This page is from a seminar co-organised by SPEEDA ASEAN and Ocean Network Express Pte. Ltd (ONE) Ltd. on 2 November 2023, at which aiESG Director Keeley spoke.'Ask the Pioneers' Carbon Neutral Frontline Series - Dejima Organisation and ESG Management Creating a New Global Trend'The report of the event is published with the permission of the organising organisation.

The seminar included a presentation on ESG initiatives in the shipping business by ONE's Shiomi, and aiESG Keighley'sENew trends in SG management, global trends and solutions.', as well as a panel discussion between the two. Keeley explained ESG research, international trends and aiESG initiatives.

The PDF version of the report is available atthis way (direction close to the speaker or towards the speaker)Available from.

Contents

ONE Shiomi: The origins of the Dejima Organisation "ONE" and the challenges of ESG management

History of the containership business

History surrounding ONE

ONE's present and future

aiESG Keighley : New trends in ESG management, global trends and solutions.

ESG research and key initiatives

State of the world

Trends in ESG

Current state of enterprise valuation methods.

aiESG initiatives

Panel discussion / ONE Shiomi, aiESG Keighley, moderator: Naito

How do I understand ESG and SDGs?

What ESG activities should the Japanese manufacturing industry undertake?

What should be prioritised among the various ESG-related indicators?

What should ESG do going forward in the Western-dominated political game?

What are the winning strategies in creating standards with a scientific approach?

Where is the ONE initiative at present?

How does ONE ensure that ESG is fun to work with?

ONE Shiomi: The origins of the Dejima Organisation "ONE" and the challenges of ESG management.

Mr Shiomi of Ocean Network Express gave a presentation on three points: an overview of the history of the containership business, the history of ONE's (Ocean Network Express) business, and the status of ONE's ESG initiatives.

Mr. Juichi Shiomi Senior Vice President Ocean Network Express Pte.

Graduated from Osaka University with a degree in economics in 1995. He was responsible for ship/aircraft finance in Asia in the bank's Transportation Sales Department from 2016 to 2009.

Joined ONE in July 2021. Initially in the Green Strategy Department (GSD), where she was involved in the development of environmental strategies; since April 2022, she has been in charge of corporate strategy, M&A and environmental strategy in the Corporate Strategy and Sustainability Department (CSS), which was restructured from the GSD. Since July of the same year, she has also held the position of Head of Public Relations; since April 2023, she has also held the position of Head of Finance.

History of the containership business

- The invention of containers.

The container box is considered the greatest invention of the 20th century. The reason is that they have driven the role of infrastructure in the global economy by significantly increasing the volume of global logistics. This is sometimes described as the containerisation of the global economy.

Specifically, the creation of the container, a box, made it possible to reduce the loading and unloading of a one-tonne load from 60 hours to two minutes. The container was also revolutionary because the person who invented it worked for a land-based logistics company, and it was designed with the connection of sea and land in mind, making it multimodal from the outset of its invention.

In terms of figures, a 19-fold increase in logistics volume has been achieved in the 40 years between 1980 and 2020. GDP growth in the global economy has also grown almost in parallel, which I believe supports the reason why the containership business is the infrastructure of the global economy.

- Containership business overview

Shipping accounts for more than 991 TP3T of Japan's international logistics, and this figure alone suggests that the world's logistics are supported by shipping.The first full container ships built in the 1960s were 750 kg in size, but today the largest ships scale up to 24,000 tonnes. The scale of the largest vessels is now up to 24,000t. In other words, the trend towards expansion is continuing.

To give you an idea of the loading capacity, a 40-foot container (about 12 metres) can hold 100,000 bananas. This means that just 60 containers are large enough to distribute one banana to every resident of Singapore, including foreigners. Container ships also carry almost all of the goods we need for our daily lives around the world, except buildings, water and electricity. The routes of container ships are changed every time to take into account the effects of typhoons, etc., forming an incredibly complex sea lane. one container ship turns around the world and is managed using AI.

History surrounding the ONE

- History of Japanese shipping companies.

We have been in the global container shipping business since around 1985. At that time, our competitors were not large in size and Japan was in a relatively high position. When it was unable to fully increase its global market share, MSC entered the containership business in 1994, and the company has expanded successively in size until it now occupies the world's largest position.

In other words, Japanese container shipping companies lost global market share in the 1990s. The reason behind this may be that shareholders were looking at business from a Japan-centric perspective and missed opportunities, or that they lost growth opportunities due to ground subsidence triggered by Japan's declining population. Today, Japan is far from the centre of international trade, with trilateral trade being the norm.

- Company profile

ONE is the company that took over the container shipping business from NYK, MOL and Kawasaki Kisen Kaisha. Today, it is the seventh largest shipping company in the world, and although not the global leader, it is a global company with 215 ships, 1.7 million containers, 11,000 employees and operations in 80 countries. In Singapore alone, there are around 550 employees working in about 20 countries.The three companies announced a merger in 2016, and after a six-month preparation period starting in October 2017, in April 2018, the company became the only Japanese ocean liner container shipping company to start new operations simultaneously in all countries worldwide. During this period, the container shipping fleet continued to grow in size, and while investment was increasing, profitability was deteriorating. In response, the company has overcome this situation by forming alliances and handling cargo without investment.

- Other company trends surrounding ONE

As the containership business deals with everyday goods, it is highly sensitive to economic conditions, and a downturn in the economy, such as the collapse of Lehman Brothers, would directly lead to a deterioration in business performance. It was against this backdrop that the Maersk Shock occurred. This was triggered by a cost war in which Maersk, the industry leader at the time, thought that it could drive out its competitors by utilising its economies of scale to provide services at fares that were just barely in the black on a cost basis. As a result, Maersk lost the most money and freight rates went down throughout the industry, making it impossible for many shipping companies to survive.

Since the Maersk shock, the container industry has moved in two main directions. One is companies adopting a family-style business structure. The other is a national company. The background to this is the history of the increasing size of ships, which makes it increasingly difficult for a single company to operate.

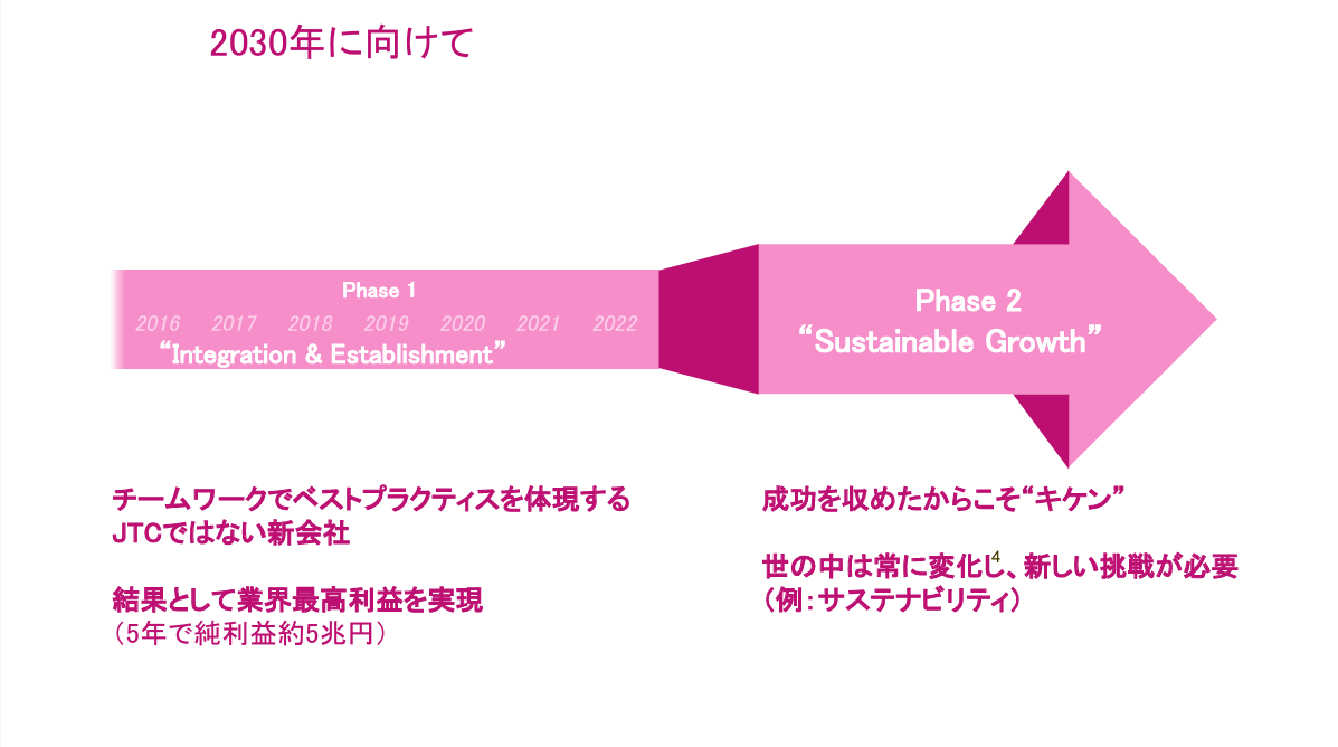

● ONE now and in the future

- Getting through the difficult times of Phase 1

ONE has a different message that is clearly conveyed when it is read as 'ONE' and when it is read as 'ONE'. When read as 'ONE', the catchphrase 'As ONE, We can.' is made clearer, indicating the intention to face up to various difficulties. It also conveys the message that the company has been considering what value it can produce as an outlier under the identity of Dejima. There were many difficulties during the chaos of the five-year start-up period, but we believe that Phase 1 was successfully completed by welcoming a Korean company called HNM and overcoming the Corona disaster with high employee engagement. And sustainability is what we consider important for Phase 2.

- Phase 2 places a high priority on sustainability.

Shipping companies have always been gamblers by nature. I believe this is due to the fact that it has been industry practice to take risks on large investments as the market grows. However, we have added sustainability to the formula as growth is expected to slow in the future, and the idea behind ONE's investment policy is that the volatility of the container business cannot be absorbed on its own.

In this context, we are also carrying out portfolio management, promoting cooperation with academia, systemising operations to a high degree through digitalisation, etc.

We are also moving in the direction of reducing our environmental footprint, for example, by attaching sails to containers, which capture the wind to improve fuel efficiency. As a result, the carbon intensity has improved by almost 20%. Furthermore, we have achieved a 60% reduction compared to the benchmark year of 2008, which was before the IMO disclosure.

In terms of the S (Social) aspect of ESG, our commitment to the local community includes the Sisters Island Marine Nature Reserve and the newly established Penguin Cove in Birdbark, etc. In terms of G (Governance), we were the first to publish a Sustainability Report and disclose all the various measures we have taken. We were also able to increase our CDP rate to B by disclosing all our various measures.

As a global company, neither a Western-style top-down company nor a Japanese-style consensus-oriented company, but a company positioned somewhere in between, we intend to compete from a unique position with owner companies around the world. Although we are based in Singapore, we intend to continue to develop our business by inheriting the spirit of challenge and other aspects of Japanese shipping.

● aiESG Keighley : New trends in ESG management, global trends and solutions.

Keeley, Associate Professor at the Faculty of Engineering, Kyushu University and Chief Researcher at aiESG Corporation, explained the ESG approach, its impact on the supply chain, the progress of international frameworks, the challenges of assessment methods and aiESG's approach.

Keely, Alexander, Ryuta.

Chief Researcher, aiESG Corporation | Associate Professor, Department of Environment and Society, Faculty of Engineering, Kyushu University

Head of research on 'ESG and Corporate Value', Ministry of the Environment. Member of the T20 Task Force, Head of Social Engineering Co-Unit, Moonshot Project "DAC-U". Research Specialist, World Bank.

Conducts empirical research from multifaceted and interdisciplinary approaches such as urban engineering and economics on a wide range of complex problems facing cities, such as energy depletion, environmental pollution, population decline and disasters, which are problems for society.

[Main research topic.

ESG analysis and social, environmental and economic impact assessment of energy technologies (e.g. renewable energy, hydrogen, DAC-U)

Analysis of a sustainable development society in a society with a declining population, based on external shocks to the economy.

Analysis of sustainable investment and green bonds.

Analysis of corporate activities and new urban proposals.

ESG research and key initiatives

After graduating from Kyoto University, I worked for the World Bank. I gradually came to believe that society would not change due to the complex intertwining of the interests of different countries at an international organisation. At that time, I was approached by Professor Umanaki, a leading ESG researcher, who asked me if I would be interested in working from an academic position to implementing the results of my research in society, and I am currently an associate professor at the Faculty of Engineering, Kyushu University.

Current major initiatives include the Ministry of the Environment's ESG and Corporate Value, the Moonshot project DAC-U (research into using thin membranes to capture carbon dioxide and other substances in the air and convert them into fuel) and submitting recommendations to the G20. The UN/New National Wealth Report refers to efforts to measure sustainability at the national and municipal level, following the work of Nobel economist Kenneth Arrow. In general, it should be understood that the main focus of the research is on ESG and finance and sustainability assessment, with a view to social implementation.

I would like you to consider that half of the ESG content I will be presenting was born out of my academia knowledge and the other half was born out of the creation of my business.

● State of the world.

The photograph on the slide shows child labour in a garment factory in Delhi, India. Child labour, migrant labour and forced labour actually exist all over the world today. The photos from Bogor, Indonesia, also capture the reality of people working barefoot in rubbish heaps, showing that people are exposed to toxic gases. The harsh reality is that the computers and mobile phones we use every day are only possible thanks to the support of this kind of labour.

This slide with a picture of a T-shirt shows the extent of the social impact on all workers back through the supply chain until a single T-shirt in the apparel industry is made. I won't go into the details, but you can see from the supply chain until one T-shirt is made that there are various issues, including gender issues and hospital access issues, under conditions where human rights are not protected. These realities are the basis of our lives, which is why I believe it is a natural progression that we need to change ESG.

● Current trends in ESG

ESG is an acronym for environmental, social and governance, and international frameworks have been developed considerably as the importance of ESG has increased.

The TCFD (Climate-related Financial Disclosure Task Force) is the most advanced disclosure by Japanese companies. However, looking at other countries, the TNFD (Task Force on Nature-Related Financial Disclosure) is attracting attention. This was released in September this year and is characterised by its Nature-Related focus, which includes not only natural capital, ecosystems and biodiversity, but also social aspects such as impacts on indigenous peoples and communities. I hope it can be understood as a state of affairs in which the international community is looking not only at the environment but also at society.

The last, TIFD, is a global movement to promote disclosure on inequality, although we do not know how far it will succeed in being compiled. We do not know to what extent this movement will become mainstream, but we think it is safe to say that a major trend is definitely coming, changing formats and names and spreading around the world.

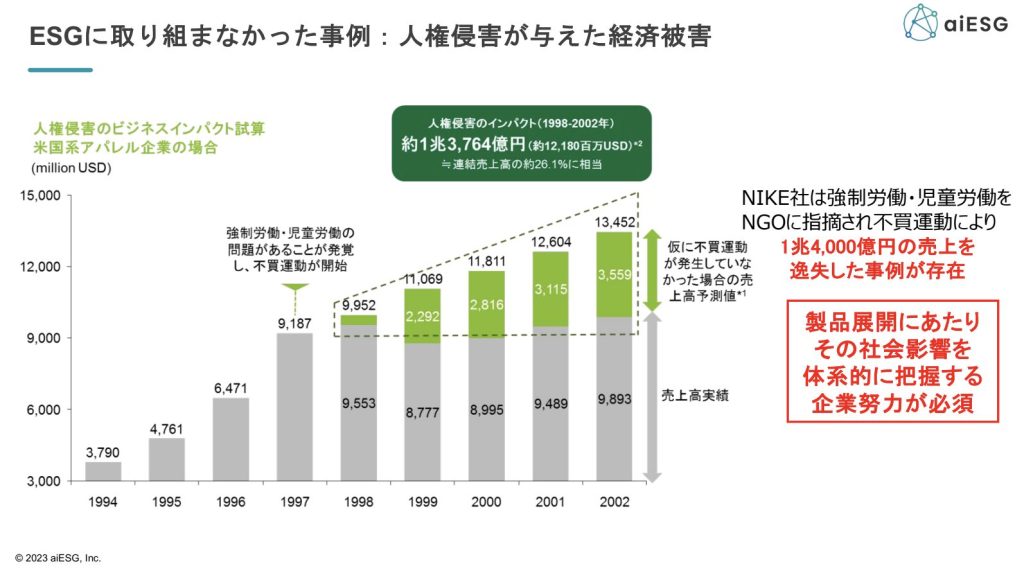

Several cases have shown that not addressing ESG issues, even in the absence of guidelines, can have a negative impact on corporate value. For example, Nike Inc. was traced down a supply chain that revealed a high incidence of forced labour at the end of the chain, which led to a boycott by consumers.

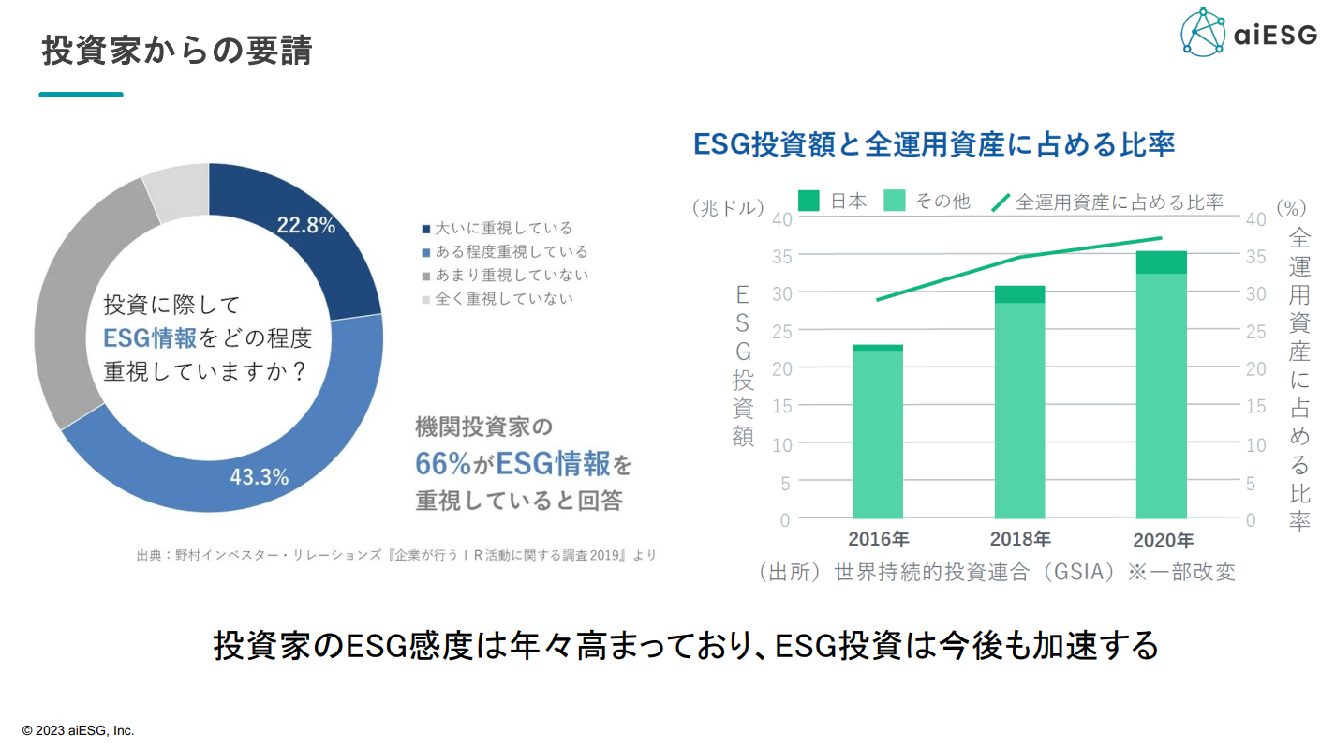

The demand from investors for ESG compliance is also increasing: although the figures are changing, partly due to a review of the definition of ESG investment, the overall trend is that the proportion of investment amounts is increasing year by year: in 2022, over 40% of investments will be ESG, according to the results.

In addition to TCFD, TNFD and TIFD, other major frameworks such as the SDGs, the Paris Agreement and Business and Human Rights are being developed as international frameworks as higher-level concepts. The current trend is that what used to be non-legally binding soft law is now becoming legally binding hard law.

In Europe, the UK and Germany have issued guidelines and have made it legal within a few years, and there is an emerging trend that the entire supply chain should be monitored from a social aspect throughout, but among the G7 countries, Japan is lagging far behind.

The number of issues that companies need to deal with, such as compliance with the CSRD (Corporate Sustainability Reporting Directive) as a further next step after the TNFD, is increasing, and although the standards are changing from moment to moment, we expect that they will eventually converge. Although this is only an estimate, the number of Japanese companies subject to CSRD is said to be around 800, a situation that cannot be overlooked.

Companies are actually starting to see cases arise where they have to disclose environmental and social information (e.g. the amount of emission reductions they have contributed to), or else they will be suspended from trading with suppliers and others. Under these circumstances, we work with companies on a daily basis to determine what should be done and to what extent.

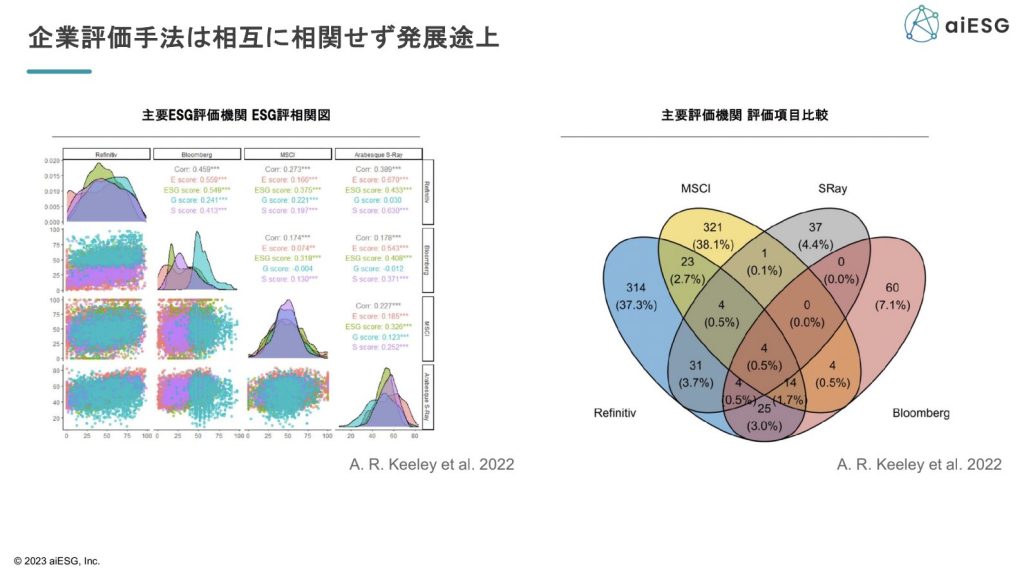

Current state of enterprise valuation methods.

The most commonly heard names of external assessment bodies used by the GPIF (Pension Fund Investment Fund Management Inc.) in ESG assessments include MSCI (Morgan Stanley-derived) and Refinitiv (Reuters-derived). They are said to have a considerable bias in terms of fairness and transparency. An actual analysis of the content of the ESG assessment data reveals a lack of consistency in the assessment items. Specifically, the correlation between the ESG scores of each assessment organisation, none of which had a correlation coefficient exceeding 0.5. This indicates that the GPIF has no idea what the investment returns would be if it were to invest based on the Bloomberg and MSCI assessment criteria. Therefore, it can be said that the companies disclosing information are also unsure what to believe.

Disclosure standards are also in a state of flux, commonly referred to as an alphabet soup. However, in recent years, they have been moving towards convergence in the form of integration with IFRS, and are expected to encompass those required to be disclosed in various assessment indicators, such as GRI, SASB, CDP and TCFD.

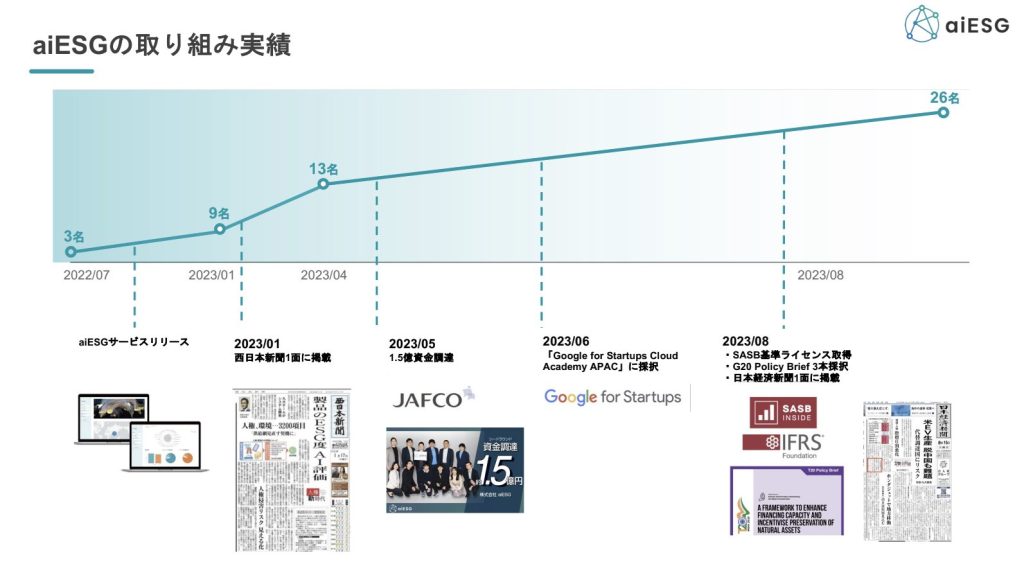

● aiESG initiatives

aiESG has been able to steadily expand its scale since its service release and has been able to increase its presence, including receiving investment from JAFCO, being selected by Google for Startups, and being selected for the G20 Policy Brief and featured in the Nikkei newspaper.

aiESG provides ESG assessments not only on a company-by-company basis, such as MSCI, but also on a product or service-by-product basis as a service. Specifically, quantitative data similar to the cost of labour hours spent on T-shirt production at the beginning of this section can be calculated based on data such as work-in-process and financial information held by the company. Naturally, if it can be done on a product-by-product basis, ESG assessment can also be done on a plant, business unit or company-by-company basis, making it highly versatile.

The data used in previous ESG assessments was quantitative data for a few items, such as CO2 and water consumption, while other items were qualitative data of zero or one. As a result, they were not very accurate evaluation indicators. We are attempting to look at all of the nearly 3,200 indicators quantitatively, collecting, for example, greenhouse gases other than CO2 and biomass.

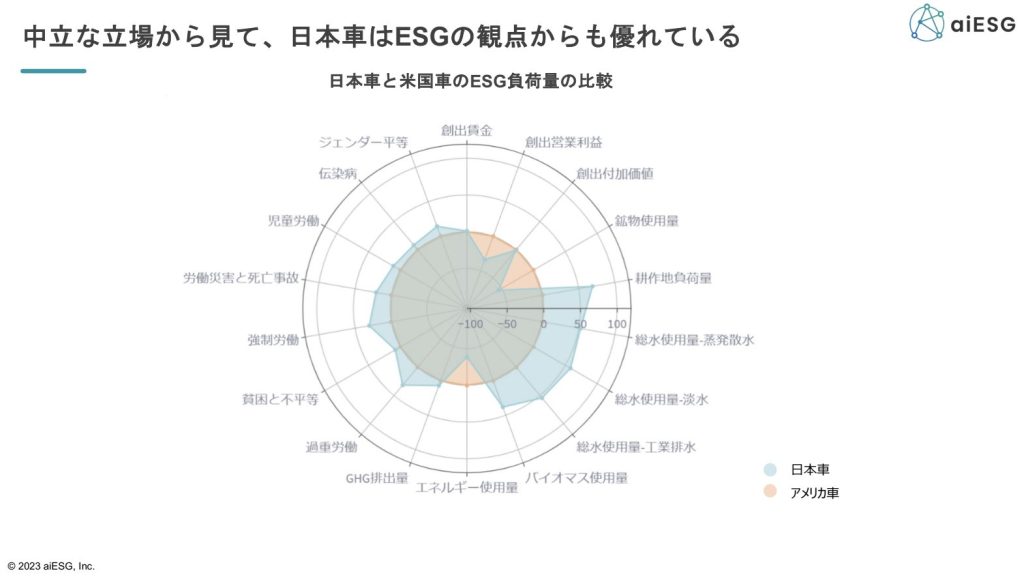

In addition, in order to accurately assess the social aspects of the project, satellite data is being created over time, which can, for example, reveal all social impacts from resource extraction to user utilisation.

The data gives the impression that Japanese companies are generally already making progress in their supply chain initiatives, which should be rewarded. Looking at the international community, Europe is leading the way in rule-making, and I feel that it is significant to disseminate information from Japan. For example, I believe that the international carbon tax adjustment measures are completely aimed at Europe's own industries, and it is no exaggeration to say that they are political measures aimed at Toyota. We feel that it is valuable to look at this in a neutral way, rather than reflecting national interests. To give an example, a product comparison of Japanese and American cars shows that, although some indicators are inferior, Japanese cars are generally more positive from an ESG perspective. With this awareness of the issue in mind, we are now working to have ESG assessments originating in Japan utilised globally.

Panel discussion / Moderator: Mr Naito

Panel discussion on ESG and SDG understanding, Japanese manufacturing activities, indicator priorities, the need for a scientific approach, links to the political game, examples of ESG initiatives, the importance of a practical approach, Ocean Network Express (ONE) KPI setting and initiatives The participants discussed the following topics.

Moderator: Mr Yasutsugu Naito

Userbase Corporation | Executive Officer, CEO of SPEEDA Southeast Asia Operations

Moved to Seoul in 2016 upon joining Userbase; through SPEEDA business, supported Japanese companies with members from ASEAN countries and Sri Lanka in research necessary for corporate planning and business development; in current position from 2020.

Prior to joining User Base, he promoted business reforms in Asia, including leading business integration and post-acquisition integration in the Greater China market. He also joined a consulting firm as a fresh graduate, where he was involved in organisational strategy, logistics reform and business reform, and has consistently promoted business reform in his career.

He is co-author of Global Organisational and Human Resource Management for Expansion into Emerging Countries.

● What is the relationship between ESG and SDGs?

- aiESG Keeley.

To give an example to promote understanding, some of the SDGs include 'responsibility for those who make and use'. This indicates that the goals include even the people who use them. It is true that the ESG and SDGs can show a correspondence, but the SDGs are something that society as a whole and all stakeholders should work on, whereas the ESGs are something that companies should work on. We have done research that shows that ESG initiatives contribute to increasing corporate value.

● What ESG activities should be undertaken by Japanese manufacturers?

- aiESG Keeley.

The idea is to reduce the risk of negative aspects of S (society) and E (environment) having a negative impact on corporate value. In addition, the key is to launch positive aspects and to use PR to increase corporate value.

In doing so, it is important to identify hot spots. For example, it is important to look at what would happen if the rapeseed oil in a product is changed from its current Dutch origin to France, Germany, Italy, etc., and to consider the most likely combination. This will of course take into account the balance with economic efficiency, but such measures will also contribute to improving the ESG score.

It is also important to work from the R&D stage. Even in the case of retailers such as Aeon and 7-Eleven, they are working on a major mission to make their products ESG-friendly across the board, and in the manufacturing industry, a simple needs check and simulation from the manufacturing stage can reduce major risks in advance.

● What should be prioritised among the various ESG-related indicators?

- aiESG Keeley.

Although MSCI is currently the most used ESG assessment, there is only a small amount of physical (quantitative data) and most decisions are made based on qualitative data without any disclosure work. Although the market now accepts this assessment, I consider it unreliable data and aiESG hopes to change this trend.

● ESG in the Western-dominated political game?

- aiESG Keeley.

To win in Europe, it is important to present quantitative indicators that are overwhelmingly scientific, neutral and free from bias. It is also important that the way quantitative indicators are presented is transparent. If we do this well, the indicators will be indisputable. This is what we are working on now, starting in Japan.

- ONE Mr Shiomi.

To add to Alex's point, the IMO was deliberating on fuel regulations and had received proposals from Japan, the EU and China respectively two years ago. In fact, the Japanese proposal was scientific and neutral, but few people knew about this fact because IMO meetings are closed to the public. The Japanese may have blindly followed the standards that were somewhat top-down and decided by Europe. Based on these facts, I think there are two things that we, as operators, should do. One is to show it quantitatively in figures. The other is to "visualise" and expose it to the world.

● What are the winning strategies in creating standards with a scientific approach?

- aiESG Keeley.

One approach comes from international organisations. Double materiality disclosure was also used by the World Economic Forum (WEF) in the context of stakeholder capitalism and was first reflected in the guidelines as soft law, which gradually became mandatory and hard law. It is important to prove correctness by approaching international organisations and national research institutes. For example, the background to the recognition of biochar in J-Credit was that the research paper was published in one IPCC report. Academic papers are more persuasive and credible because they are evidence-based. Science is not related to national interests, so it is important to put it forward at international conferences.

The other approach is from a practical perspective. In other words, this approach refers to creating de facto standards by disclosing highly reliable information. For example, the TNFD is currently at the stage of voluntary disclosure, which means that any items may be disclosed. Therefore, I think it is important for each company to build up examples by disclosing positive aspects quantitatively and transparently with easy-to-understand and reliable information.

● Where are we now with the ONE initiative?

- ONE Mr Shiomi.

In the past, this was a regulatory response, but we have started setting KPIs in the context of expanding cooperation with academia. We are now taking the stance of measuring various KPIs over a long time span and verifying, through trial and error, whether corporate value can really increase. This is like searching for a vein of ore that no one has found in the absence of a correct answer, and we hope to find a de facto standard for container shipping companies as a result.

● How does ONE ensure that ESG is fun to work with?

- ONE Mr Shiomi.

Basically, we try to have an even organisation, regardless of title or department. We also create an open atmosphere where people with ideas can take on challenges with a sense of responsibility.

This is the end of the seminar report.

aiESG provides support for ESG assessments and sustainability-related issues based on global trends. Companies and local authorities considering disclosure and sustainability-related initiatives are welcome to contact us.

Enquiry:

https://aiesg.co.jp/contact/

*Related page*.

Report list : Regulations/standards

https://aiesg.co.jp/report_tag/基準-規制/

[Commentary] Nikkei article: aiESG supply chain analysis of electric vehicle (EV) production and ESG indicators worsening due to 'de-China'.

https://aiesg.co.jp/report/2301016_nikkeiev1/

[Commentary] Alphabet soup - Disorder and convergence of sustainability standards.

https://aiesg.co.jp/report/2301226_alphabet-soup/

[The [ibid.Explanation] What is the TNFD? A new bridge between finance and the natural environment

https://aiesg.co.jp/report/230913_tnfdreport/

Commentary] What is the SASB Standard for ESG Information Disclosure? (Part 1) SASB Overview

https://aiesg.co.jp/report/2301025_sasb1/

Commentary] CSRD: The EU version of the Sustainability Reporting Standard just before it comes into force - the impact on Japanese companies.

https://aiesg.co.jp/report/2301120_csrd/