INDEX

An integrated report is a document in which a company comprehensively reports on the organization's value creation process, including not only financial information but also non-financial information such as environmental, social, and governance (ESG).

The main objective of the integrated report is to provide investors and multi-stakeholders with a better understanding of the company's sustainability and long-term performance.

In this article, we would like to inform you about the current status and the latest trends of integrated reports in Japan.

Current Status of Integrated Reporting in Japan

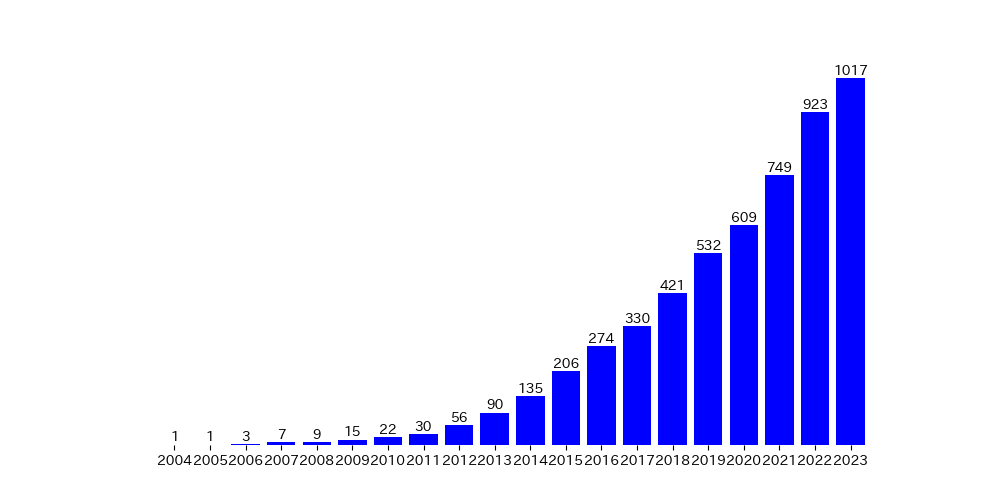

According to a survey by Edge International, the number of companies issuing integrated reports in 2023 is 1017, about 1.1 times the number of companies issuing such reports last year. Especially in recent years, the number of companies issuing such reports has been increasing rapidly.

Figure 1: Number of Companies Issuing Self-assigned Integrated Reports in Japan

(Edge International, "Trends in Integrated Reporting Supporting Sustainable Growth in Japan 2023(Compiled by the author from "The Rise of the New York Times")

As the number of issuing companies increases, so does the content.

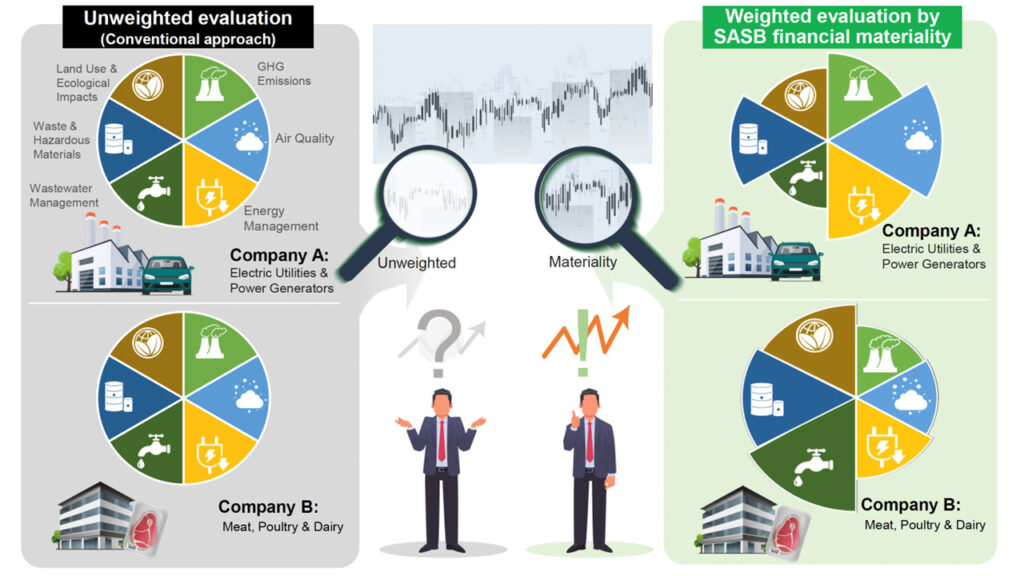

One example is the marked increase in the number of companies incorporating materiality, one of the key concepts in sustainability reporting, into their integrated reports.

Both "materiality related to corporate value," which investors pay attention to, and "materiality related to the environment and society," which multistakeholders pay attention to, have increased in the rate of disclosure in integrated reports.

There is a growing recognition that materiality disclosure is an essential element of the integrated report, and a large percentage of companies that are issuing integrated reports for the first time are now disclosing materiality.

| disclosure element | 2021 (%) | 2022 (%) |

| Disclose materiality from a corporate value perspective | 43.8 | 65.6 |

| Disclose materiality of environmental and social perspectives | 57.5 | 70.1 |

Table 1: Materiality 1 of the Integrated Report

(Edge International, "Integrated Report 2022 Study - Materiality.(Compiled by the author from "The Rise of the New York Times")

Issues of Integrated Reporting in Japan

On the other hand, there are still issues to be addressed in the integrated report.

For example, all companies mention human rights in their integrated reports. However, only a few disclose in depth an assessment of human rights risks, which is useful to investors and multistakeholders. Investors expect specific descriptions of possible risks and how to deal with the risks they face.

Disclosure of other quantitative information as indicators and targets, for example, the number of issues raised in human rights due diligence (human rights DD), would also promote investor understanding. In many cases, disclosure of materialities other than human rights is limited to introductory responses and does not go into specific details.

| Contents | With disclosure (%) | No disclosure (%) |

| SASB Reference | 19 | 81 |

| Analysis of the current situation with respect to market valuation | 30 | 70 |

| Business Portfolio Management | 59 | 41 |

| Investment Allocation | 57 | 43 |

| Understanding the cost of capital | 39 | 61 |

| Measures to address risk | 36 | 64 |

| TCFD Scenario Analysis | 74 | 26 |

| Risks, opportunities, and impacts of natural capital | 32 | 68 |

| Relationship between human resource strategy and management strategy | 68 | 32 |

| Human Rights Risk Assessment | 26 | 74 |

| Corporate Value Materiality | 86 | 14 |

| Materiality KPIs | 63 | 37 |

| intellectual property | 48 | 52 |

| DX | 67 | 33 |

| Activities of the Sustainability Committee and Other Committees | 51 | 49 |

| Activities of the Board of Directors | 64 | 36 |

| Skill sets and management strategies | 35 | 65 |

| Status of Dialogue with Shareholders and Investors | 71 | 29 |

Table 2: Materiality 2 of the Integrated Report

(Edge International, "Creating Corporate Value through Integrated Reporting: The State of Integrated Reporting in Japan 2023(Compiled by the author from "The Rise of the New York Times")

While more companies are issuing integrated reports, the lack of a standardized framework in Japan has resulted in variations in the quality and scope of reporting among companies.

Necessity of English Disclosure

And, with regard to integrated reports and other disclosures, a hot topic these days is disclosure in English.

Starting in March 2025, the Tokyo Stock Exchange will require companies listed on the prime market to disclose material information in English as well as Japanese. Overseas investors use materials disclosed by companies in English as their primary source of information when making investment decisions. Therefore, the publication of English-language versions of materials will increase the likelihood of receiving investment from both Japanese and foreign investors.

However, foreign investors are not satisfied with the current English disclosure. There are two main reasons for this.

The first is that it is not disclosed in English in the first place, or even if it is disclosed in English, the amount of information is less than the Japanese version.

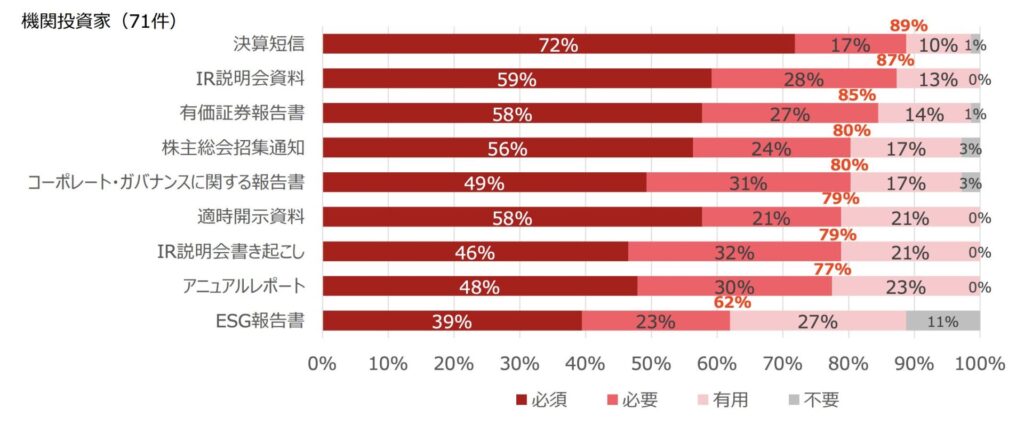

Figure 2-1: Materials Requiring English Disclosure

(Source: JPX) Results of Questionnaire Survey of Foreign Investors on English Disclosure (Summary Version))

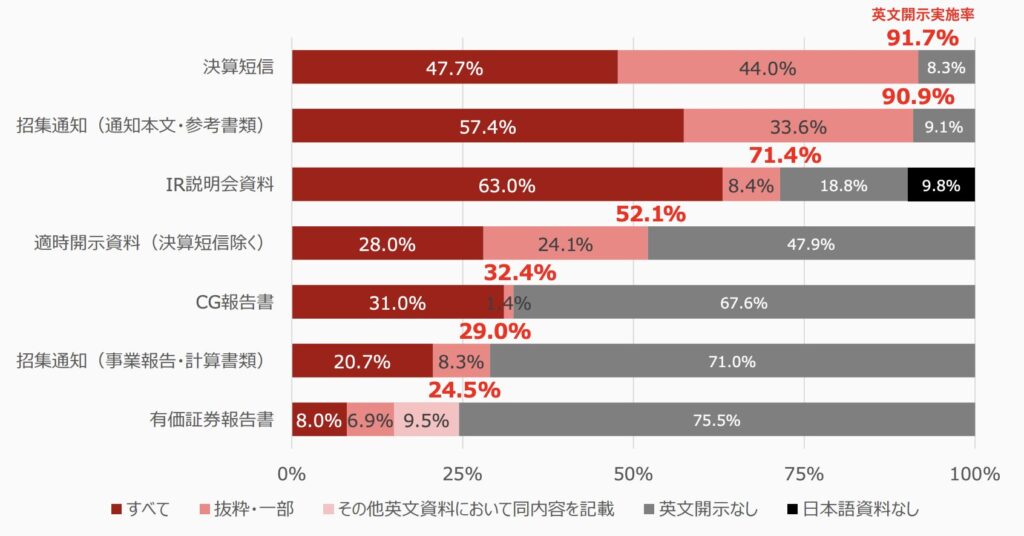

Figure 2-2: Scope of Prime Market English Disclosure

(Source: JPX) English Disclosure Survey Report)

Most foreign investors require or require that all materials be disclosed in English.

However, only about 60% at most disclose everything in English, indicating that they do not meet the demand of foreign investors.

The second reason is that disclosure of the English version is slower than the Japanese version.

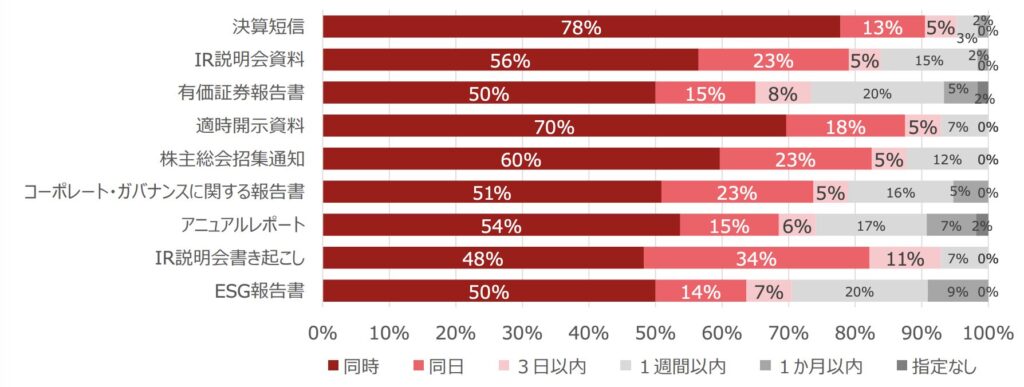

Figure 3-1: When English Disclosure is Required

(Source: JPX) Results of Questionnaire Survey of Foreign Investors on English Disclosure (Summary Version))

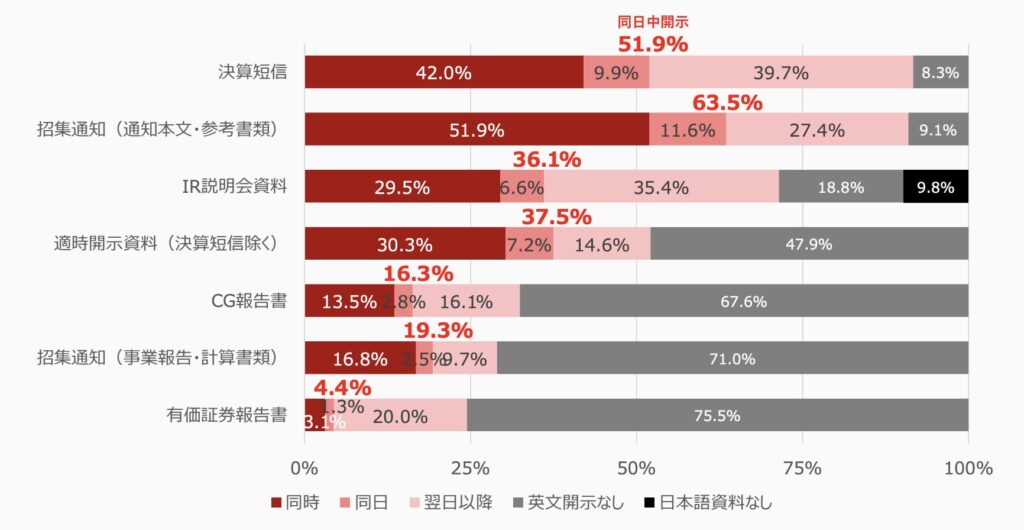

Figure 3-2: Prime Market English Disclosure Timing

(Source: JPX) English Disclosure Survey Report)

While many foreign investors are requesting disclosure on the same day, many of them are disclosing their information on the following day or later. This also shows that we have not been able to meet investors' expectations.

Insufficient English disclosure makes it difficult for overseas investors to obtain real-time information, putting them at a disadvantage compared to Japanese investors. As a result, overseas investors will not be able to secure sufficient time to make investment decisions, which may lead to withdrawal from investment in many cases.

Conclusion

Integrated reporting has become increasingly important in recent years as interest in ESG has grown.

In order to provide a deeper understanding of a company's sustainability and long-term performance, it is important to refine the content of the integrated report and clearly communicate the company's sustainable value creation process.

Furthermore, more accurate and prompt English-language disclosure will appeal to foreign investors. It can be said that English-language disclosure is essential for expanding the global investor base.

At aiESG, we have developed a generative AI toIntegrated report evaluation service "aiESG for IRWe provide the following services. In this service, we determine the consistency between ESG-related social demands and the integrated report of the company to be evaluated, and score it objectively on multiple items. Please contact us if your company is having trouble with its integrated report.

Contact us:

https://aiesg.co.jp/contact/

reference

Corporate Value Reporting Lab "Trends in Integrated Reporting Supporting Sustainable Growth in Japan 2023".

https://www.edge-intl.co.jp/wp-content/themes/edge-intl/assets/pdf/01_reserch/02/list2023_J.pdf

Edge International, "Integrated Report 2022 Survey - Materiality.

https://www.edge-intl.co.jp/wp-content/themes/edge-intl/assets/pdf/01_reserch/03/s2022_05.pdf

Edge International, Creating Corporate Value through Integrated Reporting: The State of Integrated Reporting in Japan 2023

https://www.edge-intl.co.jp/integratedreporting2023/

Financial Services Agency, "Good Practices for Disclosure of Descriptive Information 2023."

https://www.fsa.go.jp/topics/news/r5/singi/20231227/01.pdf

Tokyo Stock Exchange, "Results of Questionnaire Survey of Foreign Investors on English Disclosure (Summary Version)".

https://www.jpx.co.jp/equities/listed-co/disclosure-gate/survey-reports/nlsgeu000005qpys-att/jr4eth00000015wg.pdf

Tokyo Stock Exchange, "English Disclosure Survey Report".

https://www.jpx.co.jp/equities/listed-co/disclosure-gate/survey-reports/nlsgeu000005qpys-att/bkk2ed0000006oi6.pdf

Related page

Report List : Regulations/Standards

https://aiesg.co.jp/topics/report/tag/基準-規制/

aiESG launches "aiESG for IR," an integrated report evaluation service using generative AI.

~ Scoring the consistency of the Integrated Report with global ESG requirements~.

https://aiesg.co.jp/topics/news/aiesg-for-ir/

[Commentary] Alphabet soup

〜˜Sustainability Standards in Disarray and Convergence

https://aiesg.co.jp/topics/report/2301226_alphabet-soup/

Explanation] What is "materiality" in sustainability reporting?

https://aiesg.co.jp/topics/report/240201_materiality/