INDEX

Introduction.

In recent years, global-scale social issues that we all need to solve together have been spreading, such as the intensification and frequency of natural disasters around the world caused by global warming, and human rights abuses such as child labor and forced labor in overseas supply chains. ESG issues therefore represent challenges that need to be solved in order for various organizations, including corporations, to work toward the same goal and achieve a sustainable society. In order to solve these issues, the Sustainable Development Goals (SDGs) and the Paris Agreement have been adopted, and a shift to new industrial and social structures toward a sustainable society is underway.

However, in order to realize a sustainable society, huge amounts of public and private funds are needed for capital investment and technological development. Therefore, sustainability initiatives have become indispensable in the financial sector as well. Financial institutions need to look at sustainability not only from the perspective of reducing greenhouse gas emissions from their own business activities, but also from the perspective of portfolio risk management, taking into account the emissions of their business partners and supply chains.

This recognition has led to the rapid spread of sustainable finance. For example, according to bloomberg, ESG (environmental, social, and governance) investments are expected to reach $53 trillion by the end of 2025, up from $37.8 trillion at present. of the $140.5 trillion in total assets under management expected by 2025. Thus, the global ESG (environmental, social, and governance) asset base continues to grow. Furthermore, the 2020 COVID-19 pandemic has further increased interest in sustainable finance ("sustainable finance").

With the growing interest in sustainable finance, this month's look focuses on how the financial industry has responded to the need for a sustainable society.

What is Sustainable Finance?

The Principles for Responsible Investment (PRI), proposed by then UN Secretary-General Kofi Annan in April 2006, are an effort to promote the flow of funds to address ESG issues through investment. The PRI became an international trend when major institutional investors in the United States and Europe signed on to it.

The PRI requires institutional investors and others to take a long-term perspective and consider ESG information when analyzing and evaluating companies. The September 2015 UN General Assembly meeting on ESG issues was also a major event in the PRI's development. In addition, the SDGs adopted by agreement of all 193 member countries at the UN General Assembly in September 2015 and the Paris Agreement adopted at COP21 (the 21st meeting of the Conference of the Parties) in November 2015 have further spread interest in ESGs.

Thus, sustainable finance refers to financial approaches and initiatives that promote solutions to social issues through loans and investments, taking into account not only corporate profits but also ESG perspectives. Sustainable finance is said to consist mainly of two approaches: (1) ESG investment, in which institutional investors invest in listed companies, and (2) ESG financing, in which financial institutions provide loans to companies.

However, according to the report "Building a Financial System to Support a Sustainable Society" compiled by the Financial Services Agency in June 2021, sustainable finance is not a specific financial product, but rather is broad and refers to the entire financial structure, code of conduct, and evaluation methods for building a sustainable society. Below we will look at sustainable finance in its broadest sense, in addition to the process of investing in and financing projects to build a sustainable society.

What is ESG investment and financing?

ESG is an acronym that stands for Environment, Social, and Governance. Specifically, ESG encompasses the issues shown in Figure 1 below. Investing in and financing companies based on how they address these issues is called ESG investment and financing. In other words, ESG financing is an initiative by institutional investors and financial institutions to consider and mitigate social issues through loans and investments in companies and other entities.

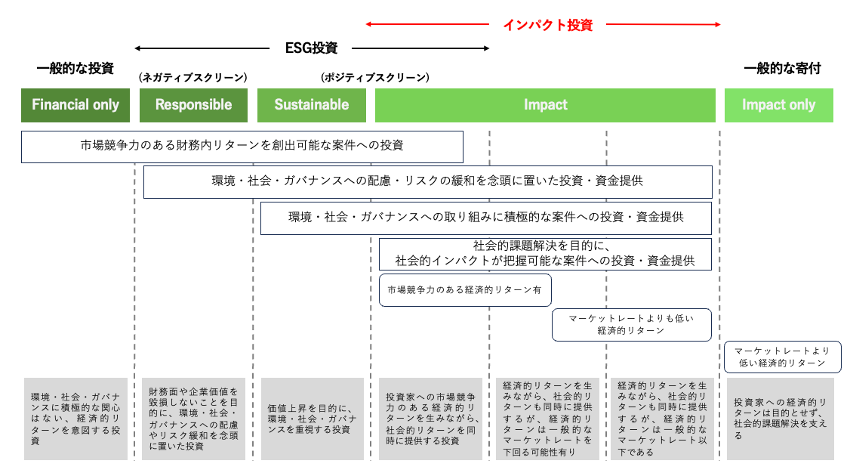

The Third Report of the Expert Group on Sustainable Finance of the Financial Services Agency (FSA) has made a particularly strong statement in the area of impact investment, which aims to balance profitability with solutions to environmental and social issues. Impact investment and ESG investment may seem similar, but what exactly are the differences? Let's take a look at the differences between impact investing and ESG investing in comparison with other approaches, including general investments.

While both impact and ESG investments have in common that they both aim to contribute to social issues, ESG investments incorporate environmental, social, and governance perspectives, but primarily consider ESG in the management and investment of a company. Impact investing, on the other hand, seeks economic benefits as well as social returns, and evaluates the results quantitatively and qualitatively. In other words, ESG investing focuses on the sustainable management of a company, whereas impact investing emphasizes direct social change and its evaluation. It should be noted, however, that ESG investment and impact investment in general encompass a wide variety of investment styles. A detailed classification of investment styles is shown in Figure 1.

Source:https://impactinvestment.jp/user/media/resources-pdf/impact_investment_report_2019.pdf

Overall picture of finance for building a sustainable society

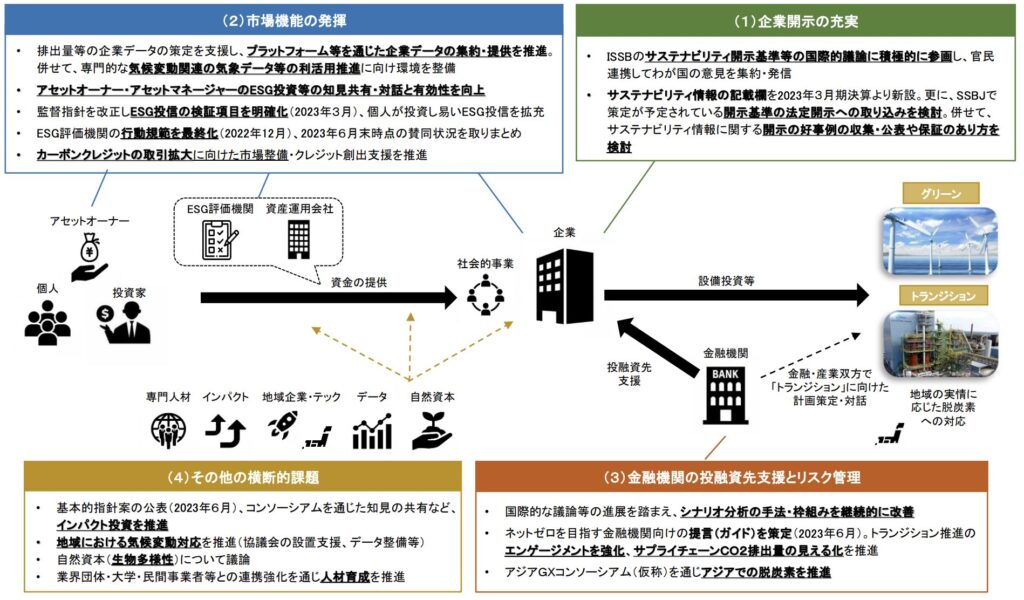

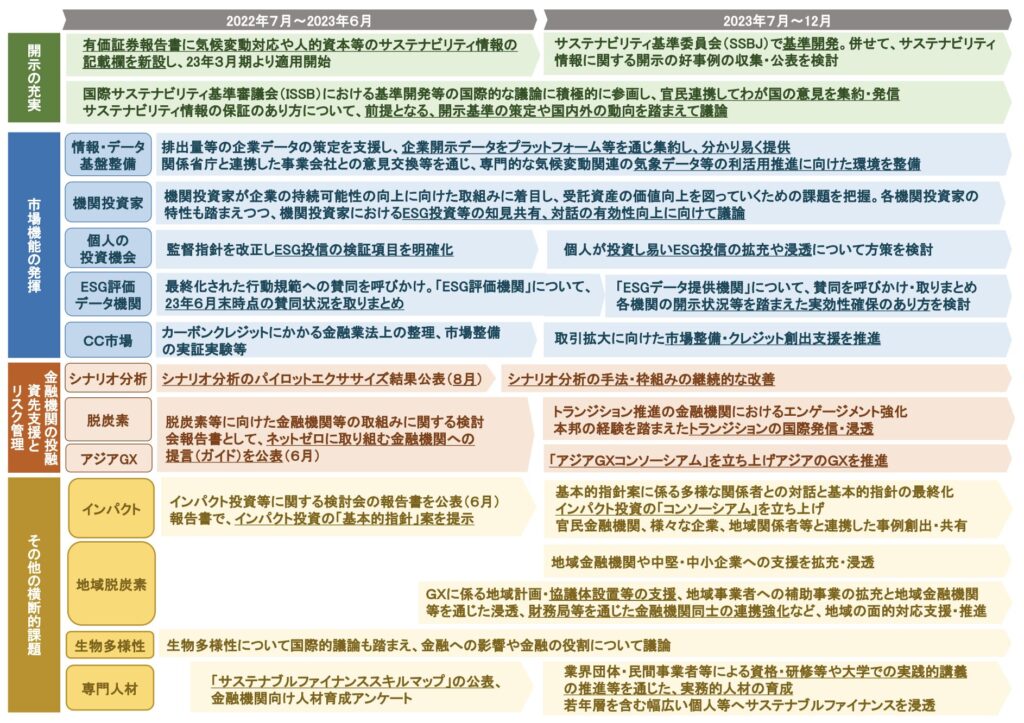

In December 2020, the FSA established the Expert Committee on Sustainable Finance to position sustainable finance as an infrastructure that supports a sustainable economic and social system. in June 2023, while maintaining the main pillars of the measures, the committee will evaluate new issues that have arisen and issues that have been recognized, and will compile an overall picture of issues and the status of implementation of the measures. The report recognizes that sustainable finance initiatives in Japan have made progress, and that institutional arrangements have been developed for each of the measures. In this report, we will take a brief look at the overall picture of sustainable finance in Japan, focusing on the four most important issues among the progress and challenges of sustainable finance initiatives listed in the third periodic report.

(1) Enhancement of corporate disclosure

The International Sustainability Standards Board (ISSB) at the IFRS Foundation finalized the general disclosure requirements (Standard S1) and climate-related disclosure standards (Standard S2) in June 2023. In addition, the International Auditing and Assurance Standards Board (IAASB) is about to finalize in September 2024 the assurance practices that assure the reliability of sustainability information by auditing firms.

(2) Market functions

This report summarizes past efforts and future issues and directions for action with regard to the development of information and data infrastructure, provision of investment opportunities to institutional investors and individuals, ESG assessment and data providers, and the carbon credit market. In the area of carbon credit trading, as international efforts to meet decarbonization targets progress, companies are increasingly being asked to procure credits in the market for reductions they have not yet achieved. In Japan, similar requests have been made to GX League companies, and with the pilot introduction of growth-oriented carbon pricing scheduled to begin in 2026, demand for carbon credit trading is expected to grow. The financial sector is expected to contribute in various ways, such as intermediating carbon credit transactions and creating new market transactions. The Tokyo Stock Exchange will also open a carbon credit market in 2023, and the Financial Services Agency is also working on legislation. The private sector is expected to develop and promote practical projects that contribute to carbon absorption and reduction, and it is important to create a high-quality market through public-private partnerships.

(3) Financial Institutions' Support for Investors and Loan Recipients and Risk Management

Status of risk management, including scenario analysis

The Financial Services Agency (FSA) and the Bank of Japan (BOJ) have conducted a pilot project on climate-related scenario analysis using the scenarios published by the Network of Financial Supervisors on Climate Change Risks (NGFS) as common scenarios, as scenario analysis was listed as an effective method in the basic approach to climate change preparedness of financial institutions released in July 2022. The FSA and the BOJ conducted a pilot project of climate-related scenario analysis using the scenarios published by the Network of Financial Supervisors on Climate Change Risks (NGFS). The results of the analysis and main issues and challenges were published in August of the same year.

Initiatives by financial institutions, etc. toward decarbonization, etc.

In order to promote effective dialogue between financial institutions and corporations, a study group on approaches by financial institutions toward decarbonization was established in October 2022, and its report was published in June 2011. The report presents recommendations on issues that financial institutions should consider, including specific measures.

Expanding GX Finance in Asia

Transition investments in Asia could be made by utilizing Japan's financial functions, leading to the creation of an international trading hub (Asian GX financial hub), etc.

(4) Other cross-cutting issues

Promoting Impact Investing

Impact investing has the same significance as sustainable finance in general in that it contributes to solving social and environmental issues through investment and improves the sustainability of investments and corporate activities in general by appropriately incorporating externalities into financial markets. In particular, there is a strong affinity with and high expectations for support for startups and other companies that aim to both solve pressing issues and achieve business viability.

Climate Change Response in the Region

SME decarbonization, which accounts for 1 to 20% of greenhouse gas emissions (Scope 1), is critical to achieving carbon neutrality. However, while responding to climate change is expected to have a variety of benefits for local SMEs, they will need to address an extremely wide variety of critical management issues in parallel with limited staff. While recognizing the importance of responding to climate change, they may find it difficult to do so due to a lack of human, information, and financial resources. On the financial side, it is expected that regional financial institutions with close ties to local companies, in cooperation with the national government, local governments, Keidanren, and others, will provide consulting services such as emissions measurement and energy conservation support.

Debate on Natural Capital and Biodiversity and Future Prospects

Accurate assessment of impacts on ecosystems is difficult, and data development is a challenge. In particular, biodiversity assessments have not progressed well, making it difficult for companies to measure their impacts. In the future, as the quality of ESG data improves and risk analysis on biodiversity is developed, companies can be expected to formulate specific environmental strategies.

Human Resource Development

A side effect of the progress of the initiative is the apparent shortage of human resources. Comprehensive efforts across sectors are important. The FSA has created a skill map to promote the development and securing of human resources.

Source:https://www.fsa.go.jp/policy/sustainable-finance/report_ja.pdf

Code of conduct and evaluation methods to realize a sustainable society.

Finally, we will look at the differences in codes of conduct, evaluation methods, etc. for building a sustainable society, with particular attention to the ICMA Principles and PIF Principles, which have been the focus of much attention recently.

What is ICMA?

The International Capital Markets Association (ICMA) plays a key role in the development of international principles for ESG finance. ICMA has a mission to promote the healthy development of international bond markets through market transparency, disclosure, and reporting, and develops voluntary guidelines and public relations activities.

Among them, various guidelines were published in January 2014, including the Green Bond Principles. Subsequently, the Social Bond Principles (June 2017), the Sustainability Linked Bond Principles (June 2020), and the Climate Transition Finance Handbook (December 2020) were added, and these principles are revised periodically. Recent revisions have highlighted the Framework and External Valuation in particular as key recommendations. External Assessment refers to the process by which an issuer appoints an external assessment body and confirms conformity through its assessment.

In ESG finance practice, issuers develop a framework based on ICMA principles and country guidelines, which is then evaluated by a valuation firm to provide an external valuation. The national guidelines, while compliant with the ICMA Principles, take into account national circumstances and specific examples of responses. However, it can be difficult to fully assess a company's sustainability based on ICMA alone. By complying with the Positive Impact Financing (PIF) Principles, which assess comprehensive efforts in a manner that complements the ICMA Principles, companies can develop a framework that allows them to raise funds based on their sustainability strategies. For example, under the Green Bond Principles, funds are selected for use based on business segmentation, which limits the assessment of impact to a limited number of business areas.

What is Positive Impact Finance (PIF)?

The United Nations Environment Programme and Finance Initiative (UNEP FI) Positive Impact Finance (PIF), developed in January 2017, aims to help companies develop activities to achieve a sustainable society, which are then reviewed, evaluated, and promoted by financial institutions and others. The framework identifies and assesses the positive impact of corporate activities, provides financing and other support, and monitors their operations The PIF principles consist of the following four principles.

Principle 1 is that positive outcomes are identified for the three pillars (environmental, social, and economic) contributing to the SDGs, and negative impacts are identified and addressed; Principle 2 is that an evaluation framework, including adequate processes, methodologies, and evaluation tools, is developed for PIF implementation; Principle 3 is that the details of projects and other means of measuring positive impact, the evaluation and monitoring process, and the positive impact are transparent; and Principle 4 is that PIF instruments are evaluated by internal organizations or third parties. Principle 3 is to ensure transparency regarding the details of projects and other activities, evaluation and monitoring processes, and positive impacts to measure impact; Principle 4 is that PIF instruments are evaluated by an internal organization or a third party; and Principle 5 is that PIF instruments are evaluated by a third party.

In other words, the PIF Principles take a comprehensive view of a company's efforts toward sustainability, referring to its key issues. It selects and funds projects that expand the positive aspects or curtail the negative aspects of a key issue to achieve that company's goals. By looking at the company's independently issued key performance indicators (KPIs), investors can easily determine whether the company is capable of sustainable growth.

Prepared by the author based on Sumitomo Mitsui Trust Bank's Positive Impact Financing

Source:https://www.smth.jp/sustainability/Initiatives_achievements/pif

aiESG provides support from basic ESG-related standards and frameworks to actual disclosure of non-financial information, so please contact us if you have any ESG-related issues.

Contact us:

https://aiesg.co.jp/contact/

Related page

Report List : Regulations/Standards

https://aiesg.co.jp/topics/report/tag/基準-規制/

Commentary] Alphabet Soup - Disruptions and Convergence of Sustainability Standards

https://aiesg.co.jp/topics/report/2301226_alphabet-soup/

SFDR: What are the EU Sustainable Finance Disclosure Rules?

~ESG-related information disclosure requirements for financial products

https://aiesg.co.jp/topics/report/2301222_sfdr/

【【Explanation] What is TNFD? A new bridge between finance and the natural environment

https://aiesg.co.jp/topics/report/230913_tnfdreport/

What is the SASB Standard for ESG Information Disclosure? (Part 1)Outline of SASB

https://aiesg.co.jp/topics/report/2301025_sasb1/

CSRD: The EU Sustainability Reporting Standard Just Before It Enters into Force: The Impact on Japanese Companies

https://aiesg.co.jp/topics/report/2301120_csrd/