INDEX

Since the disclosure of securities reports for the fiscal year ending March 31, 2023 in Japan, it has become mandatory to describe the relationship between not only environmental aspects but also social aspects and corporate activities, such as environmental initiatives, employee development, and diversity.

Meanwhile, sustainability information disclosure is becoming increasingly important worldwide: the EU has established a Corporate Sustainability Reporting Directive (CSRD) and Standard (ESRS), which will make ESG (Environmental, Social and Governance) information reporting mandatory for a wide range of companies. The U.S. has also seen a response through mandatory human capital disclosure.

Disclosure of non-financial information has become an important issue for companies.

The purpose of this report is to describe trends in sustainability reporting in Japan, Europe, and the United States, and to contribute to an understanding of the current situation.

Table of Contents

1.(Japan)Mandatory disclosure of securities reports and human capital

2.(EU/US) Treatment of social and human capital in sustainability reports of other countries

- EU

- United States of America

(Japan) Trends in ESG Information Disclosure

Conclusion

(Japan) Mandatory disclosure of human capital in securities reports

As the source of corporate value shifts from tangible to intangible assets, disclosure of not only corporate financial information but also non-financial information is becoming more important.

In Japan, the revised "Cabinet Office Ordinance on Disclosure of Corporate Information, etc." was published on January 31, 2023. In accordance with this, it has become mandatory for listed companies and others to make progress in sustainability initiatives related to social and human capital through disclosure in their annual securities reports for the fiscal year ending March 31, 2023, and to take measures to enhance the disclosure of descriptive information*.

*Descriptive information refers to information that supplements financial information and facilitates investors in making appropriate investment decisions. The disclosure of such information is intended to promote constructive dialogue between investors and companies, and is expected to improve the quality and value of corporate management.

See FSA (2019): 'Current Principles for Disclosure of Descriptive Information', p. 1.

Social capital disclosure requires a wide variety of items, including corporate environmental initiatives, climate change response, and sustainability risks and opportunities. Human capital disclosures are required to include employee development, diversity, and health and safety.

With the spread of ESG investment, increasing demands from stakeholders, and the growing proportion of intangible assets in corporate value, it is becoming increasingly important to disclose information regarding not only environmental initiatives but also social initiatives.

2.(EU/US) Treatment of social and human capital in sustainability reports of other countries

Sustainability information is becoming increasingly important worldwide. As a result, discussions on disclosure and assurance of sustainability information are occurring simultaneously not only in Japan but also in the U.S., Europe, and globally. Since these developments are occurring at an unexpected speed, Japanese companies need to keep an eye on the regulatory trends not only in their own countries but also in other regions.

EU

The EU region is one of the most advanced regions in terms of sustainability initiatives, and the CSRD (Corporate Sustainability Reporting Directive) and the ESRS (European Sustainability Reporting Standard), a delegated regulation, are the two issues that cannot be ignored as corporate sustainability reporting standards in the EU.

The CSRD, agreed by the EU Parliament and Council at the end of 2022, makes ESG information reporting mandatory for a broad group of companies, and the ESRS, which builds on the CSRD and constitutes the Delegated Regulation, provides detailed rules for companies to report not only quantitative and qualitative environmental capital analysis on their climate change efforts, but also social and human capital. and human capital as well as quantitative and qualitative analysis of environmental capital with respect to climate change initiatives.

Although the deadline for companies to comply has been adjusted according to the number of employees and other size factors, there is an ongoing need for Japanese companies to consider whether their EU subsidiaries are subject to those requirements, or whether the Japanese companies themselves are directly subject to them as non-EU companies.

The CSRD and ESRS have adopted a double materiality as a set of material issues (materialities) that are likely to affect a company's financial activities. This is distinct from the single materiality, which is designed to provide information for investors.

The ESRS discloses indicators classified into three categories: environmental (E), social (S), and governance (G). As shown in the examples below, the scope of the S indicators is quite broad, and it is necessary to keep a close eye on how the subject companies disclose their S indicators.

Example:

S1: Items related to the company's internal labor force

S2: Items pertaining to workers in the value chain

S3: Items pertaining to affected communities (e.g., local communities, indigenous peoples)

S4: Items pertaining to consumers and end users

aiESG Report, "[Commentary]CSRD: The EU Sustainability Reporting Standard Just Before It Enters into Force: The Impact on Japanese Companies" (Japanese only)

https://aiesg.co.jp/topics/report/2301120_csrd/

aiESGReportThe ESRS (European Sustainability Reporting Standard).

https://aiesg.co.jp/topics/report/2301208_esrs/

United States of America

In the U.S., corporate sustainability disclosure efforts have been intensified, and historically, a number of guidance and frameworks have been proposed. Below is a summary of two regulations with strong international influence.

The first is the Global Reporting Initiative (GRI), established in the United States in 1997. The organization published guidance for reporting environmental and social impacts in 2000. These were converted into the GRI Standards in 2016, which have been adopted as universal international rules for sustainability reporting in over 100 countries. The scope of application is not limited to environmental aspects, but also focuses on social factors such as human rights and labor. These GRI Standards are double materiality in nature, as they require companies to disclose not only their impact on investors, but also the extent of their impact on society and the environment.

The second is the SASB Standards published by the non-profit organization (SASB), which was launched in 2018. These standards are intended to make it easier for investors to compare companies by presenting five disclosure items for each of the 77 industries in 11 sectors. One of the disclosure items is human capital. With the recent integration of the SASB into the International Financial Reporting Standards (IFRS) in 2022, the impact of the SASB standards is expected to increase internationally beyond the U.S. market. In addition, as IFRS moves to ensure interoperability with GRI Standards and ESRS, the SASB Standards are expected to evolve into double materiality in the future*.

In 2020, the Securities and Exchange Surveillance Commission (SEC) will make human capital disclosure mandatory for U.S. listed companies. The SEC has listed "human resource development, human resource incentives, and employee retention" as three examples of disclosure items, which confirms that the SEC is focusing on human capital among social capital. The SEC has been focusing on human capital among the social capital items, and it is confirmed that a variety of U.S. companies have been disclosing information since 2020, but the degree of disclosure varies from company to company, indicating that more information is expected through dialogue with investors**.

*aiESG Report "[Commentary] Alphabet Soup: The Rampant Convergence of Sustainability Standards" (Japanese only)

https://aiesg.co.jp/topics/report/2301226_alphabet-soup/

**SDGs KOTORA "[2021 Update] Human Capital Disclosure of U.S. Companies"

https://sdgs.kotora.jp/column/%E7%89%B9%E9%9B%86%E8%A8%98%E4%BA%8B/o_content06/

aiESG Report "[Explanation]What is the SASB Standard for ESG Disclosure? (Part 1) Outline of SASB" (Japanese only)

https://aiesg.co.jp/topics/report/2301025_sasb1/

aiESG Report "[Explanation]What is the SASB Standard for ESG Disclosure? (Part 2): Benefits for Companies" (Japanese only)

https://aiesg.co.jp/topics/report/2301115_sasb2/

(Japan) Trends in ESG Information Disclosure

In Japan, environmental reports have been in effect since the early 1990s, and the number of reporting companies has increased since the Ministry of the Environment presented "Environmental Reporting Guidelines" in 1997. In addition to environmental initiatives, disclosure of information on social aspects has also become increasingly important.

In 2023, the Financial Services Agency will require listed companies to disclose human capital information in their securities reports. In the past, climate change-related information has been included as descriptive information in the "Management Policy, Management Environment, and Issues to be Addressed" and "Business and Other Risks" sections of the annual securities report. The new mandate requires companies to disclose both the environmental and social aspects of their business activities.

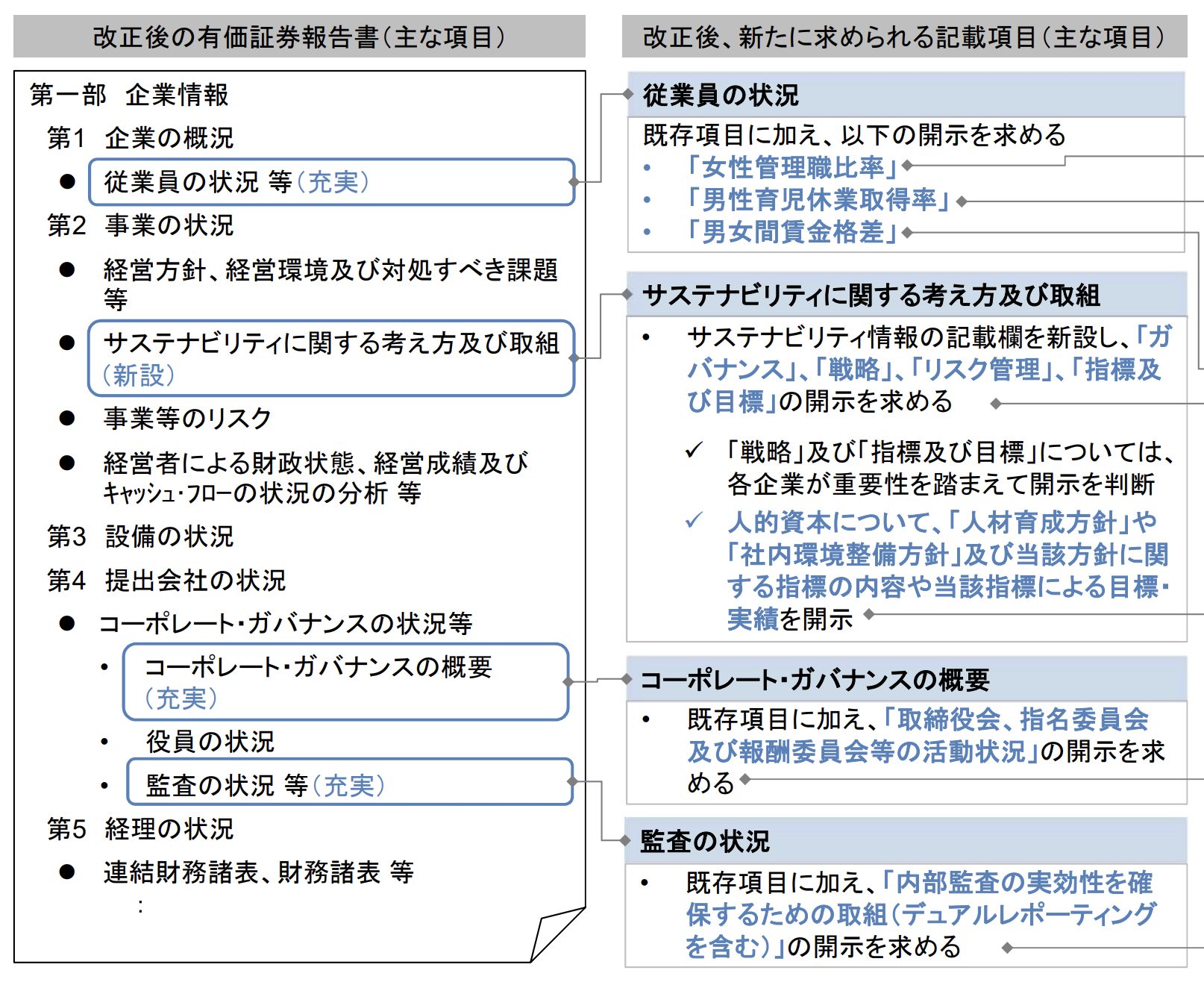

Figure 1: Reference Example of Items to be Included in the New Annual Securities Report

(Adapted from FSA, 2023. https://www.fsa.go.jp/topics/news/r4/singi/20230131/01.pdf )

Similar to the U.S. SEC's case, Japan's recent regulatory revision confirms that human capital information is being expanded while leaving some decision-making to the corporate side. The revised regulation requests the addition of the following three elements to the "employee status" section: the ratio of female managers, the ratio of male employees taking childcare leave, and the wage gap between men and women.

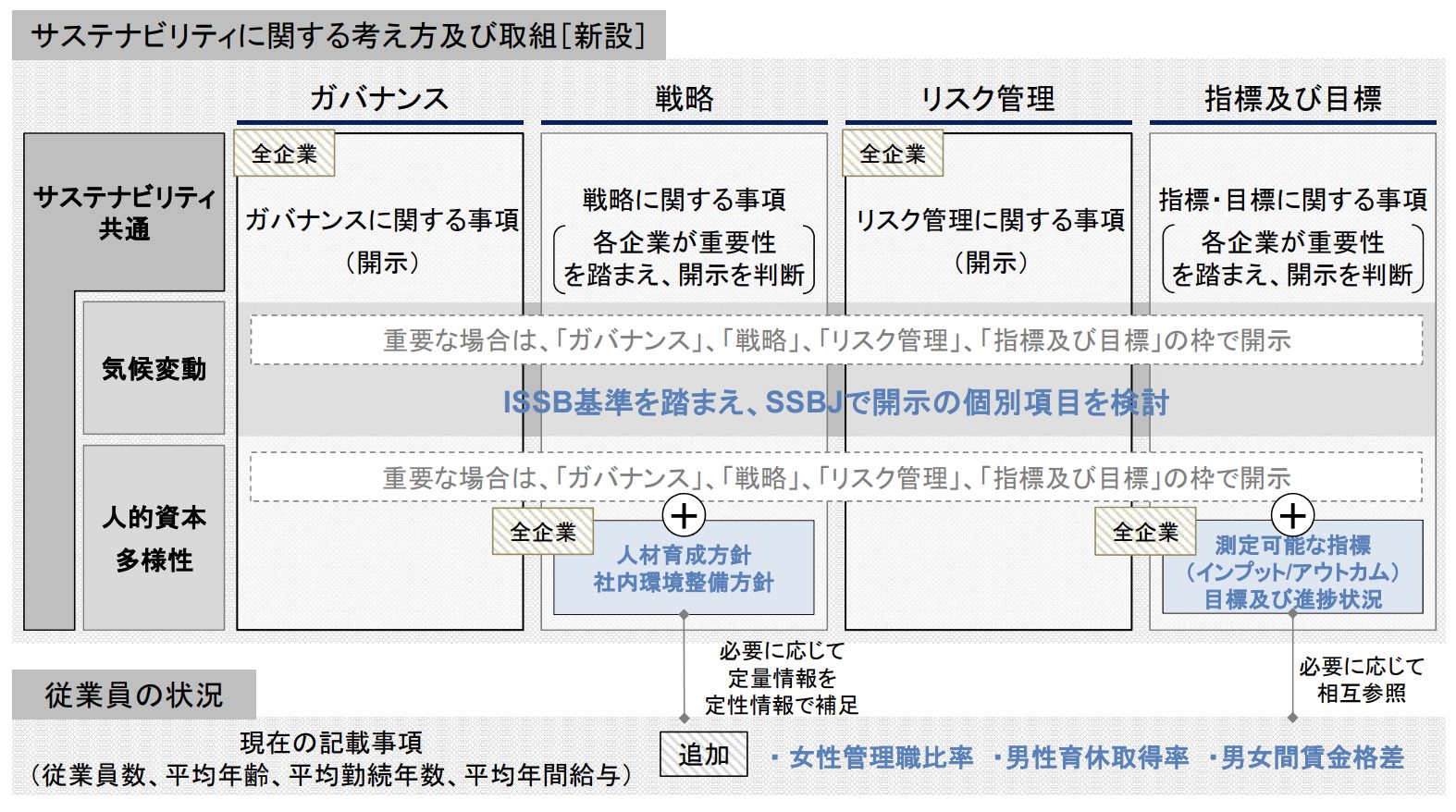

Figure 2: Overview of the columns for setting descriptions of "Sustainability Concepts and Initiatives".

(Adapted from FSA, 2023. https://www.fsa.go.jp/topics/news/r4/singi/20230131/01.pdf )

The new "Sustainability Philosophy and Initiatives" section includes four new sections to provide more information on "Environmental" and "Social (Human Capital and Diversity)" The four sections are "Governance," "Strategy," "Risk Management," and "Indicators and Targets," respectively. The four sections are "Governance," "Strategy," "Risk Management," and "Indicators and Objectives.

Of these, "Governance" and "Risk Management" are stipulated to be "required to be disclosed to all companies". This is for the reason that they are necessary as a framework for materiality judgments as companies discuss their own management aspects and value judgments.

On the other hand, "strategies" and "indicators and targets" are set as desirable but are left to each company to decide whether they should be disclosed or not.

Many Japanese companies are increasingly adopting SASB Standards and GRI Standards due to the global economy. Japan is likely to follow the lead of the U.S. and Europe and continue to develop regulations regarding the disclosure of sustainability information.

In Figure 2, it is noted that "SSBJ is considering individual items for disclosure based on ISSB standards. The Sustainability Standards Board aims to advance sustainability disclosure in Japan based on the international standards developed by the International Sustainability Standards Board (ISSB) (an organization under IFRS). As described in the previous section (Trends in the U.S.), IFRS, including ISSB, is currently undergoing rapid changes, including integration with SASB standards, and it is expected that Japan's sustainability standards will also develop according to the degree of development of the international standards being developed by ISSB. In this sense, we will not be able to ignore the trend of sustainability regulations in the U.S. and EU in the future.

aiESG Report "[Commentary]ISSB - Global Baseline for Sustainability Disclosure" (Japanese only)

https://aiesg.co.jp/topics/report/2301130_issb/

Conclusion

The importance of social capital in corporate non-financial information disclosure is increasing. In Japan, the aspect of human capital is strong, but it is not limited to human capital. In the future, companies will also need to disclose information on the efforts of all stakeholders beyond their employees, such as human rights initiatives in the supply chain. This is because the CSRD and ESRS, of which the EU is the leader, will be applied to companies outside the EU, and it can be imagined that Japan will also be required to improve its disclosure status for the purpose of attracting investors.

With new developments in sustainability disclosure in Europe and the U.S., we have confirmed that information disclosure is becoming increasingly important for Japanese companies. While companies have many years of experience in dealing with environmental capital such as climate change, the recent focus on social and human capital is expected to require more time in terms of documentation. In particular, clear data and other information on human rights responses within the supply chain will be required.

aiESG provides not only environmental, but also social and human capital data by using analytical tools developed by our company. If you have any questions regarding your company's internal sustainability disclosure, please contact us.

Contact us:

https://aiesg.co.jp/contact/

Related page

Report List : Regulations/Standards

https://aiesg.co.jp/topics/report/tag/基準-規制/

CSRD: The EU Sustainability Reporting Standard Just Before It Enters into Force: The Impact on Japanese Companies

https://aiesg.co.jp/topics/report/2301120_csrd/

Commentary] Overview of ESRS (European Sustainability Reporting Standards)

https://aiesg.co.jp/topics/report/2301208_esrs/

Commentary] Alphabet Soup - Disruptions and Convergence of Sustainability Standards

https://aiesg.co.jp/topics/report/2301226_alphabet-soup/

What is the SASB Standard for ESG Information Disclosure? (Part 1)Outline of SASB

https://aiesg.co.jp/topics/report/2301025_sasb1/

What is the SASB Standard for ESG Disclosure? (Part 2) Benefits for Companies

https://aiesg.co.jp/topics/report/2301115_sasb2/

Commentary] ISSB - Global Baseline for Sustainability Disclosure

https://aiesg.co.jp/topics/report/2301130_issb/

Explanation] What is "materiality" in sustainability reporting?

https://aiesg.co.jp/topics/report/240201_materiality/