(Head office: Hakata-ku, Fukuoka; Representative Director: Shunsuke Managi; hereafter 'aiESG'), a Kyushu University start-up that conducts quantitative ESG assessments, has conducted an ESG risk analysis of the Norinchukin Bank (Head office: Otemachi, Chiyoda-ku, Tokyo; Chairman: Kazuto Oku) portfolio, considering the supply chain of its investee companies. The results of the analysis showed that the Japanese packaged food and food products industry is a major contributor to the growth of the food industry. The results confirmed that investments and loans to Japanese packaged food and meat processing companies have an impact on land use and water impacts by the US agricultural sector.

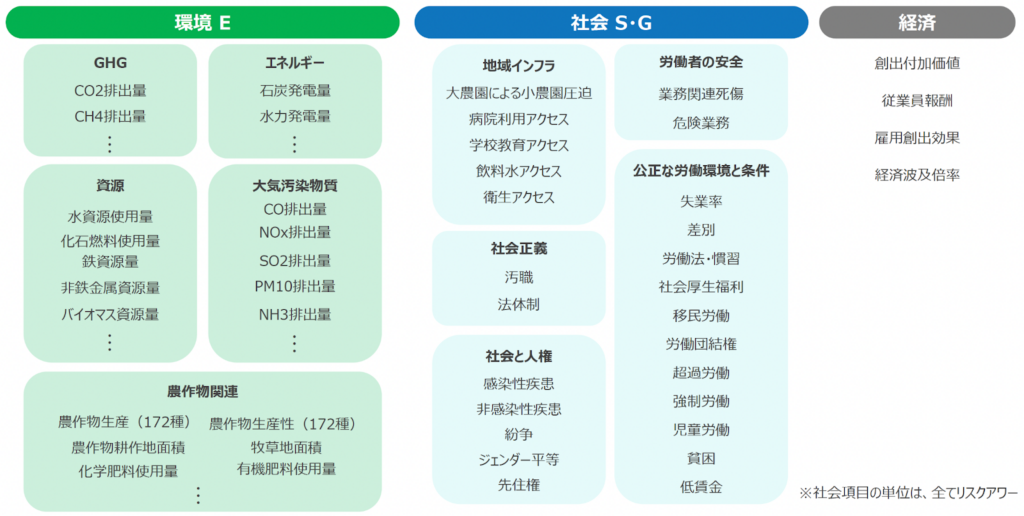

The Norinchukin Bank 'sClimate & Nature Report 2024.The analysis published in the 'GICS' visualises risks such as GHG emissions, water footprint* and human rights risks for the food-related sector (the GICS' essential commodities sector).

*Water footprint: the amount of water consumed or polluted directly or indirectly throughout its life cycle, including production, processing and distribution.

Analysis in charge of aiESG.

P53-55 Analysis considering the value chain of the investee

P75 Human rights risks in the value chain.

aiESG has established a method that traverses multiple layers of sectors from downstream to upstream in supply chain analysis using ESG indicators and statistical data to assess the cumulative environmental, water, human rights and other impacts upstream in the value chain, starting from the sector under analysis. The method is based on the sector being analysed.

Companies facing challenges in visualising nature-related risks in the value chain of their investments and investees, and proposing measures and priority setting for nature positivity based on this, are encouraged to contact us.

Enquiry about aiESG services:

https://aiesg.co.jp/contact/

Background and analysis results

The importance of the value chain is strongly emphasised in the disclosure recommendations of the Task Force on Nature-related Financial Disclosures (TNFD), which was launched in June 2021 with the approval of the G7 Finance Ministers.

By identifying nature-related impacts not only on the direct operations of the investee, but also on the investee's value chain, it is expected that the nature-related risks and opportunities of the investee that companies can identify will also be more accurate.

However, as there are currently only a limited number of companies that make disclosures based on the TNFD recommendations and publish nature-related indicators, and the available data is limited, the Norinchukin Bank has established a supply chain analysis of nature-related risks in the value chain, using ESG indicators and statistical data The analysis was attempted in collaboration with aiESG.

This analysis confirms that investments in Japanese packaged food and meat processing companies have an impact on land use and water consumption by the US agricultural sector.

This is expected to bring a new perspective to the initiatives based on the TCFD and TNFD recommendations promoted by the Norinchukin Bank, and to be used in dialogue with investment and loan recipients on measures and priority setting for nature positivity.

For more information, see Climate & Nature Report 2024, March 2024, published by the Norinchukin Bank.

Climate & Nature Report 2024 (relevant pages: P53-55, P75))

https://www.nochubank.or.jp/sustainability/backnumber/pdf/2024/climate_nature.pdf

What is aiESG (aiESG), a product-level ESG analysis service?

aiESG is the world's first service that enables comprehensive ESG analysis at product and service level. AI analysis using our ESG supply chain big data enables detailed calculations of over 3,200 ESG indicators, as well as comparisons with industry averages and conventional products. In particular, the CO2It is the world's first solution in that it can quantitatively assess not only environmental aspects such as human rights, biodiversity and labour environment, but also social and governance aspects, including human rights, biodiversity and labour environment, which have become increasingly important in recent years.

Furthermore, analysis by aiESG enables geographical estimation, which is difficult with conventional Life Cycle Assessment (LCA), and enables visualisation of environmental, social and corporate governance hotspots, not only for direct suppliers, but also for secondary and upstream suppliers.

In addition, as the only data required from the customer is product cost composition data or physical quantity data, ESG supply chain disclosures, which previously required huge amounts of man-hours, are facilitated.

Click here for an introduction to our services (https://aiesg.co.jp/report/20230515_service_aiesg/)

Related articles.

[Commentary] Key points of the TNFD final recommendations and the responses required from companies.

https://aiesg.co.jp/report/231106_tnfdreport3/

[Commentary] Nikkei article: aiESG supply chain analysis of electric vehicle (EV) production and ESG indicators worsening due to 'de-China'.

https://aiesg.co.jp/report/2301016_nikkeiev1/

[Commentary] Non-financial capital: trends in human and natural capital.

〜˜Disclosure regulations and guidelines at home and abroad

https://aiesg.co.jp/report/240329_human-natural-capital/

aiESG launches aiESG for IR, an integrated report evaluation service using generative AI.

~ Scoring consistency between integrated reporting and global ESG requirements ~.

https://aiesg.co.jp/news/aiesg-for-ir/

About aiESG (aiESG) Ltd.

We are a start-up company from Kyushu University that aims to realise a sustainable society through ESG analysis at the product and service level. aiESG, an ESG assessment platform that traces back the entire supply chain, based on years of international and academic ESG research, including work by G20 UN report representatives. The company also provides support on ESG in general. It also provides support services on all aspects of ESG.

Click here to visit our corporate website (https://aiesg.co.jp/)

Company profile

Name of company: aiESG Inc.

Head office: 2F NMF Hakata Ekimae Building, 1-15-20 Hakata Ekimae, Hakata-ku, Fukuoka City, Fukuoka

President : Shunsuke Managi

Business : Product/service level ESG analysis business.

HP : https://aiesg.co.jp/

Establishment : July 2022.

[For further information on this matter, please contact.

Addressed to public relations, aiESG Inc.

Email address:pr@aiesg.co.jp