INDEX

Since 2022, the European Financial Reporting Advisory Group (EFRAG) and the Task Force on Nature-related Financial Disclosures (TNFD) have collaborated in the development of the European Sustainability Reporting Standard (ESRS) environmental standard and TNFD recommendations and guidance In December 2023, the two organizations signed a Memorandum of Understanding (MoU) on cooperation ( MoU) was signed, highlighting the importance of advancing corporate sustainability assessment and reporting to address nature-related issues.

This issue will focus on the Correspondence Map, a mapping table released in June 2024 that shows the correspondence between the TNFD and ESRS disclosure standards.

TNFD-ESRS correspondence mapping

About EFRAG

EFRAG is a private organization established under the auspices of the European Commission and plays a key role in the development and approval of financial reporting standards in the European Union.

In its sustainability reporting activities, EFRAG supports the effective implementation of the ESRS by providing the European Commission with a draft ESRS developed under a rigorous process. For more information on the ESRS, please refer to our previously published article.

Commentary] Overview of ESRS (European Sustainability Reporting Standards)

About TNFD

published by our company.articleAs mentioned in Section 2.1, the purpose of the Framework is to design and develop a global risk management and disclosure framework for reporting and acting on nature-related issues.

Explanation] What is TNFD? A new bridge between finance and the natural environment

The TNFD aims to identify and disclose the impact of business on the natural environment and biodiversity, and conversely, the risks to which companies are exposed from changes in nature, in order to clarify the risks to the company and to receive proper evaluation from investors and society.

Correspondence Map Objectives

The Correspondence Map is a detailed mapping of the ESRS to the TNFD disclosure recommendations and indicators. This will reduce the burden on disclosure preparers. On the other hand, the mapping does not address indicators that are disclosure requirements in the ESRS but not in the TNFD, so separate consideration is required for disclosure in accordance with ESRS requirements.

Mapping Overview

| TNFD | ESRS | |

| Concepts and Definitions | Disclosure of significant nature-related impacts, risks, opportunities, and dependence on nature is recommended. Both approaches are based on a common understanding that the degradation of nature, ecosystems, and biodiversity poses risks to stakeholders, including companies and investors. | |

| materiality approach | Not limited to either single and double materiality. | Requires disclosure based on double materiality. Recognizes nature as a "silent stakeholder". |

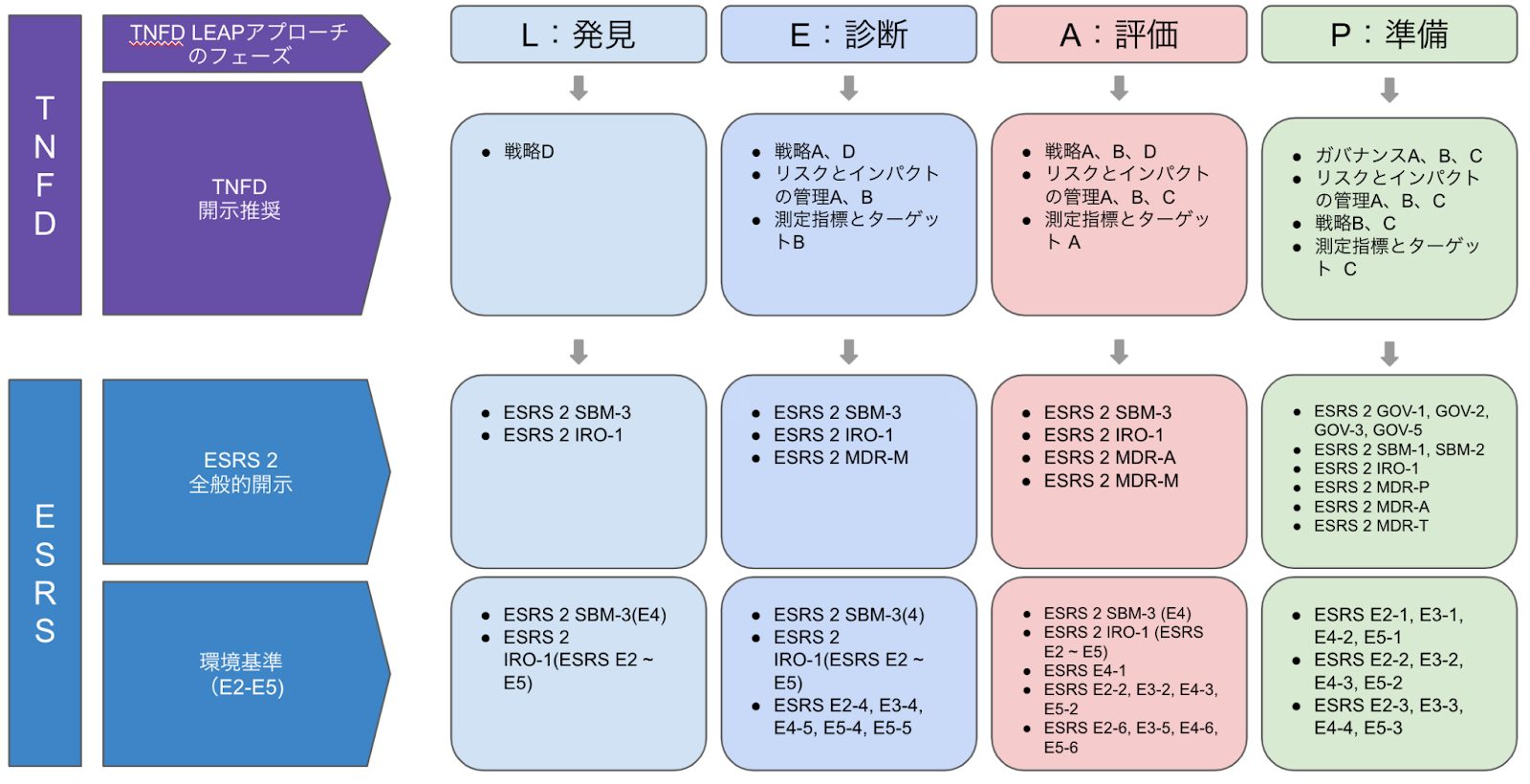

| LEAP approach (see Figure 1) | Developed the LEAP approach as a method for identifying and assessing nature-related issues. Recommended the LEAP approach as clear and accessible guidance for identifying, assessing, managing, and disclosing nature-related issues from stakeholders. | The LEAP approach can be used to assess the importance of pollution, water, biodiversity and ecosystems, and the circular economy (other than climate change), and is mentioned as a tool to use when assessing the importance of the environment (other than climate change) in your upstream and downstream value chains. |

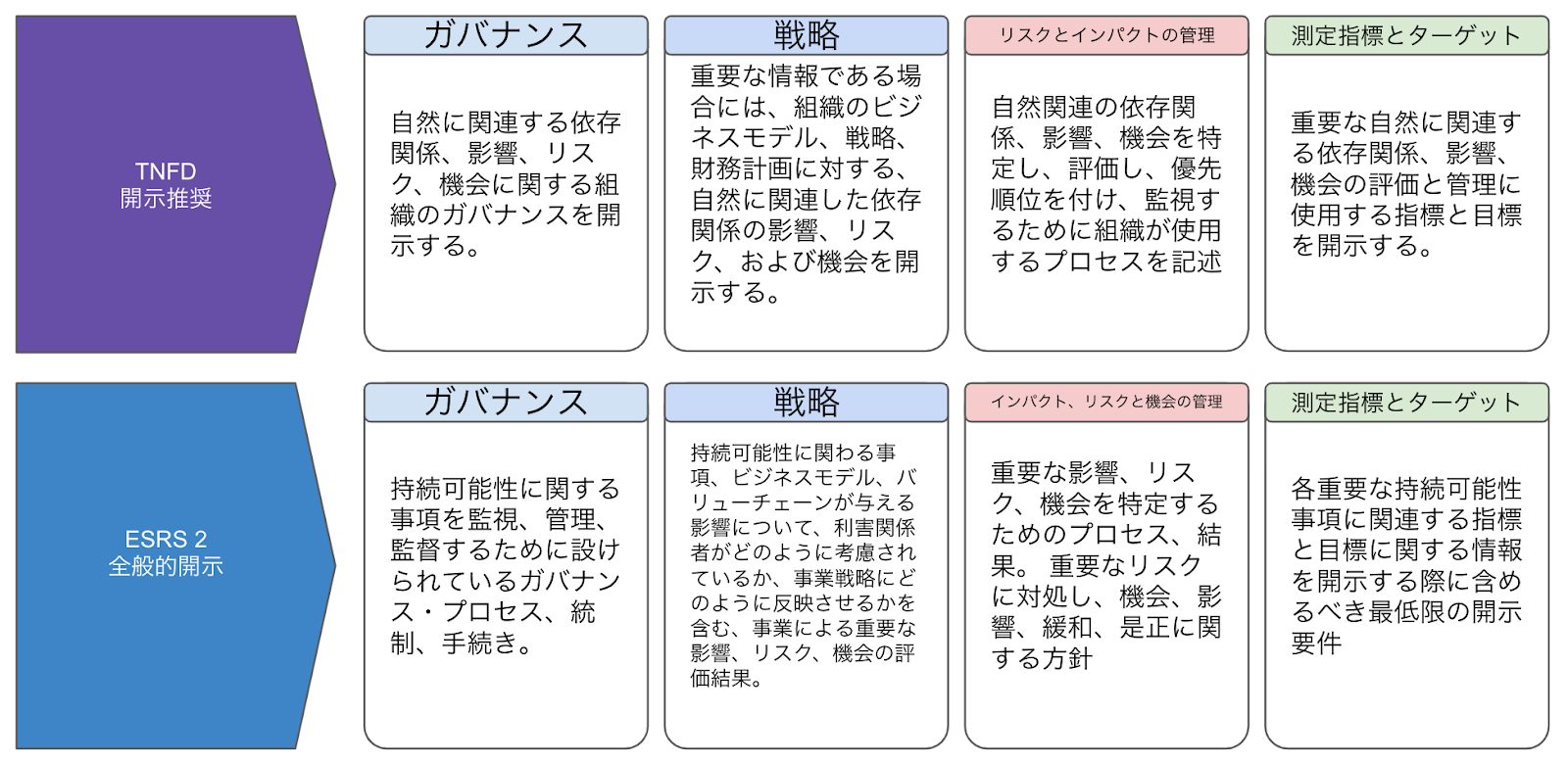

| Pillars of the report (see Figure 2) | Organized based on the four disclosure pillars of the TCFD (Governance, Strategy, Risk Management, and Metrics and Objectives), which are also adopted in the ISSB's IFRS standards. | |

| Recommended Disclosures and Indicators | All 14 TNFD recommended disclosures are addressed in the ESRS; there is strong consistency between the TNFD's key global disclosure indicators and the relevant indicators in the ESRS. | |

| Nature and Biodiversity | Defines nature as the natural world with an emphasis on biodiversity, including people and their interactions. Covers four natural areas: land, oceans, freshwater, and atmosphere. Clearly distinguishes between the concepts of "nature" and "biodiversity." | It covers four natural areas: land, oceans, freshwater, and atmosphere. The term "biodiversity" refers to the diversity of living organisms throughout the above four natural areas. |

| Impact and Dependence | Understanding natural dependencies and impacts is a prerequisite to understanding the risks and opportunities to the business. It is recommended that dependencies and impacts in the supply chain be identified and measured. Identify how the company's activities affect nature. | |

| Risks and Opportunities | It distinguishes between physical risks (which can be divided into acute and chronic), transition risks (including policy, market, technology, and reputational risks), and systemic risks. The significance of risks and opportunities is assessed based on a combination of the likelihood of occurrence and the magnitude of the expected financial effect on the organization. | |

Figure 1: Correspondence between TNFD and the LEAP approach by ESRS

The four environmental application requirements of the ESRS state that a materiality assessment can be performed using the LEAP methodology.

(Source:TNFD-ESRS correspondence mapping(Prepared by aiESG based on)

Figure 2: Four pillars with TNFD and ESRS

Both TNFD and CSRD follow the four pillars of TCFD, while double materiality is applicable.

(Source:TNFD-ESRS correspondence mapping(Prepared by aiESG based on)

TNFD has also issued sector-specific guidance in response to the 30% increase in the number of reporting companies since January 2024. This guidance includes sector-specific disclosure indicators. The sectors covered are aquaculture, biotechnology and pharmaceuticals, chemicals, power and power generation, food and agriculture, forestry and paper, metals and mining, and oil and gas. The guidelines also include examples of sector-specific value chains and ENCORE risk assessments to guide disclosure.

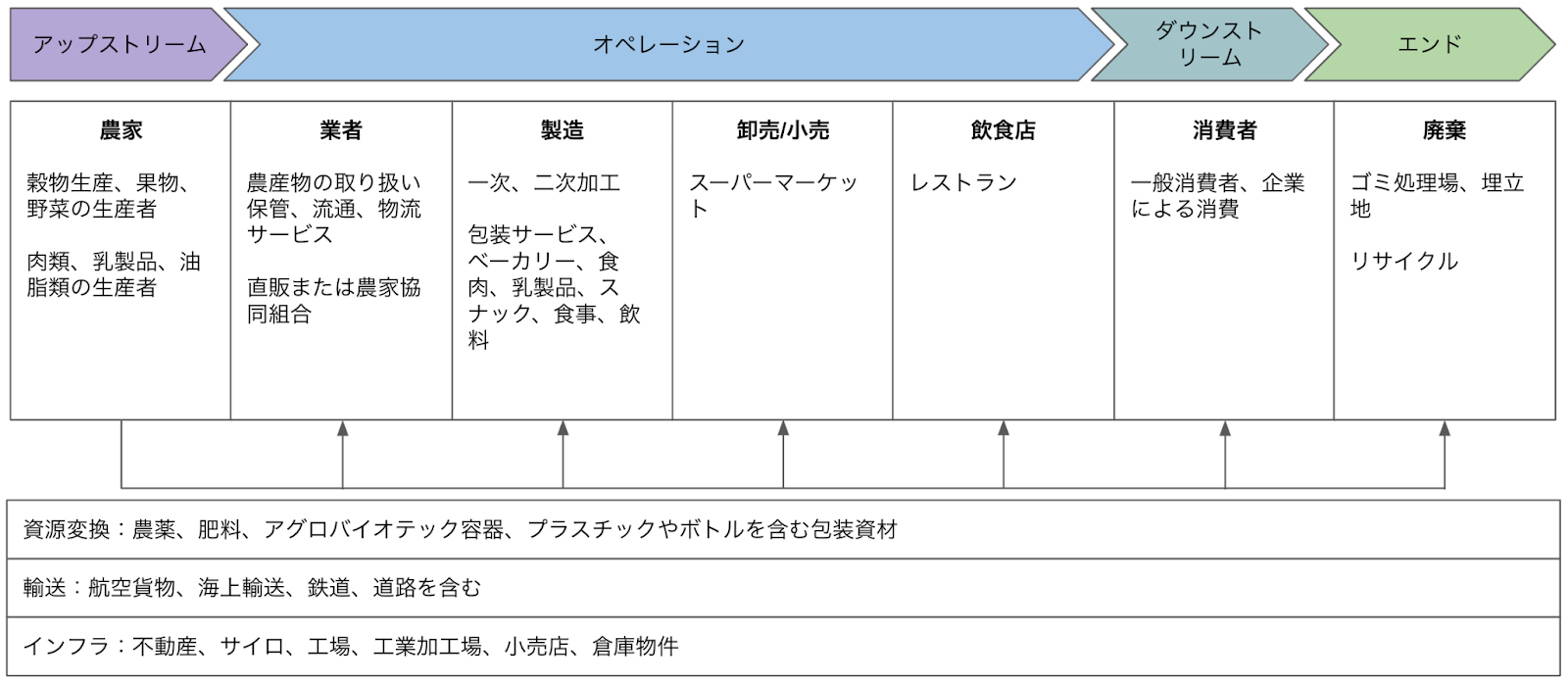

Figure 3: Examples of Value Chains in the Food and Agriculture Sector

(Source:Additional-Sector-Guidance-Food-and-Agri(Prepared by aiESG based on)

TNFD Disclosure in Japanese Companies

TNFD early adopter companies were announced in January 2024.

[Explanation] TNFD early adopters and their characteristics

The TNFD disclosure is expected to be enhanced in terms of content in the future. In the past aiESG looked at Kirin Holdings' environmental report for the year 2023, but the latest version for 2024 has more extensive disclosures.

Commentary] TNFD Disclosure Status and Issues

Kirin Group Environmental Report 2024

In the LEAP approach, a description of the scoping phase has been added to the existing analysis, and a method has been adopted to select approach targets based on the results of a comprehensive evaluation of dependency and impact. In the indicators and targets section, disclosure of Scope 3 and TNFD global core indicators, which are considered difficult to disclose, has also been added, indicating that the data base for measuring these figures is now in place. As more and more companies continue to enhance their disclosure, the level of disclosure by Japanese companies as a whole will be raised, and comparability among companies will be enhanced.

aiESG provides support from the basics of TNFD to the actual disclosure of non-financial information, so if your company is having trouble with TNFD, please contact us.

Contact us:

https://aiesg.co.jp/contact/

Related page

Report List : Regulations/Standards

Explanation] What is TNFD? A new bridge between finance and the natural environment

Commentary] TNFD Disclosure Status and Issues

Commentary] Key Points of the TNFD Final Recommendations and the Responses Required of Companies

Commentary] Nature Positive : Realizing a Society that Can Live in Harmony with Nature - About OECM and Sites for Coexistence with Nature

[Explanation] TNFD early adopters and their characteristics

Commentary] Non-Financial Capital: Trends in Human and Natural Capital - Disclosure Regulations and Guidelines in Japan and Overseas

Commentary] ISSB's Latest Trends - Biodiversity and Human Capital are now under Consideration.

Commentary] Alphabet Soup - Disruptions and Convergence of Sustainability Standards