of top management, and it was only with the establishment of such an organization that we were able to move forward.

Without the understanding of the top management, nothing will get done, even in companies that are facing disclosure. Without it, I have a feeling that those who are working on sustainability will continue to feel quite alone and in a sorry situation. Sustainability should not be an issue for the sustainability department alone, but should be a cross-company issue, involving all departments within the company, including corporate planning, accounting, finance, risk management, and so on, otherwise proper disclosure will not be possible. A word from the top is essential to unify the company.

Managi

It is top-down, isn't it? The results of this analysis and the fact that they will be utilized in the financials are easily understood by top management.

long village

In that sense, I can speak with even more confidence with this kind of information.

Managi

It's important to be connected to finance.

In my research, I created my own sustainability-focused generative AI to predict stock prices, and I can explain 5% to 10% of the index using pure ESG alone. Before, when we did a statistical analysis of stock prices, ESG had very little impact. Then 5% to 10% is getting bigger. When you start from that point, the response from companies is quite positive. Once the upper management recognizes this, they may decide to take the issue of "how to do this" down to the lower levels and move on to the next step.