Front page of the Nikkei newspaper, 15 August.Our company was featured in. The impact of the US-China conflict on the supply chain (supply chain) of electric vehicles (EVs) is analysed using the services of aiESG.

This report explains how we analysed the supply chain of electric vehicles using our proprietary ESG assessment service, aiESG, which has been included in the Forbes Asia 100 (100 Companies to Watch in Asia).

[Report Summary].

...China is likely to be excluded from the electric vehicle supply chain in the US in the future.

Analysis by aiESG shows that if China is removed from the supply chain and electric vehicles are manufactured, both environmental and human rights ESG indicators would be worse than at present.

The deterioration of ESG indicators can be attributed to an increase in the supply of components from Mexico and other countries replacing China, as well as to the inclusion of more Latin American and African countries along the supply chain.

[Background.

Growing movement to exclude China from the US EV supply chain.

The Inflation-Reduction Act (IRA), which was passed in the US in August 2022, provides for a tax credit of up to USD 7,500 per vehicle if electric vehicles are assembled in North America and 50% of battery components are manufactured in North America. The percentage of battery components sourced from North America is then scheduled to increase to 100% by 2029.

While the importance of economic security has been reaffirmed in many countries following Russia's invasion of Ukraine and the disruption of supply chains following the spread of the new coronavirus, this law is expected to exclude China from the supply chain of electric vehicles in the USA. As a result, we and the Nikkei jointly analysed what changes would occur in ESG assessments, such as environmental and human rights risks.

[Analytical Methods].

Use of the aiESG service, which enables ESG assessments for each product and service.

The analysis was carried out using the aiESG service, which combines a database and a proprietary AI to provide a precise and multifaceted ESG assessment of each product and service.

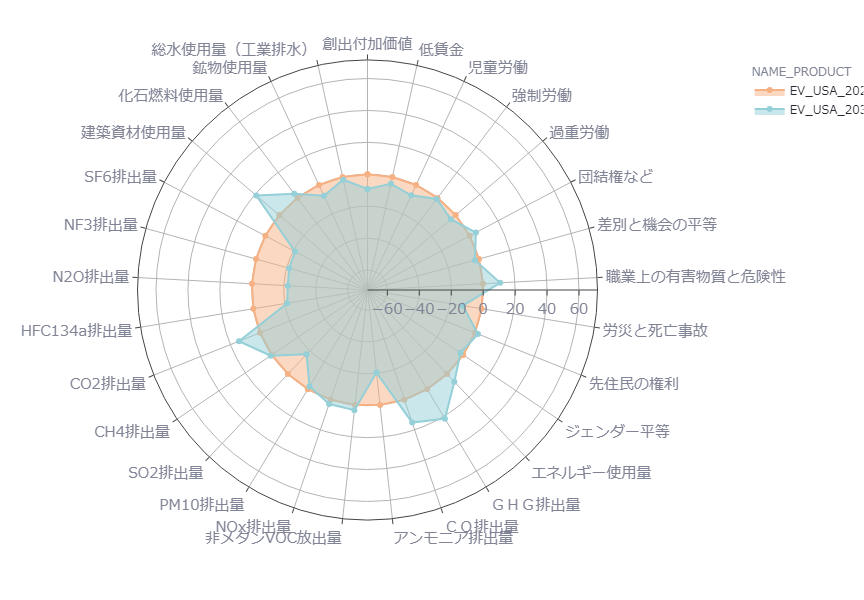

It examines how the present (2021) and future (2030) of electric vehicle manufacturing in the USA, with the expected exclusion of China from the supply chain, will change in 29 areas related to environmental and human rights risks.

For the sourcing countries that will replace China in 2030 for various components, the ratio for each sourcing country was set based on future forecast data from market research companies.

The 29 items cover a full range of environmental risk items such as greenhouse gas (GHG) emissions affecting climate change and total water consumption (industrial effluents) related to water resources, as well as human rights risk items such as forced labour, child labour, occupational accidents and fatalities.

The reason for the 29-item analysis is that the mandatory disclosure of sustainability information in securities reports has led to companies in the automotive industry disclosing their strategies and progress indicators on key ESG-related issues. We also took into account the background to the establishment of the Task Force on Nature-related Financial Disclosure (TNFD), which is expected to require more detailed biodiversity-related information disclosure in the future.

[Survey results].

Concerns that the exclusion of China from the supply chain will increase environmental and human rights risks.

In 17 of the 29 indicators, or approximately 60%, the indicators were found to be worse in year 30 than in year 21. In other words, the indicators reveal that the ESG burden will increase as a result of responding to the Inflation-Reduction Act (IRA) and excluding China from the supply chain. (Figure 1)

Looking specifically at each item, in terms of environmental risk, CO2 emissions (-14.18% compared to 2009), GHG emissions (-21.59% compared to 2009), energy use (-6.65% compared to 2009) However, the indicator worsened in nine out of 18 categories, including SO2 (sulphur dioxide) emissions (+16.94%) and PM10 (particulate matter) emissions (+2.01%), which lead to air pollution. In terms of human rights risks, the indicator worsens in seven out of ten categories, including low-paid work (+4.35%), child labour (+7.15%) and occupational accidents and fatalities (+11.89%).

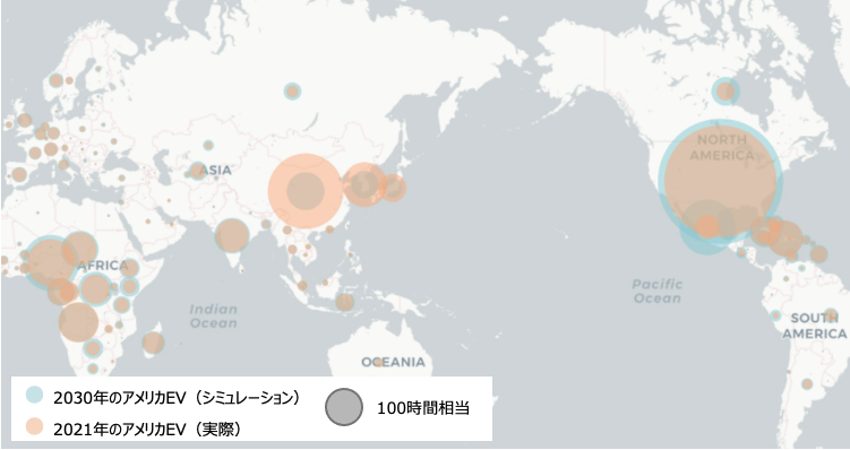

The blue and orange circles represent the loads in 2030 and 2021 respectively. The size of the circle area shows significantly that the load of China and South Korea will decrease, while the load of the USA and Mexico will increase.

The Inflation-Reduction Act (IRA) is supposedly designed to control excessive inflation and at the same time speed up energy security and climate change measures, but in electric vehicles, the law reduces greenhouse gas emissions, but has negative social impacts, such as air pollutants and human rights. Indicators show that the law may have a negative impact on social aspects such as air pollutants and human rights.

[Discussion]

The expansion of the supply chain from North America to Latin America and Africa is a factor in the deterioration of ESG indicators.

The main difference between the data set for 21 and 30 years in this analysis is the presence or absence of China in the supply chain. The analysis also looks at changes in indicators for each of the parts that make up an electric vehicle, such as the battery, motor, interior and exterior components and bodywork, but the biggest impact is on the battery: in 21 years, the main supply chain for the battery is China, South Korea and Japan, whereas in 30 years, when the Inflation-Reduction Act (IRA) will require manufacturing in North America, whereas in year 30, the US, Canada and Mexico will be the sourcing countries.

The aiESG ESG assessment traces not only the primary supply chain, but from there all supply chains beyond national borders. Therefore, with the USA, Canada and Mexico as battery sourcing countries, the ESG assessment of the supply chain can extend to surrounding countries such as Latin America and Africa.

Although human rights due diligence (human rights DD) efforts are being stepped up, particularly in Europe, the analysis found worsening indicators in seven of the ten human rights risks. A study by the International Labour Organisation found that Mexico ranks fifth in the world for occupational injury risk. It is assumed that the change in the supply chain from China to Mexico and other North American countries has had an impact on the deterioration of human rights risk indicators.

Similarly, in environmental risks, the ESG assessment of the supply chain changes from China, South Korea and Japan to the USA, Canada and Mexico, tracing it back to the neighbouring countries, could have had an impact on the deterioration of nine out of 18 indicators.

[Summary.

Major ESG challenges lurk in the trend away from EV production in China

The aiESG analysis, which traces the supply chain across borders to the end, reveals that both environmental and human rights aspects worsen in the ESG assessment if China is excluded from the US electric vehicle supply chain. The shift in the supply of batteries and other components from China to countries around the US, such as Mexico, and beyond to Latin America and Africa, is thought to have an impact on the deterioration of ESG indicators.

Through comprehensive ESG assessments of products and services, aiESG supports the development of products and services that are compatible with ESG perspectives and the formulation of marketing and branding strategies, including identifying key items to watch from an ESG risk perspective.

Companies facing challenges in developing ESG-conscious products and services, as well as marketing strategies, are encouraged to contact us.

Enquiries about services:

https://aiesg.co.jp/contact/

*Related articles*.

The results of aiESG's analysis of EV were published on the front page of the Nihon Keizai Shimbun.

https://aiesg.co.jp/news/230815_nikkei/

aiESG named to Forbes Asia 100 (100 companies to watch in Asia); webinar on 20 September to celebrate!

https://aiesg.co.jp/news/20230906_forbeswebinar/

aiESG participates in the Task Force on Nature-related Financial Disclosures (TNFD) Forum.

https://aiesg.co.jp/news/2309_tnfd/