INDEX

0. Introduction

The International Sustainability Standards Board (ISSB) released its International Sustainability Disclosure Standards in June 2023, and there is a growing movement around the world to adopt the International Sustainability Standards Board's (ISSB) International Sustainability Disclosure Standards and introduce them into their own national sustainability disclosure standards. For more information on ISSB, please refer to our previous articles.

Commentary] ISSB - Global Baseline for Sustainability Disclosure

https://aiesg.co.jp/topics/report/2301130_issb/

At the May 28, 2024 IOSCO Annual Meeting, the IFRS Foundation released a jurisdictional guide to help jurisdictions design and plan for the adoption of ISSB standards and other adoption efforts [1]. The Guide is intended to encourage jurisdictions that (1) represent 551 TP3T of global GDP, (2) represent more than 401 TP3T of global market capitalization, and (3) are responsible for more than half of global greenhouse gas emissions to either use the ISSB Standards or fully align their sustainability disclosure standards with the ISSB Standards. The goal is to

The introduction of ISSB standards is progressing in Europe and other developed countries, but efforts are also underway in emerging countries at the national level and at the regional level involving many countries.

This paper describes the status of ISSB implementation in developed countries such as the EU, the U.S., and Japan, as well as in Asian countries such as China and Singapore, and emerging countries such as Nigeria and Brazil.

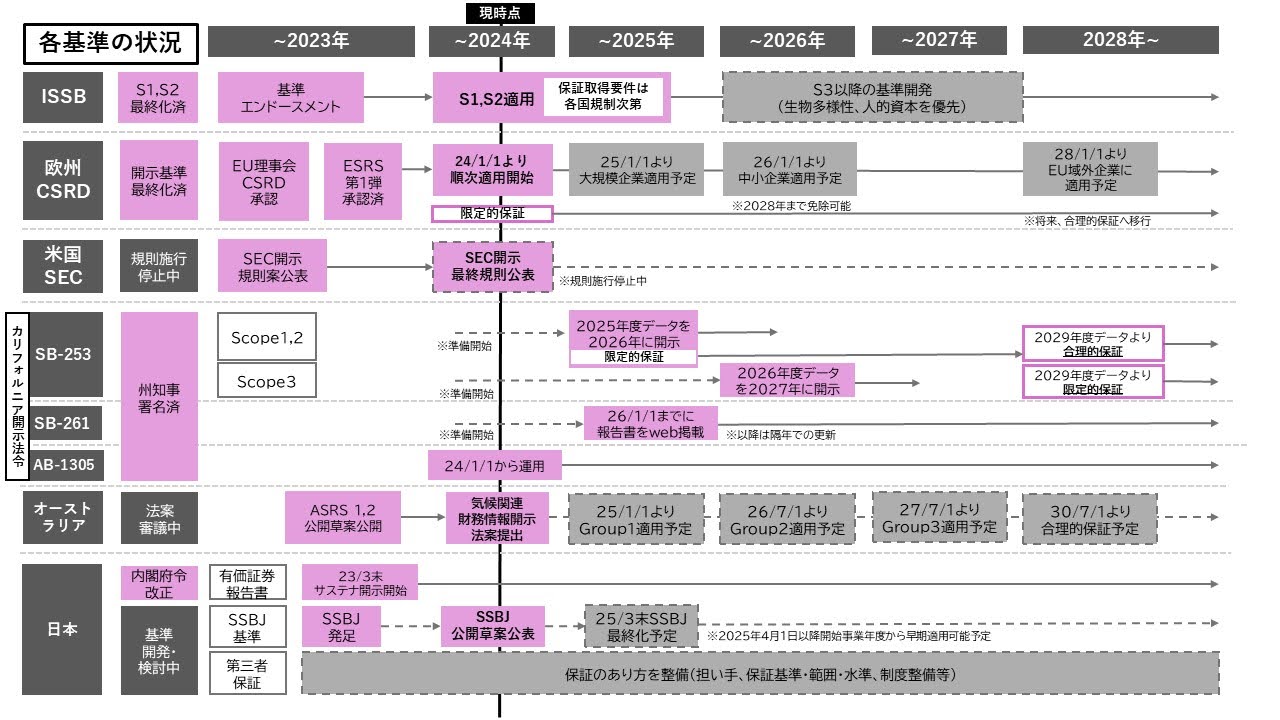

1. trends in developed countries

◆EU

The EU is considered to be the region with the most advanced sustainability initiatives, and various laws and regulations are in place.

In the EU, the Corporate Sustainability Reporting Directive (CSRD) was passed in January 2023, and disclosure in accordance with the European Sustainability Reporting Standard (ESRS), a mandatory standard, has begun[2][3].

CSRD: The European Union's Corporate Sustainability Reporting Directive Latest Information

https://aiesg.co.jp/topics/report/2407019_csrd2/

In 2028, the NFRD is expected to apply to all foreign companies with branches or subsidiaries in the EU. In 2028, the entire group of foreign companies with branches or subsidiaries in the EU is expected to be covered.

In addition, the International Organization of Securities Supervisors (IOSCO) issued a statement in support of the ISSB standards in July 2023[4]. This is expected to lead to the adoption of the ISSB standards in IOSCO member countries.

◆America

In the U.S., the SEC (U.S. Securities and Exchange Commission) climate disclosure rules are the primary standards, and while the ISSB standards have not been adopted, the SEC's climate disclosure rules have similarities with the ISSB standards in that they are consistent with the TCFD.

On March 6, 2024, the Securities and Exchange Commission (SEC) issued a final rule[5][6] requiring climate-related disclosures. The SEC has revised a number of points from the original proposal, including the exclusion of Scope 3 emissions reporting requirements and the requirement to report Scope 1 and 2 emissions only for companies that have been determined to be material. The possibility of raising the content of the rule if it is determined that insufficient information is available to adequately assess climate change risks has been indicated. In addition, the SEC has issued an order allowing for an "alternative system" of compliance with the rules decided on this time. Although the use of ISSB standards as an alternative is not permitted at this time, the SEC indicated that it may establish new rules regarding the application of ISSB and other international standards. The rules will be phased in beginning with the fiscal year beginning in 2025, depending on the size of the entity. However, due to a series of lawsuits challenging the rule, it has been announced that the implementation of the rule will be suspended until the conclusion of judicial hearings.

In California, a climate-related disclosure bill for companies was passed on October 7, 2023[7][8][9]. The bill goes one step further than the SEC's climate disclosure rules by requiring companies to disclose their Scope 3 emissions as early as fiscal year 2027 and making both publicly and privately held companies subject to the bill if they meet the requirements.

◆Australia

On October 23, 2023, the Australian Accounting Standards Board (AASB) issued a new exposure draft on climate-related financial disclosure standards [10]. Among the exposure drafts, ASRS 1 "General Requirements for Disclosure of Climate-related Financial Information" and ASRS 2 "Climate-related Financial Disclosures" were developed based on IFRS S1 and S2, respectively.

On March 27, 2024, a financial bill on climate-related financial disclosure was introduced in Congress, and on May 3, the Senate Economic and Legislative Committee released its report on the bill, supporting its passage. On the other hand, Coalition Senators have expressed concerns about several provisions of Schedule 4 and have taken a stand against it [11].

If the bill passes, the disclosure requirements for companies will be applied in stages, with Group 1 companies that meet the requirements, such as having 500 or more employees and sales of $500 million (approximately 73.3 billion yen) or more, expected to begin reporting from the fiscal year beginning January 1, 2025.

◆Japan

On March 29, 2024, the Sustainability Standards Board (SSBJ) released an exposure draft of the SSBJ standards developed based on the ISSB standards, and a finalized standard is expected to be released in March 2025[12].

Commentary] SSBJ (Sustainability Standards Board Japan) Deliberation Trends - Scope 3 Disclosure Standards in Japan

https://aiesg.co.jp/topics/report/240520_ssbj/

For TSE prime listed companies, there is a proposal to apply the SSBJ proposal in stages from companies with large market capitalization, with a certain voluntary application period.

The application of the SSBJ standards in securities reports will first target companies with a market capitalization of at least 3 trillion yen, and a proposal has been floated to apply the standards as early as the fiscal year ending March 31, 2027, although discussions are continuing to determine the timing of the application.

Figure 1: Timeline of Sustainability Disclosure Standards by Country(in Japanese history)Financial Services Agency Public Documents(Prepared by the author based on)

2. trends in Asian countries

In the Asia-Pacific region, there has been a lot of effort to adopt the ISSB standards and to implement them, including a Sustainability Summit to be held by the International Federation of Accountants in September 2023[13].

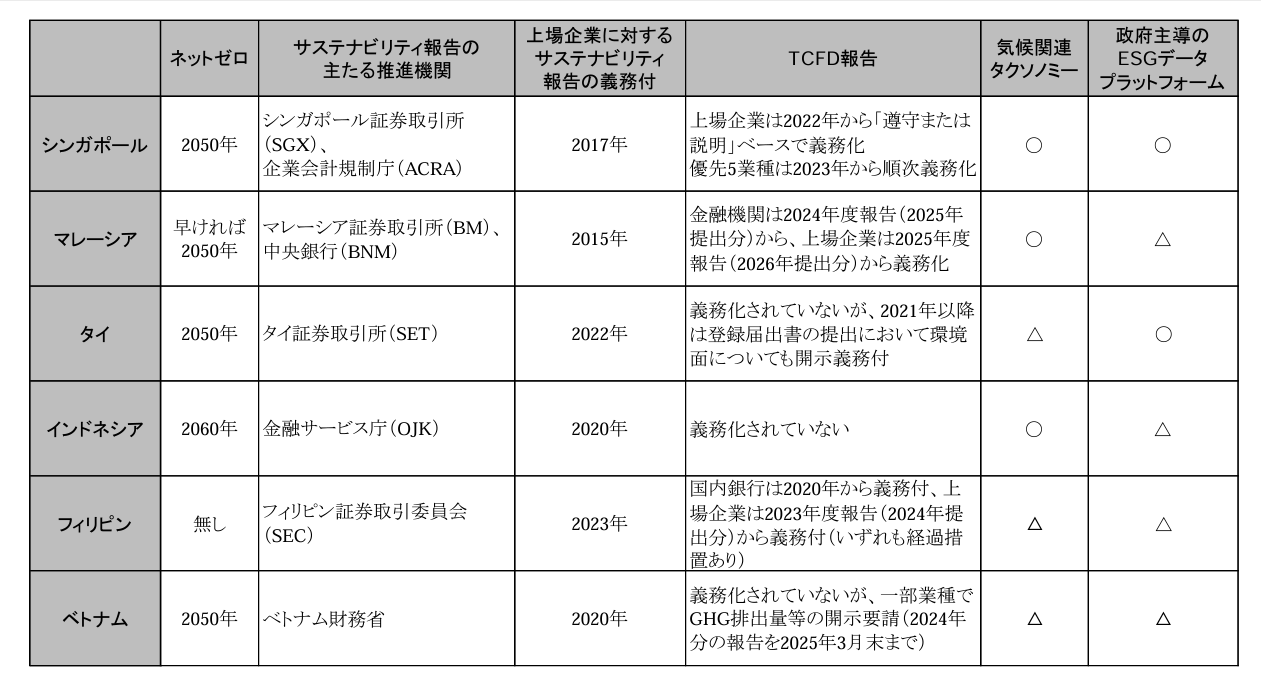

ASEAN

The ACMF (ASEAN Capital Markets) has published a roadmap for the formation of sustainable capital markets [14] in 2020. In addition, it is working to raise awareness of the ISSB standards by holding a joint meeting with the ISSB on June 27, 2023 to commemorate the publication of the ISSB standards [15], suggesting the possibility of applying the ISSB standards based on the laws and regulations within ASEAN's jurisdiction, It can be said that they are in the process of exploring the possibility of adopting the ISSB standards in the future.

In addition, according to the FSA publicly available data [16], while the percentage of ASEAN countries implementing sustainability reporting is high, only a few countries have adopted mandatory climate change-related information disclosure in accordance with the TCFD recommendations and the ISSB standards on climate change into their national frameworks.

Table 1: Climate Change Disclosure in ASEAN(in Japanese history)Financial Services Agency Public Documents(Adapted from.)

◆Singapore

On February 28, 2024, the Accounting and Corporate Regulatory Authority of Singapore (ACRA) and the Singapore Exchange (SGX) announced that all listed companies in Singapore will be required to report and submit their annual CRDs in accordance with the requirements of the ISSB standards starting in fiscal 2025 [17].

Beginning in FY2027, large NLC firms with annual revenues of $1 billion or more and total assets of $500 million or more will be subject to the same mandate.

Regarding the disclosure of greenhouse gas emissions by listed issuers, Scope 1 and 2 are required to be reported in the CRD starting in FY2025, and Scope 3 in the CRD starting in FY2026. Major NLC companies are expected to begin mandatory reporting from FY2027 and FY2029, respectively.

◆Malaysia

The Advisory Committee on Sustainability Disclosure (ACSR) was established in Malaysia on May 24, 2023, and discussions are underway to develop a Malaysian version of the ISSB standard.

On February 15, 2024, the ACSR issued a consultation paper on the proposed Malaysian version of the standard, seeking feedback on key issues such as the timing and scope of the implementation of IFRS S1 and S2 [18].

In order to understand the needs and challenges of the market, we encourage the participation of small and medium-sized companies as well as publicly traded companies and large unlisted companies.

◆China

On May 27, 2024, the Ministry of Finance of the People's Republic of China released an exposure draft of the basic sustainability disclosure standards for companies and a commentary document[19][20][21].

This draft consists of basic standards, thematic standards, and application guidance, and was developed in accordance with ISSB standards.

Implementation for companies will be phased in and eventually all companies (listed and unlisted, large and small) will be required to adopt the standard.

Climate-related disclosure standards are expected to be issued by 2027, and a Sustainability Disclosure Standard (CSDS) for Chinese companies by 2030.

3. other emerging countries

◆Nigeria

On February 3, 2024, the Financial Reporting Council of Nigeria (FRC) published its Roadmap Report for the Implementation of ISSB Standards in Nigeria (DRAFT) [22].

According to the report, the application of the IFRS Sustainability Disclosure Standard will be phased in. After early application in Phase 1 (~December 31, 2023) and voluntary application in Phase 2 (January 1, 2024 - December 31, 2027), the standard will be applied to all PIEs (socially-impacted entities) starting January 1, 2028 and to SMEs on January 1, 2030.

◆Brazil

On May 13, 2024, the Brazilian Securities Commission (CVM) issued two exposure drafts for consultation on the development of a national sustainability disclosure standard in accordance with ISSB standards: general requirements for the disclosure of sustainability-related financial information and climate-related disclosure [23][24][25]. Comments are invited until July 11 of the same year.

If approved, the mandate would begin to apply to listed companies on January 1, 2026, with earlier application possible before that date.

◆African Development Bank

On May 28, 2024, IFRS announced a partnership with the African Development Bank (AfDB) to promote sustainability-related financial disclosures in Africa [26].

Both organizations work with African financial institutions and other institutions and regulators to provide capacity building and technical assistance to support investors in their decision-making. Currently, a number of countries, including Nigeria and Kenya, have indicated that they have since adopted and used the ISSB standards.

4. Conclusion

This report provides an overview of the introduction of ISSB standards in various countries around the world, and while there are differences in judgment among countries as to whether to use ISSB standards as they are or to apply them to their own standards, it can be seen that there is growing momentum toward sustainability-related information disclosure in both developed countries and emerging economies. In addition to the active efforts of individual countries, there is also movement in response to the ISSB's efforts. On the other hand, some countries have multiple standards, and the timing of finalization and application of these standards to the market is unclear.

aiESG provides support from basic ESG-related standards and frameworks to actual disclosure of non-financial information, so please contact us if you have any ESG-related issues.

Contact us:

https://aiesg.co.jp/contact/

References

[1]https://www.ifrs.org/content/dam/ifrs/supporting-implementation/adoption-guide/inaugural-jurisdictional-guide.pdf

[2]https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32022L2464

[3]https://eur-lex.europa.eu/legal-content/en/TXT/?uri=CELEX:32023R2772

[4]https://www.iosco.org/news/pdf/IOSCONEWS703.pdf

[5]https://www.sec.gov/newsroom/press-releases/2024-31

[6]https://www.sec.gov/news/statement/cresnshaw-statement-mandatory-climate-risk-disclosures-030624

[7]https://leginfo.legislature.ca.gov/faces/billNavClient.xhtml?bill_id=202320240SB253&_ga=2.59182637.1024658143.1720416172-1495147621.1714397216

[8]https://leginfo.legislature.ca.gov/faces/billNavClient.xhtml?bill_id=202320240SB261&_ga=2.59182637.1024658143.1720416172-1495147621.1714397216

[9]https://leginfo.legislature.ca.gov/faces/billTextClient.xhtml?bill_id=202320240AB1305

[10]https://www.aasb.gov.au/admin/file/content105/c9/AASBED_SR1_10-23.pdf

[11]https://www.aph.gov.au/Parliamentary_Business/Bills_Legislation/bd/bd2324a/24bd068

[12]https://www.ssb-j.jp/jp/domestic_standards/exposure_draft.html

[13]https://www.ifac.org/events/ifac-sustainability-summit-asia-pacific

[14]https://www.theacmf.org/images/downloads/pdf/ACMF_Roadmap_high.resolution.pdf

[15]https://www.theacmf.org/media/news-release/asean-securities-regulators-team-up-with-issb-to-mark-global-launch-of-sustainability-disclosure-standards

[16]https://www.fsa.go.jp/common/about/research/20240430-4/report.pdf

[17]https://www.acra.gov.sg/news-events/news-details/id/778

[18]https://www.sc.com.my/resources/media/media-release/acsr-invites-public-feedback-on-proposed-use-of-issb-standards-in-malaysia

[19]https://viewpoint.pwc.com/dt/gx/en/pwc/in_briefs/in_briefs_INT/in_briefs_INT/ministry-of-finance-issued-the-exposure-draft-of-chinese.html#pwc-topic.dita_d6b9c4cd-8b9f-42fc-b0f2-a24a398af194

[20]https://upload.news.esnai.com/2024/0527/1716799372431.pdf

[21]https://upload.news.esnai.com/2024/0527/1716799385429.pdf

[22]https://frcnigeria.gov.ng/wp-content/uploads/2024/04/FINAL-COPY-OF-SUSTAINABILITY-ROADMAP-1.pdf

[23]https://www.ifrs.org/news-and-events/news/2023/10/brazil-adopts-issb-global-baseline/

[24]https://www.gov.br/cvm/pt-br/assuntos/noticias/2024/aberta-consulta-publica-que-torna-obrigatoria-divulgacao-de-informacoes-financeiras-relacionadas-a-sustentabilidade

[25]https://www.gov.br/cvm/pt-br/assuntos/noticias/2024/cvm-abre-consulta-publica-para-pronunciamento-tecnico-referente-a-divulgacoes-climaticas

[26]https://www.ifrs.org/news-and-events/news/2024/05/ifrs-foundation-and-african-development-bank-to-join-forces-to-promote-sustainability-related-financial-disclosures/

*Related Article*.

Report List : Regulations/Standards

ISSB - Global Baseline for Sustainability Disclosure

Commentary】Trends in SSBJ (Sustainability Standards Board of Japan) Deliberations - Scope 3 Disclosure Standards in Japan

Commentary] ISSB's Latest Trends - Biodiversity and Human Capital are now under Consideration.

CSRD: The European Union's Corporate Sustainability Reporting Directive Latest Information