INDEX

(Head office: Hakata-ku, Fukuoka; Representative Director: Shunsuke Managi; hereafter "aiESG"), a Kyushu University-launched startup that conducts quantitative ESG assessments, has conducted an ESG risk analysis of the Norinchukin Bank (Head office: Otemachi, Chiyoda-ku, Tokyo; Representative Director: Kazuto Oku) portfolio, considering the supply chain of its investee companies. The results of the ESG risk analysis were as follows. As a result, it was confirmed that investments and loans to Japanese packaged food and meat processing companies have an impact on land use and water impacts by the U.S. agricultural sector.

The Norinchukin Bank ".Climate & Nature Report 2024The analysis presented in the "GICS: Food and Related Sectors" visualizes risks such as GHG emissions, water footprint*, human rights risks, etc. for the food-related sector (GICS: Living Essentials Sector).

*Water Footprint: Amount of water consumed or polluted directly or indirectly throughout its life cycle, including production, processing, and distribution.

Analysis by aiESG

P53-55 Analysis considering the value chain of the investee

P75 Human Rights Risks in the Value Chain

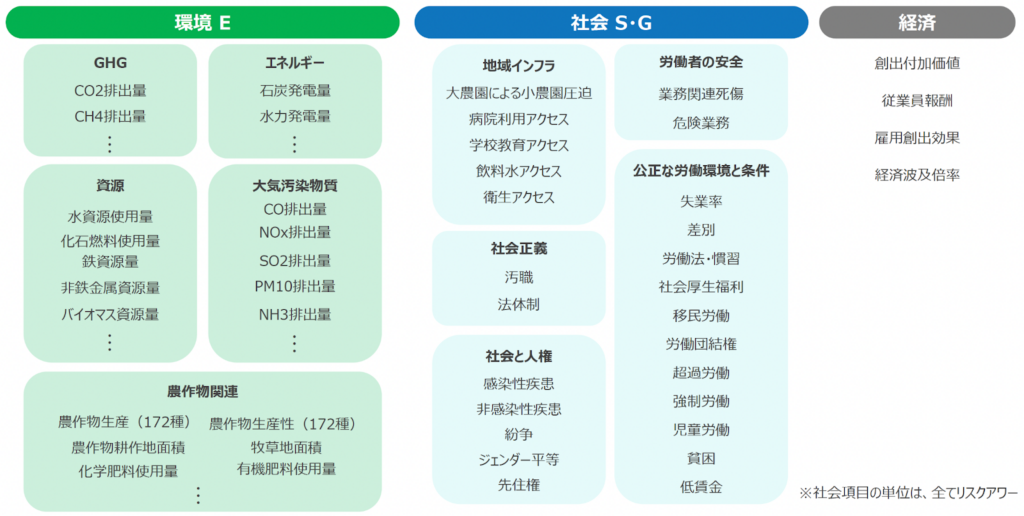

aiESG has established a method that traverses multiple layers of sectors from downstream to upstream in supply chain analysis using ESG indicators and statistical data, and evaluates the cumulative environmental, water, human rights, and other impacts upstream in the value chain, starting from the sector under analysis. The method is based on the sector under analysis.

Please feel free to contact us if you are facing challenges in visualizing nature-related risks in the value chain of your investment or portfolio companies, and proposing measures and prioritization for nature positivity based on such visualization.

Inquire about aiESG services:

https://aiesg.co.jp/contact/

Background and Analysis Results

The importance of the value chain is strongly emphasized in the disclosure recommendations of the Task Force on Nature-related Financial Disclosures (TNFD), which was launched in June 2021 with the approval of the G7 Finance Ministers.

By identifying nature-related impacts not only on the direct operations of the investee, but also on the value chain of the investee, it is expected that the nature-related risks and opportunities of the investee that companies can identify will be more accurate.

However, given that currently only a limited number of companies make disclosures based on TNFD recommendations and publish nature-related indicators, and the available data is limited, the Norinchukin Bank has established a supply chain analysis of nature-related risks in the value chain using ESG indicators and statistical data. We attempted to conduct the analysis in collaboration with aiESG.

This analysis confirms that investments in Japanese packaged food and meat processing companies have an impact on land use and water consumption by the U.S. agricultural sector.

This is expected to bring a new perspective to the initiatives promoted by the Norinchukin Bank based on the TCFD and TNFD recommendations, and to be used in dialogue with the investment and loan recipients regarding measures and priority setting for nature positivity.

For more information, please see the Climate & Nature Report 2024 published by the Norinchukin Bank in March 2024.

Climate & Nature Report 2024 (corresponding pages: P53-55, P75))

https://www.nochubank.or.jp/sustainability/backnumber/pdf/2024/climate_nature.pdf

What is aiESG, a product-level ESG analysis service?

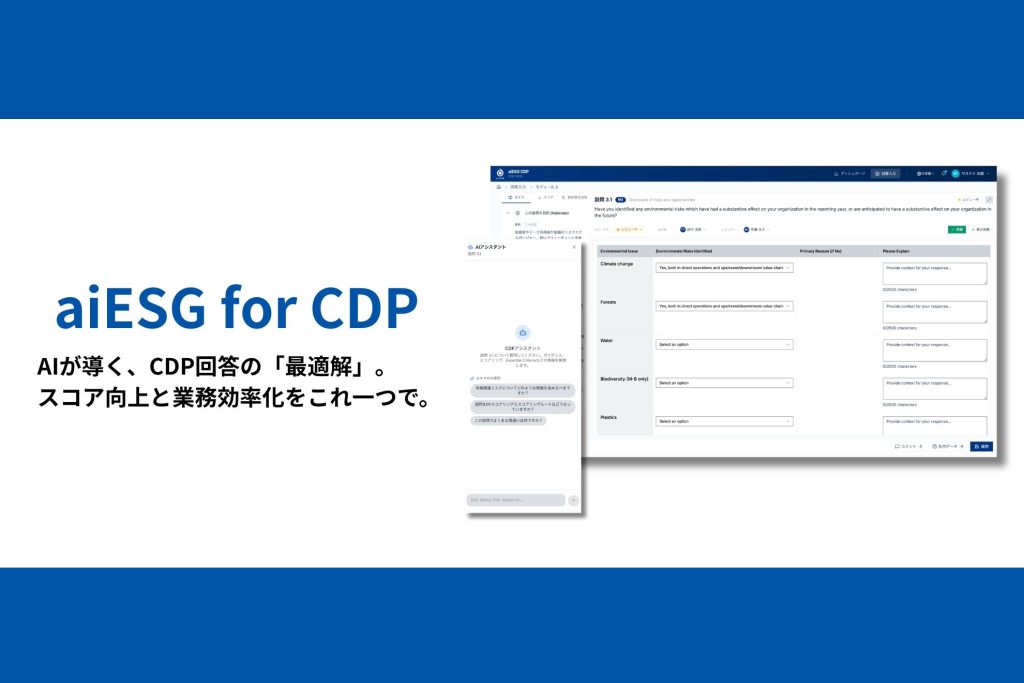

aiESG is the world's first service that enables comprehensive ESG analysis at the product and service level. Using AI analysis based on our ESG supply chain big data, aiESG can provide detailed calculations for more than 3,200 ESG indicators and compare them to industry averages and conventional products. In particular, it is possible to compare the CO2This is the world's first solution that enables quantitative evaluation of not only environmental aspects such as human rights, biodiversity, and labor environment, but also social and governance aspects, including human rights, biodiversity, and labor environment, which have become increasingly important in recent years.

Furthermore, analysis by aiESG enables geographical estimation, which is difficult with conventional Life Cycle Assessment (LCA), and visualization of environmental, social, and corporate governance hot spots, tracing back not only to direct suppliers, but also to secondary and upstream business partners.

In addition, since the only data required from the customer is product cost structure data or physical quantity data, ESG supply chain disclosures, which previously required enormous man-hours, are facilitated.

Click here for an introduction to our services (https://aiesg.co.jp/topics/report/20230515_service_aiesg/)

Related Articles

Commentary] Key Points of the TNFD Final Recommendations and the Responses Required of Companies

https://aiesg.co.jp/topics/report/231106_tnfdreport3/

[Commentary] Nikkei article: aiESG Supply Chain Analysis of "Electric Vehicle (EV) Production, ESG Indicators Deteriorate Due to 'De-China'".

https://aiesg.co.jp/topics/report/2301016_nikkeiev1/

Commentary] Nonfinancial Capital: Trends in Human and Natural Capital

〜Domestic and international disclosure regulations and guidelines

https://aiesg.co.jp/topics/report/240329_human-natural-capital/

aiESG launches "aiESG for IR," an integrated report evaluation service using generative AI.

~ Scoring the consistency of the Integrated Report with global ESG requirements~.

https://aiesg.co.jp/topics/news/aiesg-for-ir/

About aiESG

We are a start-up company from Kyushu University that aims to realize a sustainable society through ESG analysis at the product and service level. aiESG provides an ESG assessment platform "aiESG" that traces back the entire supply chain, based on years of international and academic ESG research, including work by G20 UN report representatives. We also provide support for ESG in general. We also provide support services on all aspects of ESG.

Click here to visit our corporate website https://aiesg.co.jp/)

Company Profile

Company name: aiESG Inc.

Head Office: NMF Hakata Ekimae Bldg. 2F, 1-15-20 Hakata Ekimae, Hakata-ku, Fukuoka City, Fukuoka

President and Representative Director : Shunsuke Managi

Business : ESG analysis business at the product/service level

HP : https://aiesg.co.jp/

Establishment : July 2022

For inquiries regarding this matter, please contact

To: aiESG Corporation, Public Relations

Email address:pr@aiesg.co.jp