Since the publication of the final recommendations on 18 September 2023, developments surrounding the TNFD have become more active. This website has provided background and an overview of the TNFD in the past two editions, as well as the challenges in actual disclosure.

Part 1 What is the TNFD? A new bridge between finance and the natural environment

https://aiesg.co.jp/report/230913_tnfdreport

Part 2: Status of TNFD disclosures and issues.

https://aiesg.co.jp/report/230102_tnfdreport2/

This issue focuses on the focus of the TNFD, which has been re-emphasised by the final recommendations, and the responses required from companies in the future.

Key points of the TNFD final recommendations

The Taskforce on Nature-related Financial Disclosures (TNFD) is a framework for disclosing the mutual impacts, risks and opportunities of companies and natural capital and biodiversity. It is expected that companies will receive appropriate recognition from investors and society by disclosing information in accordance with this framework.

The beta version v0.4 was released in March 2023 and the final recommendations on 18 September, and many companies in Japan have started to publish TNFD-related reports.

| Company Name | Open to the public | report |

| Kirin Holdings Company Limited | July 2022 July 2023 | ."Environmental Report 2022."Environmental Report 2023.' |

| Sumitomo Mitsui Financial Group | Apr 2023. | ."SMBC Group 2023 TNFD Report.' |

| Kao Corporation and Accenture Joint Research. | Apr 2023. | ."Business risks and opportunities posed by biodiversity - TNFD assessment Case studies based on regional characteristics -.' |

| Shiseido Co. | May 2023. | ."2023 Shiseido Climate/Nature-related Financial Disclosure Report ' |

| KDDI Corporation | Jun 2023. | ."TNFD Report 2023.' |

| NEC Corporation | July 2023. | ."NEC TNFD Report 2023.' |

| Tokyu Land Holdings Limited | Aug 2023. | ."TNFD Report - Contribution to Nature Positive in the Tokyu Land Holdings Group.' |

| Kyushu Electric Power Group | Sep 2023. | ."Kyuden Group TNFD Report 2023.' |

[Commentary] from TNFD Disclosure Status and Issues.https://aiesg.co.jp/report/230102_tnfdreport2/

Although the final recommendations have changed almost nothing significantly from the previous structure, some of the text of the general requirements and disclosure recommendations has been changed, and a variety of additional guidance has been published simultaneously to clarify the overall picture of the information that the TNFD requires to be disclosed. Some of the points that have been re-emphasised include.

1. local stakeholder involvement

Of the 14 disclosure recommendations under the four pillars (Figure 1), the description of stakeholder engagement, which was in the 'Managing risk and impact' section until beta version v0.4, has been reorganised as C under 'Governance'. Accordingly, references to indigenous peoples and local communities and a description of board and management oversight have been added. Additional indicators recommended for disclosure for all sectors also introduced a section on agreements with stakeholders in the area of operation and the impact on them (Table 2), as well as additional guidance on 'Engaging indigenous peoples, local communities and affected stakeholders' [1].

Figure 1: TNFD disclosure recommendations (Source:Executive summary of the recommendations of the TNFD)

Table 2: Additional global disclosure indicators relevant to stakeholders

(Source: prepared by the author from Recommendations of the Taskforce on Nature-related Financial Disclosures).

| index number | category | Overview. |

| A20.0 | Category: strategy Subcategory: engagement | Percentage of sites actively agreeing with local stakeholders on nature-related issues |

| A20.1 | Category: strategy Subcategory: engagement | Participation in sector-wide and/or multi-stakeholder agreements (number of agreements; number of stakeholders and stakeholder groups covered) |

| A24.3 | Category: dependency, impact, risk and opportunity management Sub-category: voluntary conservation, restoration and rehabilitation | Value of investments in nature-related community development programmes aimed at enhancing positive impacts on indigenous peoples and affected stakeholders |

The TNFD emphasises the importance of indigenous peoples and local communities, stating that their knowledge and community practices have helped to protect ecosystems [2]. One of the main features of the TNFD is that it requires disclosure of not only direct indicators about climate and resources, but also social and economic items related to nature.

2. relationship with other frameworks

The TNFD, and the LEAP approach recommended for use in TNFD disclosure, has been developed in conjunction with various other frameworks and tools (Figure 2).

Figure 2: Frameworks and tools relevant to TNFD

(Source:Recommendations of the Taskforce on Nature-related Financial Disclosures.)

In particular, it shares 11 of the 14 disclosure recommendations with the Task Force on Climate-related Financial Disclosures (TCFD) and is also aligned with the standards developed by the International The standards are also aligned with those developed by the International Sustainability Standards Board (ISSB). The aim is to meet the information needs of capital providers and lead to more effective disclosure.

For companies, the high relevance of the TNFD to existing frameworks is also considered to lower the disclosure hurdle. Although the nature of the nature-related nature of the TNFD requires a large number of indicators, the use of already adopted measurement indicators can start the discussion on information disclosure, even if only partially.

3. publication of the Getting Started Guide

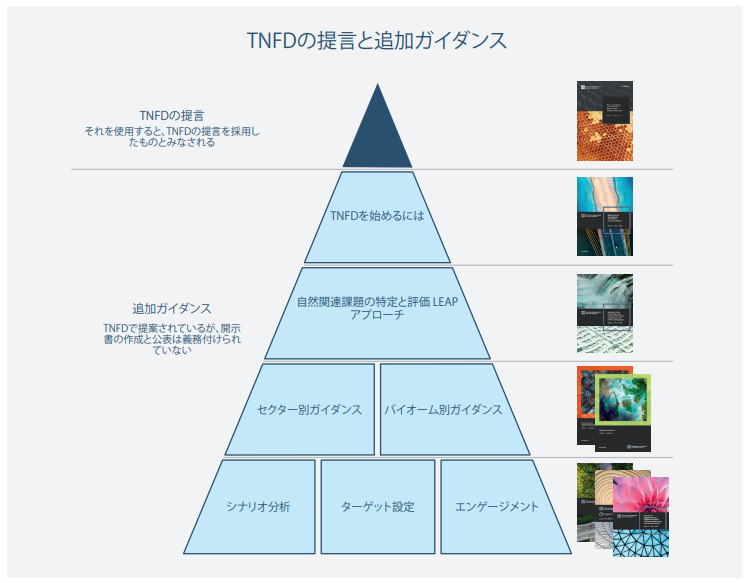

With the final recommendations, a range of additional guidance has been published (Figure 3): details on the LEAP approach and scenario analysis, as well as guidance by sector and biome, have been announced since the beta version, and now a new starting guide for getting started with the TNFD has been added. The new Getting Started Guide is now available.

Figure 3: TNFD recommendations and additional guidance (Source:Executive summary of the recommendations of the TNFD)

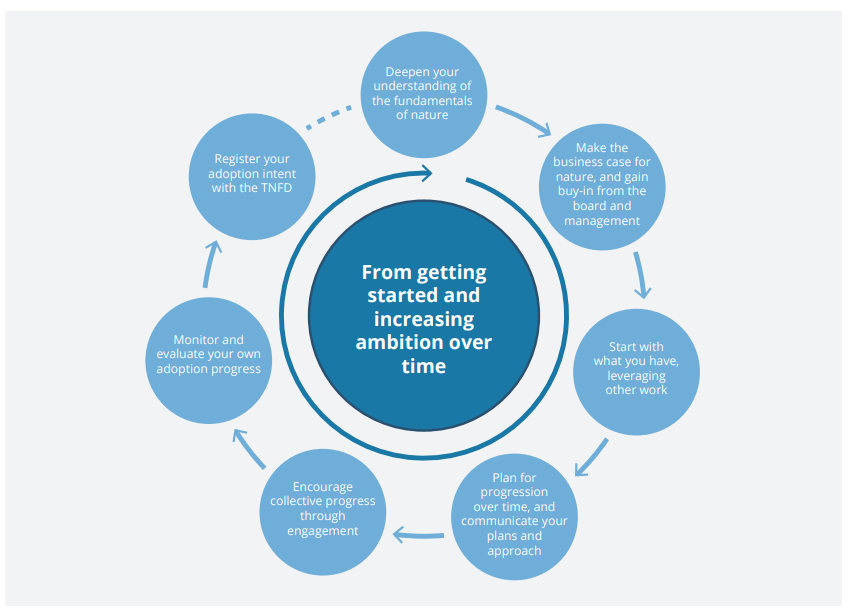

The guidance provides practical steps leading up to TNFD disclosure, considerations and findings from the beta pilot test. It provides information on key steps to consider for companies considering disclosure (Figure 4), and other tips on how to proceed with disclosure.

Figure 4: Seven key steps to start and improve TNFD disclosure

(Source:Getting started with the adoption of the TNFD Recommendations)

Discussion on TNFD voluntary disclosure

As has been mentioned, the TNFD inherits much of its structure from the TCFD, a climate change-related framework. In Japan, disclosure of information based on the TCFD, or an equivalent standard, is mandatory from 2022, and the rate of compliance is among the highest in the world [3].

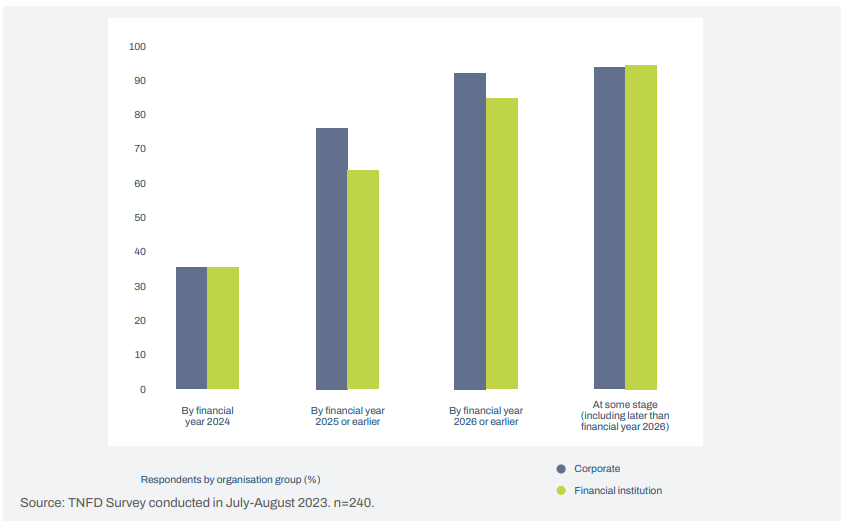

The TNFD expects this framework to spread more quickly, similar to the TCFD [4] In a survey conducted by the TNFD in summer 2023, 70% of companies and financial institutions said they could start disclosing by 2025 and 86% by 2026 By 2025. 761 TP3T of companies and 631 TP3T of financial institutions said they would be able to start disclosing, with companies likely to be able to do so sooner. (Figure 5).

Figure 5: Anticipated timing of when organisations can start TNFD disclosure

(Source:Getting started with the adoption of the TNFD Recommendations)

On the other hand, the disclosure of TNFD information is currently left solely to the autonomy of the organisation, and the variety of indicators and the difficulty of evaluation mean that the hurdles to disclosure remain high for many companies. The above survey also indicates a partial, rather than complete, start date for disclosure, and where among the 14 recommendations companies and industries can begin to disclose varies. Given this situation, it is possible that disclosure will be phased in from indicators that are closely related to each company.

Society's interest in biodiversity and the mutual impact of nature and business activities is growing even stronger. It is quite possible that pressure from investors and domestic and international parties will force you to move towards disclosure before it becomes mandatory or legal. First of all, it is necessary to understand the contact between your company and nature, and have a step-by-step discussion on how much information is currently available and what information is lacking.

Conclusion.

With the release of the final recommendations, it is expected that more attention will be paid to the TNFD than ever before. It is not an easy task for many companies to disclose information in compliance with the TNFD, which requires not only data directly related to the environment, but also community and economic indicators.

The services provided by aiESG enable ESG analysis not only on a company or business unit basis, but also on a product or service basis, and can quantitatively capture social and natural environmental aspects required by the TNFD, such as community impacts and indigenous rights, in addition to indicators such as greenhouse gas emissions, which can be measured using conventional services. The TNFD also provides a quantitative view of the social and natural environment required by the TNFD, such as community impacts and indigenous rights. Furthermore, it is possible to identify hotspots of high risk areas in the supply chain for each of these items, leading to the identification of priority areas of high risk.

Because it is a framework that is difficult to reach disclosure overnight, it is necessary to first re-acknowledge the challenges of one's own business and discuss disclosure from the point at hand, so as not to fall behind industry and social trends.

aiESG can provide support from the basics of TNFD to the actual disclosure of non-financial information. aiESG is happy to assist companies that need help in complying with TNFD.

Enquiry:

https://aiesg.co.jp/contact/

Bibliography

[1] https://tnfd.global/wp-content/uploads/2023/08/Guidance_on_engagement_with_Indigenous_Peoples_Local_Communities_and_affected_stakeholders_v1.pdf?v=1695138220

[2] https://tnfd.global/wp-content/uploads/2023/08/Recommendations_of_the_Taskforce_on_Nature-related_Financial_Disclosures_September_2023.pdf?v=1695118661

[3] https://project.nikkeibp.co.jp/ESG/atcl/column/00004/022400030/

[4] https://tnfd.global/wp-content/uploads/2023/09/Getting_started_TNFD_v1.pdf?v=1695138203

*Related page*.

[The [ibid.Explanation] What is the TNFD? A new bridge between finance and the natural environment

https://aiesg.co.jp/report/230913_tnfdreport/

[Commentary] TNFD disclosure status and issues.

https://aiesg.co.jp/report/230102_tnfdreport2/

aiESG participates in the Task Force on Nature-related Financial Disclosures (TNFD) Forum.

https://aiesg.co.jp/news/2309_tnfd/