In recent years, with the growing interest in disclosing non-financial information, such as environmental, social and human capital information, there has been an intense movement towards relevant frameworks and standards. For companies, the need to not only identify their own risks and opportunities, but also to choose the appropriate method of information disclosure, leads to an increased disclosure burden. There are also significant costs for investors in referencing and comparing different standards.

This article introduces these standards and regulations once again and the moves towards unification.

Table of Contents

Alphabet soup of disclosure standards

Elements characterising the criteria.

Movement towards unification

1. joint statement by the five non-financial standard-setting bodies

2. establishment of the ISSB

3. the European sustainability reporting standard

Establishment of the ISSB and the relationship between the various standards

SSBJ: National standard corresponding to the ISSB.

aiESG and SASB Standard Licence

Conclusion.

Alphabet soup of disclosure standards and rules

The term 'alphabet soup' is a metaphorical expression used to describe the abundance of abbreviations and acronyms. It has come to be used to refer to the non-financial information-related situation due to the heavy use of alphabets in sustainability and ESG-related frameworks and standards. The main frameworks and standards that have been published to date are summarised below.

Table 1 : Main ESG-related frameworks and standards

| name | Overview. |

| CDP Questionnaire. | [Environmental Questionnaire] CDP questionnaire sent to companies and scoring on environmental risks and opportunities based on their responses. |

| UN Principles for Responsible Investment (PRI) | Signatory organisations are obliged to submit a report every year and are expelled if they do not meet the criteria. |

| GRI Standards | [Disclosure framework] Standards for multi-stakeholder disclosure of information on the economic, environmental and social impact of an organisation. |

| IIRC Framework | [Disclosure framework (principles-based)] A framework aimed at improving the quality of information available to providers of financial capital through the preparation of an annual integrated report and more effective and productive allocation of capital. |

| SASB Standard | [Disclosure framework (individual provisions)] Standards for companies to disclose information on sustainability risks and opportunities to investors. |

| CDSB Framework | [Climate-related information disclosure framework] Standards for disclosing environmental and climate-related information to investors in companies' mainstream reports. |

| TCFDmiddle dot (typographical symbol used between parallel terms, names in katakana, etc.)TNFD | [Climate, nature and biodiversity-related information disclosure framework] Standards for disclosing climate and nature-related information with financial implications in annual financial reports. |

| CSRD | [EU: Corporate Sustainability Reporting Directive]. Sustainability reporting standard adopted in 2022. EU countries are required to make it mandatory through national legislation |

| ESRS | [EU: European Sustainability Reporting Standards]. A standard document that provides specific information on the disclosure items in the CSRD. |

| CSDDD (CS3D) Draft. | [EU: draft Corporate Sustainability Due Diligence Directive]. Draft Directive providing for corporate duty of care and mitigation of human rights and environmental impacts. |

| SFDR | [EU: Sustainable Finance Disclosure Regulations]. Disclosure rules promulgated in 2019 for financial market participants to improve transparency regarding sustainability information. |

Explanatory reports on some of these criteria are available on this website.

middle dot (typographical symbol used between parallel terms, names in katakana, etc.)ESG disclosure standards What is the SASB Standard? (Part 1) SASB Overview | aiESG

middle dot (typographical symbol used between parallel terms, names in katakana, etc.)ESG disclosure standards What is the SASB Standard? (Part 2) Benefits for companies | aiESG

middle dot (typographical symbol used between parallel terms, names in katakana, etc.)What is TNFD? A new bridge between finance and the natural environment | aiESG

middle dot (typographical symbol used between parallel terms, names in katakana, etc.)CSRD: EU version of the Sustainability Reporting Standard just before it comes into force - the impact on Japanese companies | aiESG

middle dot (typographical symbol used between parallel terms, names in katakana, etc.)ESRS (European Sustainability Reporting Standard) | aiESG

middle dot (typographical symbol used between parallel terms, names in katakana, etc.)SFDR: What are the EU Sustainable Finance Disclosure Regulations? ~ ESG-related disclosure requirements for financial instruments ~ | aiESG

In addition to these, there are a number of national standards committees and other bodies. Companies have been required to understand the characteristics of each standard and then choose which standard to comply with, or to comply with more than one standard.

Elements characterising the criteria.

Disclosure standards and frameworks have their own characteristics and are not necessarily substitutable. Factors that compare them include the subject areas, principle or bylaw principle, intended users and type of materiality.

For example, while some standards include all ESG (environmental, social and governance) as a subject of disclosure, there are also frameworks that focus specifically on the environment, such as the TCFD. The principle-based IIRC framework, which does not set standards for individual indicators, and the SASB, which provides detailed specific disclosure items, can be considered complementary to each other [1]. Other key disclosures can be characterised from several perspectives, depending on whether the main disclosure targets are investors or multi-stakeholder, and whether double materiality is adopted, which considers the impact of corporate activities on the environment and society in addition to the impact from the environment and society on the company.

According to a study by Sherman & Sterling, 85 of the 100 largest companies in the US have published CSR reports compliant with multiple standards, 38 of which are GRI, SASB, TCFD and UN Principles [2].

The situation where no one indicator is dominant and each has its own background and defences is one of the factors that have made the alphabet soup of disclosure standards so complex.

Movement towards unification

The proliferation of ESG-related standards has led to calls for uniformity from both companies and investors.

Several of the standards mentioned in the table at the beginning of this section have already been merged or consolidated. Some of the main events towards unification include

1. joint statement by the five non-financial standard-setting bodies[3]

In September 2020, five organisations - CDP, CDSB, GRI, IIRC and SASB - announced their cooperation for a comprehensive corporate disclosure system through a statement. From this point onwards, the various organisations, which had been operating separately, will accelerate their move towards unification.

2. establishment of the ISSB

It is a sub-organisation of the IFRS Foundation, established in November 2021, which is developing a unified disclosure standard that is consistent with a number of standards and frameworks. This article focuses on.

3. the European sustainability reporting standard

The CSRD (Corporate Sustainability Reporting Directive) and ESRS (European Sustainability Reporting Standard) have established a uniform reporting standard for all large companies in the EU and all companies except micro enterprises listed on EU regulated markets. It is also harmonised with the ISSB above.

Establishment of the ISSB and the relationship between the various standards

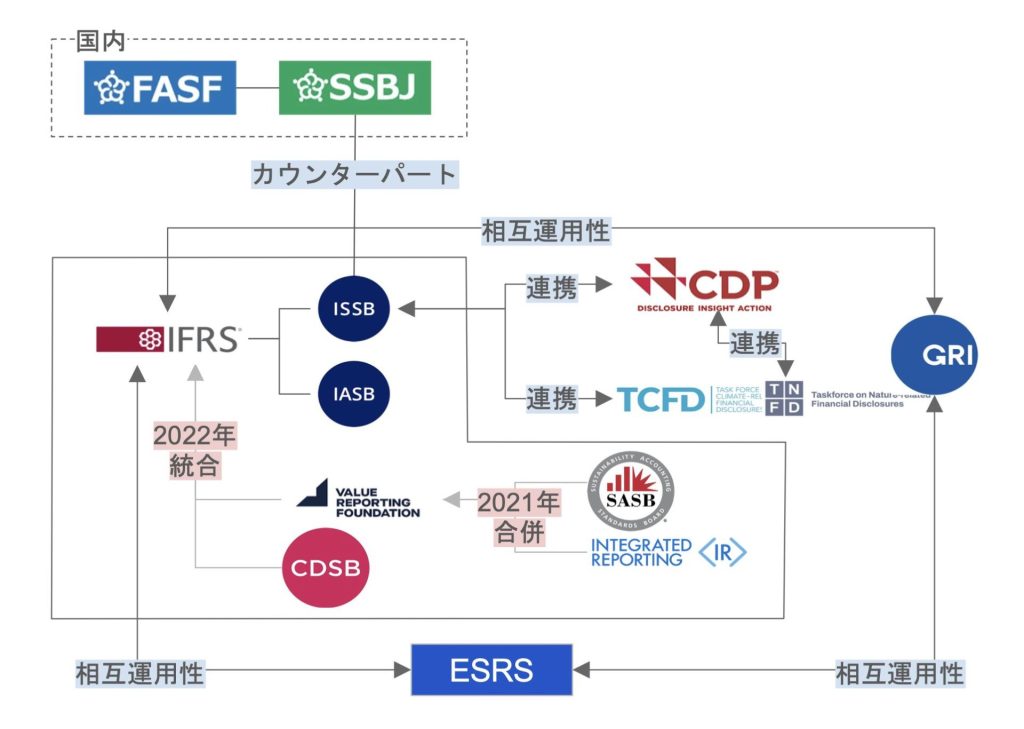

Figure 1: IFRS Foundation and surrounding standards (prepared by the author)

One of the centres of the movement towards alphabet soup convergence is the International Accounting Standards (IFRS) Foundation. In response to market demands for integrated disclosure rules, a new standards board, the International Sustainability Standards Board (ISSB), was established in November 2021 as a sub-organisation of the IFRS Foundation. Its composition and specifics are explained in more detail in the following article.

[Commentary] ISSB~Global Baseline for Sustainability Disclosure | aiESG

Around the time of the launch of the ISSB, various organisations announced their collaboration and cooperation with the IFRS Foundation: the IIRC and SASB [4], which merged to form the Value Reporting Foundation (VRF) in 2021, were integrated into the IFRS Foundation in the following year, 2022 [5]. Prior to that, CDSB was also integrated into IFRS [6]. The GRI and CDP have also each announced cooperation with the ISSB [7][8], resulting in all five organisations with joint statements in 2020 having ties to the ISSB (Table 2).

Furthermore, interoperability of the ISSB with European disclosure standards has been discussed [9]. Although the European Commission is moving towards mandatory corporate sustainability reporting through the CSRD and its subordinate ESRS, inconsistencies between these reporting standards and the ISSB standards, such as differences in the scope of ESG matters, have been reconciled. In addition, guidance texts will be prepared to assist companies applying both.

The final version of the ISSB standards, published in June 2023 [10], sets out specific industry-specific disclosure requirements in line with the TCFD framework and based on the SASB A key feature of the ISSB is that rather than creating a new standard from scratch, the ISSB aims to create a 'good fit' format that draws on existing frameworks The ISSB is aimed at a 'good-guy' format that draws on existing frameworks, rather than creating a new standard from scratch. This is expected to facilitate the intention of companies that already disclose information in accordance with other frameworks to join the ISSB, and to make it a widespread and mutually comparable ESG report.

Table 2: Movements towards unification around IFRS

| year (e.g. AD) | trend |

| Sep 2020. | Joint statement by five non-financial standard setting bodies (CDP, CDSB, GRI, IIRC, SASB). |

| Jun 2021. | IIRC and SASB merge to form VRF. |

| July 2021. | EFRAG (ESRS) and GRI signed MoU [11]. |

| Nov 2021. | Inauguration of the ISSB |

| Jan 2022. | CDSB integrated into IFRS. |

| Mar 2022. | IFRS and GRI sign MoU. |

| Aug 2022. | VRF integrated into IFRS. |

| Nov 2022. | CDP announced that it will incorporate ISSB climate change disclosure standards (from 2024 onwards). |

| Jun 2023. | ISSB publishes first standards S1 and S2. |

| July 2023. | ISSB to take over TCFD monitoring responsibilities from 2024 [12]. |

| July 2023. | ISSB and ESRS interoperability announced |

| Sep 2023. | CDP expressed its intention to align with the TNFD framework [13]. |

SSBJ: National standard corresponding to the ISSB.

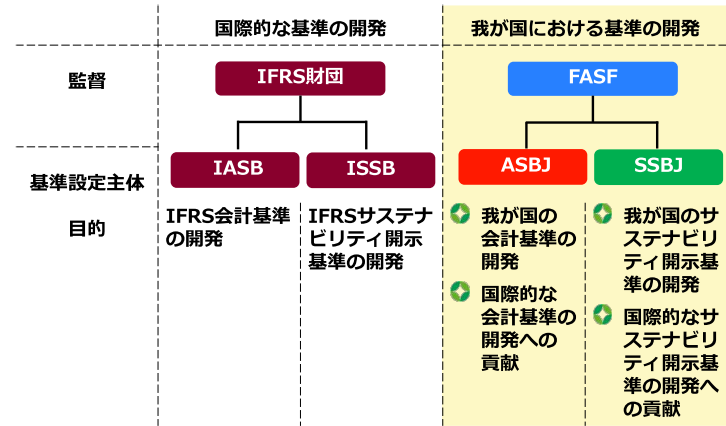

Following the establishment of the ISSBB by the IFRS Foundation, a domestic counterpart was created, the Sustainability Standards Board (SSBJ), which was established in July 2022 as an internal organisation of the Financial Accounting Standards Foundation (FASF) to develop domestic standards for sustainability disclosures and to provide input to the ISSBB. (Fig. 2).

Figure 2: Correspondence between the IFRS Foundation and the FASF (Sustainability Standards Board (SSBJ))

The SSBJ is currently developing a Japanese version of the ISSB's disclosure standards, based on IFRS S1 and IFRS S2, with plans to publish a finalised standard during FY2024 and to begin early application in the following financial year [14].

aiESG and SASB Standard Licence

With the recent convergence of disparate standards and frameworks, an increasing number of companies are now considering new non-financial disclosure initiatives and preparing reports compliant with ISSB standards. However, collecting and organising information to meet the detailed disclosure requirements and researching back through the supply chain can be a significant burden for many companies. It is also not easy to determine what analysis needs to be done, and to what extent, to be considered compliant with the standard.

In August 2023, aiESG obtained a "Corporate Reporting Software" Licence under the SASB Standard, which forms the basis for the individual provisions of the ISSB [15]. This is the first acquisition for a company headquartered in Japan and the first ESG assessment at the product and service level in the world.

This enables companies to deliver more reliable and transparent information for their ESG responses.

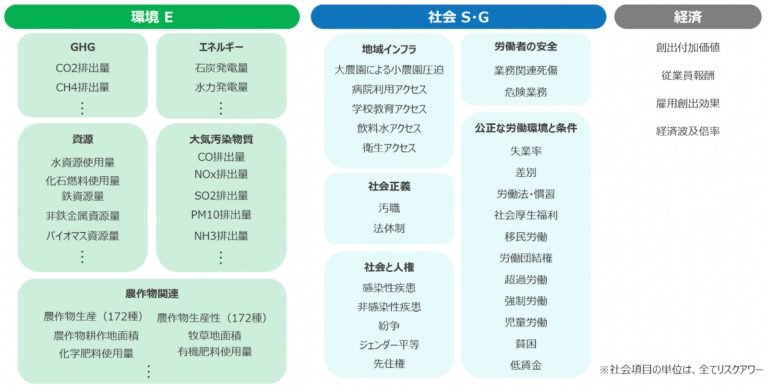

Through AI analysis using proprietary supply chain big data, aiESG calculates more than 3,200 ESG indicators that can be traced back through the supply chain [16]. These items cover not only indicators such as greenhouse gas emissions, which can be measured by traditional services, but also a wide range of other indicators such as wages, child labour, gender equality (closing the gender gap) and consumption of water and mineral resources (Figure 3).

Figure 3: List of aiESG assessment items (extract)

In addition, the only data required for analysis is product cost structure data or physical quantity data, which greatly reduces the effort required for information disclosure.

As a SASB licence holder, aiESG's services can provide reliable support for compliance with the evolving ISSB standards, which encompass many standards.

Conclusion.

In the move towards alphabet soup convergence, the ISSB has attracted much anticipation and attention as a global baseline involving many existing standards. Furthermore, its importance is likely to increase further in the future, with the announcement of interoperability with the European disclosure standard, the ESRS. Keeping a close eye on international trends in ESG disclosure and initiating early discussions towards the disclosure of information required by investors and society will lead to opportunities for companies to reduce their risk of loss and achieve further growth.

aiESG provides support on ESG-related standards and frameworks, from basic content to actual disclosure of non-financial information. aiESG is happy to assist companies with ESG compliance.

Enquiry:

https://aiesg.co.jp/contact/

Bibliography

[1] 001_05_00.pdf (meti.go.jp)

[2] Corporate Governance - Corporate Governance and Exec Compensation 2021 (shearman.com)

[3] Statement of Intent to Work Together Towards Comprehensive Corporate Reporting | Integrated Reporting

[4] Home - The Value Reporting Foundation

[5] IFRS - IFRS Foundation completes consolidation with Value Reporting Foundation

[6] IFRS - IFRS Foundation completes consolidation of CDSB from CDP

[7] IFRS - IFRS Foundation and GRI to align capital market and multi-stakeholder standards to create an interconnected approach for sustainability disclosures

[8] IFRS - ISSB at COP27: CDP to incorporate ISSB Climate-related Disclosures Standard into global environmental disclosure platform

[9] IFRS - European Commission, EFRAG and ISSB confirm high degree of climate-disclosure alignment

[10] IFRS - IFRS Sustainability Standards Navigator

[11] GRI - GRI welcomes role as 'co-constructor' of new EU sustainability reporting standards (globalreporting. org)

[12] IFRS - IFRS Foundation welcomes culmination of TCFD work and transfer of TCFD monitoring responsibilities to ISSB from 2024

[13] CDP announces intention to align with TNFD framework and drive implementation across global economy - CDP

[14] 2023_0803_ssbj.pdf (asb.or.jp)

[15] SASB - ESG Integration - Standardised Data Architecture

[16] Part 2: What services does aiESG provide | aiESG

*Related page*.

Report list : Regulations/standards

https://aiesg.co.jp/report_tag/基準-規制/

[The [ibid.Explanation] What is the TNFD? A new bridge between finance and the natural environment

https://aiesg.co.jp/report/230913_tnfdreport/

Commentary] What is the SASB Standard for ESG Information Disclosure? (Part 1) SASB Overview

https://aiesg.co.jp/report/2301025_sasb1/

Commentary] CSRD: the EU version of the sustainability reporting standard just before it enters into force.

~The impact on Japanese companies~.

https://aiesg.co.jp/report/2301120_csrd/

[Commentary] SFDR: What are the EU Sustainable Finance Disclosure Regulations?

~ESG-related disclosure obligations for financial instruments.~

https://aiesg.co.jp/report/2301222_sfdr/