Since the disclosure of the annual securities report for the year ending 31 March 2023 in Japan, it has become mandatory to describe the relationship between social aspects and corporate activities as well as environmental aspects, such as environmental initiatives, employee development and diversity.

Meanwhile, sustainability disclosure is becoming increasingly important globally: the EU has established a Corporate Sustainability Reporting Directive (CSRD) and Standard (ESRS), which will make ESG (environmental, social and governance) information reporting mandatory for a wide range of corporate groups. The US has also seen a response through mandatory human capital disclosure.

Disclosure of non-financial information is an important issue for companies.

The purpose of this paper is to describe trends in sustainability reporting in Japan, Europe and the USA, and to contribute to an understanding of the current situation.

Table of Contents

1.(Japan) Mandatory disclosure of securities reports and human capital

2.(EU/US) Treatment of social and human capital in sustainability reporting in other countries.

- EU

- United States of America

3.(Japan) Trends in ESG information disclosure

4. summary.

1.(Japan) Mandatory disclosure of human capital in securities reports.

As the source of corporate value shifts from tangible to intangible assets, more emphasis is being placed on the disclosure of non-financial information as well as corporate financial information.

In Japan, the revised Cabinet Office Ordinance on Disclosure of Corporate Information was published on 31 January 2023. In line with this, listed companies and others are now obliged to make progress on sustainability initiatives related to social and human capital through disclosure in their annual securities reports for the year ending 31 March 2023, and to take measures to enhance the disclosure of descriptive information*.

*Descriptive information refers to information that supplements financial information and facilitates investors in making appropriate investment decisions. The disclosure of such information is intended to promote constructive dialogue between investors and companies and is expected to improve the quality and value of corporate management.

See FSA (2019): 'Current Principles for the Disclosure of Descriptive Information', p.1.

Social capital disclosures require a wide range of items, including corporate environmental initiatives, climate change responses and sustainability risks and opportunities. Human capital disclosures require employee development, diversity, health and safety, etc.

Against the background of the spread of ESG investment, increasing demands from stakeholders and the growing proportion of intangible assets in corporate value, it is becoming increasingly important to disclose information on social initiatives as well as environmental initiatives.

2.(EU/US) Treatment of social and human capital in sustainability reporting in other countries.

Sustainability information is becoming increasingly important worldwide. As a result, discussions on disclosure and assurance of sustainability information are occurring simultaneously not only in Japan but also in the US, Europe and globally. As these developments are taking place at an unexpected speed, Japanese companies need to pay attention not only to their own national responses, but also to the regulatory trends in other regions.

EU

The EU region is cited as one of the most advanced regions in terms of sustainability initiatives: the CSRD (Corporate Sustainability Reporting Directive) and the ESRS (European Sustainability Reporting Standard), a delegated regulation, are the two issues that cannot be ignored as corporate sustainability reporting standards in the EU.

The CSRD, agreed by the EU Parliament and Council at the end of 2022, makes ESG information reporting mandatory for a broad group of companies; within the ESRS, which builds on the CSRD and constitutes a Delegated Regulation, it provides detailed rules not only for the quantitative and qualitative analysis of environmental capital with regard to climate change initiatives for covered companies but also for social and human capital as well as quantitative and qualitative analysis of environmental capital with regard to climate change initiatives.

The deadlines for companies to comply are adjusted between sizes, such as number of employees, but there is an ongoing need for Japanese companies to consider whether their EU subsidiaries are subject to those requirements or whether the Japanese companies themselves are directly subject to them as non-EU companies.

The CSRD and ESRS have adopted a double materiality as a set of material issues (materialities) that are likely to have an impact on a company's financial activities. This directs companies to disclose "the need to consider not only the operational impact of the company's activities, but also the social and environmental impact", which is distinct from the single materiality, which has information for investors in mind.

The ESRS discloses indicators classified according to environmental (E), social (S) and governance (G), with S items, which refer to social and human capital, further divided into S1-S4. As the examples below show, the scope of the indicators is quite broad, and it is necessary to keep a close eye on how the companies in question disclose them.

Example:

S1: Items related to in-enterprise workforce

S2: Items pertaining to workers in the value chain.

S3: Items relating to affected communities (e.g. local communities and indigenous peoples).

S4: Items pertaining to consumers and end-users

aiESG Report, "[Commentary] CSRD: The EU version of the Sustainability Reporting Standard just before it comes into force - the impact on Japanese companies".

https://aiesg.co.jp/report/2301120_csrd/

aiESGreport'[Commentary] Overview of the ESRS (European Sustainability Reporting Standard).'

https://aiesg.co.jp/report/2301208_esrs/

United States of America

In the US, corporate sustainability disclosure efforts have also been intensified, and historically a number of guidance and frameworks have been proposed. Below is a summary of two regulations with strong international influence.

The first is the Global Reporting Initiative (GRI), established in the USA in 1997. The organisation published guidance on reporting environmental and social impacts in 2000. These were transformed into the GRI Standards in 2016, which have been adopted as international universal rules for sustainability reporting in more than 100 countries. The scope of application focuses not only on environmental aspects, but also on social factors such as human rights and labour. These GRI Standards are double materiality in nature, as they require companies to disclose not only their impact on investors, but also the extent of their impact on society and the environment.

The second is the SASB Standard, published by the non-profit organisation (SASB), which was launched in 2018. These standards are intended to make it easier for investors to compare companies by presenting five disclosure items for each of the 77 industries in 11 sectors. One of the disclosure items is human capital. With the recent integration of the SASB into International Financial Reporting Standards (IFRS) in 2022, the impact of the SASB standards is expected to increase internationally beyond the US market. In addition, as IFRS moves to ensure interoperability with GRI Standards and ESRS, the SASB Standard is expected to evolve into a double materiality in the future*.

In 2020, the Securities and Exchange Surveillance Commission (SEC) will make human capital disclosure mandatory for US-listed companies. The SEC has identified "human resources development, human resources incentives and employee retention" as three examples of disclosure items, which confirms the focus on human capital among social capital. The SEC also noted three examples of items: human resources development, human resources incentives and employee retention, which confirms the focus on human capital among social capital.

*aiESG Report, "[Commentary] Alphabet soup - The disruption and convergence of sustainability standards".

https://aiesg.co.jp/report/2301226_alphabet-soup/

**SDGs KOTORA "[2021 update] Human capital disclosure of US companies".

https://sdgs.kotora.jp/column/%E7%89%B9%E9%9B%86%E8%A8%98%E4%BA%8B/o_content06/

aiESG Report, "[Explanation] What is the SASB Standard for ESG Information Disclosure? (Part 1) SASB Overview".

https://aiesg.co.jp/report/2301025_sasb1/

aiESG Report, "[Explanation] What is the SASB Standard for ESG Disclosure? (Part 2) Benefits for companies'.

https://aiesg.co.jp/report/2301115_sasb2/

3.(Japan) Trends in ESG information disclosure

In Japan, environmental reporting began to come into force in the early 1990s and the number of companies reporting has increased since the Ministry of the Environment presented its Environmental Reporting Guidelines in 1997. In addition, disclosure of information on not only environmental initiatives, but also social aspects, is becoming increasingly important.

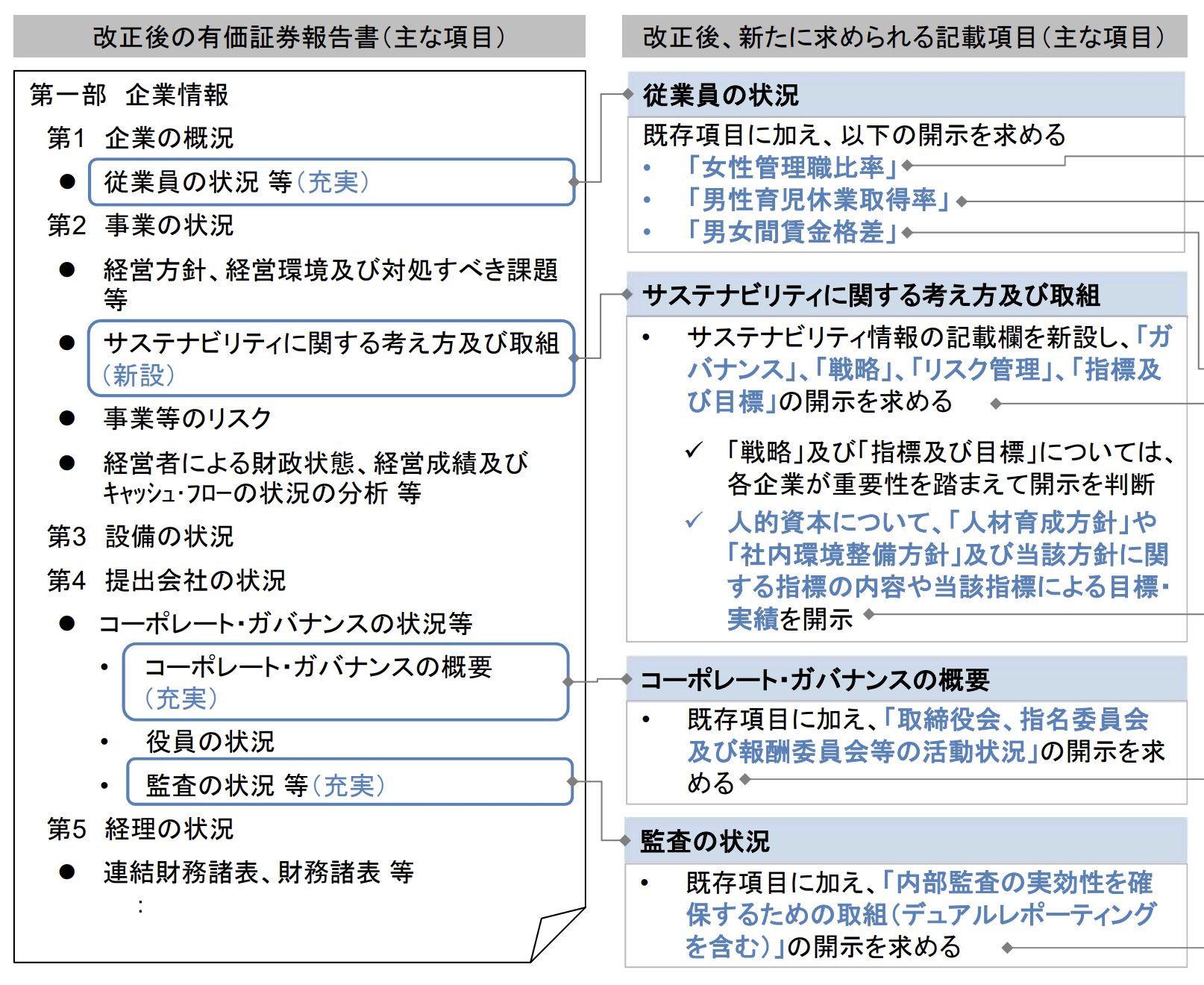

Among social and human capital, changes have been seen in recent years regarding disclosure requirements for human capital, which focuses on the environment of employees: in 2023, the Financial Services Agency will require listed companies to disclose human capital information in their annual reports. Although climate change-related information had previously been included as descriptive information in the 'Management policy, management environment and issues to be addressed' and 'Business and other risks' sections of the annual report, this new obligation will require companies to disclose both environmental and social aspects by establishing a new section, 'Sustainability-related policies and initiatives'. The new obligation requires companies to disclose both environmental and social aspects of their business.

Figure 1: Reference examples of items to be included in the new annual report

(Adapted from FSA, 2023. https://www.fsa.go.jp/news/r4/singi/20230131/01.pdf )

Similar to the US SEC case, the current regulatory revision in Japan confirms that human capital information is being expanded while leaving some decision-making to the corporate side. The regulation requests the addition of three elements under the heading 'Status of employees, etc.': 'Ratio of female managers', 'Rate of male parental leave taken', and 'Gender pay gap'.

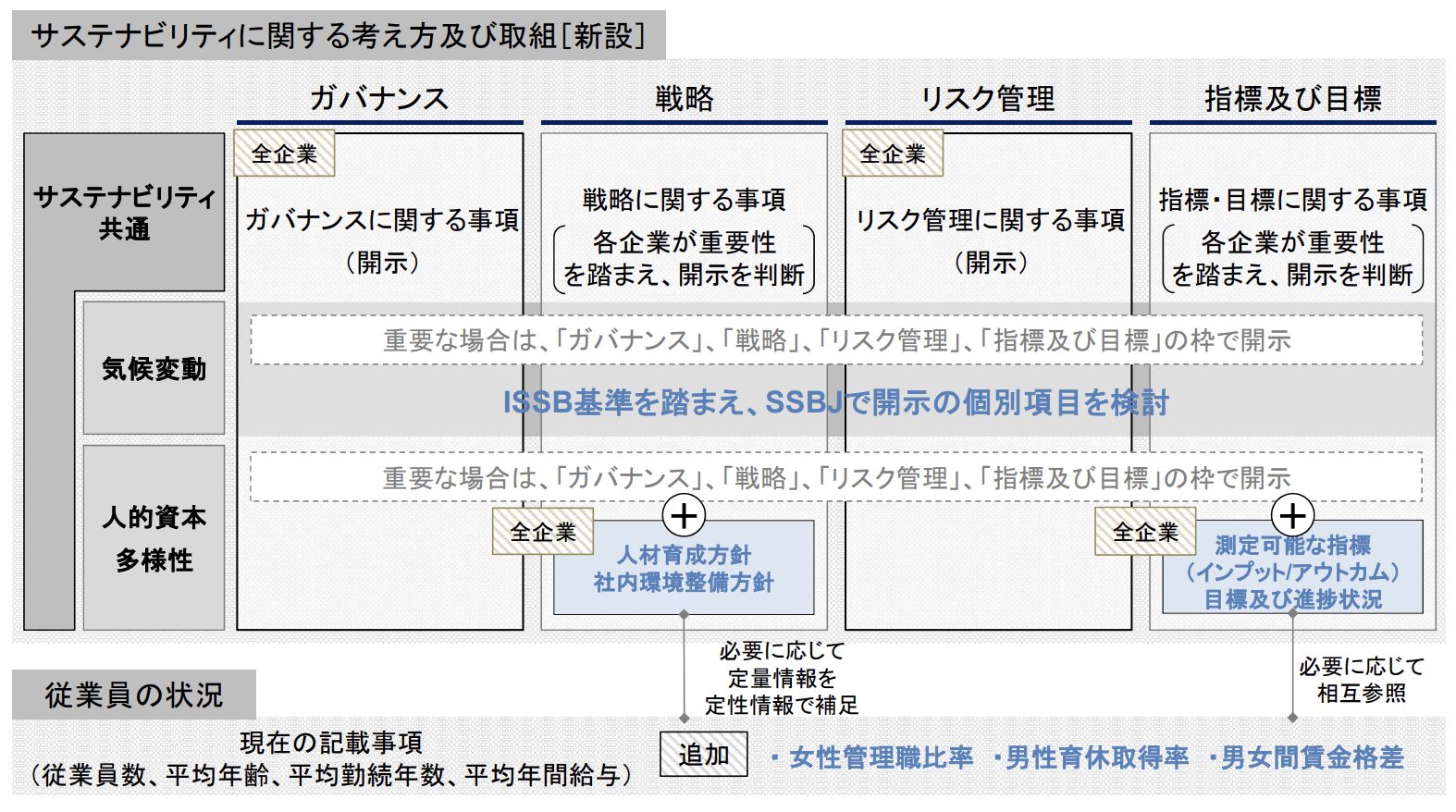

Figure 2: Overview of the set description field on 'Sustainability approach and initiatives'.

(Adapted from FSA, 2023. https://www.fsa.go.jp/news/r4/singi/20230131/01.pdf )

The new 'Sustainability Approach and Initiatives' includes four new sections, expanding information on 'Environmental' and 'Social (human capital and diversity)' The four sections are respectively 'Governance', 'Strategy', 'Risk Management' and 'Indicators and Targets'. The four sections are respectively 'Governance', 'Strategy', 'Risk management' and 'Indicators and targets'.

Of these, the regulations stipulate that 'governance' and 'risk management' are 'required to be disclosed to all companies'. This is due to the reason that they are necessary as a framework for materiality decisions as companies discuss their own management aspects and value judgments.

On the other hand, while disclosure of 'strategies' and 'indicators and targets' is set as desirable, it is left up to individual companies to decide whether or not to take action.

Many Japanese companies are increasingly adopting SASB and GRI standards due to the global economy. Japan is likely to follow the US and Europe in developing regulations for the disclosure of such sustainability information in the future.

Figure 2 shows that "the SSBJ is considering individual disclosure items based on ISSB standards", which refers to the Sustainability Standards Board established in Japan, which aims to develop sustainability disclosure in Japan based on international standards developed by the International Sustainability Standards Board (ISSB: an organisation affiliated with IFRS). It aims to develop sustainability disclosure in Japan based on the international standards developed by the International Sustainability Standards Board (ISSB: an organisation under IFRS). As described in the previous section (Developments in the US), IFRS, including ISSB, is currently undergoing rapid changes, including integration with SASB standards, and it can be expected that Japan's sustainability standards will also develop according to the degree of development of the international standards being developed by ISSB. In this sense, we will continue to be unable to ignore trends in sustainability regulations in the USA and the EU.

aiESG report, "[Commentary] ISSB - Global Baseline for Sustainability Disclosure".

https://aiesg.co.jp/report/2301130_issb/

4. summary.

The importance of social capital is increasing in the disclosure of non-financial information by companies. In Japan, the aspect of human capital is strong, but it is not limited to human capital, and in the future it will also become necessary to disclose information on the efforts of all stakeholders beyond employees, such as human rights measures in the supply chain. This is because the companies that have adapted the CSRD and ESRS, of which the EU is the first to do so, extend outside the EU, and it is imaginable that Japan will also be required to improve its disclosure situation with the aim of attracting investors.

With new developments in sustainability disclosure in Europe and the USA, it was confirmed that information disclosure is becoming increasingly important for Japanese companies. While companies have many years of experience in dealing with environmental capital, such as dealing with climate change, the recent focus on social and human capital is expected to take more time, such as in dealing with documentation. In particular, clear data and other information on human rights responses, for example, within the supply chain, is required.

aiESG provides not only environmental, but also social and human capital data through the use of analytical tools developed by the company. If you have any questions about your company's internal sustainability disclosure, please contact us.

Enquiry:

https://aiesg.co.jp/contact/

*Related page*.

Report list : Regulations/standards

https://aiesg.co.jp/report_tag/基準-規制/

Commentary] CSRD: The EU version of the Sustainability Reporting Standard just before it comes into force - the impact on Japanese companies.

https://aiesg.co.jp/report/2301120_csrd/

[Commentary] ESRS (European Sustainability Reporting Standard).

https://aiesg.co.jp/report/2301208_esrs/

[Commentary] Alphabet soup - Disorder and convergence of sustainability standards.

https://aiesg.co.jp/report/2301226_alphabet-soup/

Commentary] What is the SASB Standard for ESG Information Disclosure? (Part 1) SASB Overview

https://aiesg.co.jp/report/2301025_sasb1/

Commentary] What is the SASB Standard for ESG Disclosure? (Part 2) Benefits for companies

https://aiesg.co.jp/report/2301115_sasb2/

[Commentary] ISSB - Global Baseline for Sustainability Disclosure.

https://aiesg.co.jp/report/2301130_issb/

What is materiality in sustainability reporting?

https://aiesg.co.jp/report/240201_materiality/