What is aiESG?

Products and servicesIn.All supply chainsTraced back to

ESG assessment servicesIs!

Hello, we are an ESG Tech start-up from Kyushu University! We are an ESG Tech start-up from Kyushu University!

In this column, we will introduce aiESG trends, our services and case studies for those who are interested in aiESG, want to conduct ESG analysis but do not know what to do, or what ESG is all about in the first place. This column introduces global trends in ESG, our services and case studies. We will also regularly update you with the voices of our staff.

In our first column, we will give you some background information on how we started our service.

ESG management now and what is required.

Less than 20 years after the UN advocated for institutional investors to have an 'ESG' (environmental, social and corporate governance) perspective in 2006, the importance of ESG initiatives in companies is increasing globally. Investments made by investors that take into account the sustainability of a company are referred to as sustainable or ESG investments. Sustainable investment is a form of investment that includes ESG investment and is based on the assumption that a company or industry is sustainable.ESG investment is a form of investment in which investors are interested in corporate social responsibility and are concerned about the environment (Environment) and corporate initiatives on social issues (sadistsocial), legal compliance (g(overenance) and other aspects of governance transparency, which refers to the importance of transparency in investment.

GSIA (Global Sustainable Investment Alliance), a promotion organisation for sustainable investment that is a partnership of national ESG research organisations.1)According to the ESG Investment Association, sustainable investments that take ESG into account amount to a global total (2020) of USD 35.3 trillion (approximately 4,600 trillion yen). Furthermore, with growth rates of around 10% annually over the past few years, it is expected that the importance of addressing ESG issues will continue to grow.

The USD 35.3 trillion is equivalent to 35.91 TP3T of the total USD 98.4 trillion in assets under management of the institutional investors surveyed. This means that more than 30% of all assets under management fall under ESG investments as defined by the GSIA, and ESG considerations have become an important factor in investors' decisions. Against this backdrop, an increasing number of companies are taking these considerations into account in their management, while cases of 'greenwashing' (pretending to be involved in environmentally friendly initiatives when in reality they are not) have also emerged and are being seen as problematic. It is not easy to determine on what basis a company claims to be 'environmentally conscious' or 'respecting the human rights of those involved in the supply chain'. There is now a need for ESG data that can be objectively demonstrated to investors, business partners and consumers.

Growing interest in human rights items through the supply chain

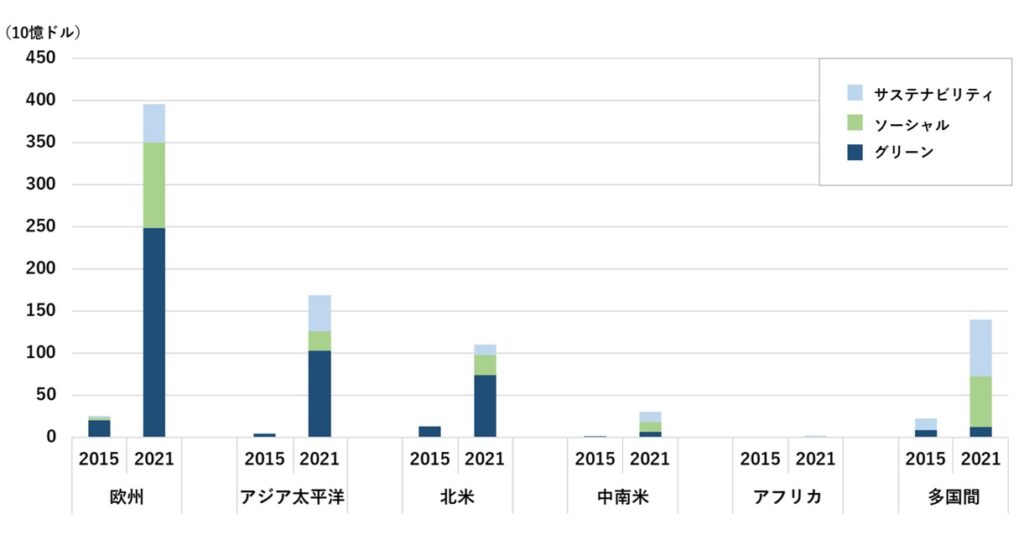

Among ESG initiatives, a particular focus in recent years has been on human rights issues through the supply chain. Figure 1 below shows the change in ESG investment between 2015 and 2021 by global region.

Figure 1: Change in global ESG investment by region

Compiled from Interactive Data Platform (Climate Bonds Initiative).

Green indicates investments in environmental damage prevention; Social indicates investments in human rights risks and community engagement in the supply chain; Sustainability indicates investments in climate change action ESG-focused investments have increased significantly between 2015 and 2021 ESG investments Overall, Europe leads the way, followed by Asia-Pacific and North America. Overall, green investments, which are investments in the environment, account for a large proportion, while social investments, which are investments in human rights, have increased in recent years.

Thus, while the traditional drive to promote sustainable supply chains has focused on the areas of preventing environmental damage and combating climate change, in recent years there has been an increase in the development of norms on human rights. For example, in February 2022, the European Commission (EC) drafted a directive on mandatory corporate sustainability and due diligence (ongoing efforts to prevent and remedy adverse human rights and environmental impacts of business activities).2)published by the European Commission. Companies are thus increasingly required to promote sustainable, socially and morally responsible corporate behaviour by anticipating and correcting negative impacts of their business activities in all processes of providing products and services.

In Japan, in September 2022, the Ministry of Economy, Trade and Industry (METI) adopted the UN Guiding Principles on Business and Human Rights (UNGP).3)and 'OECD Due Diligence Guidance for Responsible Corporate Behaviour'.4)Guidelines for Respect for Human Rights in Responsible Supply Chains, etc., based on the5)and encouraging companies to address human rights risks is accelerating (Figure 2). Furthermore, through the development of international standards on sustainable procurement (e.g. ISO 20400) and engagement (proposals to invest in a company to increase its corporate value) and investment (investment withdrawal) by ESG investors, the demand for ESG responses throughout the supply chain is further increasing.

Figure 2: Establishment of regulations on human rights-friendly corporate behaviour

In order to implement optimal ESG-conscious supplier assessment and management in the future, it will be necessary to understand ESG risks in more detail and their impact on your company beyond the traditional assessment of initiatives at the company level, taking into account upstream supply chains at the product and service level. FIG. 1.

References.

- Global Sustainable Investment Aliance: GLOBAL SUSTAINABLE INVESTMENT REVIEW 2020, https://www.gsi-alliance.org/.

- JETRO: European Commission publishes draft directive on mandatory human rights and environmental due diligence,https://www.jetro.go.jp/biznews/2022/02/270ab8bbbd9b69d1.html,2022.02.28.

- United Nations Centre for Public Information: Guiding Principles on Business and Human Rights,.https://www.unic.or.jp/texts_audiovisual/resolutions_reports/hr_council/ga_regular_session/3404/,2011.03.21.

- OECD: OECD Due Diligence Guidance for Responsible Corporate Behaviour,.https://mneguidelines.oecd.org/OECD-Due-Diligence-Guidance-for-RBC-Japanese.pdf, 2018.

- Ministry of Economy, Trade and Industry: Guidelines for respecting human rights in responsible supply chains, etc.,.https://www.meti.go.jp/press/2022/09/20220913003/20220913003-a.pdf,2022.09.