There is an increasing need to incorporate sustainability and ESG-related information in corporate annual reports. In this context, the SASB Standard stands out amongst the standards and frameworks on sustainability (ESG).

aiESG is the only Japanese company to do so,SASB standards "Corporate Reporting Software" Licence obtained.I am doing.

This article will provide an overview of the SASB Standard, including the background to its establishment.

[Brief commentary] What is the SASB Standard for ESG information disclosure?

The SASB Standards proposed by the SASB (US Sustainability Accounting Standards Board) stipulate ESG information disclosure for each of the 11 industries and 77 sectors. By ensuring fair disclosure of information between companies, this will not only provide investors and evaluation criteria with material for deciding what to invest in, but is also expected to have a significant effect in hedging risks and improving branding in corporate management. In terms of recommended standards in environmental reports, more and more Japanese companies are adopting them every year. The SASB Standard is increasingly attracting attention as an international ESG standard.

Contents - Part 1.

1. about the SASB Standard

What is 'materiality'?

2. what criteria the SASB Standards set out

What are the differences from other ESG-related frameworks?

3. who is covered by the criteria?

Japanese companies are also adopting the trend.

4. the pros and cons of legal binding

International trends in the integration of standards and frameworks for sustainability.

5. summary

Sustainability information disclosure plays an important role in appealing to investors, as corporate management is expected to respond to ESG and sustainability issues in the future. The SASB Standard is expected to be part of the first common international sustainability standard for global business in the future. The SASB Standard is expected to be part of the first common international sustainability standard for global business in the future.

Basic information on the SASB is explained in detail in two parts, Part 1 and Part 2.

The first part focuses on an overview of the SASB standard, from its inception to the legally binding nature of the regulation.

1. about the SASB Standard

The SASB (US Sustainability Accounting Standards Board) is a non-profit organisation established in the US in 2011 to help companies identify and disclose financially material sustainability information.

The purpose of its establishment was to improve the quality of corporate disclosure by developing more quantitative (and sometimes qualitative) indicators in the field of ESG, for which evaluation criteria had previously been considered private, and to contribute to investors' decision-making from a medium- to long-term perspective.

The standards for the disclosure of ESG factors that are expected to have a high future financial impact, as specified by the SASB, are known as the SASB Standards (SASB Standard).

A key feature is the focus on materiality (non-financial disclosures) with a high financial impact. The SASB Implementation Framework states that it will "develop and maintain strong reporting standards that enable companies around the world to identify, manage and communicate financially material sustainability information to investors".

In other words, the SASB Standards aim to provide an opportunity to discuss and examine economic activities between companies that ensure a fair perspective to investors through the application and disclosure of information by many companies.

It has now been adopted by over 2000 companies worldwide as the global standard for sustainability disclosure, and is also used by Japanese companies and supported by investors with large investments.

What is 'materiality'?

The term 'materiality' refers to 'key issues' in a company's activities. It is one of the non-financial indicators used by companies to communicate their activities to investors and shareholders.

The SASB defines materiality as 'information that, had it been disclosed, would have significantly altered the position of information used by a reasonable investor'.

2. what criteria the SASB Standards set out

The SASB Standard sets individual criteria for 77 industries in nine sectors aligned to the Sustainable* Industry Classification System (SICS).

*The SASB Standard defines 'sustainability' as 'corporate activities that amplify or maintain a company's ability to create shareholder value over the long term'.

Table 1: List of SICS-prescribed industries & sectors (prepared by the author)

| consumer goods | Mining and mineral processing | financing | Food and beverages | health care | infrastructure | Renewable resources and alternative energy | resource conversion | Tertiary industry (services) | communication technology | traffic |

| Apparel, accessories and footwear industry | coal business | Asset management and custody services | crops | Biotechnology and pharmaceuticals | Electricity utilities and power generators | biofuel | Aerospace and Defence | Advertising and marketing | Electronic manufacturing services (EMS), original design manufacturing (ODM) | Air cargo and logistics |

| Manufacture of household electrical appliances | Construction material entities | commercial bank | alcoholic beverage | drug retailing | Engineering and construction services | forestry management | chemistry | Casino Games | hardware (esp. computer) | airline company |

| Building materials and furniture industry | Steel business | consumer credit (finance, loan) | Food retail and distribution | Healthcare Delivery | Gas projects and distribution | Fuel cells and industrial batteries | container packaging | education | Internet media and services | Automotive Parts |

| e-commerce industry | metal mining industry | insurance | Meat, poultry and dairy | Healthcare Distributors | house construction | Bulp and paper products | Electrical and electronic equipment | Hotels and accommodation | semiconductor | Automobile manufacturing |

| Household and personal goods industry | Oil and gas - exploration and production (E&P) | Investment banks and securities firms | non-alcoholic beverage | managed care | real estate | Solar technology and project development | Industrial machinery and goods | recreational facility | Software and IT services | Car rental and leasing |

| Multiline and specialised retail and distribution | Oil and gas - midstream entities | Mortgage finance | processed food | Medical equipment and supplies | real estate brokerage | Wind technology and project development | Media and entertainment | communication service | Cruise-related | |

| Toy and sporting goods industry | Oil and gas - Refining and marketing (R&M) | Stock and commodity exchanges | restaurant (esp. Western-style) | waste management | Professional and commercial services | maritime | ||||

| Oil and gas - services | tobacco | Water utilities and services | rail transport | |||||||

| road transport |

In addition, the SASB Standard aims to create a clear disclosure standard by dividing topics according to the following five aspects of disclosure items

Environment

Social capital

Human Capital

Business model and innovation

Leadership and governance

These five core topics further branch out to form a total of 26 disclosure topics.

Table 2: Disclosure topics (prepared by authors)

| environment | SOC | human capital | Business models and innovation | Leadership and governance |

| GHG emissions | Human rights and community relations | labour practices | Product design and life cycle management | business ethics |

| Air pollution level | customer privacy | Employee health and safety | Business model resilience (resilience) | competitive behaviour |

| energy management | data security | Employee engagement and Diversity and inclusion | Supply chain management | Managing the legal and regulatory environment |

| Water and wastewater management | Marketability and pricing | Material procurement and efficiency | Serious accident risk management. | |

| Waste and hazardous substance management | Product quality and safety | Physical impacts of climate change. | systems risk management | |

| Ecological Impact. | customer welfare | |||

| Sales practices/product labelling |

These industry-specific standards and detailed disclosure topics are established because the materiality of sustainability issues varies from industry to industry.

(e.g. while 'energy management' is a highly relevant issue for companies in the real estate industry, the toy and sporting goods industry does not see significant relevance).

The SASB places a strong emphasis on establishing standards that are transparent, improve confidence building and enable companies to capture business risks and disclose clear mitigation measures using quantitative data.

How does it differ from other ESG-related frameworks?

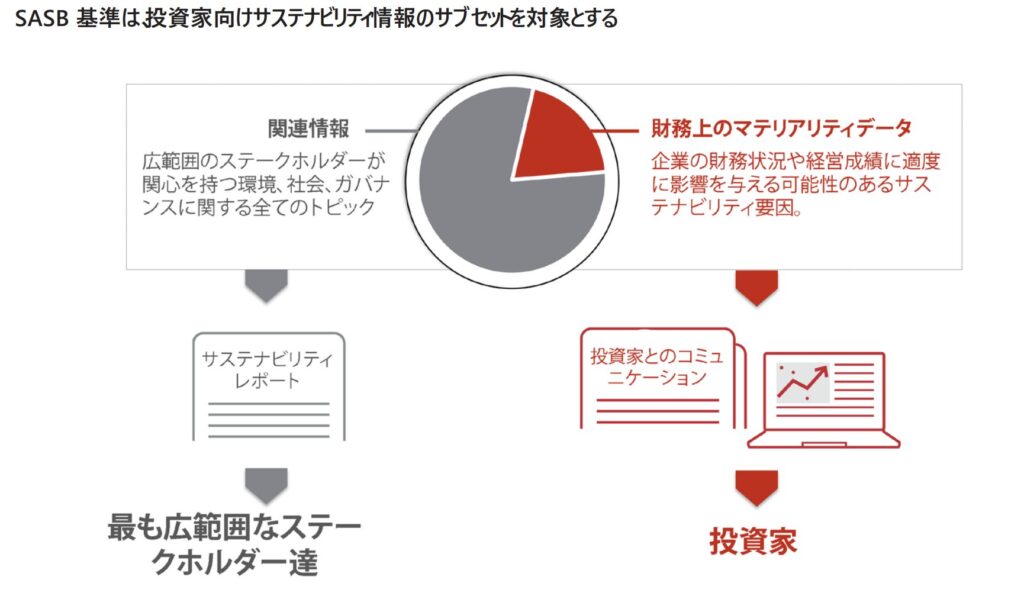

Figure 1: Relationship between the SASB standards and other frameworks (cited in SASB Implementation Primer).

The SASB makes the following distinction between the Sustainability Framework and the Sustainability Standards

'The Framework provides principles-based guidance on how information should be structured, how it should be prepared and what broad topics it should cover.'

The standards are specific as to what should be reported for each topic. They provide detailed and reproducible requirements."

Standards are the building blocks that make the Framework practical, and by their nature of ensuring comparable, consistent and reliable disclosures, the Framework and Standards are designed to be complementary and used concurrently.

From the above, the SASB Standards (criteria) can be seen as a complementary element to other sustainability frameworks (e.g. GRI and TCFD).

3. who is covered by the criteria?

The SASB Standard sets disclosure standards primarily for investors, but can be used for both commercial and non-commercial applications with a wide range of market players in mind, including companies and rating agencies.

Demonstrating compliance with the SASB standard is an economic benefit, as it shows that the company is committed to sustainability.

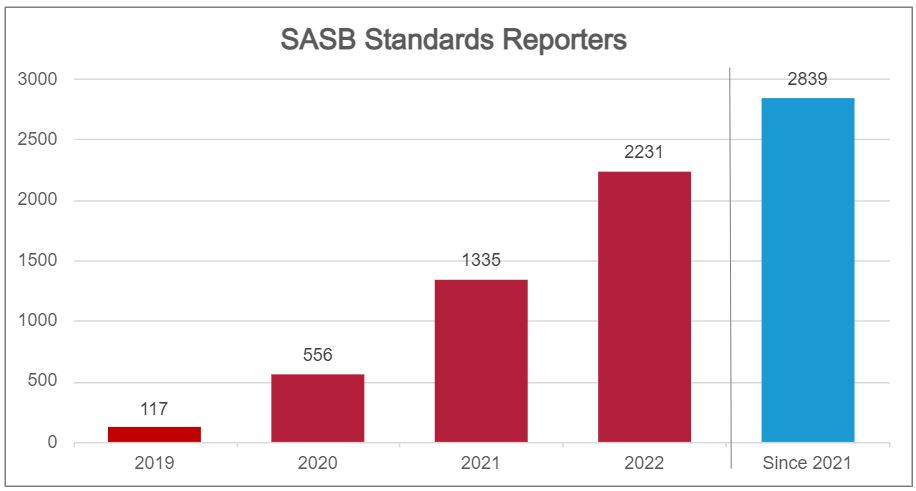

The number of companies compliant with the SASB standard as of 2022 is 2231 globally.

Figure 2: Global number of companies adopting SASB standards (cited in:https://sasb.org/about/global-use/ )

The number of companies adopting the SASB Standard was 117 in 2019, while in 2022 more than 2000 companies will have applied the SASB Standard.

In the future, the importance of the SASB Standard as an international sustainability disclosure standard is expected to increase and the number of companies adopting it to grow, taking into account that the International Sustainability Standards Board (ISSB) has stated that it will be integrated with the SASB Standard.

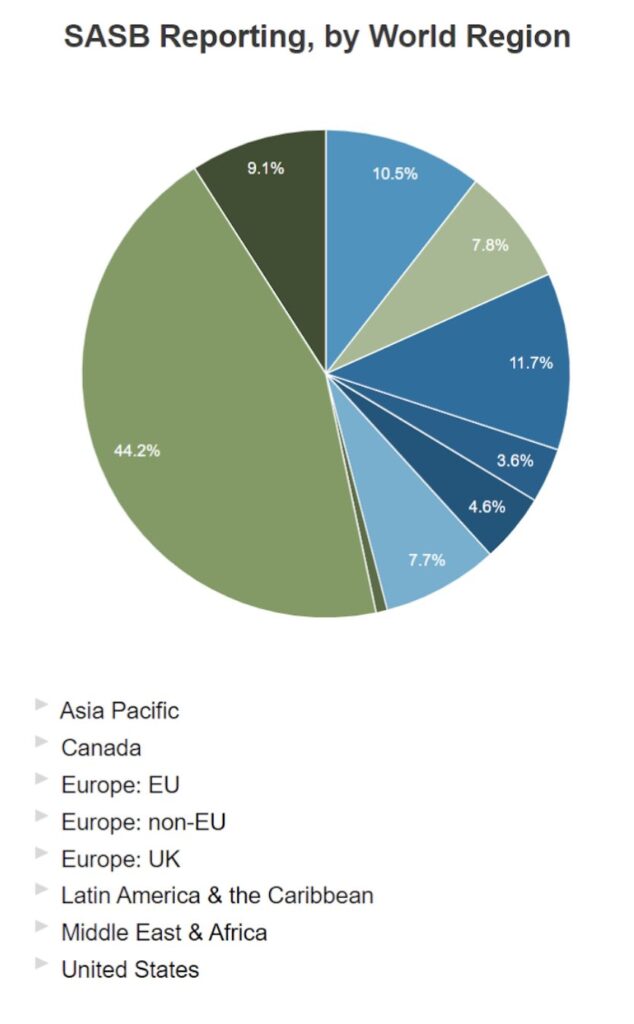

Figure 3: Employer location classification (citation. https://sasb.org/about/global-use/ )

A review of the locations of companies that have adopted the SASB standard (as of 2022) confirms that while the majority of companies are from the US, the proportion of companies from Europe and the Pacific is also expanding (Image 3).

Japanese companies are increasingly adopting SASB.

The SASB Standards can be officially accessed in Japanese as well as English. The presence of the SASB Standards as sustainability standards in Japanese companies is expected to increase in the future.

At present, the number of Japanese companies that have published reports compliant with the SASB Standards is 65 according to the Profile of SASB Standards Reporters published by the SASB (total for 2018-2022).

Table 3: Selected excerpts from Japanese companies compliant with the 2022 SASB Standard

(Prepared by author with reference to Profile of SASB Standards Reporters:. https://sasb.org/company-use/sasb-reporters/ )

| Company Name | SICS regulated industries | SICS Regulated Sector | Degree of SASB compliance |

| Shiseido | Household and personal products | consumer goods | full compliance |

| INPEX Corporation. | Oil and gas - exploration and production (E&P) | Mining and mineral processing | full compliance |

| Mizuho Bank | commercial bank | financing | partial compliance |

| Asahi Group Holdings Ltd. | alcoholic beverage | Food and beverages | full compliance |

| Takeda Pharmaceuticals | Biotechnology and pharmaceuticals | health care | full compliance |

| Kansai Electric Power Co. | Electricity utilities and power generators | infrastructure | partial compliance |

| Sumitomo Forestry | forestry management | Renewable resources and alternative energy | full compliance |

| Asahi Kasei Corporation | chemistry | resource conversion | full compliance |

| Advantest Corporation | semiconductor | communication technology | full compliance |

| Nissan Motor | Automobile manufacturing | traffic | full compliance |

Table 3 above confirms that major Japanese companies, regardless of industry, report in accordance with SASB standards.

4. the pros and cons of legal binding

As the SASB Standards are published by a non-profit organisation, they are not legally binding on companies. This means that there is no penalty for non-compliance.

However, there are examples where the SASB Standard has been adopted as a sustainability standard used within corporate reports, as well as other standards.

For example, the ESRS European Sustainability Reporting Standard will become operational in the EU in 2023, and the European Commission has included the SASB among other recommended frameworks. Also,Discussion in the US on making it mandatory to disclose SASB information within institutional disclosure documents.In some cases, such as the following, this has taken place.

In Japan, the disclosure of sustainability information in securities reports and other documents will also become mandatory from January 2023. This means that compliance with sustainability standards is an urgent issue for Japanese companies.

International trends in the integration of standards and frameworks for sustainability.

Investors and companies are demanding simpler sustainability disclosures to reduce the complexity of multiple frameworks. Given the large number of sustainability frameworks and standards, in June 2021, the SASB completed a merger with the International Integrated Reporting Council (IIRC) to form the Value Reporting Foundation (VRF). This was done with the aim of establishing a more comprehensive and consistent corporate reporting framework.

In 2022, the International Financial Reporting Standards (IFRS) Foundation took over the SASB standards through a merger with the VRF, an international not-for-profit organisation that aims to develop investment standards while ensuring transparency; the newly established International Sustainability Standards Board (ISSB) within the IFRS aims to strengthen and expand the SASB standards, including integration with the Climate-related Financial The ISSB aims to strengthen and expand the SASB standards, including integration with the Task Force on Climate-related Financial Disclosures (TCFD) standards, to simplify application and improve sustainability reporting.

Thus, international standards and frameworks on sustainability are in the process of being integrated, and the SASB Standard will become increasingly important.

5. summary

The first part of this report provides an overview of the SASB Standard, which is an important sustainability standard for modern companies and an important means of increasing their appeal to investors. Their importance will increase in the future and their integration and adoption internationally.

The second part of the report will cover the benefits of companies actually adopting the SASB Standards, as well as an explanation of the indicators in actual operation. It will also explain the services that aiESG can provide in relation to the application of the SASB Standards.

aiESG is the only Japanese company to have obtained a SASB standards "Corporate Reporting Software" Licence.

Japan's first ESG assessment institute, aiESG obtains a licence under the international sustainability standard SASB Standard as an ESG assessment institute.

https://aiesg.co.jp/news/20230808_sasb/

We can assist you with everything from the basics about SASBs to the actual disclosure of non-financial information.

Companies that need help with SASB compliance are encouraged to contact us.

Enquiry:

https://aiesg.co.jp/contact/

*Related page*.

Japan's first ESG assessment institute, aiESG obtains a licence under the international sustainability standard SASB Standard as an ESG assessment institute.

https://aiesg.co.jp/news/20230808_sasb/

Commentary] What is the SASB Standard for ESG Disclosure? (Part 2) Benefits for companies

https://aiesg.co.jp/report/2301115_sasb2/

[Explanation] What is the TNFD? A new bridge between finance and the natural environment

https://aiesg.co.jp/report/230913_tnfdreport/

[Commentary] TNFD disclosure status and issues.

https://aiesg.co.jp/report/230102_tnfdreport2/

[Commentary] Key points of the TNFD final recommendations and the responses required from companies.

https://aiesg.co.jp/report/231106_tnfdreport3/