INDEX

Introduction.

On February 19, 2025, a paper co-authored by Takuya Shimamura, aiESG, and Shunsuke Managi, President, and others, was published.

Title of paper: Evaluating the impact of report readability on ESG scores: A generative AI approach

DOI (paper link):https://doi.org/10.1016/j.irfa.2025.104027

This article provides an easy-to-understand explanation of the research and the services provided by aiESG. those interested in ESG data analysis and strategy development are encouraged to read to the end.

Research Points/Summary

This study created a new index to evaluate the readability of corporate reports using AI (GPT-4) and analyzed the relationship between ESG scores and readability. 414 sustainability reports from the top 150 companies in the S&P 500 were analyzed and found that the more readable the report was, including context and background explanations, the higher the ESG score and the smaller the variation in score across rating agencies. The more readable the report was, the higher the ESG score and the smaller the variation in score across rating agencies. This was particularly true for companies that received less media attention, indicating that readability has a significant impact on ESG evaluation.

Background and Objectives

Companies disclose environmental, social, and governance (ESG) information in their sustainability reports and other documents. However, the amount of jargon and unclear sentence structure can make it difficult for evaluators and investors to accurately understand the content.

In previous studies, readability indices focusing on "character and word features" such as sentence length and number of syllables have been the norm. On the other hand, background explanations and context, which are necessary for understanding the meaning of a text, have not been sufficiently evaluated.

Therefore, this study aims to develop a new readability index using AI (GPT-4) to evaluate the "semantic linkage" and "necessary background explanation" of a report, and to clarify the relationship between readability and the score assigned by ESG rating agencies. We will also examine how media attention and reader background knowledge affect the relationship between readability and ESG ratings.

analysis

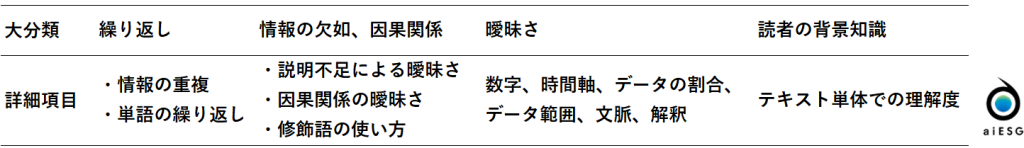

The analysis for this study included 414 sustainability reports issued by the top 150 S&P 500 companies from 2017 to 2021. The reports were divided into 40-sentence chunks and rated on a total of 12 items (Table 1) using the GPT-4 on a scale of 0 to 10. For the readability ratings obtained, we statistically tested the relationship between the actual ESG scores, the variation in ESG scores among different rating agencies, media attention, and background knowledge of the reader.

result

The analysis of this study yielded the following findings

- Reports with higher AI readability ratings have higher average ESG scores and less variation in scores among rating agencies.

- The impact of readability on ESG scores is greater for companies with less media attention

- When the AI was given the roles of linguist and investor, the investor's readability rating was more strongly linked to the ESG score

- Traditional word or letter count indicators have little correlation with ESG scores

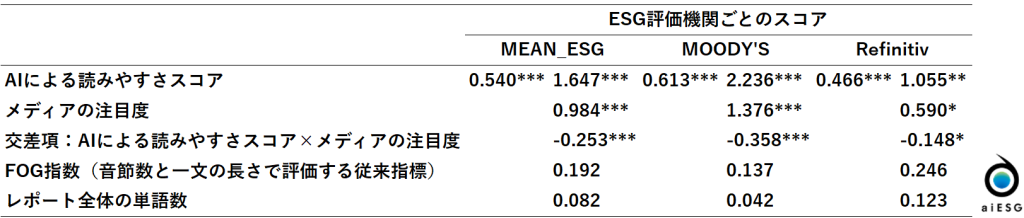

The table below shows the relationship between the ESG score and the readability index and other indicators. For example, for the top left term, an increase of 1 in readability indicates an increase of 0.540 in the ESG score as evaluated by Mean_ESG.

Statistical dominance is represented by *,**,*** for 10%, 5%, and 1%. The even columns for each evaluation agency include a cross term.

consideration

The results of this study indicate that composing texts in accordance with appropriate context and background information can reduce misinterpretations among ESG assessors and lead to more stable and enhanced evaluations of companies.

Especially for companies with less public recognition, readability tends to be more important, as there are fewer sources of information other than reports. In this day and age of shifting media, a report that takes context into account can be of great value. When preparing a report, it is not just a matter of adding more information, but also of clearly explaining what was done, when, and how.

summary

In preparing reports, companies are expected to avoid the overuse of jargon and to write text that is easy for anyone to understand, incorporating background explanations and specific examples. In addition, regulatory authorities and industry associations should clarify the requirements for "easy-to-understand explanations" in their disclosure guidelines and provide guidelines that emphasize context and background information.

aiESG Inc. provides comprehensive support ranging from organizing ESG indicators to assisting in the preparation of corporate reports. please feel free to contact us if you have any problems with ESG-related information disclosure or practices.

About aIESG's services:https://aiesg.co.jp/service/