Since the publication of the TNFD (Task Force on Nature-related Financial Disclosure) final recommendations on 18 September 2023, this website has provided background and an overview of the recommendations and the issues involved in actual disclosure in the past three issues.

Part 1 What is the TNFD? A new bridge between finance and the natural environment

Part 2: Status of TNFD disclosures and issues.

Part 3: Key points of the TNFD final recommendations and the response required from companies.

In this issue, we focus on the actual disclosures made by companies about TNFD early adopters and their characteristics, which were announced at the Davos conference on 16 January 2024.

TNFD early adopters and disclosure reports

The TNFD published its final recommendations in September 2023, and companies that start disclosing based on such recommendations by FY2025 are announced as early adopters.

320 companies from 46 countries were announced as early adopters, of which 80, or a quarter of the total, were Japanese companies.

The following are 26 Japanese companies that have registered as TNFD early adopters as of February 2024 and have already published TNFD reports. (Table 1)

| sector | enterprise | report |

| Food and beverages | monosodium glutamate (brand name) | biodiversity |

| Asahi Group Holdings Ltd. | Sustainability report | |

| Kirin Holdings Company Limited | Environmental Report 2023. | |

| Suntory Foods International | Disclosure based on TNFD recommendations. | |

| Nissui | TNFD Report 2023. | |

| Meiji Holdings Ltd. | biodiversity | |

| Nissin Foods Holdings Ltd. | biodiversity | |

financing | Asset Management One | Sustainability report |

| Dai-ichi Life Holdings, Inc. | Integrated Report 2023. | |

| The Central Bank of Agriculture and Forestry | Sustainability Report 2023.f | |

| Sumitomo Mitsui Financial Group | 2023 TNFD Report. | |

| MS&AD Insurance Group Holdings, Inc. | TCFD and TNFD reports | |

| Resona Asset Management | Climate/Nature-related Financial Disclosure Report | |

| communication | NTT Data Group | Environmental Report |

| KDDI | TNFD Report 2023v1 | |

| SoftBank (Japanese telecommunications company) | Biodiversity conservation. | |

| real estate | Tokyu Land Holdings Limited | TNFD Report |

| Sekisui House | Value Report 2023. | |

| rubber | Bridgestone | TCFD/TNFD comparison table |

| Sumitomo Rubber Industries, Ltd. | Response to TNFD. | |

| air transportation | Japan Air Lines | P Integrated Reporting |

| infrastructure | Kyushu Electric Power Co. | TNFD Report 2023. |

| electronic goods | NEC | TNFD Report 2023. |

| chemistry | Sekisui Chemical | TCFD and TNFD reports |

| trading company | Sumitomo Corporation | ESG Communication Book 2023. |

| construction | Sumitomo Forestry | Biodiversity conservation. |

Disclosure features.

In actual TNFD disclosures, many companies are following the disclosure recommendations and classifying their disclosures according to governance, strategy, risk and impact management, metrics and targets. Companies disclosing in trial analyses and beta versions of TNFD reports have initially started to follow the framework of the LEAP approach.

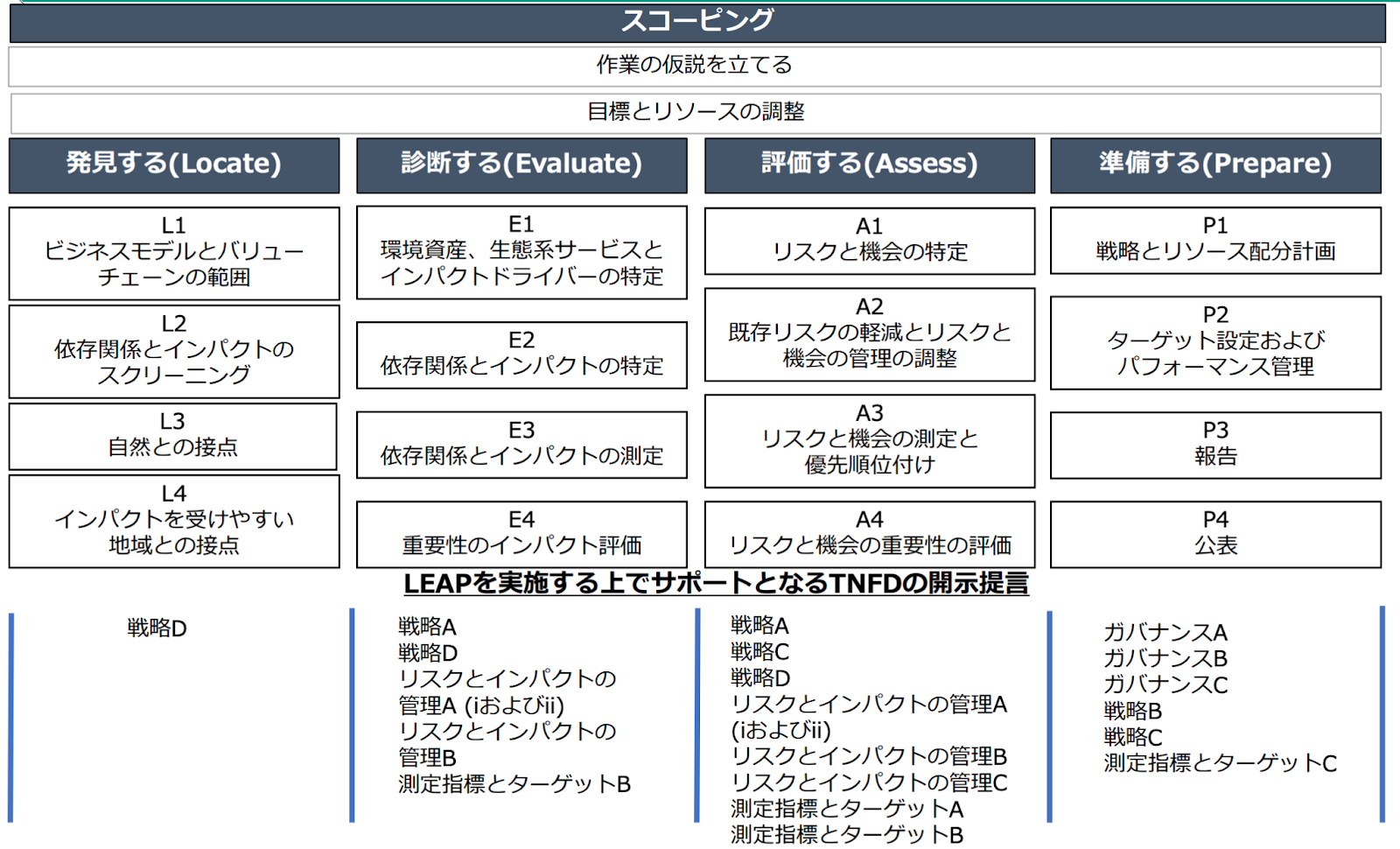

The Ministry of the Environment has organised each phase of the LEAP approach by linking which disclosure recommendations it corresponds to. (Figure 1)

Figure 1: Source: 'LEAP/TNFD Explanation Workshop for Nature-Related Financial Information Disclosure 《Advanced Edition》', Ministry of the Environment.

The following is a summary of the tools and analytical procedures used for each of the four pillars of disclosure recommendations in an actual company's TNFD report disclosure. In governance, the TCFD is omitted as it follows the TCFD.

1. strategy

a. Understanding reliance on and impacts on natural capital

A heat map was created using tools and indicators such as ENCORE and NBI to identify dependence on and impact on natural capital, and a four-point scale was used to identify projects that are dependent on nature and have a high impact on nature-related risks.

b. risk assessment on natural capital.

Items with high scores from the results of the dependency and impact assessment and items with high risk from a business perspective are identified and organised into physical and transition risks. The following tools are often used for each nature-related risk in risk assessment.

(1) Water: AQUEDUCT, Water Risk Filter.

(2) Biodiversity: IBAT, J-BMP, BiomeViewer, KBA.

(3) Forests: WBCSD, Biodiversity Risk Filter

c. Opportunities.

Describes biodiversity initiatives in which the project can demonstrate its strengths and support for Nature Positive initiatives.

2. risk and impact management

Includes a description of efforts to reduce identified risks, the establishment of risk management regulations and internal governance systems.

3. metrics and targets

Many companies disclose figures that are already disclosed in TCFDs and environmental reports, etc. Few companies still disclose based on the global core disclosure indicators that are strongly required to be disclosed in the TNFD.

TNFD disclosure issues.

Although many TNFD reports as a whole have adopted the LEAP approach to analysis, there are a wide range of disclosure proposals, LEAP elements and reports with no clear classification, which creates hurdles in making company-by-company side-by-side comparisons.

With regard to the last of the four pillars, the disclosure of metrics and targets, although ESG-related data required by the TCFD and other regulations are being disclosed, very few companies are disclosing them in the form of core indicators required by the TNFD, indicating that the aggregation of data itself is a challenge. The data aggregation itself is clearly a challenge.

Some of the issues raised by companies that have actually undertaken TNFD disclosure include the difficulty of setting up and disclosing scenarios for each business on their own in the absence of normative disclosure, the need for guidance on LEAP analysis because of the challenge of identifying priority areas for conglomerates with a wide range of business areas, and the lack of clarity in the definition of what is meant by core indicators when disclosing core indicators. In addition, the definitions of what the indicators mean are unclear when disclosing core indicators.

Although the framework in TNFD disclosures is set, detailed item-by-item interpretations and definitions remain unclear, and a better understanding of definitions is needed to ensure comparability between companies.

Examples of corporate TNFD disclosures

As an actual disclosure case study, Nissui is discussed. Nissui is a company thatGroup Integrated Reportin the "As a business dependent on natural capital, we believe it is necessary to look at our relationship with natural capital from a larger perspective than just the fisheries resource surveys we have been carrying out" and, on a trial basis, the TNFD (Task Force on Nature-related Financial Disclosures) disclosure framework advocates the Using the LEAP approach proposed in the TNFD (Nature Related Financial Disclosure Task Force) disclosure framework on a trial basis, the report deciphers the relationship between dependence on and impacts on nature, analyses risks and opportunities, and examines measures to address them.

Nissui

| process | Overview. |

| Scope. | Identification of the scope for adopting the LEAP was carried out using the Science Based Targets Network (SBTN). Assessed the natural impacts of the value chain and its own operations and set the scope of analysis. |

| Locate. | Identify the maritime zones from which your company procures seafood using FAOs as priority areas. |

| Evaluate | Primary assessment of the relationship between dependence and impacts on nature in fisheries and aquaculture operations using ENCORE. A secondary assessment (qualitative assessment) was conducted again, taking into account the actual situation of the company's own operations and upstream value chains. |

| assess | Physical and transition risks and opportunities are organised for fisheries and aquaculture operations respectively. The impacts arising from such risks and opportunities are also described. |

| Prepare | Describes measures to mitigate risks and development systems to realise business opportunities |

The scenarios and rationale are detailed in the Scope process, which explains why fisheries and aquaculture projects were included in the assessment.

Due to the limitation that ENCORE does not allow for an analysis that reflects the characteristics of the company's business, a qualitative assessment is also conducted as a secondary assessment, which describes the impact and dependence of the company's business on natural capital in an easy-to-understand manner.

It also discloses on the Core Global Core Indicators, which is a step forward in TNFD disclosure.

Direction of corporate response.

At the 15th Conference of the Parties (COP15) to the Convention on Biological Diversity in December 2022, international biodiversity targets were adopted for 2030 and 2050 TNFD disclosure is not mandatory, but the number of TNFD early adopter companies announced at the Davos meeting is also increasing. In light of the number of TNFD early adopter companies announced at Davos, the number of companies disclosing in the future is sure to increase. It is also important to note that, as with the TCFD recommendations, it is possible that in the future sustainability information disclosure may be required to be based on the TNFD recommendations.

The services provided by aiESG enable ESG analysis not only on a company or business unit basis, but also on a product or service basis, and can quantitatively capture social and natural environmental aspects required by the TNFD, such as community impacts and indigenous rights, in addition to indicators such as greenhouse gas emissions, which can be measured using conventional services. The TNFD also provides a quantitative view of the social and natural environment required by the TNFD, such as community impacts and indigenous rights. Furthermore, it is possible to identify hotspots of high risk areas in the supply chain for each of these items, leading to the identification of priority areas of high risk.

Because it is a framework that is difficult to reach disclosure overnight, it is necessary to first re-acknowledge the challenges of one's own business and discuss disclosure from the point at hand, so as not to fall behind industry and social trends.

aiESG can provide support from the basics of TNFD to the actual disclosure of non-financial information. aiESG is happy to assist companies that need help in complying with TNFD.

Enquiry:

https://aiesg.co.jp/contact/

*Related page*.

Report list : Regulations/standards

https://aiesg.co.jp/report_tag/基準-規制/

[The [ibid.Explanation] What is the TNFD? A new bridge between finance and the natural environment

https://aiesg.co.jp/report/230913_tnfdreport/

[Commentary] TNFD disclosure status and issues.

https://aiesg.co.jp/report/230102_tnfdreport2/

[Commentary] Key points of the TNFD final recommendations and the responses required from companies.

https://aiesg.co.jp/report/231106_tnfdreport3/

Commentary] Nature Positive : Creating a society that can live in harmony with nature.

~About OECMs and nature-friendly sites~.

https://aiesg.co.jp/report/240214_nature-positive/

The TNFD commentary book 'TNFD Corporate Strategy - Nature Positives, Risks and Opportunities', partly authored by aiESG, is published.

https://aiesg.co.jp/news/2400228_tnfd-publication/