INDEX

As companies are required to work toward the realization of a sustainable society, the concept and approach of "sustainable finance," which aims to solve various social problems by investing in and financing companies, is gaining popularity. How will the government respond to this new financial system, and how will companies be asked to deal with it?

This report introduces the latest trends in sustainable finance from the Fourth Report of the Expert Group on Sustainable Finance released by the Financial Services Agency in July 2024.

Table of Contents

What is Sustainable Finance?

Explanation of the main points of the Fourth Report

Development of market institutions

Importance of increasing stakeholders' interest in sustainable finance

Promoting Transition Finance

Initiatives Related to Decarbonization and Diversified Sustainability Issues

Major changes since the third report

Responses required of companies

What is Sustainable Finance?

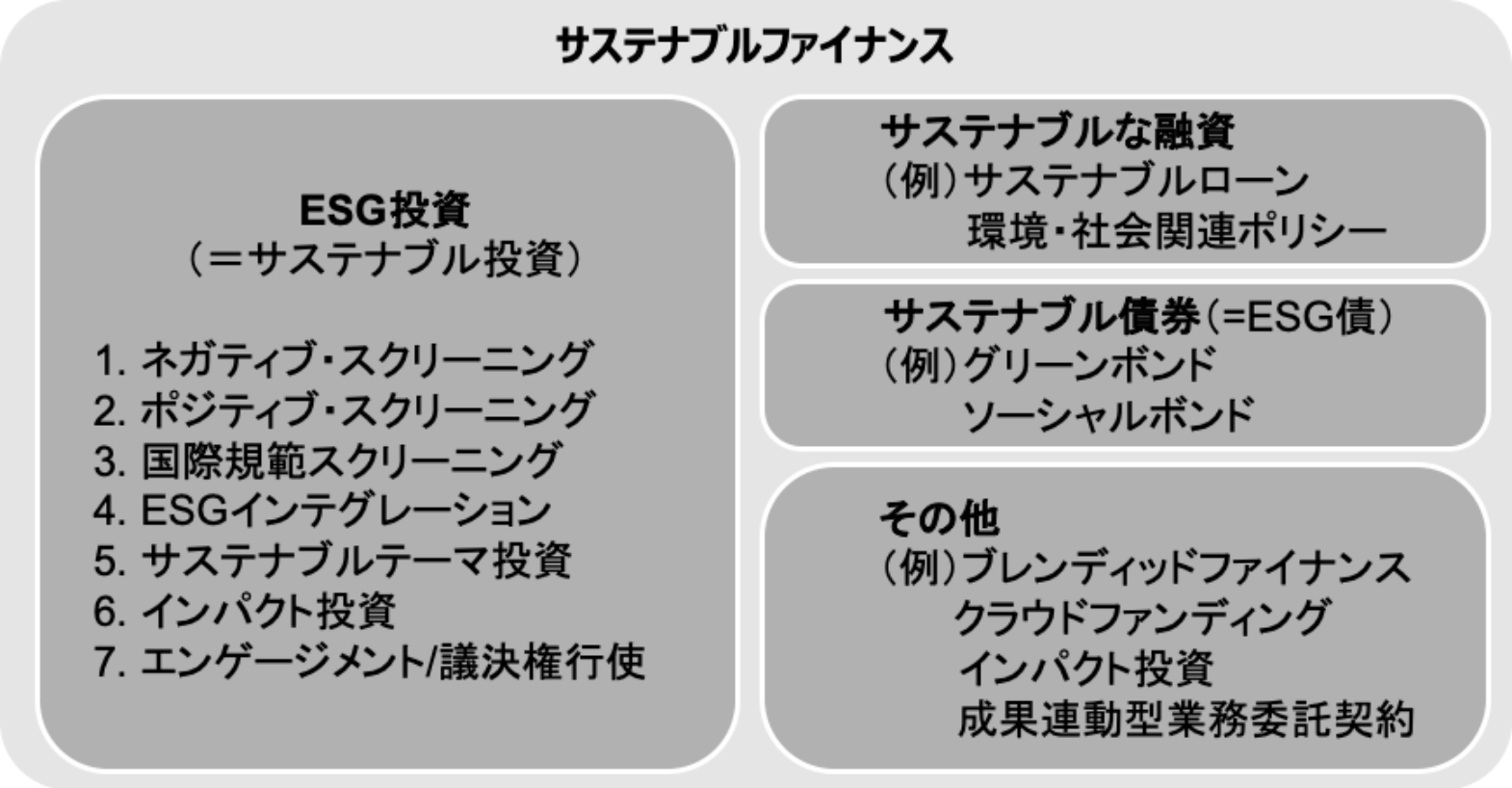

To begin with, what exactly does sustainable finance mean? The Financial Services Agency (FSA) explains that it is "finance to realize a sustainable society. *1

The ISO Technical Committee on Sustainable Finance (ISO/TC 322) also defines sustainable finance as "the integration of sustainability considerations, including environmental, social, and governance practices, into the financing and procurement of economic activities. *2

ESG investment and sustainable loans are specific examples of sustainable finance.

Figure 1: Bureau of Policy Planning, Tokyo Metropolitan Government, "What is Sustainable Finance (top)"Adapted from *3

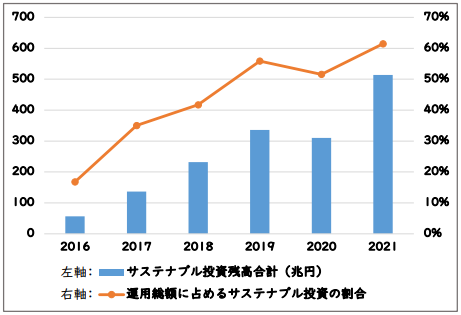

As the transition to a sustainable society has become more important in recent years, the presence of sustainable finance has increased dramatically. For example, the ratio of sustainable investments to total investments by Japanese institutional investors has increased by more than 40% over the past few years (Figure 2), and the use of sustainable finance is becoming indispensable for securing funds for corporate growth and for the growth of the Japanese economy.

Figure 2: Salary and Mutual Aid Division, Principal Accounting Bureau, Ministry of Finance, "ESG Investments."Adapted from *4

Since December 2020, the Expert Committee on Sustainable Finance has been convened by the Financial Services Agency to promote the growth of Japanese companies and economy by attracting sustainable investment funds to Japan and expanding sustainable finance, which is estimated to total about $30 trillion*5 worldwide.

To learn more about sustainable finance, please click here.

Sustainable Finance - Sustainability in the Financial Industry

Explanation of the main points of the Fourth Report

On July 9, 2024, the fourth report, the latest report of the Expert Panel on Sustainable Finance, was released. The original report can be viewed at the following link

FSA:Fourth Report of the Expert Group on Sustainable Finance

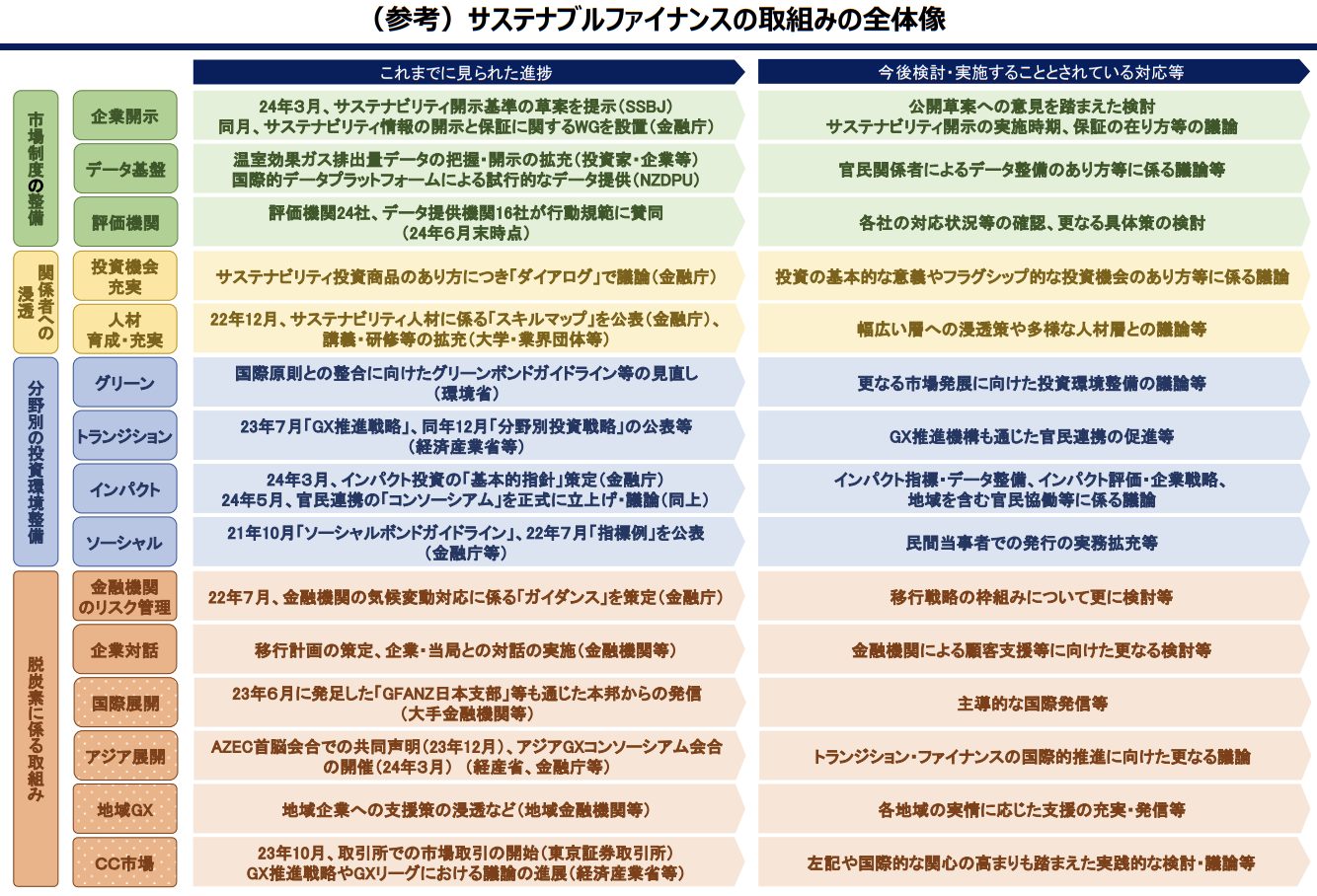

This section describes particularly important aspects of the sustainable finance initiatives and issues addressed in the fourth report in each of the four areas of "development of market institutions," "promotion to stakeholders," "development of investment environment by sector," and "initiatives related to decarbonization.

Fig. 3 Fourth Report of the Expert Group on Sustainable FinanceAdapted from *6

(1) Development of market system

In order to expand the scale of sustainable finance, it is necessary to develop an environment in which investors and others can obtain accurate data to compare and judge each investment product. The Fourth Assessment Report presents the following three points as important: "companies should voluntarily disclose sustainability information," "a data infrastructure should be developed to aggregate and provide sustainability information from various companies," and "ESG evaluation organizations should function appropriately.

For example, in March 2024, the Sustainability Standards Board of Japan (SSBJ) released a draft of its corporate disclosure standards, and there have been moves to enhance corporate disclosure. In addition, the Financial Services Agency provides EDINET and other systems that allow the general public to view the contents of securities report disclosures on computers. *7 *8

On the other hand, the report points out that non-financial information used to evaluate corporate sustainability efforts is often non-quantitative and difficult to standardize and improve in quality. While efforts have already been made, such as establishing a code of conduct for ESG evaluation organizations, the report states that it is important to consider further concrete measures to ensure the practicality and reliability of sustainability information. *9

(⑵ Importance of increasing stakeholders' interest in sustainable finance

If investors become interested in and knowledgeable about sustainable finance and actively invest in sustainable investments, companies and the economy as a whole will grow steadily and over the long term. Therefore, the policy is that a wide range of investment opportunities should be expanded to attract investors' interest.

For institutional investors, such as asset owners, we encourage them to manage and invest their assets in a sustainable manner by, for example, announcing the "Asset Owner Principles (draft)". *10 For individual investors, the JICPA has also created a system to make it easier for individuals to make sustainable investments by, for example, announcing supervisory guidelines for ESG investment trusts. *11

However, in the fourth periodic report, it is pointed out that "while sustainable finance initiatives and measures are progressing, understanding of the basic significance of sustainable finance has not necessarily been widely disseminated. In particular, it is difficult for individual investors to grasp the significance and effects of sustainable investment, and it is difficult for them to feel that they are helping to solve social issues. In order to further increase investors' interest in sustainable finance, it is important to provide investment opportunities and information that enable them to concretely feel the basic significance and effects of sustainable investment. Specifically, the report points out that products that have a clear use of funds and make it easy to imagine and feel the benefits of investment, such as bonds that invest in projects that contribute to environmental improvement in the community, are likely to attract interest.

The report also indicated that, due to a lack of sustainability human resources, super-disciplinary and comprehensive knowledge on sustainable investment has not fully penetrated all levels of management and other stakeholders. In order to develop sustainable human resources, we are considering widely disseminating information on the needs of sustainable human resources and their specific career paths, and increasing the number of human resources who are interested in sustainable finance through open discussions with a wide range of human resources and stakeholders.

(3) Promotion of Transition Finance

Of the four investments listed in Figure 3, "Investment Environment Development by Sector," this section introduces the efforts to date and future prospects for "Transition Finance," a topic that received special emphasis in the fourth periodic report.

Transition finance refers to "a new financing method that aims to support companies that are making steady efforts to reduce GHG emissions in accordance with their long-term strategies toward the realization of a decarbonized society. *12 GX is an abbreviation for "Green Transformation" and refers to the shift in economic and industrial structure toward a clean energy-centered society by reducing the use of fossil energy. For example, when a company implements GX initiatives, it is eligible for transition financing, which enables smooth financing.

To learn more about GX, please click here.

Commentary] Overview of Japan's GX Strategy - Toward Accelerating Green Transformation

In recent years, Japan has been very active in the field of transition finance, as exemplified by the promotion of GX investment. In February 2024, the Japanese government issued the world's first government-issued transition bond, the Climate Transition Interest-Bearing Bond. *13 *14 *15 The Fourth Report positioned the Climate Transition Interest Bonds as "a catalyst for further expansion of transition finance in Japan and abroad," and it is expected that transition finance initiatives will further expand in the future.

⑷ Initiatives related to decarbonization and diversifying sustainability issues

As decarbonization initiatives related to transition finance, the fourth report addresses "Risk Management and Customer Support at Financial Institutions," "Promoting International and Regional Decarbonization and GX," and "Carbon Credit Markets.

In July 2022, the Financial Services Agency (FSA) published its "Basic Approach to Addressing Climate Change at Financial Institutions. *16 It also states that "it is important for financial institutions to contribute to the growth and sustainability of the economy and society by identifying risks and opportunities associated with their clients' businesses, and by reducing risks and promoting opportunities (in short)" (p. 20 of the fourth periodic report), thus taking the stance that financial institutions should help their clients manage risks associated with climate change. The report also states that financial institutions should help their customers manage their climate change risks.

With regard to the development and penetration of international decarbonization and GX, the report states that it will continue to promote and disseminate GX, showing the achievements of the "Asian GX Consortium" and the "AZEC Summit Meeting" and other events. On the other hand, while GX for SMEs*17 , which account for 20% of GHG emissions as a business sector, is an important issue, the report indicates that it is not always easy for SMEs facing various management issues to engage in GX. In order to support SMEs' efforts toward GX, the report explains that it will be important to communicate that decarbonization efforts will not only reduce risks for companies, but also lead to improved management and the creation of business opportunities.

As for carbon credits, he cited as an example the GX League's emissions trading system, which is scheduled to be fully operational in FY2026*18 , and indicated that he expects trading to further expand and diversify in the future, and that he intends to promote research and discussion to ensure the transparency and soundness of carbon credit trading. The committee also indicated its policy to promote research and discussion to ensure the transparency and soundness of transactions related to carbon credits.

On the other hand, the Fourth Assessment Report points out that the environmental and social issues of today are becoming increasingly diverse, including biodiversity protection and human rights issues associated with labor in the supply chain, and that various sustainability issues affect each other in the same way that preservation of natural capital leads to improvement of climate change. The Fourth Assessment Report points out that, in order to solve sustainability issues, it is necessary to comprehensively consider various environmental and social issues from a broad perspective, not limited to decarbonization and GX (see page 5 of the Fourth Assessment Report). (From the Fourth Report, p.5: Core Issue (3))

Major changes since the third report

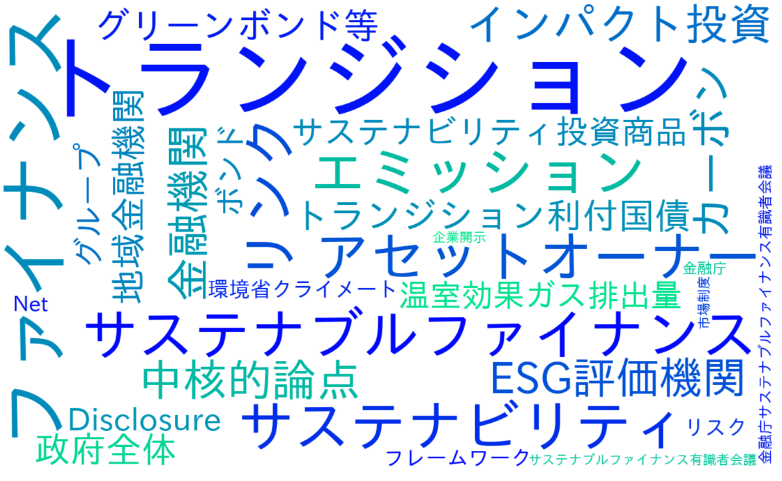

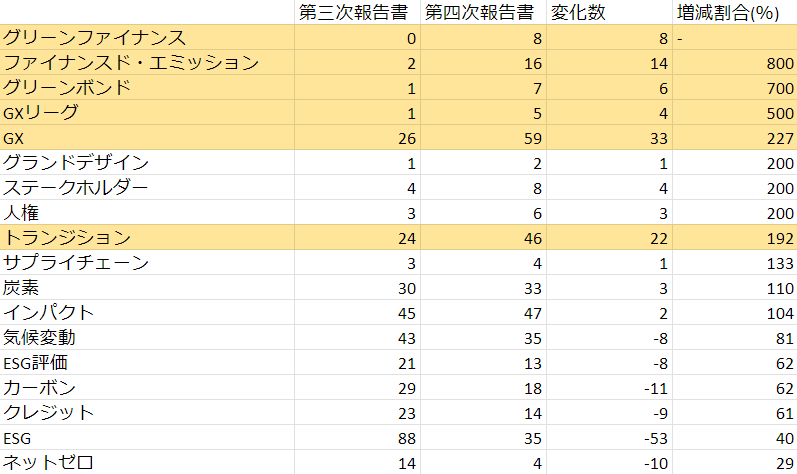

In the year from the release of the Third Report in June 2023 to the release of the Fourth Report, how have the circumstances surrounding Sustainable Finds, as well as the FSA and the government's approach and approach to sustainable finance, changed? We will explain the changes since the Third Report by comparing the word clouds and word counts of the Third Report and the Fourth Report.

Figure 4: Word cloud for the third report(Prepared by the author)

Figure 5: Word Cloud of the Fourth Report(Prepared by the author)

Table 1 Table comparing the number of occurrences of characteristic words(Prepared by the author)

The word cloud in Figures 4 and 5 shows that words related to transition finance, such as "transition" and "transition interest-bearing bonds," are more prominent in the fourth periodic report than in the third periodic report. Table 1 extracts the characteristic words that appear in the third and fourth periodic reports. Words such as "financed emissions" and "GX League" increase in number of occurrences in the fourth periodic report. Instead, the number of occurrences of words such as "climate change" and "ESG" in the fourth periodic report is lower than in the third periodic report, indicating a move to provide more concrete support to companies.

The terms "green finance" and "green bonds" have also become more frequently seen since the fourth report. Green finance refers to "bonds or borrowings*19 to raise funds specifically for initiatives in environmental fields such as global warming countermeasures and renewable energy," and green bonds refer to bonds of such initiatives.

The fourth periodic report points out that "international principles have been updated from time to time regarding financial instruments with green characteristics, and it is important to continuously discuss them domestically and (omitted) reflect them in the Japanese framework in a timely manner. In fact, the "Green Bond Guidelines*20" established in 2017 have been revised twice so far, and it is expected that the systems and regulations related to green finance will continue to change.

Responses required of companies

Due to the government's active efforts, future investments and loans are expected to be more influenced by sustainable finance. What measures will companies be required to take in order to receive smooth financial support?

Promote and publicize initiatives for a decarbonized society

The movement to promote transition finance has become very active in recent years, and we believe that companies that are actively engaged in GX and other initiatives for a decarbonized society will be highly valued by investors and financial institutions in the future.

Enhancement of Sustainability Information Disclosure

By quantifying and publicizing their efforts toward a sustainable society, investors interested in sustainable finance will find it easier to invest and finance. A subsidy program to subsidize the cost of receiving a third-party evaluation from an ESG evaluation organization, etc., when financing through transition finance will begin in June 2024*21, and it is expected that many companies will disclose sustainability information and improve their information.

aiESG provides ESG analysis services related to the supply chain of manufactured goods. If you have any questions or concerns about corporate disclosure, please feel free to contact us.

Contact us:https://aiesg.co.jp/contact/

References

*1 https://www.fsa.go.jp/policy/sustainable-finance/index.html

*2 https://webdesk.jsa.or.jp/common/W10K0500/index/dev/isotc_322/

*3 https://2021.tsfw.tokyo/what_is_sustainable_01

*4 https://www.mof.go.jp/about_mof/councils/fiscal_system_council/sub-of_kkr/proceedings/material/kyosai20221125-3-2.pdf

*5 https://www.gsi-alliance.org/members-resources/gsir2022/

*6 https://www.fsa.go.jp/singi/sustainable_finance/siryou/20240709/01.pdf

*7 https://www.ssb-j.jp/jp/domestic_standards/exposure_draft/y2024/2024-0329.html

*8 https://www.fsa.go.jp/search/20231211.html

*9 https://www.fsa.go.jp/topics/news/r4/singi/20221215/20221215.html

*10 https://www.cas.go.jp/jp/seisaku/atarashii_sihonsyugi/bunkakai/asset_dai4/siryou1.pdf

*11 https://www.fsa.go.jp/common/law/guide/kinyushohin/

*12 https://www.meti.go.jp/policy/energy_environment/global_warming/transition_finance.html

*13 https://www.fsa.go.jp/topics/news/r2/singi/20210507_2/03.pdf

*14 https://www.fsa.go.jp/topics/news/r4/singi/20230616.html

*15 https://www.mof.go.jp/jgbs/topics/JapanClimateTransitionBonds/index.html

*16 https://www.teitanso.or.jp/cif3/

*17 https://www.env.go.jp/content/000123580.pdf

*18 https://www.env.go.jp/earth/ondanka/page_01417.html

*19 https://www.resonabank.co.jp/hojin/service/kigyoseicho/sien/sei_c0410.html

*20 https://greenfinanceportal.env.go.jp/bond/guideline/guideline.html

*21 https://www.teitanso.or.jp/cif3/

[Related Article.

Report List : Regulations/Standards

Sustainable Finance -Sustainability in the Financial Industry

Commentary] Overview of Japan's GX Strategy - Toward Accelerating Green Transformation

Commentary] Current Status and Issues of Sustainable Investment

SFDR: What is the EU Sustainable Finance Disclosure Regulation? ~ESG-related Information Disclosure Requirements for Financial Products

Commentary] Alphabet Soup - Disruptions and Convergence of Sustainability Standards