INDEX

Corporate activities and sustainability have become inextricably linked in recent years. In particular, the European Union (EU) adopted the Corporate Sustainability Reporting Directive (CSRD) at the end of 2023, which mandates transparent and comprehensive reporting of corporate sustainability initiatives.

And the European Sustainability Reporting Standard (ESRS) has emerged as a specific reporting standard for compliance with this CSRD.

The ESRS is a set of guidelines that defines how companies should report material information on ESG (Environmental, Social and Governance) issues. In the future, compliance with the ESRS will be essential for companies operating in the EU market.

As of December 2023, a blog post on ESRS is available at aiESG.

Commentary] Overview of ESRS (European Sustainability Reporting Standards)

This paper will summarize the outline of the ESRS, followed by the latest information and its impact on Japanese companies. As sustainability initiatives continue to grow in importance, understanding the ESRS will be a key point for EU companies.

We have also written articles in the past about CSRD, which directs the ESRS as a standard, and a better understanding of CSRD will lead to a better understanding of the ESRS. Please refer to this article as well.

CSRD: The EU Sustainability Reporting Standard Just Before It Enters into Force: The Impact on Japanese Companies

CSRD: The European Union's Corporate Sustainability Reporting Directive Latest Information

Table of Contents

1. overview of ESRS

Summary of ESRS Requirements

Relationship between ESRS and CSRD

2. Current Situation Surrounding the ESRS

Implementation

Sectoral Requirements of the ESRS

About ESRS for SMEs: Overview

Current Status of ESRS-LSME

ESRS for non-EU companies

3. A step toward globalization: working with IFRS

4. Response by Japanese Companies

5. summary

1. overview of ESRS

The ESRS is a reporting standard based on the Corporate Sustainability Reporting Directive (CSRD), which requires companies to report comprehensive sustainability-related information.

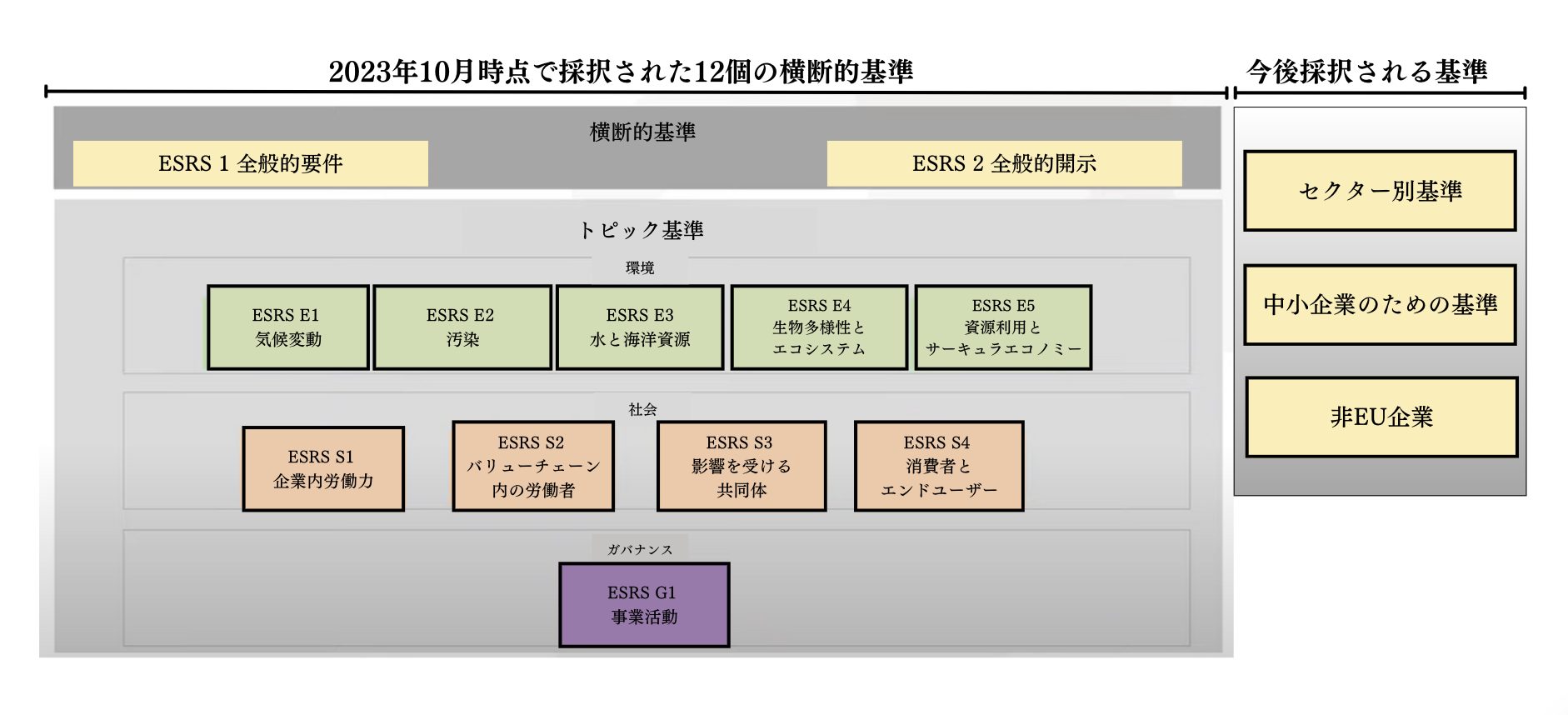

It consists of 12 reporting criteria related to ESG (Environmental, Social and Governance) and is intended to provide more detailed and clear reporting of a company's sustainability efforts.

With the introduction of this standard, companies will be able to more effectively measure, manage, and report on their sustainability performance. Investors and other stakeholders will also be able to better understand and evaluate a company's sustainability efforts.

The ESRS applies to all companies operating in the EU market, not just EU companies (meaning those headquartered in the EU). As sustainability initiatives become increasingly important to the competitiveness of companies in the future, compliance with the ESRS will become an essential issue for companies.

Summary of ESRS Requirements

Figure 1: ESRS overview diagram

(Translated and revised to the latest version of EFRAG agency presentation materials:https://www.youtube.com/watch?v=a1pdAO62bH0)

The 12 reporting criteria are categorized as shown in Figure 1.

.

ESRS E1: Climate Change

ESRS E2: Pollution

ESRS E3: Water and Marine Resources

ESRS E4: Biodiversity and Ecosystems

ESRS E5: Resource Use and Circular Economy

.

ESRS S1: In-house labor force

ESRS S2: Workers in the value chain

ESRS S3: Affected Communities

ESRS S4: Consumers and end users

.

ESRS G1: Business Activities

These standards apply to all covered entities, and companies subject to the corporate conditions specified by the CSRD must comply with the requirements of the ESRS.

On the other hand, "sector-specific criteria," "criteria for SMEs," and "criteria for non-EU companies" will be discussed and set separately.

Relationship between ESRS and CSRD

Sustainability reports under the CSRD must comply with the ESRS, which is separately provided for in the Commission's Delegated Legislation.

The ESRS, a sustainability standard based on the CSRD, is being developed by the European Financial Reporting Advisory Group (EFRAG).ESRS 1stis in effect.

2. current situation surrounding ESRS

Implementation

The full application of the ESRS is mandatory in relation to the application of the CSRD to some large groups of companies in the EU from 2024 (the report will be issued in 2025).

| Eligibility: Satisfy at least two of the three requirements for two consecutive fiscal years.*Microenterprises are exempted if they meet two or more of the following requirements | Operation start date | |

| NFRD-eligible companies (large companies) | Listed on EU regulated markets with more than 500 employees and banks, etc. | From January 1, 2024 |

| large-scale | More than 250 employees OR net sales of more than EUR 40 million OR balance sheet total (total assets) of more than EUR 20 million | From January 1, 2025 |

| mid-scale | Less than or equal to 250 employees OR less than or equal to 40 million euro in total sales OR less than or equal to 20 million euro in total balance sheet (total assets) | From January 1, 2026 |

| small scale | Less than 50 employees OR less than 8 million euro in total sales OR less than 4 million euro in total balance sheet (total assets) | From January 1, 2026 |

| Microenterprises (Exemptions) | Less than 10 employees OR less than 700,000 euro in sales OR less than 350,000 euro in total balance sheet (total assets) | No plan to apply (if conditions are met) |

| Non-EU Companies | Prerequisite: Non-EU ultimate parent company's total sales in the EU exceeded 150 million EUR for the past two consecutive fiscal years & Additional conditions (either one of which must be satisfied): (1) EU subsidiary is a large company or listed company OR (2) EU branch's total sales in the EU exceed 40 million EUR | From January 1, 2028 |

As Table 1 shows, all large EU companies will be covered from January 1, 2025. Medium and smaller sized companies and non-EU companies (companies outside the EU) will be covered after that date.

Covered companies are under pressure to comply with the ESRS in accordance with the application of the CSRD. However, against the background of the still ongoing debate on the creation of sectoral requirements, the European Parliament has decided to adopt the sectoral requirementsDecided to postpone for two yearsI am doing this.

Sectoral Requirements of the ESRS

The sectoral requirements of the ESRS were to be fully applied to all relevant sectors beginning in 2024. However, as of March 2023, the Commission decided to delay the application of the ESRS to certain sectors, and the sectoral requirements were scheduled to be adopted by the end of June 2024.

In May 2024, the European Commission decided to postpone it for another two years, so that the sectoral requirements will be finalized as of 2026. This means that companies (especially for EU companies that will be subject to the CSRD by 2024~2026) are expected to focus on the general standards of the ESRS and the crosscutting general disclosure requirements.

| sector | Current Phase | Next Steps | Anticipated start date for the next phase |

| Oil and Gas | Initial Draft - Approval | SRB Discussion (TBD*) | undecided |

| Coal, quarrying and mining | Initial Draft - Approval | SRB Discussion (TBD*) | undecided |

| road transport | Initial draft - under verification | undecided | undecided |

| Agriculture, Livestock, Fishery | Initial draft - in preparation | undecided | undecided |

| automobile | Initial draft - under investigation | undecided | undecided |

| Energy production and utilities | Initial draft - under investigation | undecided | undecided |

| Food & Beverage | Initial draft - under investigation | undecided | undecided |

| Textiles, accessories, footwear and jewelry | Initial draft - under investigation | undecided | undecided |

About ESRS for SMEs: Overview

It is clear that the ESRS for listed SMEs ("ESRS-LSME") will be more simplified than the standard for large companies. As an expected timeline, the expected effective date is January 1, 2026, and an opt-out instrument will be reserved for listed SMEs (companies subject to the CSRD) for a period of two years.

This means that from the effective date of January 1, 2026 until December 31, 2028, SMEs subject to the CSRD can choose not to comply with the relevant ESRS-LSME. However, after January 1, 2029, all eligible companies must be ESRS-compliant.

Current Status of ESRS-LSME

The EFRAG (European Financial Reporting Advisory Group), which administers the ESRS, has started public discussions on the ESRS-LSME through a draft publication as of January 22, 2024. The collection of opinions on the ESRS-LSME ended on May 21, 2024, but we can confirm that the process is now in the coordination phase through a questionnaire survey of various organizations.

At the time of writing (July 2024), no further developments have been confirmed, but EFRAG has indicated that discussions are underway with the aim of having the agreement enter into force in 2026.

ESRS for Non-EU Companies

The European Parliament has indicated its intention to develop supplemental standards for non-EU companies (companies outside the EU). Originally scheduled to publish this supplemental information here by June 30, 2024, the European Parliament has announced that it will postpone its publication until June 30, 2026. At the latest, in 2029, non-EU companies will be forced to publish their sustainability reports in line with the application of the CSRD.

The European Parliament has issued a statement that it will help deferrals to focus on crosscutting standards. It is important for Japanese companies to start thinking about how to respond to the crosscutting standards.

3. a step toward globalization: linkage with IFRS

EFRAG is working with the International Sustainability Standards Board (ISSB) to help ensure consistency regarding sustainability reporting standards. This is aimed at reducing the burden on companies through enhanced reconciliation between both the ESRS and the ISSB Sustainability Standards.

In May 2024, the IFRS Foundation and EFRAG will work together to promote alignment of ISSB and ESRS standards.Interoperability GuidanceThe new standards are published in the following table. This is intended to eliminate the need for companies to address multiple standards separately, primarily by considering the following responses

Common definitions and terminology: Ensure consistency in the use and definition of terms in both standards.

Harmonization of requirements: Considering the specific needs of each standard, align the requirements with the scope of the standard as much as possible

Modular Approach: Allows companies to apply both standards in a complementary manner and avoids duplication of reporting efforts.

Although the CSRD/ESRS covers the European region, it can be expected that the internationalization and integration of regulations will progress in the future by linking with sustainability reporting standards in other regions.

4. response of japanese companies

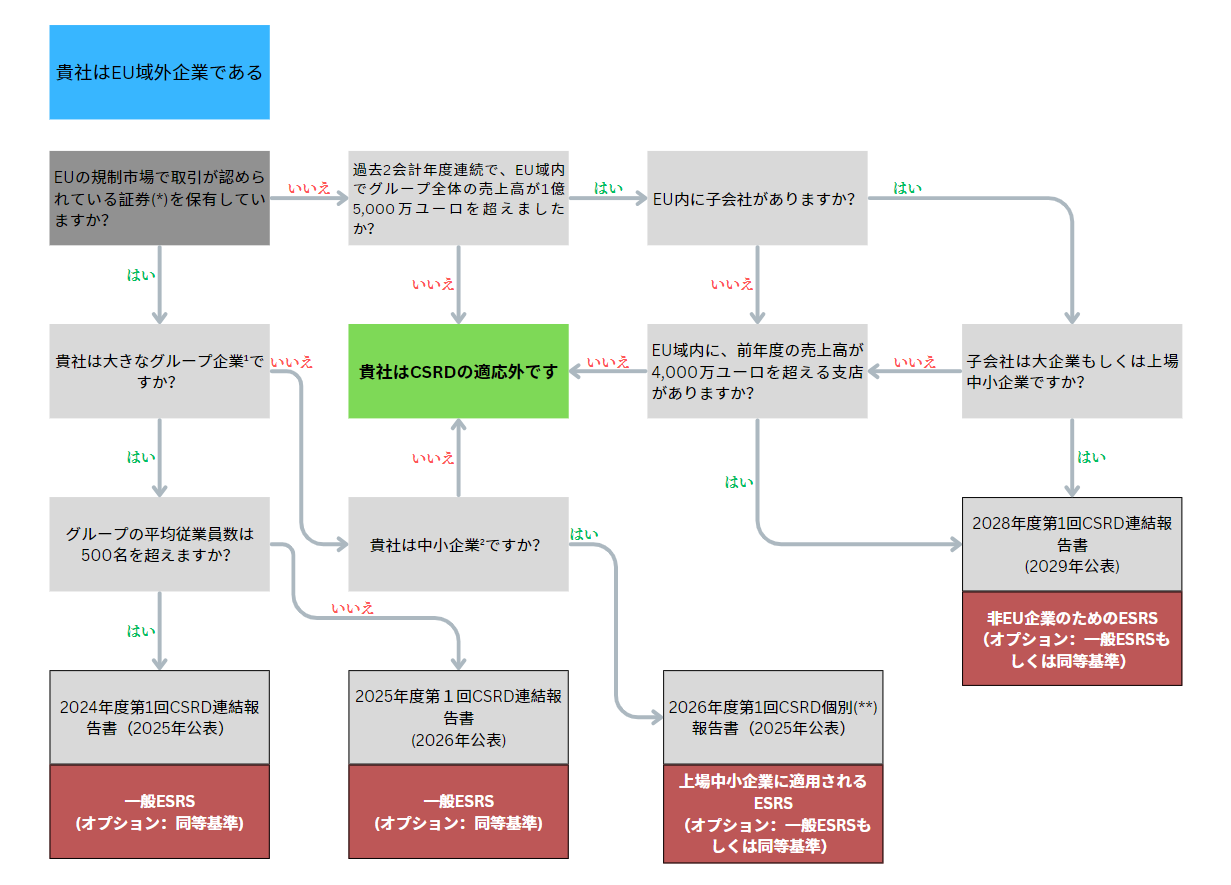

In order for Japanese companies to take the necessary actions, it is first necessary to confirm the conditions for applying CSRD to their own companies.

(*): All classes of securities (shares, bonds, etc.) transferable on the capital market. If only debt securities are to be issued, the par value per unit must be less than EUR 100,000. Otherwise, answer "NO" to this question.

(**): In this case, the sustainability report is prepared at the level of the non-EU parent company excluding its subsidiaries (i.e., on a stand-alone basis, not on a consolidated basis).

¹: 2 out of 3: average of at least 250 employees, net sales of at least EUR 40 million, balance sheet total of at least EUR 20 million

²:2 out of 3: 10 < average number of employees ≤ 250, 700,000 EUR < sales ≤ 40 million EUR, 350,000 EUR < balance sheet total ≤ 20 million EUR

Figure 2: Flow chart of actions to be taken by Japanese companies (Author's translation of material from mazars)

(https://www.forvismazars.com/group/en/content/download/1151519/58967343 )

The Japan External Trade Organization (JETRO) has summarized the application process as follows in its "Practical Guidance on ESRS Application for Japanese Companies Subject to CSRD (p.15)" published as of May 2024. This document summarizes mainly the initial to mid-term stages of the application process, but it also confirms the necessity of establishing a cross-departmental cooperative system within Japanese companies.

The Japan External Trade Organization (JETRO) has summarized the application process as follows in its "Practical Guidance on ESRS Application for Japanese Companies Subject to CSRD (p.15)" published as of May 2024. This document summarizes mainly the initial to mid-term stages of the application process, but it also confirms the necessity of establishing a cross-departmental cooperative system within Japanese companies.

| stage | What to do at each stage of the process |

| 1. understanding of the system itself | This is the stage in which the company deepens its understanding of the "effective date" and "scope" of the CSRD, as well as the specific disclosure requirements of the ESRS. Q. Are there any subsidiaries or other entities within the consolidated group that are subject to CSRD? Q. Will the Japanese parent company or the EU subsidiary take the lead in the response? Q. Who is in charge? Thus, it is required to recognize and agree among departments and companies on the schedule for application and the establishment of mid-term goals for the purpose of measuring progress. |

| 2. gap analysis of in-house sustainability information (from a bird's eye view) | The ESRS requires public disclosure of quantitative and qualitative indicators. Therefore, you need to understand the current sustainability reporting status of your company. Non-financial information disclosed externally by the Japanese parent company (e.g., sustainability reports, integrated reports, etc.) Internal rules for sustainability items Results of compliance with relevant regulations in each EU Member State and sector Sustainability item questionnaires from suppliers Results of questionnaires/interviews with internal stakeholders of the company, etc. Knowing and understanding these factors will assist in a high-level gap analysis (clarification of what is done and not done) and will allow the company to confirm the degree of difficulty in adapting to ESRS disclosure requirements. At this stage, a rough judgment is fine. |

| 3. double materiality assessment | Double materiality is a concept that assumes that the "materiality of the impact of non-financial information" at the time the report is prepared has two influences: i. the impact it would have on corporate management (for investors) and ii. the impact it would have on social and environmental aspects (for a larger group of stakeholders). Through the gap analysis, it is expected that you will identify items that are important to your company and identify the sustainability items, ESRS disclosure requirements, and data points that are subject to disclosure. In addition, the double materiality assessment process is required to be disclosed in ESRS2, so it is important to describe it at this stage. In addition, tentative discussions are required regarding third-party guarantee providers and double materiality assessments. |

| 4. more detailed gap analysis | It is expected that a more detailed gap analysis will be conducted on the "topics identified as important" through the double materiality assessment. At this stage, it is important to confirm the analysis through the following checklist. Has a policy been developed? Is the content of the policy comprehensive and compatible with the disclosure requirements of the ESRS standards? Are the figures for disclosure aggregated? How are the figures aggregated? Is the method of repair appropriate in light of ESRS standards? Are the goals defined? Are the goals sufficiently detailed and clear? |

| 5. roadmap development | Based on the results of a detailed gap analysis, a plan (roadmap) for ESRS compliance will be developed, including the responsible departments and persons, timing of implementation, priorities, etc. |

5. summary

The ESRS is a sustainability reporting standard that applies to all companies operating in the EU market, not just those in the EU.

Japanese companies doing a certain amount of business in the EU will also be subject to the CSRD/ESRS from 2028 at the latest. Therefore, it will be important to go through a coping plan as early as possible to prepare for a smooth transition to the ESRS.

The ESRS and sectoral requirements for SMEs are still under discussion and are expected to enter into force in 2026. This means that there is more room for EU companies to focus on crosscutting standards.

The ESRS plays an important role in making a company's sustainability efforts transparent and increasing stakeholder understanding.

As sustainability initiatives become increasingly important in the future, an understanding of the ESRS cannot be ignored by Japanese companies.

aiESG offers ESG analysis services for the supply chain of manufactured goods, and we encourage any company interested in applying the ESRS or other international standards to contact us with any questions they may have.

Contact us:

https://aiesg.co.jp/contact/

*Related Article*.

CSRD: The EU Sustainability Reporting Standard Just Before It Enters into Force: The Impact on Japanese Companies

CSRD: The European Union's Corporate Sustainability Reporting Directive Latest Information

Commentary] Overview of ESRS (European Sustainability Reporting Standards)

Commentary] Alphabet Soup: The Disruptions and Convergence of Sustainability Standards