INDEX

Introduction.

This article is a commentary on the paper co-authored by aiESG's Data Scientist Jiaxu Zhang, Chief Researcher Keeley Alexander Ryuta, and Representative Director Shunsuke Managi.

This article provides an easy-to-understand explanation of the research and the services provided by aiESG. those interested in ESG data analysis and strategy development are encouraged to read to the end.

Title of paper: Does participation in China U.S. trade impede carbon emission reduction efforts across countries?

DOI (paper link):https://doi.org/10.1016/j.ecolecon.2025.108732

Research Points/Summary

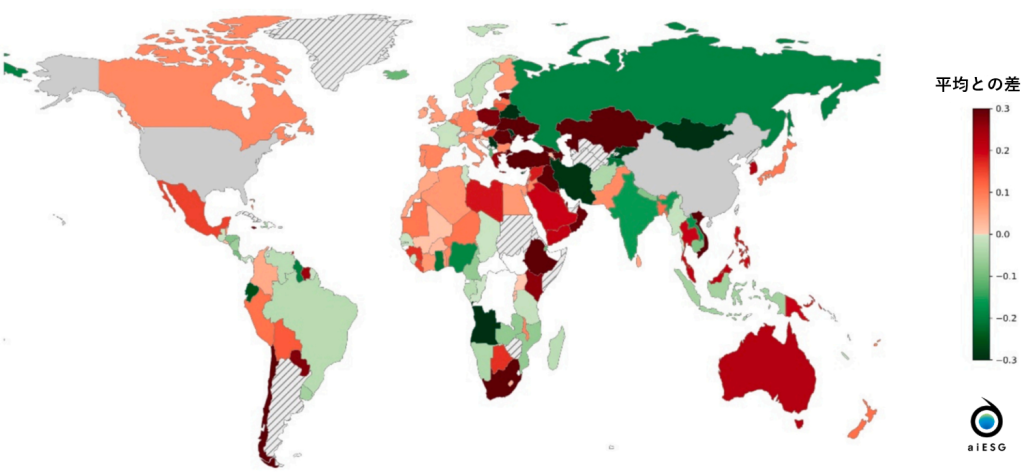

This study examines the impact of trade between China and the U.S. on global carbon dioxide emission intensity over the period 2000-2021, covering 189 countries and 26 sectors, and finds that emission intensity tends to be higher than the global average in countries involved in China-U.S. trade, but that this difference has narrowed over time. emissions intensity in China and U.S.-based trade. By region, a declining trend is observed in Europe and the United States, while diverse changes are observed in Asia, South America, and Africa. By industry, electricity, gas, and water remain high, while electronics and machinery are improving. The impact varies depending on the direction of trade (China→U.S., U.S.→China), indicating that industry characteristics and trade position affect emission intensity.

Background and Objectives

Climate change is a pressing global issue, and international trade has been identified as a contributing factor. In particular, trade between the world's two largest economies, China and the United States, has a significant impact on global carbon emissions. While this trade promotes economic growth, it can also lead to adverse environmental phenomena such as "carbon leakage" and the "pollution haven effect. These are phenomena that result in the relocation of production from countries with strict environmental regulations to countries with less stringent regulations, which in turn increases global emissions and pollution.

Previous studies have often focused on the bilateral relationship between China and the U.S. or on specific trade pathways, and have lacked analysis of emission intensity and long-term changes across participating countries and by trade direction. This study aims to systematically analyze how China's and the United States' involvement in trade affects the carbon emission intensity of each country.

analysis

In this study, we combined a database covering data across 189 countries and 26 industries from 2000 to 2021 with a multi-regional Input-Output (MRIO) model to track trade-related carbon emissions in detail. Specifically, we calculated the difference (σ value) between each country's emission intensity in trade between China and the U.S. and the average of its exports to the world as a whole, and compared the results by industry (primary, secondary, and tertiary) and by trade direction (China to the U.S. and U.S. to China).

result

Overall trends:.China-U.S. trade participants exhibit higher carbon emission intensity than the global average trade, but this difference is gradually narrowing over time.

Regional trends:.Countries in North America and Europe tend to have lower emission intensity in trade between China and the U.S. than the global average because of their high value-added and low-carbon products and services. On the other hand, countries in Asia, South America, and Africa show different trends in emission intensity from region to region due to differences in their economies and industrial structures.

Note: Shaded lines indicate countries with no data. Figure 1 in the paper was translated by aiESG.

Trends by Industry

- Electricity, gas, and water: High emission intensity continues due to difficulty in updating facilities for stable supply.

- Electromechanical industry: Highly efficient design of large production lines maintains low emission intensity.

- Agriculture and fishing:

- China → U.S.A.: Emission intensity has decreased significantly due to increased efficiency through large-scale management.

- U.S.A. → China: Shift from low to high emissions. Influenced by changes in demand in the Chinese market, etc.

- mining industry: Emission intensity increased due to a shift in development of low-grade resources.

- Textiles & ApparelThe increase is due to the shift from labor-intensive processes to energy-intensive processes such as dyeing.

- Wholesale and retailThe number of companies that have been affected by the earthquake and tsunami in Japan is expected to increase.

- Food & Beverage:

- China → U.S.: High emissions continue due to dependence on primary processing.

- U.S.A. → China: Low emissions until 2011, but increased due to entry of emerging market countries. Then, after the pandemic, emissions were low again due to a shift to a more efficient production model.

consideration

This study reveals that countries participating in China-U.S. trade tend to have higher carbon emission intensity than the global average. The results support the "pollution haven hypothesis" that pollution-intensive industries relocate to less-regulated countries. While there is a trend for emission intensity to gradually converge to the global average as technology diffusion and production networks deepen, this improvement may be due to geographic relocation of high-emitting processes rather than necessarily to technological innovation.

By region, North America and Europe showed improvement, while Asia, South America, and Africa showed different trends by country. By industry, the infrastructure sector continued to experience high emissions due to constraints on facility renewal, while the electronics and machinery sector showed a downward trend due to technological progress. The services sector, including wholesale and retail trade and finance, showed an increase in "hard-to-see" indirect emissions due to increasingly complex logistics and inventory management.

In addition, impacts varied by trade direction, particularly in the agriculture and food sectors, where there were examples of direct impacts of export destination market regulations and demand on production methods. These results indicate the need for "relational carbon accounting," which focuses on specific trade relationships rather than country-specific aggregate volumes.

summary

This paper pointed out the tendency of trade between China and the U.S. to increase the emission intensity of third countries and emphasized the importance of emission reductions according to industrial structure and trade relations. aiESG Inc. has the technology to analyze and visualize the entire economic structure, and to visualize the entire supply chain by company, product, and service using AI and big data, and to quantitatively evaluate ESG risks including human and natural capital. Please feel free to contact us if you have any questions or concerns about ESG-related information disclosure or practices.

About aIESG's services:https://aiesg.co.jp/service/