(This article is the second part of a back and forth section; please also see the first part if you would like to see an overview explanation of the SASB standards, etc.)

[Commentary] What is the SASB Standard for ESG information disclosure? (Part 1)

https://aiesg.co.jp/report/2301025_sasb1/

[Commentary] What is the SASB Standard for ESG information disclosure? (Part 2)

Although the SASB itself is not legally binding, the SASB Standards have become the recommended standard for mandatory ESG disclosure, which is being developed in many countries. It also provides benefits such as improved branding and reduced management risk. In addition, research conducted by aiESG members and others has shown that the SASB Standards are effective in ESG management.

Contents - Part 2.

1. benefits for businesses

2. publication of indicators according to SASB standards

3. support for SASB compliance provided by aiESG

4. summary.

In recent years, as companies have placed increasing importance on addressing sustainability, the number of companies adopting the SASB Standards has been on the rise, along with their growing international influence. The second part of this report focuses on the benefits of companies adopting the SASB Standards, which specify disclosure requirements for important ESG information on sustainability. After reviewing the detailed provisions of the SASB Standards necessary to secure these benefits, reference is also made to the services that aiESG can provide.

1. Advantages for businesses

The SASB Standard facilitates investor decision aids with uniformity of information through adherence to finely set standards.

This is likely to bring significant benefits to businesses.

Advantage 1: 'Clear and efficient information disclosure'

The clarity of the published indicators and the detailed specification of the analysis methods enable companies to publish sustainability indicators that make effective use of their limited time and money.

Benefit 2: 'Improved branding'

In recent years, sustainability compliance, led by the SDGs, has become a strong expectation for all companies.

In some regions, cases have been identified where environmentally friendly corporate activities and related reporting are mandatory, and sustainability initiatives in corporate activities are becoming a factor that cannot be ignored as a motivation for investors.

Disclosure in accordance with SASB standards can create the impression to investors (as well as to stakeholders as a whole) that a company follows sustainability standards in terms of its corporate image.

A side benefit of being a company compliant with the SASB standard is the expected ease of access to market funding and other opportunities.

The application of the SASB standard will be highly effective in terms of improving company branding in the future.

Advantage 3: 'Reduced management risk'.

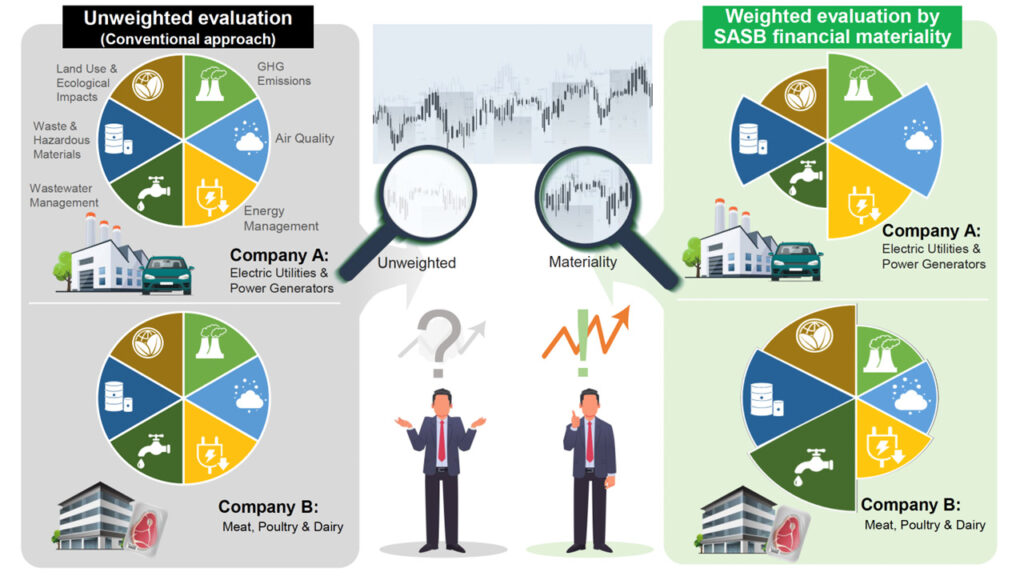

The SASB standard imposes quantitative (qualitative) indicator disclosure on five main aspects, although detailed indicators vary from industry to industry.

From a risk management perspective, considering the introduction and publication of these indicators will enable the construction of management strategies that take a long-term perspective on risk.

In particular, the SASB requires public disclosure of ESG-related matters that have a significant financial impact, which also contributes significantly to eliminating the risk of damaging corporate value.

The number of companies adopting the SASB standard will continue to grow globally, as the benefits of adopting the SASB standard exist in terms of risk avoidance for company management.

The following section explains what requirements are imposed on the actual procedure for index publication.

2. Publication of indicators according to SASB standards.

Companies can prepare reports compliant with the SASB standard by referring to the SASB Implementation Primer, which is published by the official

The main items that the SASB Standard requires companies to disclose are

middle dot (typographical symbol used between parallel terms, names in katakana, etc.)Disclosure topic:.

A set of disclosure topics that vary by industry sector; the SASB Standards enumerate how the management and mismanagement of disclosure topics can affect the long-term value creation of a company. On average, the SASB Standards contain six disclosure topics per industry.

middle dot (typographical symbol used between parallel terms, names in katakana, etc.)Accounting metrics:.

Both quantitative and qualitative indicators are used to measure the performance of disclosure topics. There are 13 indicators for each industry sector.

middle dot (typographical symbol used between parallel terms, names in katakana, etc.)Technical protocol:.

It provides clear instructions to companies on definitions and scope* so that metrics can be compared between companies. This also serves as an instruction to independent third-party evaluation bodies.

*Define, scope of application, accounting, aggregation and display

middle dot (typographical symbol used between parallel terms, names in katakana, etc.)Activitiy metrics:.

Refers to an indicator used to measure the size of a company's operations. The purpose of disclosing the operational background is to facilitate normalisation to the relevant disclosure analysis.

An important aspect of SASB standards reporting for companies is the increased profit margin that can be achieved by attracting the attention of investors and investment assessment bodies through compliance with, for example, the analytical methods set out.

The SASB Standards play an important role as an element of clearer sustainability disclosures, as investors have been shown to significantly price companies that comply with the SASB Standards.

3. Support to SASB compliance provided by aiESG.

We, aiESG, the ESG assessment company, are the first Japanese company to obtain a Corporate Reporting Software licence under the IFRS Foundation's SASB Standard, the international sustainability disclosure standard.

Japan's first ESG assessment institute, aiESG obtains a licence under the international sustainability standard SASB Standard as an ESG assessment institute.

https://aiesg.co.jp/news/20230808_sasb/

Through academic research, aiESG members have shown that the SASB Standards are effective in ESG management, which they have.

[Paper commentary] The relationship between environmental assessment and stock returns.

~ Investors regard companies that do not engage in environmental management as a significant risk ~.

https://aiesg.co.jp/report/230712_escore_investor/

Through this research, ESG assessments can be made more transparent, in addition to being able to offer an analytical service dedicated to the ESG information that investors and companies place the highest priority on, through licensing to the SASB standard.

Analysis using our ESG supply chain big data enables us to provide detailed estimates for over 3,200 ESG indicators, including human rights, water resources and governance.

The quantitative analysis required for reporting in accordance with SASB standards can also be performed by referring to data provided by the company.

4. summary

The SASB standard is effective in appealing to investors because addressing ESG and sustainability is extremely important in today's corporate management SASB has been established as a common international standard for sustainability information disclosure and has been adopted by many companies around the world, and increasingly by Japanese companies as well. Although not legally binding, the SASB will become increasingly important in the future due to the growing trend towards integration of international sustainability standards and frameworks. The benefits for companies include uniformity of information, improved branding and reduced management risk, and the SASB standard will bring significant benefits to corporate management. In reporting, companies should refer to the SASB Implementation Primer and comply with disclosure items, accounting indicators, technical protocols and activity indicators. aiESG provides analytical services that comply with the SASB Standards and improve the transparency of ESG assessments.

aiESG can assist with everything from the basics about SASBs to the actual disclosure of non-financial information.

Companies that need help with SASB compliance are encouraged to contact us.

Enquiry:

https://aiesg.co.jp/contact/

*Related page*.

Commentary] What is the SASB Standard for ESG Information Disclosure? (Part 1) SASB Overview

https://aiesg.co.jp/report/2301025_sasb1/

Japan's first ESG assessment institute, aiESG obtains a licence under the international sustainability standard SASB Standard as an ESG assessment institute.

https://aiesg.co.jp/news/20230808_sasb/

[Paper commentary] The relationship between environmental assessment and stock returns.

~ Investors regard companies that do not engage in environmental management as a significant risk ~.

https://aiesg.co.jp/report/230712_escore_investor/