24 May 2023, co-authored by Shunsuke Managi, Managing Director, and Keely Alexander Ryuta, Director and Chief Researcher, 'How ESG assessments that take into account financial materiality can help investors understand financial ESG risks and how they are reflected in equity returns'. The paper examines how ESG assessments considering financial materiality can help investors understand financial ESG risks and how they are reflected in stock returns.

The research results were published in Corporate Social Responsibility and Environmental Management (2022 Impact Factor: 9.8), a top journal in the field of environmental economics and environmental management.

Do investors incorporate financial materiality? Remapping the environmental information in corporate sustainability reporting

https://onlinelibrary.wiley.com/doi/10.1002/csr.2524

This report will explain the content of the above paper.

summary

This study examines the integration of accounting indicators (financial materiality *see below) published by the US Sustainability Accounting Standards Board (SASB) into a company's environmental score assessment to help investors understand a company's environmental risks. The study examines whether the integration of accounting indicators (financial materiality *see below) published by the SASB (Sustainability Accounting Standards Board) helps investors to understand the environmental risks of companies.

Although corporate disclosure of environmental information is increasing in line with the rise in sustainable investment, the financial impact of corporate environmental initiatives is not fully taken into account.

This study reveals changes in investors' evaluations of companies as a result of incorporating financial materiality in their environmental score assessments.

Background and objectives

With the increase in sustainable investment, the importance of assessing environmental, social and corporate governance (ESG) information is growing.

On the other hand, the business characteristics of companies are diverse and the importance of each ESG item differs according to differences in business characteristics. However, the importance of most ESG items was determined by the company's own and stakeholders' perspectives, without considering differences in business characteristics. Some of them are not essential for shareholders and neither profitability nor risk can be predicted, which may not allow for a proper understanding of ESG risks in the capital markets.

ESG assessments from a shareholder perspective are essential for investors to distinguish between companies that are performing well in both financial and ESG terms and to further identify ESG risks in the capital markets.

Among these challenges,Financial materialityis attracting a lot of attention.

Materiality refers to the 'key issues' that a company prioritises.

Financial materiality is a criterion for assessing the impact of issues related to ESG items (environmental and social issues) on a company's finances.

The authors considered that incorporating financial materiality into environmental score (E-score) assessments may make it easier for shareholders to make sustainable investment decisions.

The study therefore aimed to identify the following

How does integrating financial materiality (the extent to which environmental issues impact on a company's finances) into environmental score assessments help investors to understand their financial environmental risks?

... and how the integration of financial materiality and environmental score assessments is reflected in stock returns.

Method.

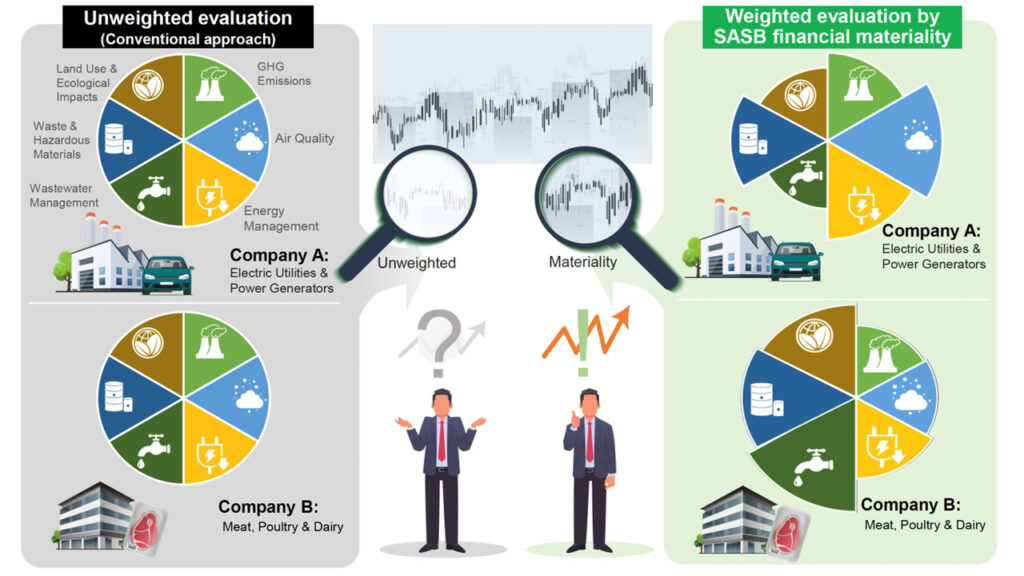

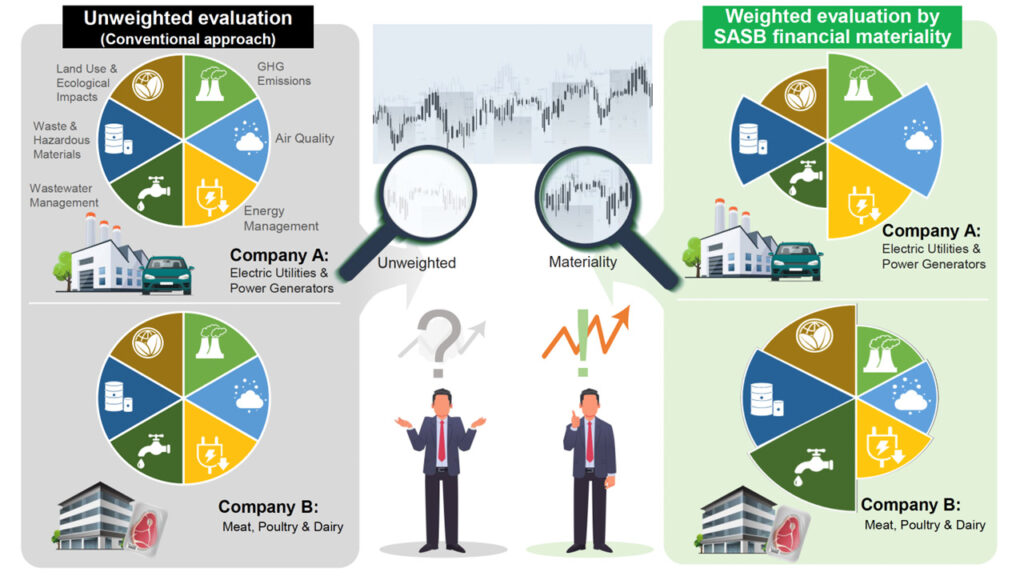

In response to the above issues, the authors used information on financial materiality published by the US Sustainability Accounting Standards Board (SASB) in 2018 to identify the financial materiality of each company's environmental information and re-evaluate the environmental score according to the company's status in addressing environmental issues.

The analysis used data from 1766 US-listed companies (10,084 companies in total) for the period 2011-2020 to analyse the relationship between environmental measures and share price returns related to financial materiality in ESG investments.

The impact of the inclusion of financial materiality on share price earnings by comparing earnings when grouped according to a stakeholder-oriented environmental score rating (Refinitiv E score) versus when grouped according to an environmental score rating weighted by the SASB financial materiality. The impact of the inclusion of financial materiality on share price earnings was tested by comparing earnings.

Result.

The analysis yielded the following results.

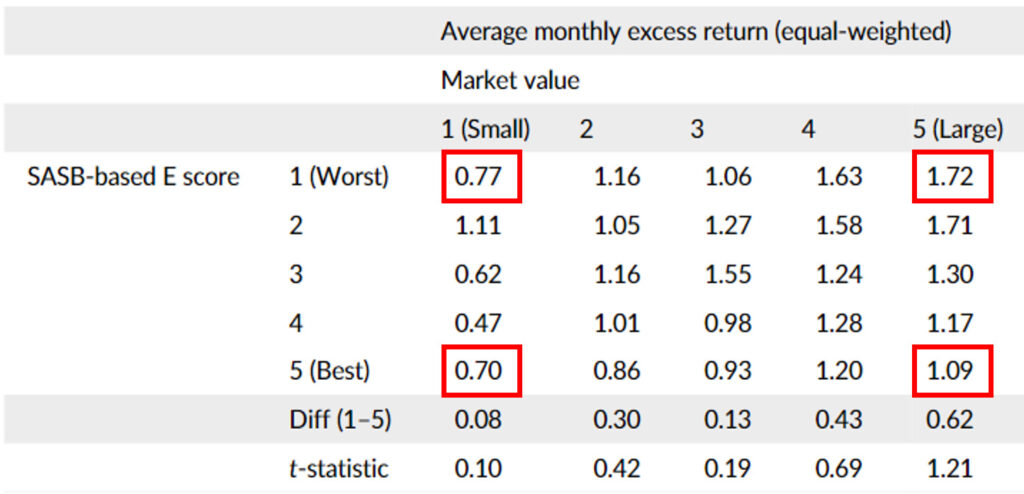

- Investors consider companies that are reluctant to take environmental measures related to financial materiality to be high-risk stocks and seek share price returns commensurate with that risk (Table 1).

- As shareholder and stakeholder perspectives differ in assessing environmental risks and making investment decisions, it is important to consider both perspectives (Table 2).

1. about.

Table 1 shows monthly excess returns based on SASB's financial materiality indicatorsnote 1 (supplementary information)The magnitude of the In the highest quintile of Market Value, the lowest SASB-based E-score excess return is 1.72% per month, while the highest E-score excess return is 1.09% per month. In contrast, in the lower quintile of market capitalisation, the lowest SASB-based E-score excess return is 0.77% per month, while the highest E-score excess return is 0.70% per month.

This shows that investors seek excess returns for companies with low measures of financial materiality (SASB-based E score of 1 (worst)), and that the larger the company (market value), the more return they are seeking for their risk. The larger the market value, the more return is sought for the risk.

Table 1.Estimated excess returns based on SASB

2. about.

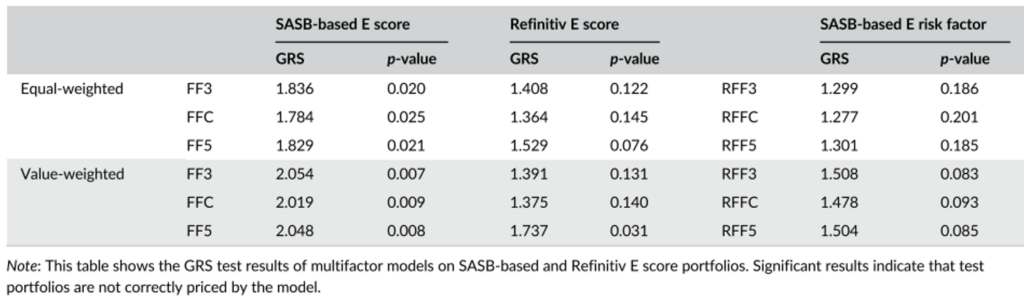

GRS Test*2shows that the difference in the magnitude of investment returns relative to the magnitude of environmental risk observed for 1. is only important for SASB-based (shareholder perspective) E score portfolios and not for Refinitive E score (stakeholder perspective) portfolios (Table 2). This means that investors consider financial materiality-related environmental risks, i.e. shareholder-related environmental risks, in their investment decisions, rather than wider stakeholder-related environmental risks.

The different views of SASB-based and Refinitive-based E-score portfolios illustrate the importance of considering both perspectives.

Table 2.Results of the GRS test

discussion

By incorporating environmental risk factors related to financial materiality into investment decisions, this research has enabled the prediction of excess returns and the appropriate assessment of a company's environmental measures.

By aligning financial and environmental indicators, this approach promotes a more comprehensive understanding of sustainability and encourages companies to prioritise economic and environmental considerations.

These findings contribute to the debate on the role of ESG factors in investment strategies and underline the importance of financial materiality considerations in achieving a sustainable and resilient economy.

1 Excess return: the difference between the return on risk-free assets (safe assets). A positive value indicates good investment performance, while a negative value indicates poor investment performance.

2 In financial economics, one of the statistical hypothesis tests used to examine the validity of multi-factor asset pricing models.

[Explanatory note

Xie, J., Tanaka, Y., Keeley, A. R., Fujii, H., & Managi, S. (2023). Do Investors Incorporate Financial Materiality? Remapping the Environmental Information in Corporate Sustainability Reporting. Responsibility and Environmental Management, 30(4).

https://onlinelibrary.wiley.com/doi/10.1002/csr.2524

*Related articles*.