INDEX

Held on August 27, 2024.12th GX (Green Transformation) Executive Meetingwere mainly discussing the future of the energy situation in Japan. In addition, starting on September 3, the Cabinet Office will be given the task of establishing theCarbon Pricing Specialized Working Group for GX Realizationhas been opened and discussions on GX-ETS (emissions trading) have begun in earnest. The Japanese economy is currently undergoing a major transformation toward decarbonization.

In February 2023, the Ministry of Economy, Trade and Industry ("METI") announced that it would establish a "Basic Policy for GX Realization~In July of the same year, the "Strategy to Promote the Transition to a Decarbonized Growth-Oriented Economic Structure" (GX Promotion Strategy). The reason for establishing this policy and strategy is to respond to the transformation of the global energy situation. METI has positioned the "Green Transformation (GX)" as a major shift in industrial and energy policy in the postwar period, shifting the fossil energy-centered industrial and social structure to a clean energy-centered one. In addition to the energy security perspective, GX also includes the achievement of international commitments to reduce greenhouse gas emissions by 461 TP3T in FY2030 and to be carbon neutral by 2050 (Ministry of the Environment).

Japan will actively cooperate with a wide variety of government, administrative, business, financial, and academic institutions to shift to the "decarbonized growth-oriented economic structure" described above (prime minister's official residence).

This paper describes an overview of GX strategies in Japan and summarizes issues that corporate sustainability officers should be aware of.

Table of Contents

GX Promotion Strategy and Budget

2. current efforts related to the GX Promotion Strategy

2.1 Overview of Transition Bonds

2.1.2. GX League Overview

2.2 Development of ESG Information Disclosure

2.3. decarbonization strategy of the Ministry of Agriculture, Forestry and Fisheries

What are the responses that Japanese companies can consider from now on?

Conclusion

GX Promotion Strategy and Budget

The GX Strategy is based on the aspects of resolving the energy security challenges that Japan faces and the "pursuit of efforts to limit the average global temperature increase to 1.5°C" as dictated by the Paris Agreement (Ministry of Foreign Affairs), which is an aspect of the international commitment. In 2020, Japan declared its commitment to reduce its emissions by 46% by 2030 based on 2013 emission levels, and to become carbon neutral* in terms of "emissions and removals" by 2050.

*Carbon neutral means that greenhouse gas emissions and absorption are balanced.

The Japanese government is aiming to be even more proactive in its efforts to go carbon neutral by 2023 by enacting the "Act on Promotion of Smooth Transition to a Decarbonized Growth-Oriented Economic Structure" (Act No. 114 of 2023, as amended).GX Promotion Act) and "A Bill to Partially Amend the Electricity Business Act, etc. to Establish an Electricity Supply System for the Realization of a Decarbonized Society" (GX Decarbonization Power Supply Act) was enacted. After policy specifics based on this law, the "GX Promotion Strategy" approved by the Cabinet in July 2023 classified the main government initiatives into the following two categories.

i. GX initiatives based on the basic premise of securing a stable energy supply:

In addition to thorough energy conservation, promote decarbonization efforts toward GX, including a shift to decarbonized power sources that contribute to energy self-sufficiency, such as renewable energy and nuclear power.

ii. Realization and implementation of the "Growth-Oriented Carbon Pricing Concept" etc.:

Promote carbon pricing markets, including bold upfront investment support through "GX Economic Transition Bonds" and other means, upfront GX investment incentives through carbon pricing, and the use of new financial instruments.

In order to achieve the GX Promotion Strategy, the Japanese government has approved a Cabinet decision to spend 603.6 billion yen in FY2024 for GX promotion measures. This amount was originally estimated at 1,260.8 billion yen as of 2023, but was halved after discussions with the Ministry of Finance (Global Human Environment Forum). published by METI in February 2023, "Basic Policy for GX Realization (Draft)In the case of the GX, considering that the amount of government support over the next 10 years is approximately 20 trillion yen and the amount of public-private investment is expected to be 150 trillion yen (for the entire 10 years), the Japanese government's GX promotion strategy currently has a lower-than-expected budgetary sense.

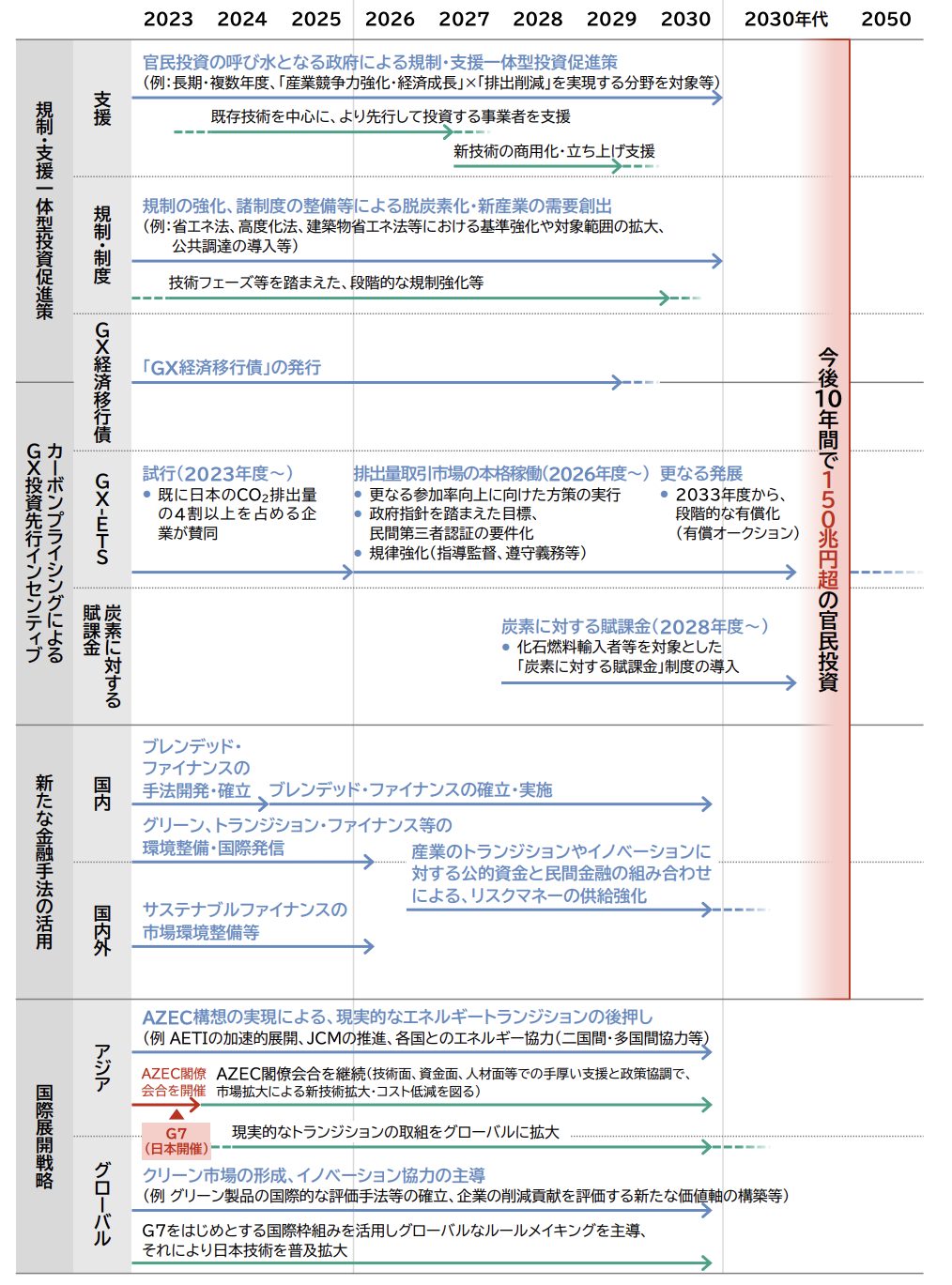

GX policies for the next 10 years can be divided into the following five categories (Financial Services AgencyReference p. 1 citation).

(1) Establishment of GX Economic Transition Bonds

Embodying the "Growth-Oriented Carbon Pricing Concept

Advance government financing through "GX Economic Transition Bonds".

(2) Investment Promotion Measures Integrated with Regulations and Support

Maximize effectiveness of fiscal stimulus through regulatory and institutional measures

Creation of a new institutional framework to enhance profitability and investment predictability

(iii) Gradual development and utilization of the GX League

Promote voluntary emissions trading through the pilot operation of the GX League and implement trading, including the development of a carbon credit market.

(4) Use of new financial instruments

Combining green transition and innovation financing methods to attract global ESG funds

Improvement of corporate information disclosure, enhancement of credibility of ESG assessment organizations, and development of infrastructure for data distribution

(5) International Expansion Strategy

Strengthen decarbonization cooperation among Asian countries by realizing the Asian Zero Emission Community concept, etc.

Promote innovation cooperation in the field of clean energy with the U.S. and other advanced countries

The Ministry of Economy, Trade and Industry has published a "Climate Transition Bond FrameworkAccording to the "Overall Roadmap for the Next 10 Years" (Figure 1) in the "GX Strategy", the GX strategy will be directed toward a conscious effort to develop the Japanese domestic market and eventually the international market, mainly in the form of intensive efforts through investment and financing. It can be confirmed that these strategies are by no means focused solely on "decarbonization," but are intended to promote the transformation of society as a whole, taking into account environmental, social, and governance (ESG) aspects.

Figure 1: Overall roadmap for the next 10 years(in Japanese history)METI)

2. current efforts related to the GX Promotion Strategy

After setting the strategy in 2023, the Japanese government has been focusing on two measures to achieve the GX Plan.

a. Climate Transition BondsFramework development

b. Growth-orientedcarbon pricing conceptIntroduction of the GX League (pilot operation of the GX League)

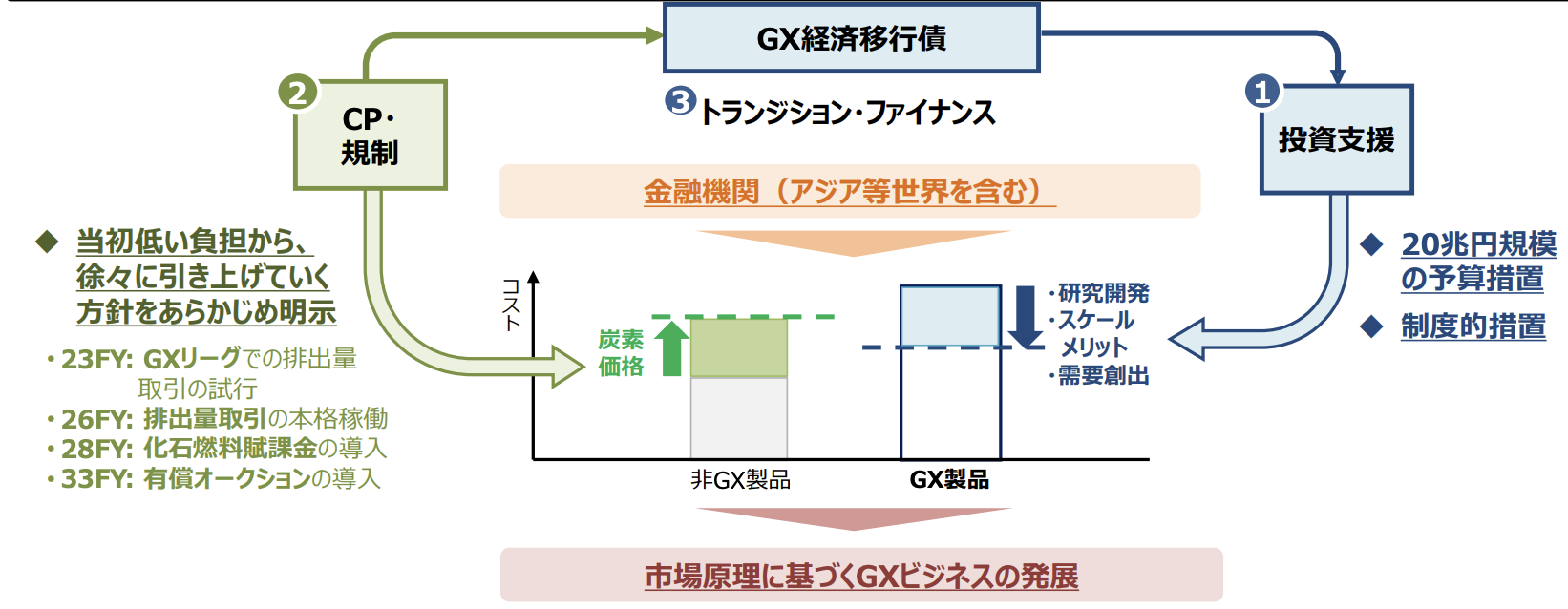

The above policies are aimed at creating a cyclical investment cycle for decarbonization efforts (see Figure 2). Notably, the Japanese government has focused on working with companies with a long-term view in decarbonization. Simply wanting to reduce carbon emissions directly can make economic activity more difficult, depending on the industrial form (especially in the power and heavy industries). The Japanese government aims to actively promote investment in "investment in technology development that can reduce carbon emissions in the future" and to incentivize reductions across the economic market by introducing the term "reduction contribution," which refers to the amount of carbon emissions reduced by other companies as a result of the technology developed.

Figure 2: Investment Promotion Package under the Growth-Oriented Carbon Pricing Initiative(in Japanese history)cabinet materials)

The steps to cyclical decarbonization envisioned by the government are as follows The projects that are reported to have started planning now arebold-typeNotation.

(1) Upfront investment support in the amount of 20 trillion yen (total for 10 years) using "GX Economic Transition Bonds*" *Redemption by 2050

The world's first "national entity" issued by a national government.transition bondStimulation of private sector efforts to decarbonize the economy through the "Economic Transition Bonds" (ETCBs).

(2) Incentives related to GX investment priorities through the introduction of carbon pricing (establishment of a carbon emissions market)

Anticipated timing of carbon pricing implementation

The League of Voluntary Participating Enterprises (LVIPEs)Pilot operation of the "Carbon Trading Scheme (GX-ETS)" within the GX League

From FY2026] Full-scale launch of an "emissions trading system" based on the situation of each company in high-emission industries, etc.

Fossil fuel levy system imposed on importers, etc.

From FY2033, a "paid auction" system will be gradually introduced for power generation companies.

(3) Use of "transition finance" as a new financial method

Transition finance is a new financing method that aims to support companies that are making steady efforts to reduce GHG emissions in accordance with their medium- to long-term strategies toward the realization of a decarbonized society.METI).

In the following, "Transition Bonds" and "GX League" will be explained, followed concurrently by "ESG Information Disclosure Development" and "New Movements by MAFF" related to the GX strategy.

2.1 Overview of Transition Bonds

In working toward the transition to carbon neutrality, METI will emphasize the importance of designing carbon pricing that ensures predictability and appropriate social transformation through discussions with industry (METI). In particular, the company has taken a proactive stance on carbon pricing.

The primary concept of the Transition Bonds (GX Economic Transition Bonds) is to "support companies and others that are taking on the challenge of a rapid decarbonization transition by using the carbon pricing that will take effect in the future as a source of redemption.

In addition, one of the objectives is to promote transition financing by private financial institutions by encouraging private sector investment in decarbonization by including projects that contribute to the transition toward decarbonization in the use of funds.

Finally, it is also suggested that GX Economic Transition Bonds be issued as individual issues (Climate Transition Bonds) and that a regular reporting system that promotes dialogue between investors and the market, among other things, be put in place to encourage transformation toward steady decarbonization throughout society.

Thus, METI aims to develop Climate Transition Bonds as a means to raise the necessary funds to promote GX in Japan (METI). The government will promote GX through public-private partnerships while implementing upfront investment support in the amount of 20 trillion yen.

2.1.2. GX League Overview

As stated in the concept of the GX Economic Transition Bonds, the Japanese government is currently actively working to develop a Japanese version of a carbon pricing market.GX LeagueThe GX League is a federation of companies that voluntarily participate in the GX League and establishes a system of cooperation between the public, private, and academic sectors to achieve carbon neutral policies through the ties among participating companies. The total amount of greenhouse gases emitted by the 679 Japanese companies participating in the GX League will account for about 40% of Japan's total greenhouse gas emissions by 2023.

The GX League's main activity is to pilot the establishment of a "carbon pricing market" as mentioned above, called the GX-ETS (Emissions Trading Scheme), which currently (as of 2024) allows trading in the experimental market of emissions in excess of or in reductions from the emission reduction targets for the first phase (2023-2025). The experimental market will allow companies to trade their emission reductions or excess emissions in relation to their emission reduction targets for the first phase (2023~2025). Participating companies are required to set and report their [1] 2030 emission reduction targets, [2] 2025 emission reduction targets, and [3] emission reduction targets for the first phase (2023-2025). At present, trading is limited to "direct domestic emissions," but the Japanese government, which is considering a full-fledged launch of an emissions trading scheme in FY2026, is expected to expand the scope of trading through the GXLeague.

2.2 Development of ESG Information Disclosure

METIThe "Sustainable Finance Promotion" is listed as one of the future actions of the GX Strategy. Citing the fact that Japan has the world's largest number of companies supporting the TCFD (Task Force on Climate-related Financial Disclosure), METI states that it is important to further promote practical information disclosure on the part of companies. Therefore, it is expected that "ESG market expansion" will further progress in the future.

An important aspect of ESG market expansion is "companies' disclosure of non-financial information on sustainability. In recent years, standards and regulations for ESG information disclosure have been developed and evolved in many countries around the world, with Europe leading the way. Japan has followed other regions in making changes, such as requiring the inclusion of "sustainability" items in securities reports.

With ESG (Environmental, Social, and Governance) in its crown, these developments are by no means limited to the environment. It is also important to draw attention to a company's "human rights, employment, and labor practices," and to develop a transparent environment throughout the supply chain. In securities reports, items such as those related to "corporate governance" have likewise been newly established. It can be confirmed that globally, companies are building a system to report social and governance aspects of their operations.

Reference:aiESG "[Commentary] The Importance of Social and Human Capital in Securities Reports.

Although the GX strategy is "carbon neutral by 2050," Japanese companies will be forced to establish and pursue "ESG strategies" in parallel in the process of aiming for decarbonization. This means that they will be required to address environmental, social, and governance issues throughout their supply chains.

2.3. decarbonization strategy of the Ministry of Agriculture, Forestry and Fisheries

Although not within the framework of the GX Promotion Strategy, the Ministry of Agriculture, Forestry and Fisheries (MAFF) has also been actively addressing sustainability from the perspective of environmental conservation in recent years. Starting in April 2024, MAFF will require all projects to "reduce environmental impact" as a condition for receiving subsidies (Nikkei ESG). This response aims to make it mandatory to reduce environmental impact in all eligible projects totaling 2.27 trillion yen, thereby balancing the environment and productivity.

This strategy aims to achieve both increased productivity and connectivity in the food, agriculture, forestry, and fisheries industries through innovation.Green Food System StrategyIt was established in the wake of the "Green Food System Strategy" (formulated in 2021). The Green Food System Strategy sets targets for decarbonization in primary and other industries and reduction of food loss, with the aim of achieving carbon neutrality by 2050.

The Ministry of Agriculture, Forestry and Fisheries (MAFF) has been experimenting with a "greenhouse gas reduction index" since FY2022 with the aim of promoting "visualization" to consumers, not only by tightening the conditions of subsidy projects. The "Greenhouse Gas Reduction Indicatorbe seenThe program has been named "The Environmental Impact Reduction Program (EAP)," and is working to ensure that sustainable efforts are made throughout the entire cycle from production to consumption by visualizing the environmental impact reduction measures of specific domestic crops.

It is expected that the GX strategy and others will eventually grant conditions through subsidies to Japanese companies in selected industries, and it can be said that the government's efforts toward carbon neutrality in 2050 are making progress, albeit gradually.

What are the responses that Japanese companies can consider from now on?

As GX strategies develop in the future, it will become increasingly important for Japanese companies to manage their businesses with decarbonization and ultimately sustainability in mind. In particular, the full launch of the carbon market will be considered, requiring companies to actively calculate and report emissions. In addition, Japanese companies will have to respond to the sustainability reporting standards regulations that are currently being developed globally, as well as promote GX strategies.

In order for Japanese companies to adapt to the GX strategy at this time, the following efforts are expected.

1. Identification of emissions and establishment of reduction targets.: With the pilot operation of the GX League, companies will need to accurately assess their own GHG emissions and set clear reduction targets. At the time of the first phase, only the direct domestic emissions of the company are eligible for trading, but the scope may be expanded after the full-scale launch (assumed to be in FY2026). What is important is that the trading in the carbon market and the associated incentives can be effectively utilized through the monitoring and management of progress in emission reductions from an early stage.

2. Compliance with Sustainability Reporting Standards: Compliance with internationally required sustainability reporting standards (CSRD/ESRS, SASB, TCFD/ TNFD, etc.) will also be important in promoting carbon neutrality. In particular, "transparent" reporting of emission reduction efforts and reduction of environmental impacts will help gain the trust of investors and consumers in Japan and abroad. Compliance with these standards will also lead to the consideration of long-term management risks within the company, and will enable the development of a clear roadmap for achieving carbon neutrality.

3. Building a sustainable supply chainCompanies need to decarbonize not only themselves, but also their entire supply chain. From raw material procurement, manufacturing, and distribution, to consumption and disposal, it is important to develop and implement strategies to minimize environmental impacts, in cooperation with partners.

Environmental concerns are not the only important aspect of GX strategies. As indicated by the Sustainability Reporting Standards, Japanese companies will need to be aware of their entire supply chain, and to quantitatively analyze and disclose human rights and governance issues as well.

Conclusion

Japan's GX Strategy is a major step toward achieving carbon neutrality by strengthening its commitment to energy security and greenhouse gas reduction. The strategy aims to promote a shift to clean energy and introduce carbon pricing and transition financing, bringing businesses and the government together to work toward a decarbonized society.

For Japanese companies, it is important to understand their own greenhouse gas emissions and set reduction targets in order to adapt to this strategy. In addition, companies are required to comply with sustainability reporting standards, and their future business strategies must take a long-term view toward decarbonization. By starting these initiatives early, companies can become more competitive in the carbon market and achieve sustainable economic growth.

aiESG offers a comprehensive analysis of all ESG issues, which can make a significant contribution to understanding and addressing the supply chain as a whole. ESG. If your company's long-term sustainability plan requires these indicators, please contact aiESG.

Contact us:

https://aiesg.co.jp/contact/

*Related Article*.

Report List : Regulations/Standards

Commentary] The Importance of Social and Human Capital in Securities Reports

Commentary】Trends in SSBJ (Sustainability Standards Board of Japan) Deliberations - Scope 3 Disclosure Standards in Japan

Clarifying the Relationship between Corporate Climate Change Measures and Cost of Capital: Data Analysis of 2,100 Japanese Firms Reveals a Relationship.

The Environmental and Social Impact of Supply Chains - Sustainable ESG-Oriented Supply Chains: A Strategic Imperative for Modern Business